It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

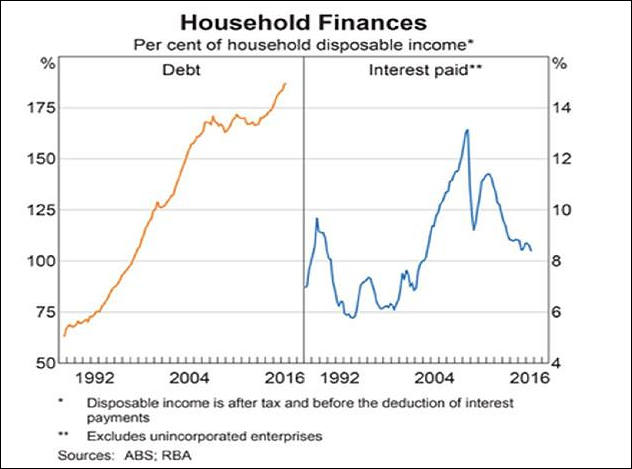

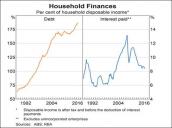

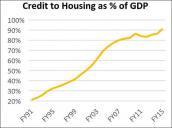

Australian Household Debt

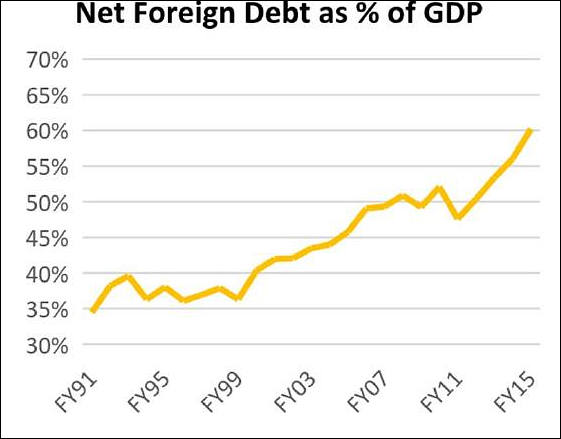

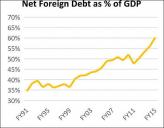

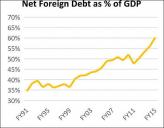

Net Foreign Debt

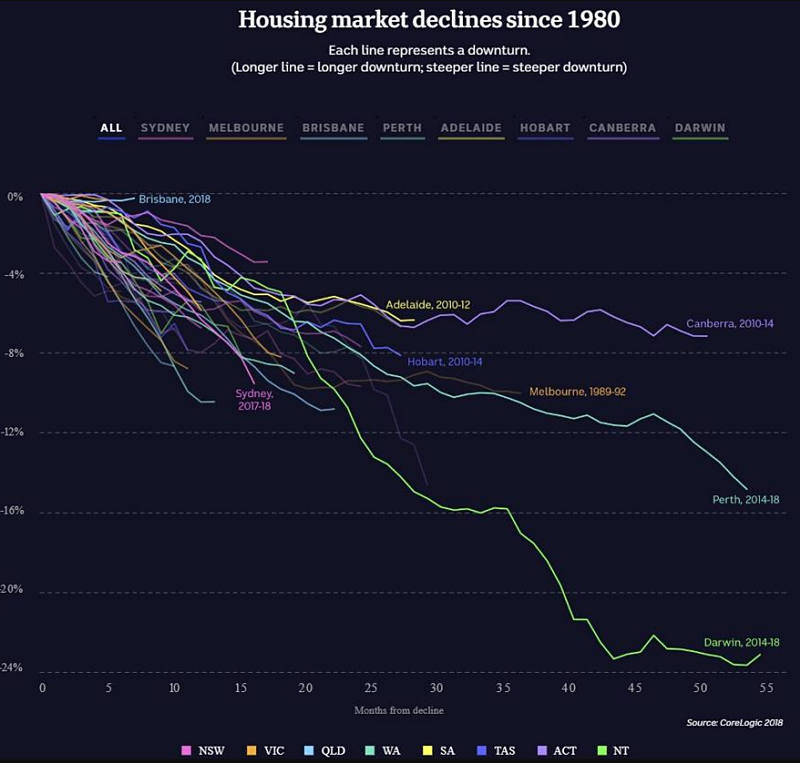

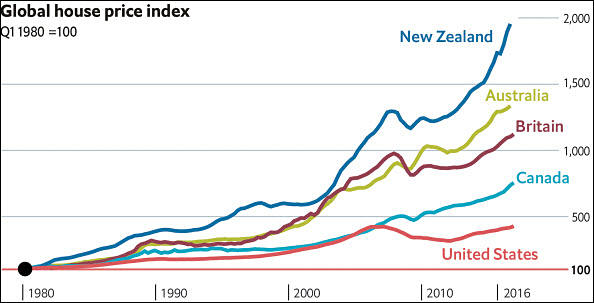

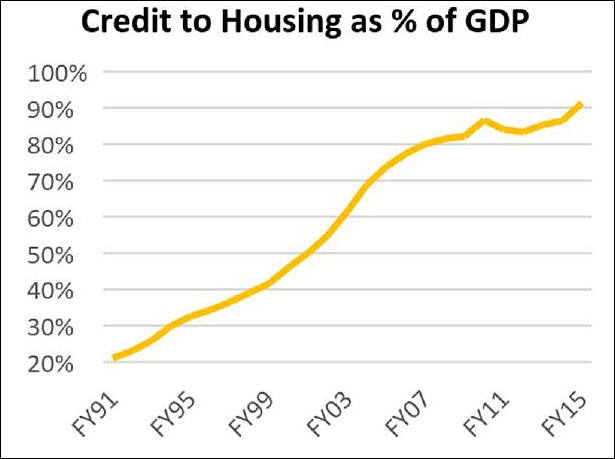

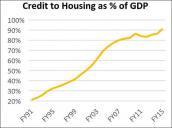

Housing Bubble

sample734.jpg632 x 469 - 37K

sample734.jpg632 x 469 - 37K

sample735.jpg561 x 439 - 29K

sample735.jpg561 x 439 - 29K

sample736.jpg615 x 459 - 33K

sample736.jpg615 x 459 - 33K -

Do not worry, nothing will change. It is director who set the circus scenery, not the clowns.

Here lot of people worried how fast mr. Trump will start to return manufacturing back to US, and fight for real working people :-)

-

Labour has been pretty racist in the past (my GF has literally been crying over the news of Labour/NZF/Greens getting elected, as she is a foreigner. Which reminds me, we should hurry up with getting the immigration paperwork done before they tighten up the rules....):

“39.5% of last names in a list of house sales sound Chinese”

https://www.kiwiblog.co.nz/2015/07/labour_blames_the_chinese.html

(the reality is only a very small % of house purchases are by non-citizens/residents)

After 9yrs out of power, is a bit sad to see them return to government. I just watched the live stream of the moment when Jacinda got sworn in as PM a few minutes ago.

-

New Zealand also much love "no bubble" state

Thirty-seven-year-old Jacinda Ardern, a member of the New Zealand Labour Party, became the world’s youngest female leader.

"We have agreed on banning the purchase of existing homes by foreign buyers," Ms Ardern said on Tuesday, while also announcing plans to slash immigration and focus on job creation.

It won't have any effect, of course, except making lot of firms and people specializing on being fake owners.

-

In a nutshell, China's buying our resources again so we can all breathe.

China sneezes and Australia will catch a cold.

Hi @tenjin, I have worked mainly in the television industry as a freelancer, AD, floor manager, assistant producer etc, in Melbourne. So my advice on work would come from that angle.

@Haberdasher, do you feel the film industry is better in Sydney or Melbourne? (or Brisbane?!)

