-

TSMC 3nm

- 15% better transistor density compared to 5nm (instead of 66%)

- up to 10-15% performance improvement with same energy consumption

- or 20-25% less energy consumptionwith similar performance

- TSMC will still use completely unsuitable for such norms FinFET approach

TSMC turned into marketing monster making one fake new process after another.

They have big money and lead for now, but this train can go into deep trench.

-

With U.S. government restrictions on China's Huawei, SMIC will take over production of Kirin modem chips at 14nm from TSMC at 7nm.

SMIC, the fifth-largest pure-play foundry, will be able to produce chips at 7nm even without EUV lithography, as early as next year.

SMIC's n+1 process already offers performance at 14nm close to TSMC's at 7nm.

Concerns about sanctions against SMIC will not materialize this year amid concerns of further negative financial impact on U.S. companies following the first round of sanctions.

https://seekingalpha.com/article/4359158-china-who-needs-tsmc-when-smic

-

It remains to be seen whether unsatisfactory yield rates at Samsung Electronics' 5nm EUV process may affect the launch of Qualcomm's next-generation flagship 5G mobile chip series, according to industry sources.

Nice.

-

On July 20, according to foreign media reports, TSMC will also launch a 4nm process between 5nm and 3nm process .

According to the report, TSMC mentioned the 4nm process in the second quarter conference call disclosed on its official website and stated that it will start the 4nm process as an extension of the 5nm process. In addition, the 4nm process will be compatible with the design rules of the 5nm process, and it has a cost-effective advantage over the 5nm process. It is aimed at the next wave of 5nm products and plans to mass-produce in 2022.

It is reported that TSMC has stated that 3nm will continue to use FinEFT technology. The main consideration is that customers' designs on the 5nm process can also be used in the 3nm process. There is no need to face the problem of redesigning products. TSMC can maintain its own cost competitiveness and gain more Customer orders.

-

Electricity issues

Data centers are on course to consume 15% of the world’s electricity by 2025, according to Applied Materials Inc., the world’s largest maker of chip equipment. Those giant warehouses of computers currently suck in about 2%, the company said.

“AI has the potential to change everything,” said Applied Materials Chief Executive Officer Gary Dickerson speaking in a prerecorded remote keynote for the industry’s Semicon West conference. “But AI has an Achilles’ heel that -- unless addressed -- will prevent it from reaching its true potential. That Achilles heel is power consumption. Training neural networks is incredibly energy-intensive when done with the technology that’s available today.”

Idea is to move to some custom silicon, but issue is that such investment is very risky as new or wastly improved existing approach will require dumping all and everything of existing rack mounted hardware.

-

Intel 7nm

The company’s 7nm-based CPU product timing is shifting approximately six months relative to prior expectations. The primary driver is the yield of Intel’s 7nm process, which based on recent data, is now trending approximately twelve months behind the company’s internal target.

And counting.

7nm can be final process that will ever be developed by Intel.

-

Intel desktop retail CPUs sales staggering fall

YoY fall reaches 70% in EU, around 55% in US and up to 80% in some Asian countries.

Long OEM contracts keep company afloat, but they will start to expire this fall.

After announcement about 12 months delay industry insiders started to talk that no 7nm will be used for desktop and server high performance CPUs till 2024 at least.

Huge issue of Intel 7nm is the heat dissipation, transistors leakage and EUV steps.

To lower leakage on smaller transistor they need to move from FinFET but it instantly makes number of defects around 10x from previous, as it is new approach and much more complex.

This is also reason why TSMC management instead fakes the new silicon processes keeping simple and large transistors and paying more to PR and press coverage.

-

AMD Q2 2020

- Income increased 26% YoY

- Profits soared 4.5x times YoY

- Rise is mostly due to extreme margins on Rizen 2 based chips (Epyc and Threadripper also)

-

AMD and TSMC

Over the past year, AMD's investment volume at TSMC has increased significantly. In the beginning of 2019, the monthly production volume was only about 2,000 to 3,000, which is not even the top five customers. The average monthly production volume this year has increased to 7,500 to 8,000. The number of films will grow to above 16,000 next year. It is estimated that the number of films produced in the second quarter of next year will surpass Apple, becoming TSMC’s largest customer for the first time, accounting for more than 20% of revenue.

