It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Memory distributors have become more uncertain about demand due to the rapidly spreading coronavirus pandemic, and may adjust downward their quotes if demand turns out to be disappointing in the second half of 2020.

-

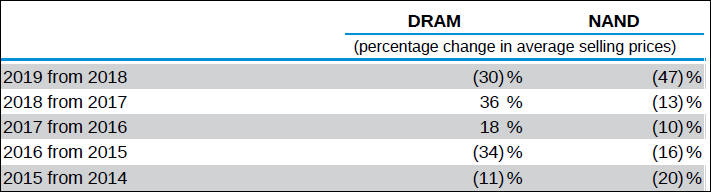

DRAM and NAND flash prices are facing increasing downward pressure, due to a slump in demand for consumer electronics devices,

It is not much real price drop on market now still.

-

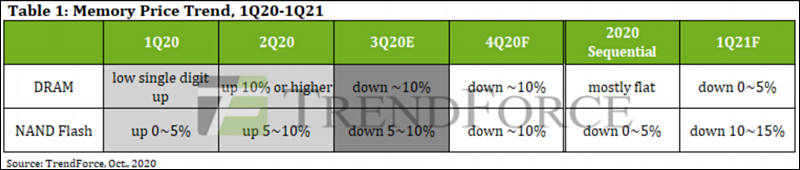

Memory contract prices have continued their rallies in the second quarter of 2020 despite the coronavirus outbreak, which has prompted market research firms to downgrade their global IC market outlook this year to negative growth.

DRAM and NAND flash prices have been rising despite the virus hitting hard demand for smartphones and other consumer electronics devices.

DRAM prices rose 12% due to tight cartel agreement.

-

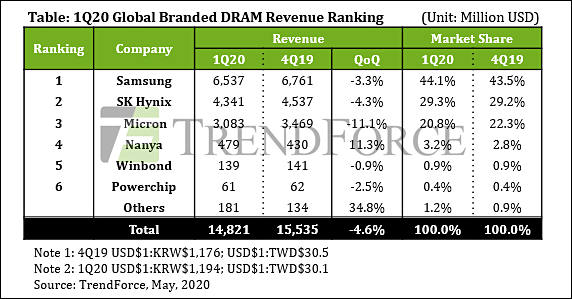

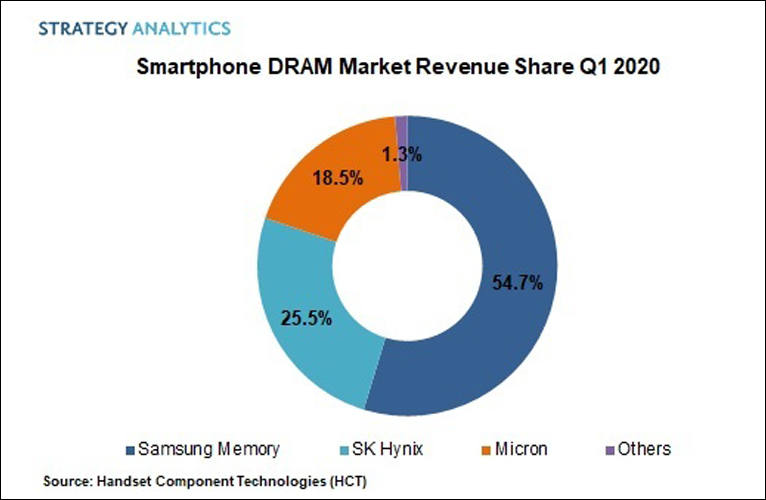

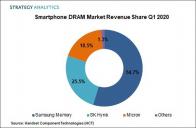

Samsung Electronics Co. maintained its dominant status in the global DRAM market in the first quarter of 2020.

Samsung's market share in the global DRAM market stood at 44.1 percent in the January-March period, up 0.6 percentage point from three months earlier, while its revenue declined 3.3 percent to US$6.5 billion over the cited period.

Its local competitor SK hynix Inc. came in second with a 29.3 percent market share in the first quarter, up 0.1 percentage point from three months earlier.

U.S. chipmaker Micron Technology Inc. took third place with a 20.8 percent market share in the first quarter, down 1.5 percentage points from three months earlier.

Total DRAM production capacity is not expected to show noticeable growth this year. The growth of the DRAM industry's bit output in 2020 will be mainly driven by suppliers' 1Y-nm and 1Z-nm migrations instead of a rise in wafer starts.

Same cartel again who fixed all prices.

-

Nanya Technology expects DRAM contract prices to continue rising in the third quarter of 2020, as demand arising from stay-at-home economy remains robust.

Shite.

