-

Stock prices for wheat are breaking records. They have already surpassed a nine-year high, surpassing the $ 8 a bushel mark. And according to a number of experts, they may well rise to the level of 2008 - $9-12.

"The price of benchmark wheat on the Chicago stock exchange rose above $ 8 a bushel for the first time since December 2012," Prime said in a November 2 trading session.

-

According to various experts, including a specialist from the analytical company Gartner Mikako Kitagawa , the average cost of PCs and laptops in just a year increased by 10% at once. And this is in Europe and the USA, in the Russian Federation the situation is even more complicated. According to Vedomosti, the rise in prices for computers only in the second quarter of 2021 amounted to at least 20%.

-

Over the past twelve months, the cost of lithium carbonate in China has more than quadrupled, and the only thing that saves lithium batteries from a proportional rise in cost is that the specific content of this element in them is not so high.

Nickel sulphate prices in China increased by more than 30% over the same period, while cobalt hydroxide rose by more than 80%. The situation is exacerbated by planned power outages at factories in China, which have been undertaken by local authorities since the end of September. With the continuing dynamics of growth in prices for minerals, lithium batteries containing nickel, cobalt and manganese may rise in price by almost 10% worldwide next year, following China

-

Larry Fink, CEO of BlackRock:

Inflation will definitely not be just temporary, it is a new regime. Energy hunger will increase inflationary pressures, which will hit both the wallets of citizens and businesses. And one of the reasons for this is the green policy, which has led to restrictions on hydrocarbon production, which and generated energy inflation.

-

Battery-grade lithium carbonate price has risen 440%. Lithium price has been on the rise since 2020, bringing production costs of EV batteries higher. Prices of battery cells and battery packs will rise by at least 30%.

-

“Hyperinflation is going to change everything. It’s happening,”

“It will happen in the U.S. soon, and so the world.”

Twitter CEO Jack Dorsey

-

In Central Europe, "fuel tourism" is reviving: due to the sharp rise in gasoline prices in Germany, Germans are sent en masse to neighboring countries - Austria, Poland and the Czech Republic. A liter in Germany costs almost two euros. This is more than even the UK, which is experiencing a serious post-Brexit transport crisis.

The difference with neighbors can reach 50 euro cents - according to German drivers, this fully compensates for a longer journey to refuel abroad. At the same time, many people do not limit themselves to a full tank, but take canisters with them: forecasts for a rise in prices in the Federal Republic are disappointing.

-

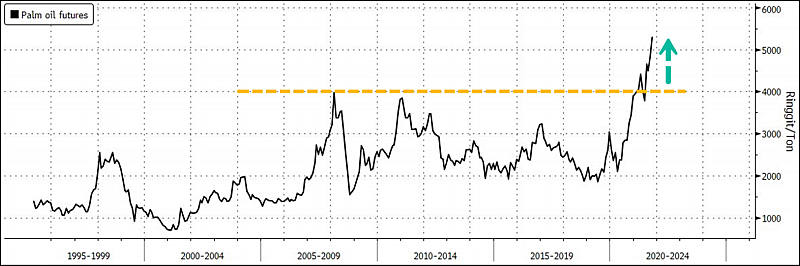

Prices of edible oils have been rising across the world. Palm oil, the world's most consumed vegetable oil, surged to a new record high, spreading concerns about persistent global food inflation.

Malaysia's palm oil futures soared more than 40% this year, while soybean oil is up more than 50%. Prices of canola oil are also at a record.

sa18592.jpg800 x 266 - 43K

sa18592.jpg800 x 266 - 43K -

Consumers around the world are about to get socked with even higher prices on everyday items, companies from food giant Unilever Plc to lubricant maker WD-40 Co. warned this week as they grapple with supply difficulties.

The maker of Dove soap and Magnum ice-cream bars jacked up prices by more than 4% on average last quarter, the biggest jump since 2012, and signaled elevated pricing will continue into next year. A similar refrain came from Nestle SA, Procter & Gamble Co. and Danone SA, whose products dominate supermarket aisles and kitchen cupboards.

“We’re in for at least another 12 months of inflationary pressures,” Unilever CEO Alan Jope said in a Bloomberg Television interview. “We are in a once-in-two-decades inflationary environment.”

