It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Contract prices for DRAM held flat in August 2019, with prices for 8GB PC DRAM modules averaging US$25.5.

DRAM suppliers thus became firmer in their price negotiations as they saw the positive change in the demand situation.

DRAMeXchange forecast that the global DRAM industry bit output will increase only 12.5% in 2020, which will be the smallest growth in 10 years. DRAM chipmakers have put increased focus on profitability. Samsung Electronics, SK Hynix and Micron Technology are all expected to lower their respective capex next year by at least 10%.

This is why capitalism must be eliminated, as this guys openly tell you that it is their personal profits, profits for very few are important, not actual needs of hundreds of millions.

-

First results of new cartel agreement that stopped price fall

DRAM memory maker Nanya Technology saw its September revenues remain above NT$5 billion (US$161.6 million). Revenues for the third quarter of 2019 came to nearly NT$14.8 billion, rising 19% sequentially.

DRAM contract prices have stopped falling. Prices for August and September held flat, with prices for the third quarter set to stop falling too, said the price tracker.

-

Bolstered by stable shipment increases, DRAM prices are likely to rebound in the first quarter of 2020 at the earliest after staying flat or experiencing slight fluctuations in the preceding quarter, according to Nanya Technology president Pei-Ing Lee.

All according to the plan.

-

Hummm this pisses me offf badly, I will by my new 64GB Kit RAM before the year ends and the best offer I can find. Maybe in the next 2 or 3 years prices will be up again.

-

Samsung Electronics, SK Hynix and Micron Technology have all developed their respective 1z-nanometer process technology for the manufacture of DRAM memory

Idea here is to rise density and start making 32Gb DRAM sticks using usual number of chips.

Usually you will see significant overclocking potential degradation associated with this.

-

The global DRAM market, now over 90% controlled by three major players Samsung Electronics, SK Hynix and Micron, is likely to experience a structural shakeup in the next 5-10 years, with a new DRAM business unit set up by China's government-backed Tsinghua Unigroup expected to pose the largest potential threat to the top-3.

Nice.

-

DRAM prices slide must almost stop

-

Sales in the global DRAM market grew 4.1% sequentially to US$15.45 billion in the third quarter of 2019, following three quarters of sequential drops.

Looking into the fourth quarter, DRAM makers are expected to see their shipments climb further thanks to growing demand for servers and smartphones.

Cartel works again.

-

DRAM prices will hit bottom in the fourth quarter and start rising next year, said ESMT

Bad.

-

The memory sector is expected to resume growth momentum in 2020 thanks to steady increase in demand for 5G and server applications, with DRAM and NAND flash to see supply shortfalls (double-digit ones) in second-half 2020, according to industry sources.

-

Reason of current DDR4 price plunge

ChangXin Memory Technologies, Chinese company formerly known as "Innotron Memory", is China's first and only domestic DRAM supplier. ChangXin is now reportedly shipping its first DRAM wafers. With an output of around 20000 wafers per month, the company is currently building LPDDR4, DDR4 8Gbit chips using the "10-nanometer class" node, which is supposed to be 18 or 19 nm size

The company expects to double its wafer output to 40000 wafers per month sometime around Q2 of 2020 when additional expansion facilities will start production.

Keeping memory prices at previous level had been very dangerous, as in such case Chinese companies could literally trash cartel in 2-3 years time. So, cartel agreed to drop memory and NAND prices to hold competition longer (as now they'll have around 2-2.5x less profits they could reinvest in equipment). Cartel has huge headstart, so any profits cut will affect new competition 10x more.

US, who stands behind Intel and Micron, also do everything possible to stop any new equipment contracts.

-

DRAM spot prices were previously affected by an influx of downgraded 1Xnm chips in the spot market at rock-bottom prices due to product returns, DRAMeXchange indicated. Although downgraded chips are currently still being returned, memory module makers and channel brokers have become more willing to raise their inventories. With the stockpile of downgraded 1Xnm chips being quickly digested, spot prices have also started rising.

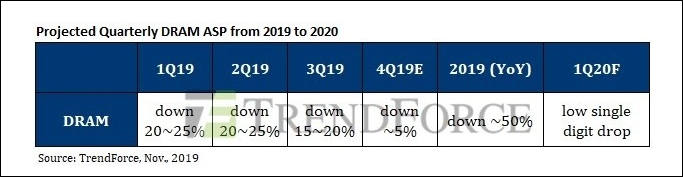

DRAMeXchange forecasts that contract prices of PC DRAM, specialty DRAM and mobile DRAM products for the first quarter of 2020 will register minor sequential drops.

-

Graphics DRAM contract prices for the first quarter of 2020 are forecast to rise over 5% sequentially, with the price rally outperforming other DRAM products' price increases, according to DRAMeXchange.

