-

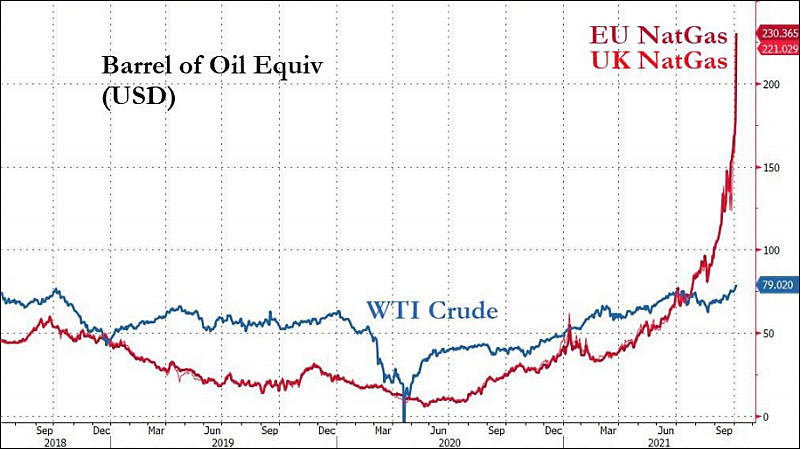

You can now see that oil price is manipulated to stay where it is.

First major manipulation started in 2008, next step was made in 2014.

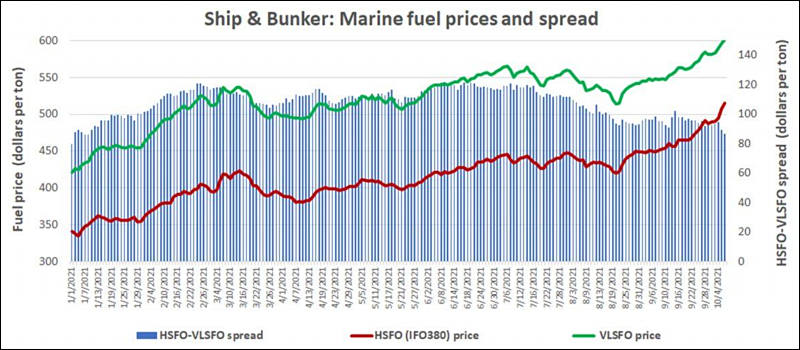

sa18420.jpg800 x 449 - 62K

sa18420.jpg800 x 449 - 62K -

Australia’s Newcastle thermal coal, a global benchmark, is trading at $202 a metric ton, three times higher than at the end of 2019. Global production of coal, which generates around 40% of the world’s electricity, is about 5% below pre-pandemic levels.

In Europe, the rising prices for coal and other energy resources have hit factory output and driven household energy bills higher. Major coal importers in Asia, including Japan and South Korea, are jostling to secure supplies.

-

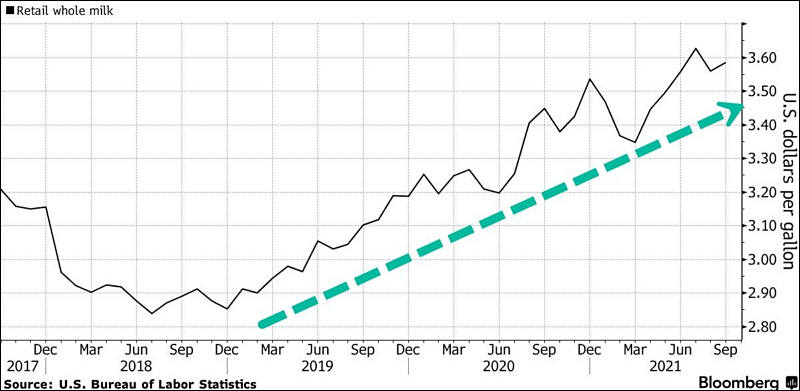

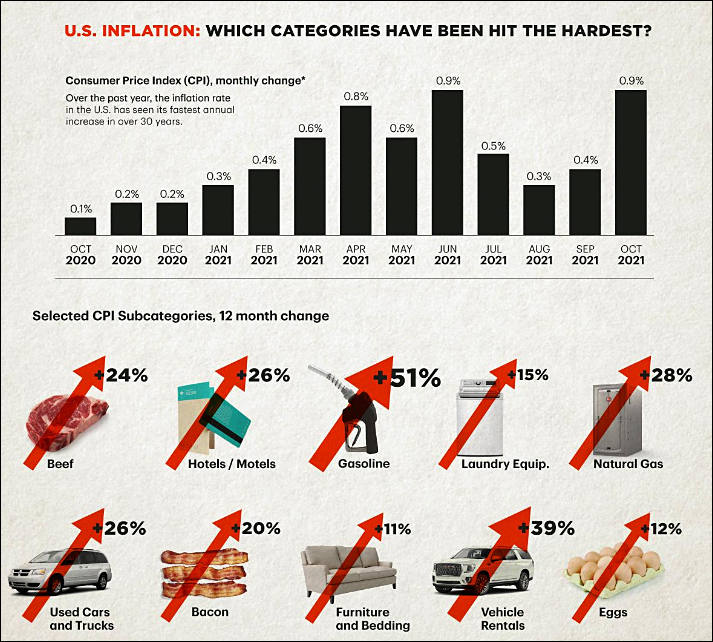

Consumers around the world should get used to the high prices of groceries. This was stated in an interview with the BBC by the CEO of the American corporation Kraft Heinz Miguel Patricio.

