It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Chip shortage likely to persist through 2022, says Silicon Motion: Foundry and backend capacity constraints resulting in a global shortage of semiconductors will likely persist through 2022, according to Silicon Motion Technology, a Taiwan-based NAND flash device controller specialist.

Car chips shortages showed that COVID had been already used to hide big issues in manufacturing. As car sales rebounded too fast it can be seen in full force.

-

TSMC's board approved capital appropriations of about US$11.8 billion for fab construction and installation of fab facility systems, installation and upgrade of advanced technology capacity, as well as other purposes including installation of mature and specialty technology capacity, installation and upgrade of advanced packaging capacity, and second-quarter 2021 R&D capital investments and sustaining capital expenditures.

TSMC's board also approved a NT$2.50 per share cash dividend for the fourth quarter of 2020, when the company reported net profits hit a record high of NT$142.77 billion or NT$5.51 per share.

-

China's industry ministry said this week that it met with automotive and chip manufacturers to try and help ease what is now being called a "crisis" of a shortage in global semiconductors.

Shortage of chips in auto industry seems like bad reason to keep auto production at low levels reached during COVID. As most of them are made on old lines and always had been very predictable.

Something went off in original COVID plan so some pause formed.

-

According to reports, SMIC is planning to build a new SN1 factory in Shanghai to manufacture chips on 12 "(300 mm) wafers. On this production line, the company will be able to produce up to 35,000 wafers per month, following advanced manufacturing processes below 14 nm. It is planned to spend $ 12 billion on the enterprise. SMIC is moving forward in the development of 7-nm chip production, but now its plans are hampered by the inability to purchase equipment for printing in deep ultraviolet (EUV) range due to US sanctions. This lithography uses shorter wavelengths of light and allows for more efficient downsizing of transistors.

-

TSMC is believed to have been under political pressure to set up an advanced wafer fab locally in the US in the wake of the US-China trade war.

Who could have though...

-

TechNews reports that TSMC's 3nm production quotas have been distributed until 2024. The company intends to expand the new stage of lithography in four stages. "The right of the first wedding night", as noted, will traditionally go to Apple, which will be the first to start receiving 3nm products among all TSMC customers.

The next three waves will include AMD, NVIDIA, Xilinx, Qualcomm and some others, according to Taiwanese sources.

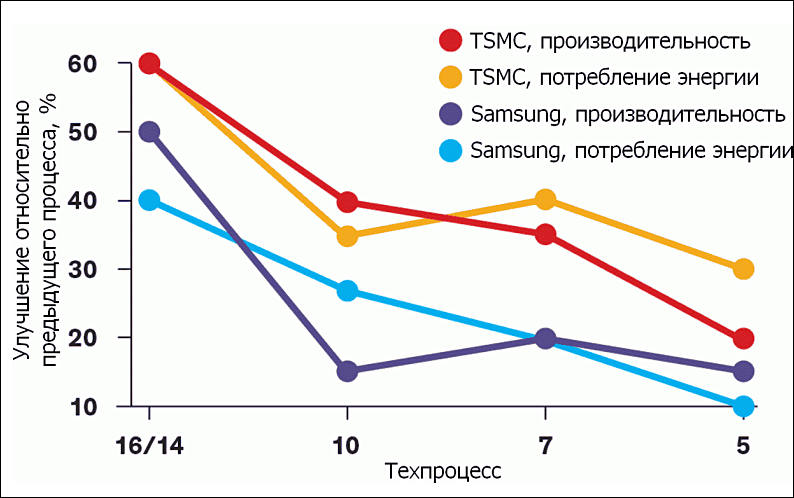

Initially TSMC will be able to process up to 55 thousand silicon wafers with 3-nm products per month per month, and by 2023 the volumes will grow to 105 thousand silicon wafers per month. The new process technology will increase the density of transistors by 70%, as well as either increase the speed by 15% with constant power consumption, or reduce energy consumption by 30% compared to the 5nm process technology. According to preliminary estimates, TSMC is ready to invest $ 71.6 billion in the development of 3-nm technology.

It is expected that 3nm chip design and manufacturing will cost around 1.5-1.7x more compared to present 5-7nm processes. So, for around 15% performance gain during non intense tasks you also will pay around 20-30% premium. New processes now become more expensive for each unit of chip performance, progress turned into regress.

-

Nvidia and Qualcomm reportedly have already reached agreements with TSMC for capacity support from its next-generation manufacturing processes,

All eggs will be in one basket and it can fall from the cliff.