According to AMD plan, its latest fourth-generation EPYC server processor "Genoa" (referring to the product code) is determined to be unveiled next year. It is a Zen 4 architecture and will be produced in 5nm. The supply chain said that the new product was originally planned to be put into production in the second half of 2021. In order to advance TSMC's 5nm production capacity, it may conduct risky trial production in the fourth quarter of this year and launch mass production in the first half of next year.

As for the mass production of the new Ryzen 5000 series processors in 2021 and the accelerated processor Ryzen 5000 APU series, they will still be produced on a 7nm process. According to the progress, it is estimated that 5 and 7 nanometers will enter the peak of mass production in the second and third quarters of next year.

AMD product line in 2022 will fully adopt the 5-nanometer process.

https://money.udn.com/money/story/5612/4750592

Something is up with TSMC 5nm and also 7nm+ processes, as they significantly lag compared to their previous plans. Also AMD changed Zen 3 slides to no longer feature 7nm+.

In fact due to TSMC issues AMD can enter hard period if Zen3 will be only 3-5% better than previous generation as invester and management want to significantly increas processor sales while not being able to keep same progress in performance.

-

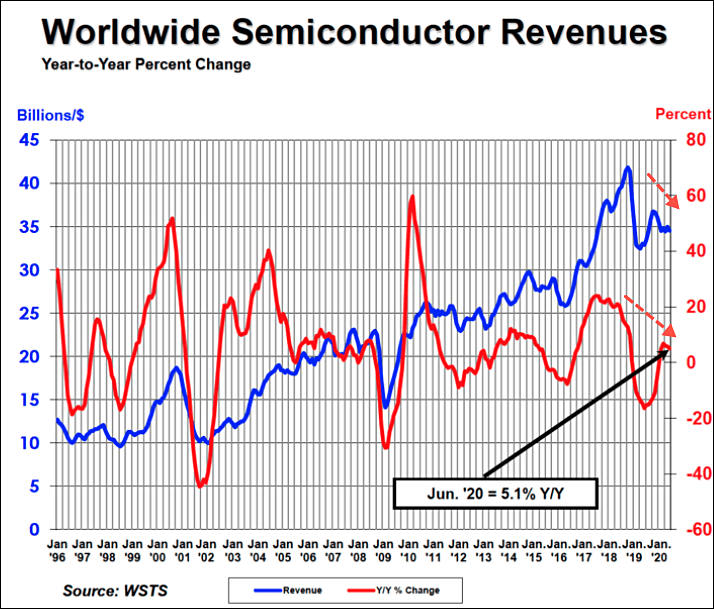

Big money that cause inflation found their way into semiconductors

Pure-play foundries including TSMC, UMC and VIS have raised their 8-inch wafer fabrication quotes by 10-20% recently to reflect their tight capacities, according to industry sources.

Another reason is huge wall we'll hit very soon. So companies want to pile more cash to try to hold on last possible processes longer.

-

Applied Materials Says New Tool Breaks Chip Resistance Bottleneck, as smallest vertical connections were becoming unworkable for new generations of chips.