-

Notebook brands are facing the pressure of reflecting the extra costs from components, production and logistics on the prices of their new notebooks.

-

According to the IEA's October winter fuels outlook (pdf), nearly half of U.S. households that warm their homes with mainly natural gas can expect to spend an average of 30% more on their "multi-year high" bills compared with last year. The agency added that bills would be 50% higher if the winter is 10% colder than average and 22% higher if the winter is 10% warmer than average.

The forecast rise in costs, according to the report, will result in an average natural-gas home-heating bill of $746 from Oct. 1 to March 31, compared with about $573 during the same period last year.

-

Final demand PPI prices increased by 8.6% compared to a year ago, which is a historical record for the entire measurement period (since 2010)

Prices for goods of intermediate demand (intermediate demand PPI, this is something that still has to be processed before being turned into goods) has risen by a wild 23.9%, breaking a nearly half-century record since the mid-70s)

-

Highest price rise since the 1974 oil crisis: Wholesale prices in Germany climbed 13.2 percent in September. The drivers were metals and refined products.

The flywheel of inflation is accelerating in Germany. In September, wholesale selling prices in the country grew at the fastest pace in more than 47 years. According to the Federal Statistical Office, they were 13.2% higher than a year earlier. The most significant increase was last seen in June 1974, when prices jumped 13.3 during the first oil crisis.

These are considered to be an indicator of future inflationary trends, since wholesale trade is the link between manufacturers and end consumers. In August, the inflation rate in wholesale trade was 12.3%, and in July - 11.3%. It was already unusually high.

"The high growth in wholesale prices compared to September 2020 is due, on the one hand, to the currently sharply increased prices for many types of raw materials and intermediate goods," the statisticians write. "On the other hand, a low base effect comes into play as a result of the very low price level in previous months due to the pandemic."

A strong factor in the rise in prices, according to available data, was the rise in prices for ores, metals and intermediate metal products - by 62.8 percent. Petroleum products cost 42.3 percent more than a year ago. There was also a particularly strong jump in prices in the wholesale of scrap and residual materials (+ 84.6%), as well as round timber and processed timber (+ 54.6%). Grain, raw tobacco, seeds and animal feed also increased significantly (+23.9 percent).

-

Consumers around the world should get used to the high prices of groceries. This was stated in an interview with the BBC by the CEO of the American corporation Kraft Heinz Miguel Patricio.

According to him, prices are rising for several reasons: the pandemic has disrupted the supply of resources necessary for food production, the supply does not keep pace with the growing demand against the backdrop of economic recovery, and the increase in wages and the rise in energy prices have increased costs for producers.

Patricio noted that the cost of food will continue to increase in the future as the world's population grows and the amount of land on which to grow food is not. The situation can only be corrected by technologies that will "increase the efficiency" of farms, added the head of Kraft Heinz.

-

Australia’s Newcastle thermal coal, a global benchmark, is trading at $202 a metric ton, three times higher than at the end of 2019. Global production of coal, which generates around 40% of the world’s electricity, is about 5% below pre-pandemic levels.

In Europe, the rising prices for coal and other energy resources have hit factory output and driven household energy bills higher. Major coal importers in Asia, including Japan and South Korea, are jostling to secure supplies.

-

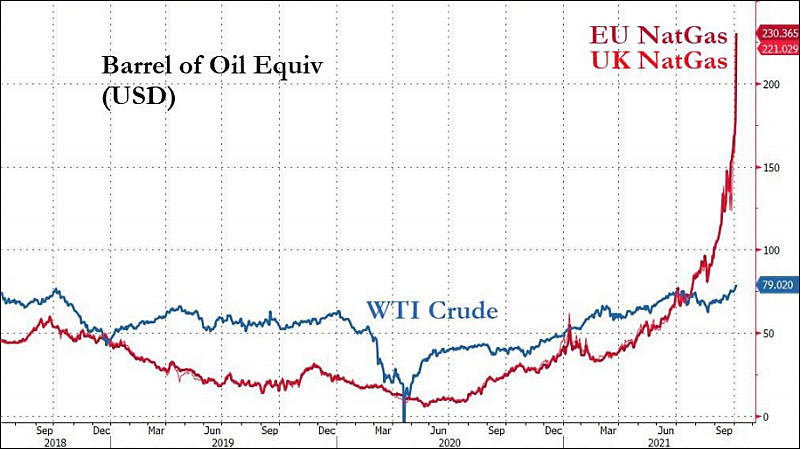

You can now see that oil price is manipulated to stay where it is.