-

TSMC has already struck a deal with Intel under which the pure-play foundry will use 3nm process technology to manufacture the US vendor's core CPU products, with volume production scheduled for the second half of 2022, according to sources.

So it is only one "3nm" process now. Fake 3nm, of course, but still.

-

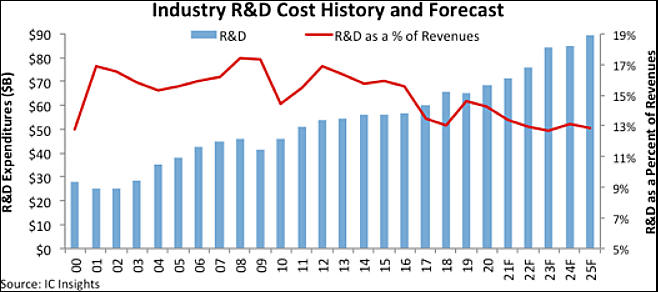

Research and development spending by semiconductor companies worldwide is forecast to grow 4% in 2021 to $71.4 billion after rising 5% in 2020 to a record high of $68.4 billion, according to IC Insights’ new 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. Total R&D spending by semiconductor companies is expected to rise by a compound annual growth rate (CAGR) of 5.8% between 2021 and 2025 to $89.3 billion.

Total semiconductor R&D spending has declined in only four years since the end of the 1970s (-1% in 2019 during an economic slowdown, -10% in 2009 after the industry was hit by a major global recession, and back-to-back drops of -1% in 2002 and -10% in 2001 when an economic downturn coincided with the implosion of the Internet “dot-com” bubble at the turn of the century). In the aftermath of the global recession of 2008-2009, R&D spending recovered strongly in 2010 and 2011, but then outlays slowed during the rest of the last decade for a variety of reasons, including ongoing uncertainty about the global economy and an historic wave of acquisitions in the chip industry.

Since the year 2000, total semiconductor R&D spending as a percent of worldwide sales has exceeded the four-decade historical average of 14.6% in all but five years (2000, 2010, 2017, 2018, and 2020).

Intel continued to top all other semiconductor suppliers in R&D expenditures in 2020, accounting for about 19% of the industry’s total. However, cost cuts, the elimination some product categories, and a drive to maximize efficiencies resulted in a 4% decrease in Intel’s R&D outlays in 2020 to an estimated $12.9 billion after its spending declined 1% in 2019, when its share was 22% of the industry’s total. The 2019-2020 drops in Intel R&D expenditures were the first consecutive annual declines for the company since 2008 and 2009. The 4% decrease in 2020 was the largest R&D decline for Intel since the mid 1990s. Second-ranked Samsung increased its R&D spending by 19% in 2020 to $5.6 billion partly because the South Korean memory giant stepped up development of leading-edge logic processes (of 5nm and below) to compete in the advanced IC foundry business with market leader Taiwan Semiconductor Manufacturing Co., which raised its expenditures on research and development by 24% to nearly $3.7 billion last year.

You can see both extreme greed and monopolization from this.

The wall is very near and now all companies are unprepared, TSMC just have highest speed and it will be hit hardest in time.

sa16260.jpg658 x 292 - 44K

sa16260.jpg658 x 292 - 44K -

Both TSMC and UMC are expected to sustain full capacity utilization for 28nm manufacturing process at their 8-inch and 12-inch fabs throughout third-quarter 2021, with gross margins from the mature node hitting new records.

It means that they are rising prices and they need to to finance 2nm and 3nm projects where they try to stop for another 8-10 years.

-

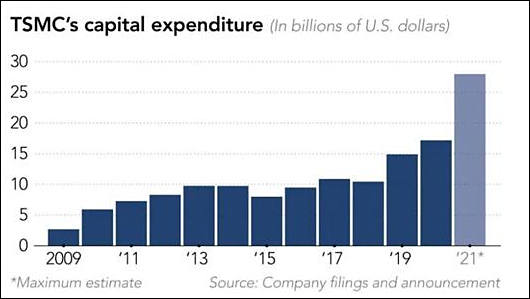

Throughout 2020, TSMC had to update its budget for expanding production and mastering new technical processes almost monthly. As a result, it reached $ 18 billion, but this year the company is going to spend a record $28 billion on specialized needs.

TSMC becoming sacred cow, hence the change of US attitude toward Taiwan.

Almost all TSMC factories are wrongly located in very risky areas.

