-

Capitalism is very efficient, somewhere. DRAM prices (same as NAND) is kind of mad, due to production/consumption issues and cartel agreements that followed.

-

Spot market prices for DRAM memory continued to fall in May, but the price drops slowed down substantially compared to those in April, according to industry sources.

-

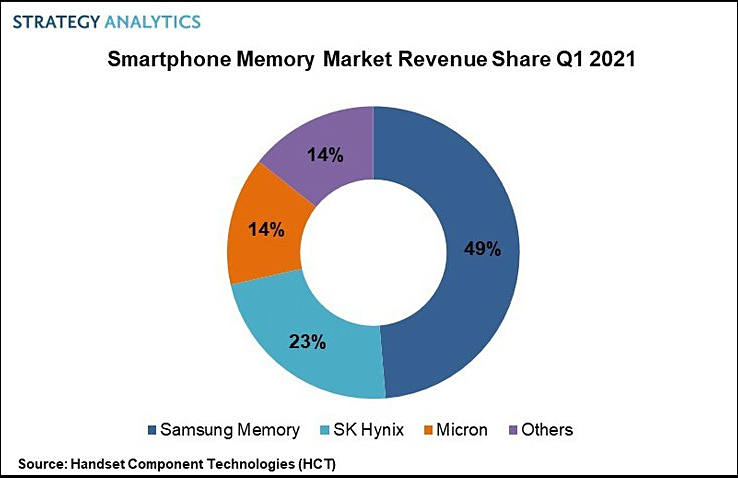

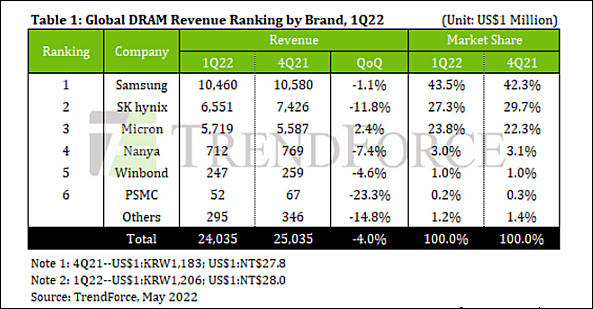

According to a recent report by analysts from TrendForce, global sales in the DRAM memory market in the first quarter sank by 4.0% and amounted to $24.03 billion. Experts attribute this to rising inflation, geopolitical instability, and weakening demand for these products. The outlook for the future is also pessimistic.

Due to lower contract prices, profit forecasts for Samsung and SK hynix and Micron were cut by 48%, 39% and 40.1%, respectively. Given the current market transition to the production of DDR5 memory and the high demand for these products, the new profit forecasts of these manufacturers may be revised, but in a positive direction.

sa7076.jpg593 x 309 - 59K

sa7076.jpg593 x 309 - 59K -

A study by TrendForce shows that global DRAM shipments decreased by 5.8% in the last quarter of last year compared to the third quarter of 2021. The total revenue of the DRAM market for the last quarter of last year was approximately $25.03 billion.

-

DDR5 memory has started to plummet in price. Moreover, the drop is very significant - in some cases we are talking about reducing the cost by 80% at once.

-

They are afraid, very afraid

Micron announced that it will close its RAM chip design center in China until December 2022. The official reason for the center's closure is the need to focus on the development of NAND flash memory. According to experts, Micron is simply protecting itself from leaks of DRAM technology to Chinese firms, where the company's specialists are fleeing in pursuit of huge salaries.

-

DRAM and NAND flash contract prices are likely to rally sooner than previously expected, due to supply-side constraints arising from COVID-19 induced lockdowns in China, according to industry sources.

-

DDR4 spot market prices continue to rebound despite the still-sluggish end-market demand, according to industry sources.

-

Considering a new PC for editing.

At the moment no local dealer has DDR5 DIMMs. And basically no one has graphics cards either.

-

DRAM and NAND flash memory spot prices continue trending downward but at a slower pace, and are expected to bottom out in the first quarter of next year, according to industry sources.

-

Spot market prices for mainstream DDR4 DRAM memory have been falling since October

-

Commodity DRAM prices likely to fall 15-20% in 1Q22.

-

DRAM contract prices will post a larger-than-expected drop in the fourth quarter of 2021, as spot prices have been fluctuating widely

-

Memory module maker Adata Technology expects price stability to take place in the DRAM spot market starting the fourth quarter of 2021.

-

DRAM spot prices have fallen at a rapid pace in August, which may put contract prices for the fourth quarter under downward pressure.

-

According to the estimates of experts of the analytical company TrendForce, the total revenue from the sale of DRAM in the second quarter of 2021 amounted to 24.1 billion US dollars, an increase of 26% compared to the previous quarter.

-

Server DRAM prices are expected to rise 5-10% sequentially in the third quarter of 2021.