“On a 25-year mortgage, you’ll pay $24,000 in interest on the stamp duty so basically in total it costs $56,000 per house on average in Victoria over the life of a mortgage.”

WOW! That is insane that level of tax on every single house sale.

-

That's the media doing the bankers bidding by creating an . Prices will keep going up over the long term.

Talking to citizens it is certainly not "issue that does not exist".

Property is the same as any commodity and is subject to supply & demand,

Supply and demand basic things from economics book work if you both parts have free will. If it was selling and buying of additional optional summer house it can be viewed such (with restrictions). But people need property to live in, capitalist sellers want maximum profits. Hence the thing you see.

Specific situation happens due to two part thing. One is foreign (mostly Chinese bourgeoisie) buyers who spend easy money they did not work hard for. Second is requirement of general credit bubble, as rising house costs allow you to push more consumer credits to citizens.

-

No sign of a housing price crash or recession in Australia, yet. There has only ever been two very slight downturns in my 60 years here. There is no price "bubble". That's the media doing the bankers bidding by creating an issue that does not exist. Prices will keep going up over the long term. The chart above is very revealing about the US economy, rather than showing any problem with other countries. Property is the same as any commodity and is subject to supply & demand, even if the supply & demand are manipulated by bankers in indirect ways.

-

Neither give a fuck about our children and their children.

Well...

Under capitalism a democratic republic, like every other form of state, is nothing but a machine for the suppression of the proletariat. The big bourgeois knows this from his most intimate acquaintance with the real leaders and with the most profound (and therefore frequently the most concealed) springs of every bourgeois state machine.

:-)

-

That link is a very well written and accurate document of the present situation. Stamp duty is one of the biggest hurdles young and older people have to face financially when buying property. They also have big expenses with State government, local councils, and conveyancing , who have money making tools that add exorbitant price on top of actual property value. Rivers of gold for the Banks and Governments in that order. Neither give a fuck about our children and their children.