First major manipulation started in 2008, next step was made in 2014.

sa18420.jpg800 x 449 - 62K

sa18420.jpg800 x 449 - 62K -

Electricity and gas prices in Italy

Household electricity bills will rise by 29.8% for the typical family and gas bills will go up by 14.4%, Italy’s energy regulatory authority Arera confirmed in a press release last week. The new national tariffs came into effect on Friday, the start of the fourth quarter of 2021. The increase comes amid surging energy costs across Europe, and beyond.

The price rise passed on to Italian consumers could’ve reached 45 percent, Arera said, if the government had not stepped in to cap the new rise in rates.

-

The cost of thermal coal with a calorific value of 6,000 kcal / kg in North-Western Europe over the past week increased by 16.5% to $ 232.2 per ton (cif Amsterdam - Rotterdam - Antwerp), reaching its highest level in at least twenty years ... Fuel price exceeded by about 6% the previous record set in 2008

-

The price of gas in Europe during the trading on October 4 again broke the record and for the first time exceeded $ 1200 per 1,000 cubic meters. m, according to the data of the ICE exchange.

The price of November futures on the TTF hub in the Netherlands reached $ 1200.36 per 1,000 cubic meters during trading. m, or € 99.99 per MWh (based on the current EUR / USD exchange rate, ICE prices are presented in EUR per MWh).

Last week, the price of gas in Europe for the first time in history exceeded $ 1,000 per 1,000 cubic meters. m, and then $ 1,100.

-

From January to September this year, lithium carbonate price rose 171%; lithium hydroxide price rose 173%; and lithium hexafluorophosphate price rose 273%. Cobalt price rose 34% and nickel 21%.

Lithium-based materials show the highest price increase because lithium battery is the main component of EV. NMC batteries use lithium carbonate and lithium hydroxide, while LFP batteries use lithium hexafluorophosphate.

From the beginning of this year to mid-September, lithium carbonate increased from around CNY50,000 (US$7,730) to CNY146,000 per ton; lithium hydroxide rose to CNY145,000 per ton; lithium hexafluorophosphate increased from around CNY115,000 to CNY430,000 per ton.

-

The rise in import prices in Germany in August was the largest in 40 years. This was driven by a surge in oil and gas prices, and bottlenecks in the raw material supply chain were further exacerbated, indicating further price increases for consumers. Import prices jumped 16.5 percent in August from the previous year, the Federal Statistical Office said yesterday, beating economists' forecasts of growth by 16.1 percent, up from 15 percent in July.

The August rise was the sharpest since September 1981, when the second oil crisis pushed prices up 17.4 percent. Energy import prices rose 93.6 percent in August from the previous year, mainly due to strong increases in natural gas prices, the Statistics Office said.

Prices for many types of raw materials have also risen sharply. Iron ore was 96.8 percent more expensive in August, while sawnwood and planed wood prices rose 61.6 percent, while base metals, steel and ferroalloys rose 57.7 percent.

At the same time, supply chain bottlenecks affecting German companies have worsened further, a poll released yesterday by the Ifo Institute showed. About 77.4 percent of German industrial firms reported difficulties purchasing intermediates and raw materials this month. According to Ifo, among car companies this figure was 97 percent.

-

Increasing foundry and materials costs are prompting some major IC vendors in Taiwan to decide to raise their product prices in fourth quarter of 2021.

-

Construction costs reportedly rose 12.8% year-over-year due to shortages and rising prices for building materials, a record since 1979. In particular, wood has risen in price by 70% over the year, polyvinyl chloride (pipes) by 65%, as well as metals and metal products.

Sales of unfinished homes are growing strongly - that is, when the owner, due to a shortage and rising prices, cannot complete the construction himself, and a drop in sales makes one think about the prospects of the market and the corresponding risks, so he is in a hurry to get rid of it as soon as possible.

95% of the houses on the market are now either unfinished, or construction has not begun at all.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320