-

Despite increased uncertainty in DRAM contract pricing, prices are unlikely to collapse in 2022 as major suppliers remain cautious about building additional fab capacities.

-

DRAM chipmaker Nanya Technology saw its revenue reach a 34-month high of NT$7.95 billion (US$285.6 million) in July 2021, while specialty DRAM and flash chipmaker Winbond Electronics' revenue hit a record high of NT$9.09 billion.

Macronix International's revenue rose 18.7% sequentially and 36.4% on year to NT$4.28 billion in July 2021. The chipmaker specializes in NOR flash and ROM memory.

Nanya disclosed its cumulative 2021 revenue through July climbed 34.9% from a year earlier to NT$48.32 billion. The July sum represents increases of 4.1% on month and about 62% on year.

A rally in chip ASPs and improvement in product mix boosted Nanya's gross margin to 42.3% in the second quarter of 2021, when net profits came to a 10-quarter high of NT$6.16 billion. EPS for the quarter arrived at NT$2.00. The DRAM chipmaker remains upbeat about its chip ASPs which will continue to rise in the third quarter.

-

Module makers as criminals

Adata's first-half net income rose 200% year-on-year to Taiwanese $ 2.26 billion ($ 81.4 million). The favorable financial results were mainly driven by two factors: higher prices for memory chips, as well as strong demand for products due to a global shortage of components.

Apacer also showed positive results, with net income for the first half of 2021 of 239 million Taiwanese dollars ($ 8.61 million) on earnings per share of 2.91 Taiwanese dollars ($ 0.10). Net income for the second quarter reached 169 million Taiwanese dollars ($ 6.09 million), up 196% from the same period in 2020.

-

Contract market prices for DRAM and NAND flash memory have both registered a modest 5-10% growth in the third quarter of 2021,

-

Niche-market DDR3 memory prices will continue to register double-digit increases in the third and fourth quarters of 2021, due mainly to supply-side constraints.

-

DRAM and NAND flash contract prices are set to continue their rally but at a slower pace in the third quarter, coupled with continued correction in spot market prices. A crossover point where contract prices approach and exceed spot prices may take place in the second half of this year, the sources said.

Memory module firms had already stockpiled chips, which made a positive contribution to their profitability in the first half of 2021. However, channel sales in China were a disappointment, and have remained sluggish

-

DRAM contract prices, which registered a substantial increase in the second quarter of 2021, are expected to continue their rally in the third quarter, according to chipmaker Nanya Technology.

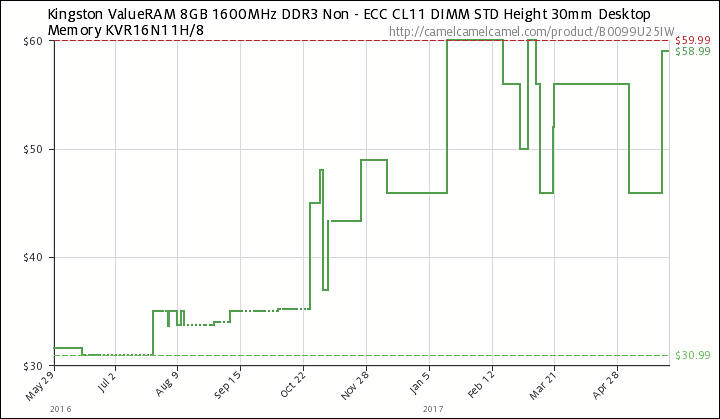

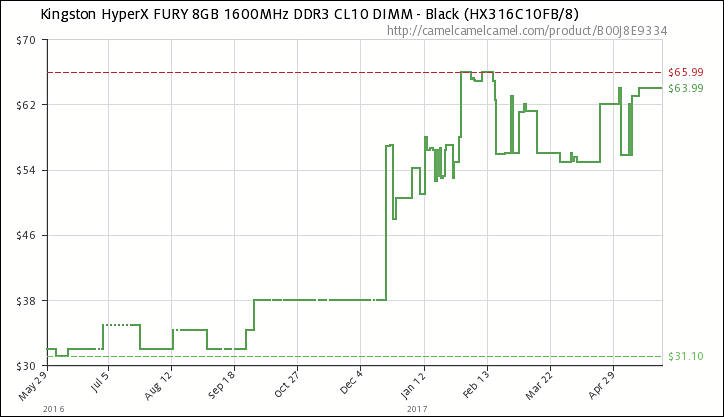

And this ones are even worse.

-

Memory module maker Adata Technology expects DRAM contract prices to register a double-digit sequential surge in the third quarter of 2021, with an over 15% rise in low-power DRAM prices.

PC and server DRAM contract prices will continue their double-digit increases in the third quarter, while prices for mobile DRAM chips will rise over 15%.

Shits.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,983

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,362

- ↳ Panasonic992

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras115

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,419

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319