-

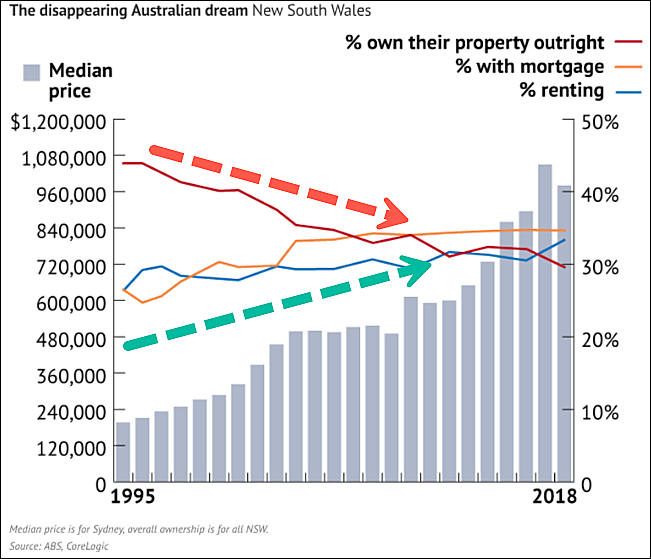

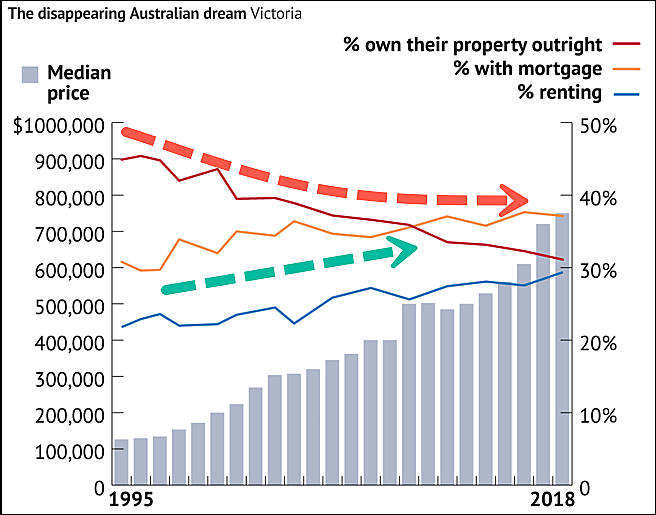

Improvements are clear

Property Council Australia’s deputy executive director of the Victorian division, Asher Judah, said affordable housing in Melbourne was getting worse every year while also blaming the soaring cost of stamp duty.

He said stamp duty had increased a whopping 795 per cent. Back in 1995, the average home cost $131,000 and stamp duty cost an extra $4000.

But today, people are paying $620,000 for an average home but $32,000 extra for stamp duty.

“On a 25-year mortgage, you’ll pay $24,000 in interest on the stamp duty so basically in total it costs $56,000 per house on average in Victoria over the life of a mortgage.”

-

@Vitaiy_Kiselev Good point.

-

That seems to be the situation so many young people are facing. Possibly dammed if they do, and dammed if they don't. Their high levels of debt is just a way of life that they've grown up in, and that's before a lot of them have a mortgage.

It is false choice.

If some rapist came and asked you choose one of two ways he want to fuck your daughter you won't be thinking what to choose. Here the solution is the same.

-

@Kinvermark thanks for those 2 links, fascinating stuff.

"So you will likely loose slowly over time if don't buy a house and you MAY lose really big if you do by a house!"

That seems to be the situation so many young people are facing. Possibly dammed if they do, and dammed if they don't. Their high levels of debt is just a way of life that they've grown up in, and that's before a lot of them have a mortgage.

-

Their approach is very popular lately, but had been used for long long time. Idea it so focus on bankers, as if they are some separate evil entity. Such sites and papers have huge flaws, like even not understanding that is the role of government and central banks.

Home prices and mortgages is also nothing new, it is indirect tax that ruling class imposes on workers.

Personally, I am not a socialist, but I certainly don't support unfettered capitalism either - the system needs to change.

Where is no good capitalism variants. So, improving capitalism is waste of time.

-

Here is a link to some videos they made:

http://positivemoney.org/how-money-works/banking-101-video-course/

There is also one specifically about housing: http://positivemoney.org/issues/house-prices/

The key fact to understand is that because we now have 97% of our money held in electronic accounts (3% is paper & coin) and because BANKS (not the government!) create this electronic money at the point at which they make a loan (very often a home mortgage), the system is prone to problems of price inflation of certain kinds of assets (ie housing and land), instability (a debt is created at the same time as the new money), and the inability of a Countries' central reserve bank to have any real influence on the system (which is why we have seen decades of ever dropping interest rates - even negative (really weird!) rates - with no stimulating impact on the economy.

With housing, we are really in big trouble because (in my opinion) the system makes it likely that houses will continue to strongly inflate in price with occasional big drops like the 2008 sub-prime crash in the USA. (So you will likely loose slowly over time if don't buy a house and you MAY lose really big if you do by a house! )

Personally, I am not a socialist, but I certainly don't support unfettered capitalism either - the system needs to change.

-

Can you post here short version for lazy guys?

-

I think you will find the articles on this site very interesting and informative:

The articles explain how the central banking system now REALLY works, why interest rates are no longer influenced primarily by a countries central reserve, and why so much of the money supply is tied to mortgages. It is a serious site by real economists and verifiable by Bank of England technical papers.

-

Well it had to start happening but I didn't think interest rates would start heading north until later on in the year. Wasn't the Reserve Bank, nor the Federal Govt, but the good old banks are taking it upon themselves to do it. One of the major 4 Banks increased home loan rates to existing loans and investment loans. 25 basis points to home loans. JP Morgan advised yesterday that housing investors could expect to see hikes of 3% in the near future. Lot of people gonna get caught out. Once again I hope I'm wrong.

