It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Supply-side uncertainty arising from a recent power outage at Micron Technology's DRAM fab in Taiwan is prompting memory module houses to stop taking new orders and adopt a wait-and-see attitude, according to industry sources.

Here we go again, this guys regularly do something if they feel prices pressure.

-

Spot market prices for DRAM memory have surged recently and reached levels that are over 20% higher than contract market prices, according to sources at memory module houses.

-

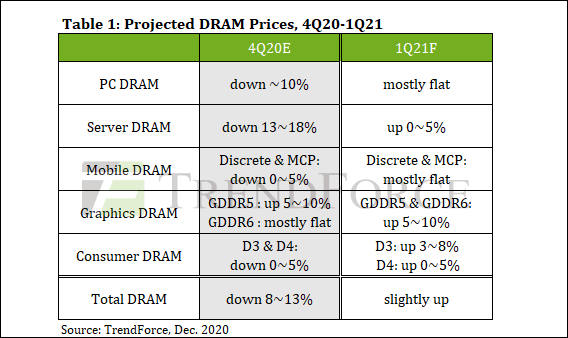

DRAM prices will start to rally in the first quarter and rise through the second quarter of 2021, due to undersupply in the market, according to chipmaker Nanya Technology.

-

DRAM contract market prices have risen 5-10% in the first quarter of 2021, and will continue their rally in the second quarter, according to sources at memory module makers.

-

DRAM prices are expected to rise through the third quarter of 2021 before heading for a correction in the fourth quarter, according to industry sources.

-

GDDR makers want to get their cut from huge profits GPU makers are getting

Actually AMD and Nvidia usually sell to manufacturers both GPU + set of memory chips, such way they become intermediary who started to get huge profits for nothing.

According to the resource MyDrivers, prices will rise for both GDDR6 memory and GDDR5 memory, which are distributed in many video cards of different generations. Already at the beginning of this quarter, prices for video cards were increased by manufacturers due to the rise in prices for memory chips, and after the Chinese New Year holidays, which will end on February 17, the price increase will be felt on a wide range of graphics cards.

-

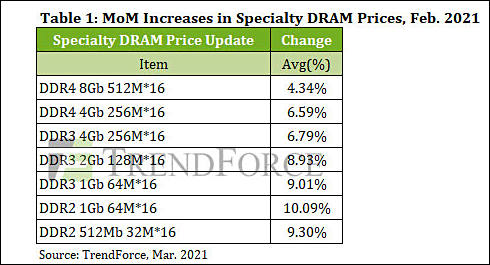

DDR3 prices are expected to rise 40-50% in 2021, according to industry sources, which estimated previously a slower 30% increase.

Make sure to stockpile it if you need :-) Can be also nice simple investment.

-

DRAM contract prices are set to continue rising in the second quarter of 2021, according to Nanya Technology, which has reported sequential and on-year increases in February revenue.

Cartel works again in full now.

-

DRAM and NOR flash memory prices are expected to rise through the second half of 2021, as growth on the supply side fails to catch up, according to industry sources.

-

Memory module house Adata Technology expects shortages of DRAM memory to become severe in the second quarter, thanks to robust demand for notebooks, handsets and data centers, and a pick-up in demand for automotive electronics applications. DRAM prices have been rising and will rise at a faster pace in the second >quarter, Adata said.

-

Over the month, the cost of DDR4 chips increased by 7% at once, and DDR2 - by 10%. As for SSDs, their price by the end of the second quarter of 2021 increased by 5%, this is the corporate sector. Custom SSDs are up 8% more expensive.

-

Global supply of DDR3 chips has fallen short of demand by at least over 30,000 wafers, which has been pushing up pricing for the memory, according to industry sources.

Here we go again.

-

ChangXin Memory Technologies (CXMT) and Yangtze Memory Technologies (YMTC) are both looking to ramp up their chip output with substantial production yield rate improvements this year, and may start contributing meaningfully to the global memory industry.

They are our only hope...

-

DRAM contract prices will register a larger sequential rise in the second quarter after rising 5-10% in the first quarter, according to industry sources.

-

PC DRAM contract prices, which has grown 3-8% in the first quarter, are forecast to register another sequential growth of 13-18% in the second quarter.

Major DRAM chip vendors remain conservative about building additional output resulting in limited growth in the global bit supply.

Shitty cartel again.

-

Nanya reported revenue climbed 10.7% on month and 19.6% from a year earlier to NT$6.41 billion in March 2021. Revenue for the first quarter represented a 20.1% sequential rise.

Adata expects DRAM prices to rise at a faster pace in the second quarter, while NAND flash prices will begin to rise thanks to rising demand for high-density SSDs.

-

Contract market prices for PC- and server-use DRAM memory will rise about 10% in May alone.

-

US law firm Hagens Berman has filed a class action lawsuit on behalf of consumers against three of the largest RAM manufacturers: Samsung Electronics, SK Hynix and Micron Technology.

The total market share of memory chips occupied by Samsung Electronics, SK Hynix and American Micron Technology is almost 100%. These companies account for 42.1%, 29.5% and 23% of the memory market, respectively - together this is about 95%. There are other manufacturers, but their importance is still small, as is the market share.

Hagens Berman's lawsuit indicates that memory prices have doubled in a short period of time, causing problems in the consumer segment. The lawsuit was filed on behalf of American consumers.

-

DRAM contract prices are expected to grow 10-15% sequentially in the third quarter after an over 20% rally in the prior quarter, while growth in NOR flash prices will also decelerate in the second half of this year.

-

DRAM and NAND flash memory contract prices are set to register double-digit increases in the third quarter of 2021, according to industry sources.

-

DRAM contract prices will rise by a slower 3-8% rate in the third quarter after registering a 18-23% rally in the second quarter.

-

Global DRAM revenue surged 30% on year and 9% sequentially to US$19 billion in the first quarter of 2021, according to Counterpoint Research.

-

Samsung Electronics and SK Hynix will see their combined sales of memory products (mainly DRAM and NAND flash chips) increase 16.7% sequentially to KRW26 trillion (US$23.3 billion) in the second quarter of 2021, buoyed by rising chip ASPs

Just morons.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,987

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,364

- ↳ Panasonic993

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320