-

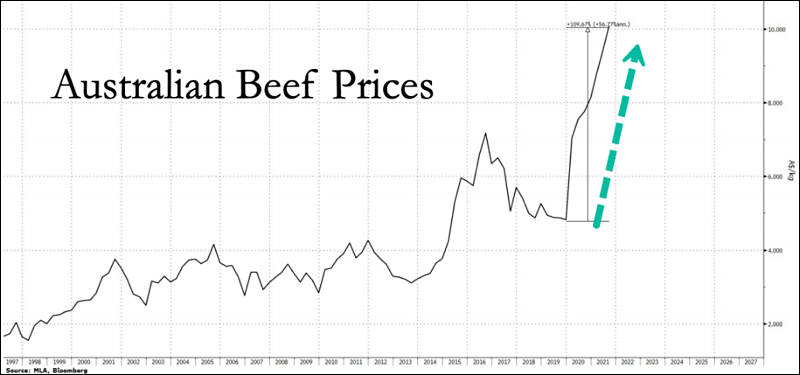

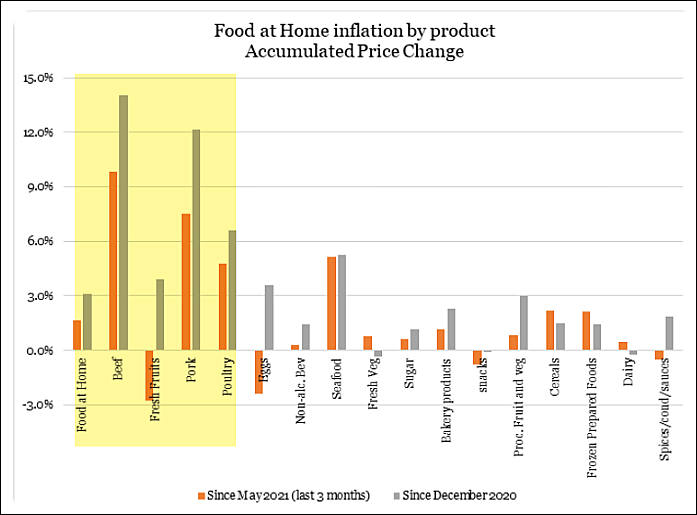

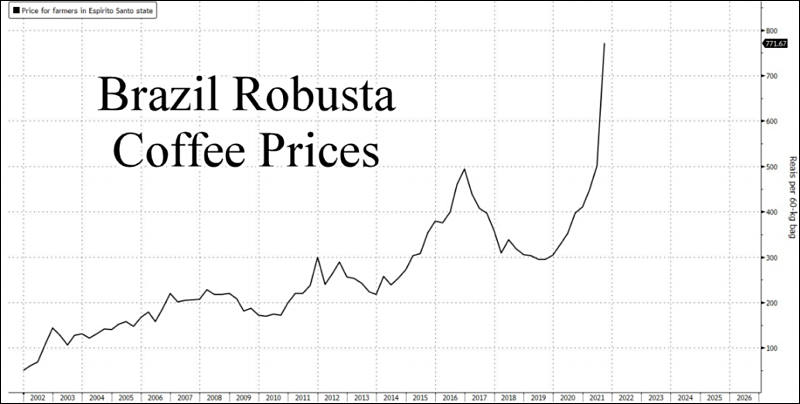

Food prices in July were up 31% from the same month last year, according to an index compiled by the United Nations’ Food and Agriculture Organization.

Huge part of inflation comes from Chinese poor and medium class. As they go close to additionally $6 trillions in their hands from government subsidies directly and to firms.

As China can't much rise food production it started to wipe out everything from global market.

Local governments also got trillions and love to buy and store products in case of COVID outbreak event, so they can be sure be safe in their position.

-

sa18067.jpg800 x 426 - 36K

sa18067.jpg800 x 426 - 36K

sa18068.jpg800 x 419 - 34K

sa18068.jpg800 x 419 - 34K

sa18069.jpg800 x 491 - 34K

sa18069.jpg800 x 491 - 34K

sa18070.jpg800 x 480 - 42K

sa18070.jpg800 x 480 - 42K -

FAO released a statement Thursday that detailed after two consecutive months of declines, world food prices in August jumped due to solid gains in sugar, vegetable oils, and cereals.