The majority of Nvidia's graphics card shipments is based on its GeForce RTX platform using GDDR6 memory, while AMD has "completely" switched to GDDR6 for its latest 7nm Navi series GPUs. Sony and Microsoft are both looking to roll out their new-generation gaming consoles equipped with GDDR6 memory in the second half of 2020.

-

Spot market prices for DRAM and NAND flash memory will continue rallying in the short term, driven by the ongoing trade disputes between Japan and South Korea, as well as suppliers' production cutbacks

and Samsung again with same thing

A brief power outage that took place recently at Samsung Electronics' production base in Hwaseong will have a short-term impact on the memory spot market prices, industry sources believe.

-

Anticipating that memory chip prices will be rising this year, memory module makers have started replenishing inventory while also making upward adjustments in their DRAM module quotes,

Memory module manufacturers have seen their order visibility stretched this year, and are positive about their product ASPs that are likely to be 20-30% higher than their 2019 average.

Parasites again want to prosper.

-

Poor Hynix

SK Hynix saw its operating profits plunge 87% to KRW2.71 trillion (US$2.28 billion) in 2019, while consolidated revenues decreased 33% on year to KRW26.99 trillion. The company generated net income of KRW2.02 trillion, down 87% from 2018 levels.

Macroeconomic uncertainty resulted in excess inventory levels at customers, said SK Hynix, adding that its clients were also conservative about placing orders. As a result, a slowdown in demand as well as chip price falls eroded the company's profitability last year.

Sadly, this poor criminals do not tell you about their previous cartel agreements, about their own measures during 2019 to cut production and not putting new equipment.

-

And this is how cartel stopped price drop

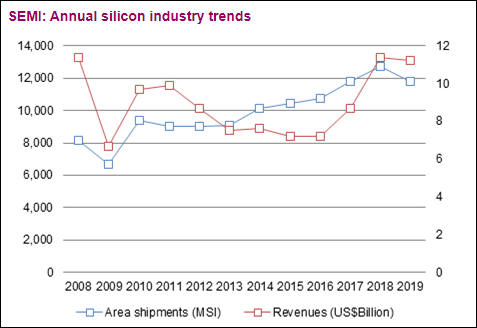

Worldwide silicon wafer area shipments in 2019 declined 7% from the 2018 record high, while revenues slipped 2% on year but remained above the US$11 billion mark, according to the SEMI Silicon Manufacturers Group (SMG).

If cartel of monopolies won't control NAND and DRAM production, as well as wafers production (via same investors) - it'll be huge difference. For example - typical minimal RAM size for desktop had been 64GB already with 128-256GB being norm for desktop models, same is true for SSD disks size.

sa12109.jpg477 x 328 - 27K

sa12109.jpg477 x 328 - 27K -

DRAM contract prices will start rising in the first quarter of 2020.

Sales in the global DRAM market slipped 1.5% sequentially to US$15.54 billion in the fourth quarter of 2019. Suppliers' bit shipment growth was able to offset their chip ASP decreases.

Samsung remained the world's top DRAM vendor with a 43.5% market share in the fourth quarter, followed by SK Hynix with a 29.2% share and Micron Technology with a 22.3% share.

Criminal cartel. Note that Samsung also is part of same criminal cartel with Sony on sensors market.

-

Could it be a good investment to buy fast ddr4 banks for future? Like... Alot

Can it be a safe investment, due to shortages from coronavirus effects.

-

Hard to say, as smartphones and servers get most of the memory. And production is almost stopped now.

On other side it is lot of final sticks manufacturing in china (not chips itself).

-

Chipmaker SK Hynix, a key Apple supplier, reported Thursday that a trainee tested positive for Covid-19 at its Icheon, South Korea, facility, reported Reuters.

Hynix told 800 employees on Thursday not to return to work and conduct self-quarantining at their homes as a prevention measure to stop the spread of the deadly virus.

Bad.

-

See. I will buy ddr4 sticks for future shortage

-

The rapid spread of coronavirus in Korea has raised increasing concerns about global supply of memory chips in 2020 as Korean makers, Samsung Electronics and SK Hynix, account for 73% global output of these devices.

-

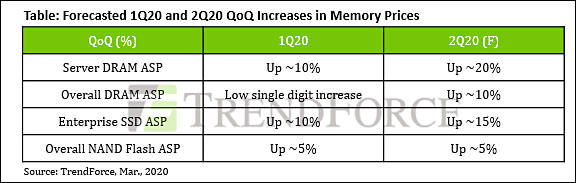

DRAM and NAND flash memory contract prices are expected to register double-digit increases in the second quarter of 2020, driven by growing demand for data centers, and enterprise-class SSDs and other applications.

Nice wishes :-) How about smartphones demand that tanked?

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,987

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,364

- ↳ Panasonic993

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320