-

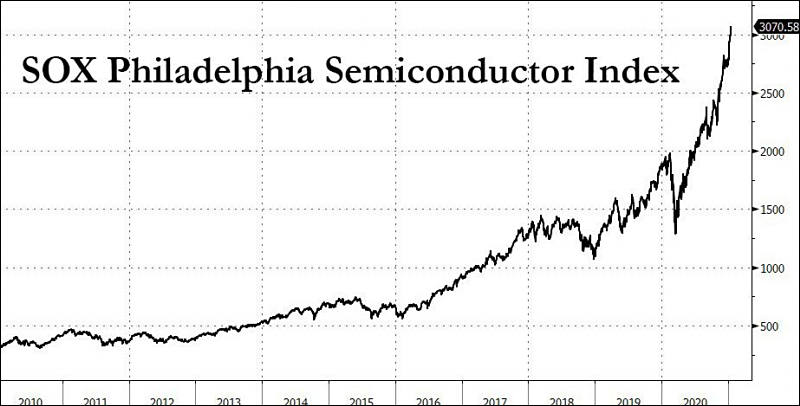

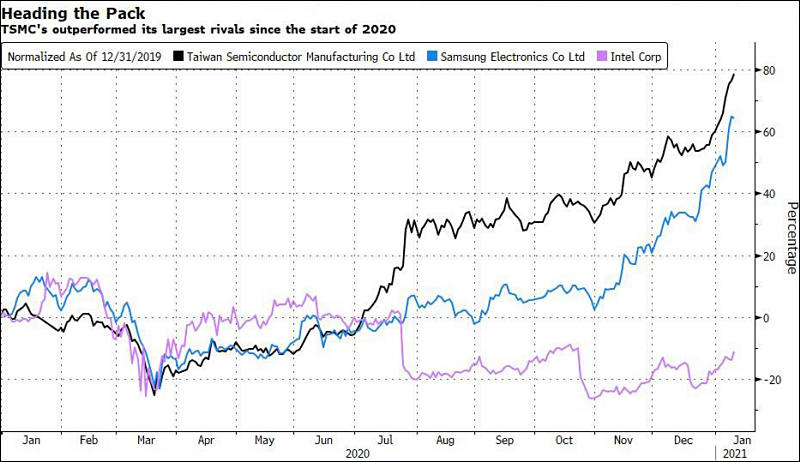

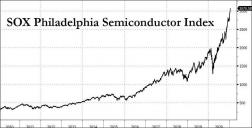

Media now help to make another stock bubble as TSMC badly needs money.

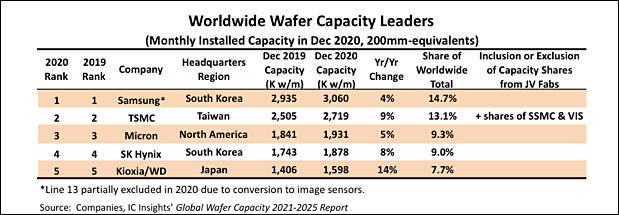

sa16220.jpg800 x 406 - 46K

sa16220.jpg800 x 406 - 46K

sa16221.jpg800 x 462 - 67K

sa16221.jpg800 x 462 - 67K -

As automakers build vehicles that resemble more of a computer, they're facing a shortage of semiconductors that is now beginning to affect vehicle production. Both Ford Motor and Nissan Motor said they froze production at plants in the U.S and Japan, respectively, as they work with suppliers to resolve the situation and monitor additional impacts.

Rumors are that AMD, Nvidia and ASIC makers offered best terms trying to get their billions from crypto bubble.

-

Taiwan manufacturers dreams

IC Insights has forecast that China-produced ICs will represent only 19.4% of the country's IC market in 2025, a fraction of the country's "Made in China 2025" goal of 70%.

Although China has been the largest consuming country for ICs since 2005, it does not necessarily mean that large increases in IC production within China would immediately follow. IC production in China represented 15.9% of its US$143.4 billion IC market in 2020, up from 10.2% in 2010, IC Insights said. Moreover, IC Insights forecast that this share will increase by 3.5pp from 2020 to 19.4% in 2025.

If China-based IC manufacturing rises to US$43.2 billion in 2025 as IC Insights forecasts, China-based IC production would still represent only 7.5% of the total forecast 2025 worldwide IC market of US$577.9 billion. Even after adding a significant markup to some of the Chinese producers' IC sales (many Chinese IC producers are foundries that sell their ICs to companies that re-sell these products to the electronic system producers), China-based IC production would still likely represent only about 10% of the global IC market in 2025.