-

OK, so I'm hoping to round-off this general intro to what's happening in Oz economics with ..

Why are we still buying houses we can't afford?

When will we get to the point that we just say NO?

this has the potential to be like what happened in the US — maybe even worse.

The pros and cons of some of the top suggestions to make buying a house more doable, along with the likelihood of them ever actually happening. "In Sydney, Brisbane and Melbourne it's nothing but a speculative, credit-fuelled housing bubble. It's what happened in Ireland and what happened in a lot of parts of the US in the past decade," he says.

"A lot of people thought the housing market was invincible and it could only go up and one day it crashed and it burned a lot of people, and the financial system along with it."

Youth unemployment in Australia is currently sitting at 13.3 per cent.

-

Insecure, stressed, and underemployed: The daily reality for millions of Australians

The rise of the part-timer

The sectors of the economy that have enjoyed increased activity are healthcare, hospitality, and tourism. These sectors tend to be biased towards hiring part-time workers.

During the 1980s and 1990s both men and women were working more, and earning more (excluding the recession). Recently, however, the economy's been unable to sustain those jobs.

Now, women tend to be working 25 hours a week, while men also work 25 hours a week (in trend terms). So, overall, the household is working more, but because both jobs may not be strictly full-time, the actual combined take-home pay at the end of the day is less.

So yes, you guessed it, overall we're working more, for less pay.

-

We could (but probably won't) go into recession today

The Federal Government will be watching closely as the Australian Bureau of Statistics (ABS) releases its gross domestic product (GDP) figures later today.

Last time around, they showed Australia's economy had gone backwards. If that happens for the second quarter in a row, we'll be in a technical recession.

The term, "recession" is this arbitrary thing a lot of us are starting to roll our eyes at.

In a nutshell, China's buying our resources again so we can all breathe.

So we're out of the woods?

Well, no.

The expectation is that annual growth will remain around 2 per cent. According to Trading Economics, the average rate for Australia from 1960 until 2016 was 3.49 per cent.

Many economists think Australia's "potential" growth rate has slowed down, in part because of our aging population, so they see the par annual growth figure being around 2.75-3 per cent to keep unemployment steady

-

You sound like someone who can be confident of entry to Australia, so you may well find employment in your media field.

For others intending to emigrate to Australia, it's a good idea to look up our immigration points system for different kinds of visitors. (Basically the country selects people we need - so the healthy, honest, English-speaking, solvent and trained tend to get chosen).

Unless people qualify for immigration under family reunion or political asylum grounds, (which awards them high points) the bulk of candidates fall into the employment based category as specified on the Department's website: https://www.border.gov.au/Trav/Work/Work/Skills-assessment-and-assessing-authorities/skilled-occupations-lists/CSOL

Film and TV graduates do figure on the list (notably, video producers aren't needed much according to a note I read somewhere on the website):

- Artistic Director 212111 VETASSESS

- Media Producer (excluding Video) 212112 VETASSESS

- Radio Presenter 212113 VETASSESS

- Television Presenter 212114 VETASSESS

- Author 212211 VETASSESS

- Book or Script Editor 212212 VETASSESS

- Art Director (Film, Television or Stage) 212311 VETASSESS

- Director (Film, Television, Radio or Stage) 212312 VETASSESS

- Director of Photography 212313 VETASSESS

- Film and Video Editor 212314 VETASSESS

- Program Director (Television or Radio) 212315 VETASSESS

- Stage Manager 212316 VETASSESS

- Technical Director 212317 VETASSESS

- Video Producer 212318 VETASSESS

- Film, Television, Radio and Stage Directors nec 212399 VETASSESS

- Copywriter 212411 VETASSESS

When it comes to accommodation in cities, I tell people to check the real estate sites first for something you can afford, then use Google maps to work out commute times.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,355

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319