-

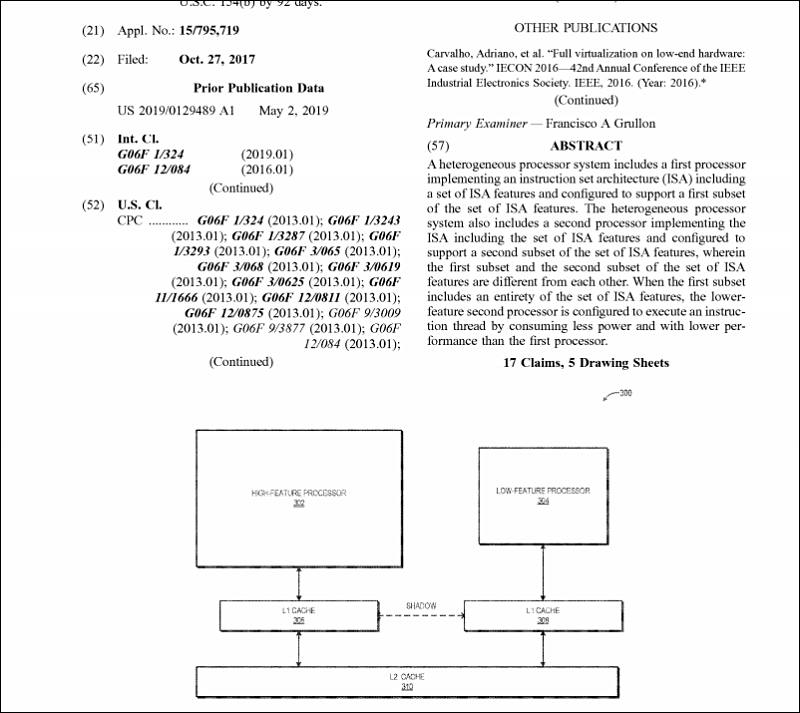

AMD also plans to make Big.Little processors

http://www.freepatentsonline.com/10698472.pdf

Intel already made such thing also.

Companies want to go this way as it is one of the last methods to market more cores.

And it is also not bad for notebooks (but mostly useless, as properly underclocked x86 cores are no different).

sa14037.jpg800 x 713 - 79K

sa14037.jpg800 x 713 - 79K -

TSMC July revenue declined 12.3% on month but remain above NT$100 billion (US$3.4 billion).

TSMC has consolidated revenue of NT$105.96 billion for July 2020, up 25% on year. Revenue totaled NT$727.26 billion for the first seven months of the year, rising 33.6% from the same period in 2019.

TSMC expectations for revenues is between US$11.2 billion and US$11.5 billion in the third quarter of 2020, which is a 9.3% sequential increase at the midpoint.

First effects for taking US side in China-US trade war.

If China will be smart and will find weak point we can see full stop of TSMC productiona s soon as this fall.

-

The board of Taiwan Semiconductor Manufacturing Company (TSMC) has approved capital appropriations of about US$5.27 billion for the installation and expansion of advanced technology capacity, installation of specialty technology and advanced packaging capacity, as well as fab construction, installation of fab facility systems and capitalized leased assets, and fourth-quarter 2020 R&D capital investments and sustaining capital expenditures.

TSMC's board also approved a NT$2.50 per share cash dividend for the second quarter of 2020, when the company reported net profits surged 81% on year and a slight 3.3% sequentially to NT$120.82 billion (US$4.1 billion) with EPS coming to NT$4.66, or US$0.78 per ADR unit.

Company is now financed directly by US printing press.

-

Two Chinese government-backed chip projects have together hired more than 100 veteran engineers and managers from Taiwan Semiconductor Manufacturing Co., the world's leading chipmaker, since last year, multiple sources have told the Nikkei Asian Review.

The hirings are aimed at helping Beijing achieve its goal of fostering a domestic chip industry in order to cut China's reliance on foreign suppliers, the sources said.

Quanxin Integrated Circuit Manufacturing (Jinan), better known as QXIC, and Wuhan Hongxin Semiconductor Manufacturing Co., or HSMC, along with their various associate and affiliate companies, are little-known outside the industry. But in addition to employing more than 50 former TSMC employees each, both are also led by ex-TSMC executives with established reputations in the chip world. The two projects are aiming to develop 14-nanometer and 12-nanometer chip process technologies, which are two to three generations behind TSMC but still the most cutting-edge in China.

Hongxin and QXIC, founded in 2017 and 2019, respectively, are part of a recent boom in China's semiconductor industry as Beijing prioritizes self-sufficiency in key tech areas impacted by tensions with Washington.

-

TSMC’s 5nm process is in short supply and was enthusiastically welcomed by Apple, Qualcomm, AMD, NVIDIA, MediaTek, Intel, Bitland, Altera, and others.

Apple has significant demand for 5nm process chipsets, including the chipsets used in the A14 and A14 X application processors and MacBook, and is considering the possibility of securing between 40,000 and 45,000 5nm process chipsets from TSMC in the first quarter of next year.