-

Global NAND demand is forecast to increase 25% y-y in 2020, exceeding the predicted supply growth of 22% y-y. In particular, the fact that Sony’s PS5 (to be launched in 2H20) is to be equipped with an SSD instead of an HDD?a first for the console series?should contribute to strengthening NAND demand. Assuming that the PS5 comes equipped with 825 GB of NAND per unit and sells 20mn units pa, 2020 global NAND demand should climb 5%.

-

Memory spot prices particularly those for DRAM have started to rise reflecting a pick-up in buying momentum prior to China's 618 shopping festival.

-

As of last Friday, the spot price of the 8-gigabit DDR4 DRAM was $2.85, down 21.6 percent from the April 3 peak of $3.637, according to market tracker DRAMeXchange.

Good news.

-

DRAM and NAND flash memory prices will turn weak and start falling over the next two to three quarters, if smartphone sales buck seasonal trends and disappoint in the second half of 2020,

-

Peak smartphones coming :-)

Over the long term it'll be more demand for server DRAM (dynamic random-access memory), which Citi estimates will see compound annual growth (CAGR) of 35%, helped by cloud and MEC computing. Server DRAM applications’ share in total DRAM will jump from 24% in 2017 to 60% in 2024, they expect. Mobile DRAM‘s share is seen decelerating to CAGR of 10%, dropping to 25% by 2024 after peaking at 43% in 2017.

-

The DRAM and NAND flash markets will be oversupplied until the first half of 2021, according to Chang Chia-kun, president for memory module maker Apacer Technology.

Good news.

-

Industry memory prices are expected to fall by as much as 10% in Q4 of this year.

-

But good things won't last long

Three major DRAM suppliers - Samsung, SK Hynix and Micron Technology - are expected to make further cuts in their DRAM capital spending in 2020 as most new facilities and upgrades to current fabs are in place to handle near-term demand, IC Insights indicated. Samsung's DRAM capital expenditure budget will decline 21% to US$4.9 billion this year, while SK Hynix will trim its DRAM capex budget 38% to US$4 billion. Micron is expected to cut its DRAM capex by 16% this year to US$3.6 billion.

Collectively, suppliers are expected to allocate US$15.1 billion to DRAM capex spending this year, a 20% decline from US$19.1 billion in 2019 and down from the record high of US$23.2 billion spent for DRAM in 2018, IC Insights said.

With proper planning average DDR4 price can be cut by 70% without any bad consequences for everyone but greedy investors and cartel managers.

-

DRAM spot market prices have rallied over 5% since last week amid speculation about Huawei building up inventory prior to new US sanctions against it.

-

Samsung Electronics and other major chip suppliers have held nearly four months of DRAM and NAND flash inventories on average, due to a slowdown in orders for datacenter applications and overall weaker consumer sentiment than pre-pandemic levels.

Capitalist system is always most efficient and never form piles of necessary goods to keep prices artificially high (c) Austrian economists school.

-

Spot market prices for DRAM memory have rallied 10-15% so far in September 2020, according to sources at memory module houses. Huawei's aggressive chip purchases prior to new US sanctions against it have led to the spot price hikes.

All Huawei stock is 4-5 month tops according to smartphone industry info.

-

DRAM is now 72% of total Micron income. Rising 29% YoY.

Due to cartel agreements and technology advancement profits on DDR4 DRAM, especially mobile variants are now close to record that happened during highest memory prices.

Micron can afford selling memory chips at around 30-35% of current price and still get good cut.

-

Spot market prices for DRAM and NAND flash memory have been rising over the past several weeks, with ASP for the former unlikely to fall in the fourth quarter of 2020, according to sources at memory module makers.

Now due to Huawei we have almost 100% proof of cartel agreement. As companies have huge piles of memory and despite it they are able to rise the price.

-

Memory spot prices have been rising with the rally set to continue until at least the end of October 2020, according to Simon Chen, chairman for memory module house Adata technology.

-

The supply of PC memory chips and devices has already fallen short of demand, with the tight supply unlikely to ease until the first quarter of 2021, according to sources in Taiwan's memory industry.

Inventories for notebook applications have been dragged down and are even insufficient to satisfy customer demand, Chen said.

Sales of enterprise and gaming notebooks will be better than those of consumer models in 2021. Adata expects gaming products to account for over 10% of company revenue next year, Chen said.

In reality cartel fully controlled memory prices all 2020 year. Despite cost to production significant fall they managed to keep huge profits.

-

The combined memory output value of South Korean vendors Samsung Electronics and SK Hynix are expected to register a sequential decrease of 9.5% in fourth-quarter 2020 after falling in the third quarter,

Such way cartel keeps margins big.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,987

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,364

- ↳ Panasonic993

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320