<FAO’s food price index, which follows international prices of globally traded food commodities, averaged 127.4 points in August, up 3.9 points (3.1%) from July and 31.5 points (32.9%) from the same period last year.

-

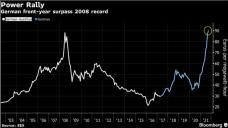

Electricity inflation

Electricity prices from the UK to Spain have jumped to all-time highs, people in Spain have taken to the streets, while prices so high across Europe could be a drag on economic recovery from the pandemic.

In Spain, day-ahead electricity prices soared to a new record this week, which is a "huge political issue." Consumers in Spain are protesting against utilities as households now pay about double what they paid for electricity at that time last year.

Electricity prices also hit records this week in the UK, Germany and France.

-

Aluminum prices have reached their highest level in the last 13 years. On Monday, September 13, the COMEX contract for the metal for November delivery rose 3.5% to $ 3,025.75 a tonne. Aluminum was last traded at these levels in 2008.

Aluminum prices have continued to rise for the past three consecutive weeks. During this time, they added 15%.

-

Uranium contracts have been steadily getting more expensive since 17 August. During this time, they added 32.8%. At the same time, just over the past week, the growth was almost 15%, which was the best weekly increase in more than ten years - since the accident at the Fukushima nuclear power plant in 2011.

-

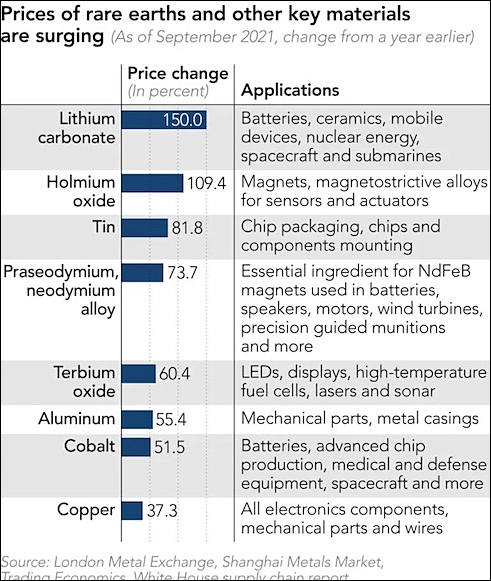

Manufacturers are worried about rising prices for rare earth metals. For example, the cost of neodymium used in speaker production has doubled since last year to $ 117,300 per ton in August.

China is the only country that has a complete supply chain for rare earths, from mining to processing. Last year, the Celestial Empire controlled 55% of the world's production capacity and 85% of the total processing of rare earth elements.

The cost of neodymium oxide, a key resource for electric motors and wind turbines, rose 21.1%. Holmium, which is used in magnets for sensors and mechanisms, has risen in price by almost 50% this year.

It is reported that the price of tin has almost doubled compared to last year.