TSMC is now looking ahead to the 3nm chip model. TSMC’s foundries plan to begin risk production on the 3nm process node next year. TSMC says its 3nm chips will provide a 10 to 15 percent performance increase and a 20 to 25 percent increase in energy efficiency. Today’s report mentions that Apple’s A16 chips (which will ship in 2022) will be manufactured in a 3nm process

Expect big surprises with 3nm and even strange events with existing 5nm.

Today all PR and marketing resources are being provided to TSMC, almost all critical articles postponed and pushed out of big media. And result will follow.

-

New Intel approach

-

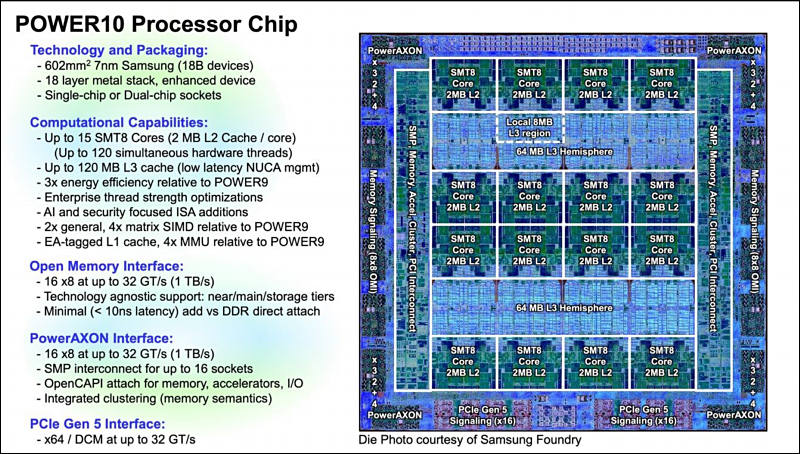

IBM Power10 CPU, made using Samsung 7nm process

sa14131.jpg800 x 454 - 130K

sa14131.jpg800 x 454 - 130K -

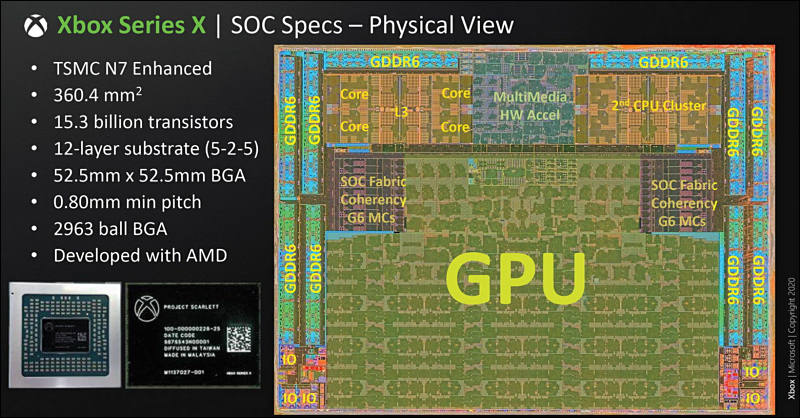

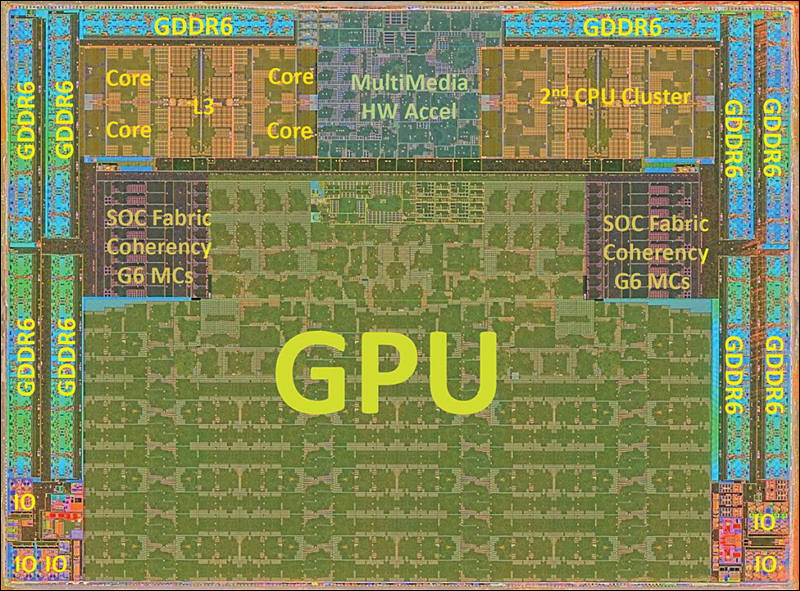

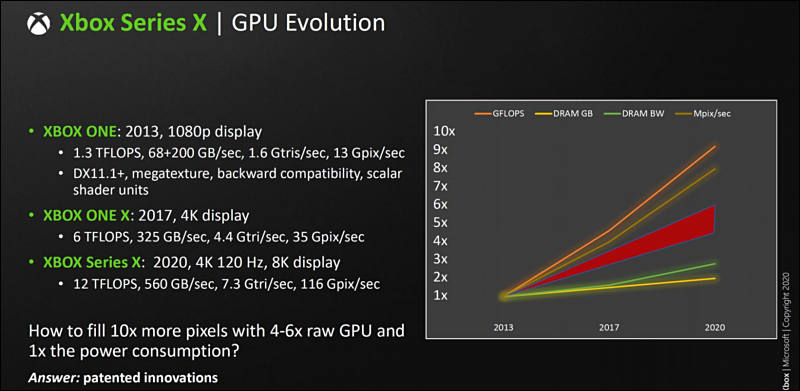

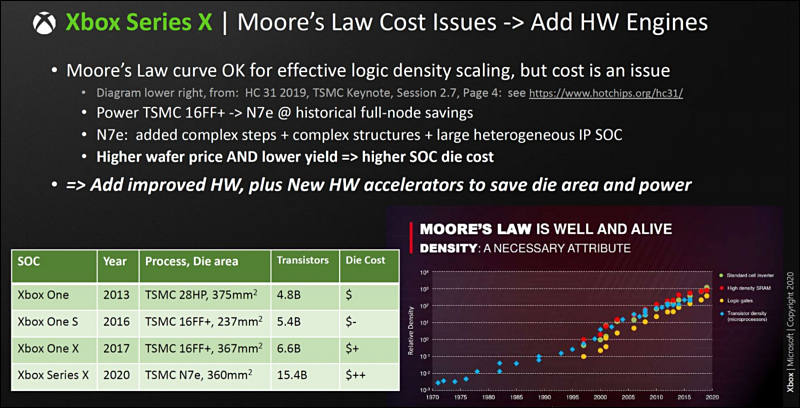

Note the issues mentioned and how small are Zen 2 cres part on Xbox X LSI

-

TSMC at its upcoming technology symposiums will disclose more details about the foundry's 3nm and 2nm process nodes, and advanced 3D heterogeneous integration technology, such as SoIC (system-on-integrated chips) packaging.

-

Energy efficiency of TSMC is constantly falling