Taiwan guys are very afraid of any Chinese progress as island is actually very bad place for silicone production due to constant quakes and very expensive also, where each firm keep huge profits.

Silicone factories building costs and workforce are much cheaper in all mainland Chinese regions. Hence the huge fears.

-

The US trade ban against China-based SMIC has restricted the pure-play foundry's capability of obtaining semiconductor equipment for its process technology advancements. Nevertheless, a more significant challenge facing SMIC is insufficient supplies of chemical raw materials and consumables.

War will be vicious.

-

TSMC's 2021 capex will beat the record-high target of US$17 billion set last year, the report quoted market watchers as saying. The foundry will utilize its capex this year for the expansion of its 5nm process capacity, installation of more-advanced 3nm process capacity, and 2nm process R&D.

The pure-play foundry is expected to budget more than US$20 billion in capex this year.

Situation on TSMC is bad now as similar to Intel with super successful 14nm it can hit wall with problematic 3nm that they can't make to work still even for small batches.

-

According to the source, the revenue of companies in the semiconductor sector in 2021 will increase by 8-10%, while the revenues of specialized companies will grow by 15-18%.

Everything becoming more and more expensive. Mergers will follow.

-

Issues are serious, free market ends here - EU Signs €145bn Declaration to Develop Next Gen Processors and 2nm Technology

In a major push to give Europe pride of place in the global semiconductor design and fabrication ecosystem, 17 EU member states this week signed a joint declaration to commit to work together in developing next generation, trusted low-power embedded processors and advanced process technologies down to 2nm. It will allocate up to €145bn funding for this European initiative over the next 2-3 years.

-

Nice article on silicon progress and processes (use google translate)

sa16056.jpg794 x 498 - 60K

sa16056.jpg794 x 498 - 60K -

TSMC and Samsung Electronics have both encountered different but critical bottlenecks in the development of their respective 3nm process technologies, according to industry sources. The foundry houses may have to delay moving their respective 3nm process to volume production.

Who could have thought.

And it will be real tragedy for Apple.

-

Intel has big issues

Third Point investment fund, which owns a $ 1 billion stake in Intel, sent a letter to chairman of the board of directors Omar Ishrak listing "strategic alternatives" designed to stop the company's business degradation.

Intel management is encouraged to augment the portion of products outsourced to third parties such as TSMC or Samsung. According to the authors of the initiative, it is advisable to create a joint venture with them to ensure the allocation of sufficient production capacity for the release of Intel products. These same joint ventures should attract new customers to the American soil for contract manufacturing of Intel - it is assumed that Apple or Microsoft will want to entrust a new contractor with the release of their processors in the United States.

Intel should get rid of some of its assets, according to activists. We are talking, in particular, about the business of Altera on the development of programmable matrices, for which Intel at one time dumped $ 16.7 billion. Investors also believe that Intel needs to do something about the outflow of qualified personnel, who are demoralized by the policy pursued in recent years company management. In general, Intel has already expressed its willingness to consider the Third Point proposals.

-

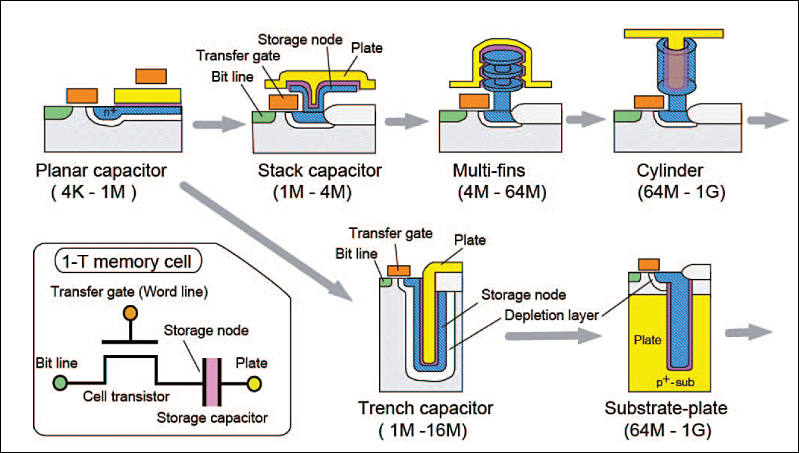

DRAM memory progress

You can see approach that is similar to that NAND manufacturers are doing, yet it is no layers for now.

sa16030.jpg799 x 453 - 72K

sa16030.jpg799 x 453 - 72K

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,981

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,362

- ↳ Panasonic992

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras115

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,417

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,580

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319