sa18283.jpg491 x 581 - 71K

sa18283.jpg491 x 581 - 71K -

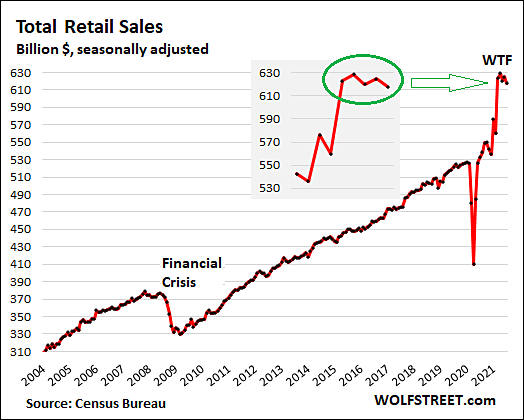

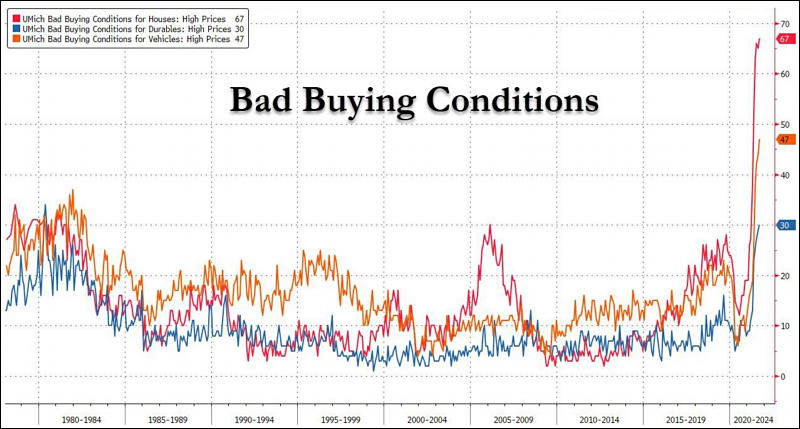

There was a complete rout of net favorable views of buying conditions: household durables fell to the lowest level since 1980, vehicles fell to the lowest level since 1974, and homes to the lowest level since 1982. These record drops were all due to complaints about high prices: homes had the highest negative ratings of home prices ever recorded, vehicles had the most negative price references since 1974 (in response to the first oil embargo), and durables had the worst price rating since 1980.

sa18306.jpg800 x 429 - 70K

sa18306.jpg800 x 429 - 70K -

On September 10, the benchmark coal traded at $ 177.50 per tonne. This is more than a twofold increase in prices since the beginning of the year and an even larger increase in prices compared to $ 50 per tonne a year earlier.

-

Construction costs reportedly rose 12.8% year-over-year due to shortages and rising prices for building materials, a record since 1979. In particular, wood has risen in price by 70% over the year, polyvinyl chloride (pipes) by 65%, as well as metals and metal products.

Sales of unfinished homes are growing strongly - that is, when the owner, due to a shortage and rising prices, cannot complete the construction himself, and a drop in sales makes one think about the prospects of the market and the corresponding risks, so he is in a hurry to get rid of it as soon as possible.

95% of the houses on the market are now either unfinished, or construction has not begun at all.

-

Increasing foundry and materials costs are prompting some major IC vendors in Taiwan to decide to raise their product prices in fourth quarter of 2021.

-

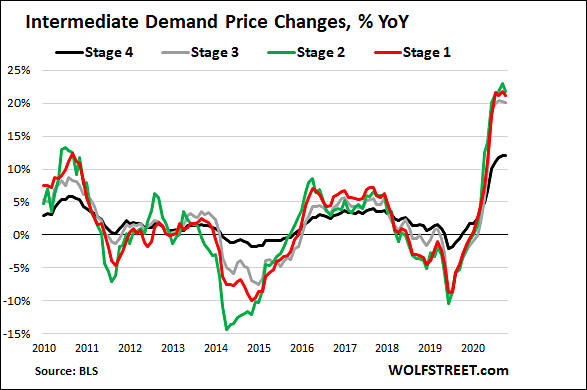

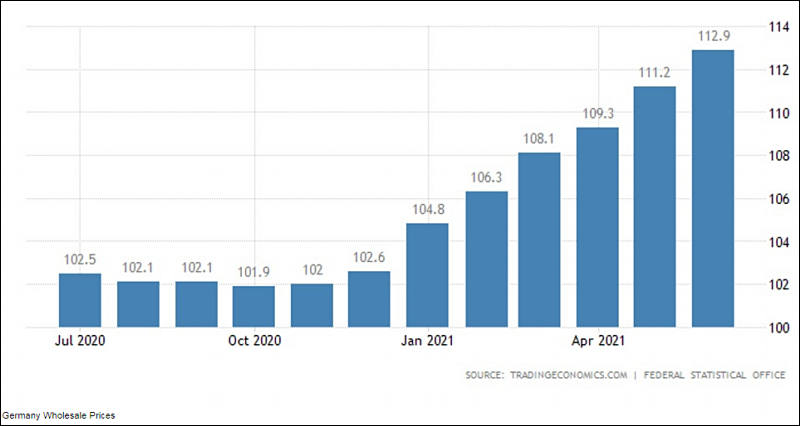

The rise in import prices in Germany in August was the largest in 40 years. This was driven by a surge in oil and gas prices, and bottlenecks in the raw material supply chain were further exacerbated, indicating further price increases for consumers. Import prices jumped 16.5 percent in August from the previous year, the Federal Statistical Office said yesterday, beating economists' forecasts of growth by 16.1 percent, up from 15 percent in July.