According to him, prices are rising for several reasons: the pandemic has disrupted the supply of resources necessary for food production, the supply does not keep pace with the growing demand against the backdrop of economic recovery, and the increase in wages and the rise in energy prices have increased costs for producers.

Patricio noted that the cost of food will continue to increase in the future as the world's population grows and the amount of land on which to grow food is not. The situation can only be corrected by technologies that will "increase the efficiency" of farms, added the head of Kraft Heinz.

-

Highest price rise since the 1974 oil crisis: Wholesale prices in Germany climbed 13.2 percent in September. The drivers were metals and refined products.

The flywheel of inflation is accelerating in Germany. In September, wholesale selling prices in the country grew at the fastest pace in more than 47 years. According to the Federal Statistical Office, they were 13.2% higher than a year earlier. The most significant increase was last seen in June 1974, when prices jumped 13.3 during the first oil crisis.

These are considered to be an indicator of future inflationary trends, since wholesale trade is the link between manufacturers and end consumers. In August, the inflation rate in wholesale trade was 12.3%, and in July - 11.3%. It was already unusually high.

"The high growth in wholesale prices compared to September 2020 is due, on the one hand, to the currently sharply increased prices for many types of raw materials and intermediate goods," the statisticians write. "On the other hand, a low base effect comes into play as a result of the very low price level in previous months due to the pandemic."

A strong factor in the rise in prices, according to available data, was the rise in prices for ores, metals and intermediate metal products - by 62.8 percent. Petroleum products cost 42.3 percent more than a year ago. There was also a particularly strong jump in prices in the wholesale of scrap and residual materials (+ 84.6%), as well as round timber and processed timber (+ 54.6%). Grain, raw tobacco, seeds and animal feed also increased significantly (+23.9 percent).

-

Final demand PPI prices increased by 8.6% compared to a year ago, which is a historical record for the entire measurement period (since 2010)

Prices for goods of intermediate demand (intermediate demand PPI, this is something that still has to be processed before being turned into goods) has risen by a wild 23.9%, breaking a nearly half-century record since the mid-70s)

-

According to the IEA's October winter fuels outlook (pdf), nearly half of U.S. households that warm their homes with mainly natural gas can expect to spend an average of 30% more on their "multi-year high" bills compared with last year. The agency added that bills would be 50% higher if the winter is 10% colder than average and 22% higher if the winter is 10% warmer than average.

The forecast rise in costs, according to the report, will result in an average natural-gas home-heating bill of $746 from Oct. 1 to March 31, compared with about $573 during the same period last year.

-

Notebook brands are facing the pressure of reflecting the extra costs from components, production and logistics on the prices of their new notebooks.

-

Consumers around the world are about to get socked with even higher prices on everyday items, companies from food giant Unilever Plc to lubricant maker WD-40 Co. warned this week as they grapple with supply difficulties.

The maker of Dove soap and Magnum ice-cream bars jacked up prices by more than 4% on average last quarter, the biggest jump since 2012, and signaled elevated pricing will continue into next year. A similar refrain came from Nestle SA, Procter & Gamble Co. and Danone SA, whose products dominate supermarket aisles and kitchen cupboards.

“We’re in for at least another 12 months of inflationary pressures,” Unilever CEO Alan Jope said in a Bloomberg Television interview. “We are in a once-in-two-decades inflationary environment.”

-

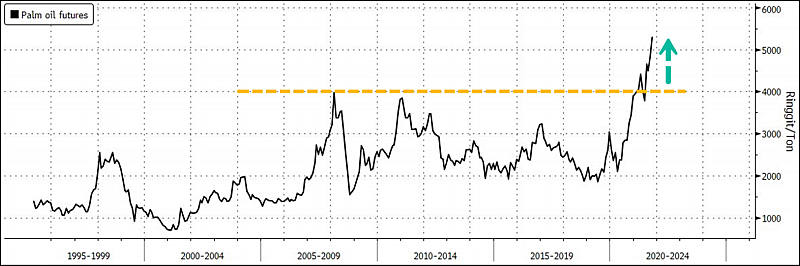

Prices of edible oils have been rising across the world. Palm oil, the world's most consumed vegetable oil, surged to a new record high, spreading concerns about persistent global food inflation.

Malaysia's palm oil futures soared more than 40% this year, while soybean oil is up more than 50%. Prices of canola oil are also at a record.

sa18592.jpg800 x 266 - 43K

sa18592.jpg800 x 266 - 43K -

In Central Europe, "fuel tourism" is reviving: due to the sharp rise in gasoline prices in Germany, Germans are sent en masse to neighboring countries - Austria, Poland and the Czech Republic. A liter in Germany costs almost two euros. This is more than even the UK, which is experiencing a serious post-Brexit transport crisis.