The August rise was the sharpest since September 1981, when the second oil crisis pushed prices up 17.4 percent. Energy import prices rose 93.6 percent in August from the previous year, mainly due to strong increases in natural gas prices, the Statistics Office said.

Prices for many types of raw materials have also risen sharply. Iron ore was 96.8 percent more expensive in August, while sawnwood and planed wood prices rose 61.6 percent, while base metals, steel and ferroalloys rose 57.7 percent.

At the same time, supply chain bottlenecks affecting German companies have worsened further, a poll released yesterday by the Ifo Institute showed. About 77.4 percent of German industrial firms reported difficulties purchasing intermediates and raw materials this month. According to Ifo, among car companies this figure was 97 percent.

-

From January to September this year, lithium carbonate price rose 171%; lithium hydroxide price rose 173%; and lithium hexafluorophosphate price rose 273%. Cobalt price rose 34% and nickel 21%.

Lithium-based materials show the highest price increase because lithium battery is the main component of EV. NMC batteries use lithium carbonate and lithium hydroxide, while LFP batteries use lithium hexafluorophosphate.

From the beginning of this year to mid-September, lithium carbonate increased from around CNY50,000 (US$7,730) to CNY146,000 per ton; lithium hydroxide rose to CNY145,000 per ton; lithium hexafluorophosphate increased from around CNY115,000 to CNY430,000 per ton.

-

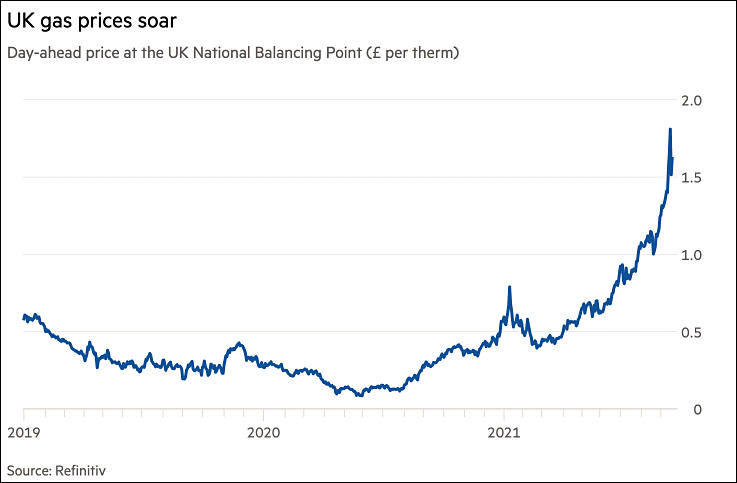

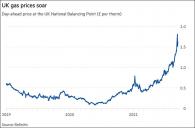

The price of gas in Europe during the trading on October 4 again broke the record and for the first time exceeded $ 1200 per 1,000 cubic meters. m, according to the data of the ICE exchange.

The price of November futures on the TTF hub in the Netherlands reached $ 1200.36 per 1,000 cubic meters during trading. m, or € 99.99 per MWh (based on the current EUR / USD exchange rate, ICE prices are presented in EUR per MWh).

Last week, the price of gas in Europe for the first time in history exceeded $ 1,000 per 1,000 cubic meters. m, and then $ 1,100.

-

The cost of thermal coal with a calorific value of 6,000 kcal / kg in North-Western Europe over the past week increased by 16.5% to $ 232.2 per ton (cif Amsterdam - Rotterdam - Antwerp), reaching its highest level in at least twenty years ... Fuel price exceeded by about 6% the previous record set in 2008

-

Electricity and gas prices in Italy

Household electricity bills will rise by 29.8% for the typical family and gas bills will go up by 14.4%, Italy’s energy regulatory authority Arera confirmed in a press release last week. The new national tariffs came into effect on Friday, the start of the fourth quarter of 2021. The increase comes amid surging energy costs across Europe, and beyond.

The price rise passed on to Italian consumers could’ve reached 45 percent, Arera said, if the government had not stepped in to cap the new rise in rates.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320