The difference with neighbors can reach 50 euro cents - according to German drivers, this fully compensates for a longer journey to refuel abroad. At the same time, many people do not limit themselves to a full tank, but take canisters with them: forecasts for a rise in prices in the Federal Republic are disappointing.

-

“Hyperinflation is going to change everything. It’s happening,”

“It will happen in the U.S. soon, and so the world.”

Twitter CEO Jack Dorsey

-

Battery-grade lithium carbonate price has risen 440%. Lithium price has been on the rise since 2020, bringing production costs of EV batteries higher. Prices of battery cells and battery packs will rise by at least 30%.

-

Larry Fink, CEO of BlackRock:

Inflation will definitely not be just temporary, it is a new regime. Energy hunger will increase inflationary pressures, which will hit both the wallets of citizens and businesses. And one of the reasons for this is the green policy, which has led to restrictions on hydrocarbon production, which and generated energy inflation.

-

Over the past twelve months, the cost of lithium carbonate in China has more than quadrupled, and the only thing that saves lithium batteries from a proportional rise in cost is that the specific content of this element in them is not so high.

Nickel sulphate prices in China increased by more than 30% over the same period, while cobalt hydroxide rose by more than 80%. The situation is exacerbated by planned power outages at factories in China, which have been undertaken by local authorities since the end of September. With the continuing dynamics of growth in prices for minerals, lithium batteries containing nickel, cobalt and manganese may rise in price by almost 10% worldwide next year, following China

-

According to various experts, including a specialist from the analytical company Gartner Mikako Kitagawa , the average cost of PCs and laptops in just a year increased by 10% at once. And this is in Europe and the USA, in the Russian Federation the situation is even more complicated. According to Vedomosti, the rise in prices for computers only in the second quarter of 2021 amounted to at least 20%.

-

Stock prices for wheat are breaking records. They have already surpassed a nine-year high, surpassing the $ 8 a bushel mark. And according to a number of experts, they may well rise to the level of 2008 - $9-12.

"The price of benchmark wheat on the Chicago stock exchange rose above $ 8 a bushel for the first time since December 2012," Prime said in a November 2 trading session.

-

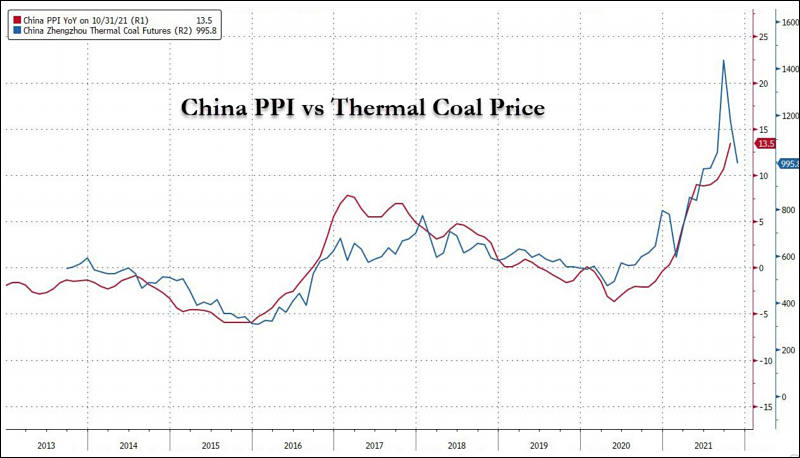

Chinese statistics report that producer prices (PPI) in October rose by 10.7% compared with the same month a year ago, which is a record for the entire observation period, i.e. since at least November 1995.

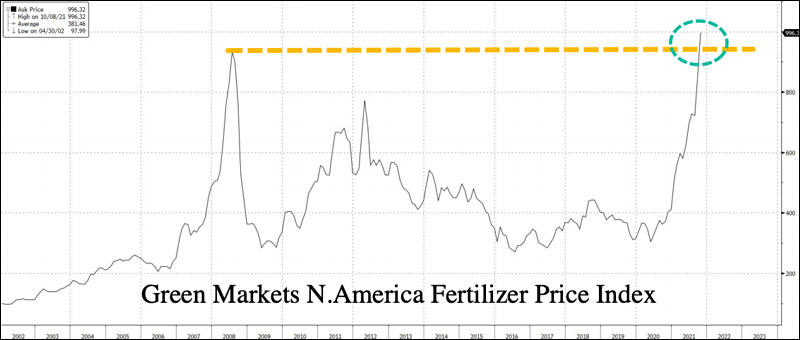

sa18723.jpg800 x 458 - 54K

sa18723.jpg800 x 458 - 54K -

The University of Michigan’s consumer sentiment index fell to 66.8 in November – down sharply from the October reading of 71.7 and well below economists’ forecast for a reading of 72.4.

“Consumer sentiment fell in early November to its lowest level in a decade due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation,” Richard Curtin, the survey’s chief economist, said in a statement.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320