According to TSMC’s Corporate Social Responsibility Report, in 2019, including the Taiwan plant, WaferTech, TSMC (China), TSMC (Nanjing), and Caiyu, TSMC’s global energy consumption was 14.33 billion kWh , an increase of 5.412 billion kWh from five years ago, average annual growth rate in the past five years is 12.5%. After the opening of TSMC's 3nm semiconductor manufacturing plant, it is estimated that power consumption will reach 7 billion kWh .

And here the fairy tale begins

TSMC has pledged to use 100% renewable energy by 2050 (means - never). TSMC has signed an agreement with the wind power company Wosch to contract the power generation of its two wind farms in the next 20 years, which is expected to consume 3.45 billion kWh of green electricity each year.

It is not because they can use such energy, it is because such energy allows to overcome fossil energy shortages.

So for TSMC renewable energy will be partially used where its output will be good, but company will still need to be able to get 100% of energy from traditional sources, and this normally means that some Taiwan factories will need to find other place.

-

Zen 3 will still keep 7nm process, TSMC is unable to make high performance 5nm

Rumors are that TSMC 5nm products have issues with thermals on high frequencies.

As in reality it is almost same 7nm process on low level (same Fin-FET transistors). Stake of TSMC is very high as if they will fail it can be staggering, as both Samsung and Intel while looking like they are behind invest tons of time into new transistor structure and many other complex improvements.

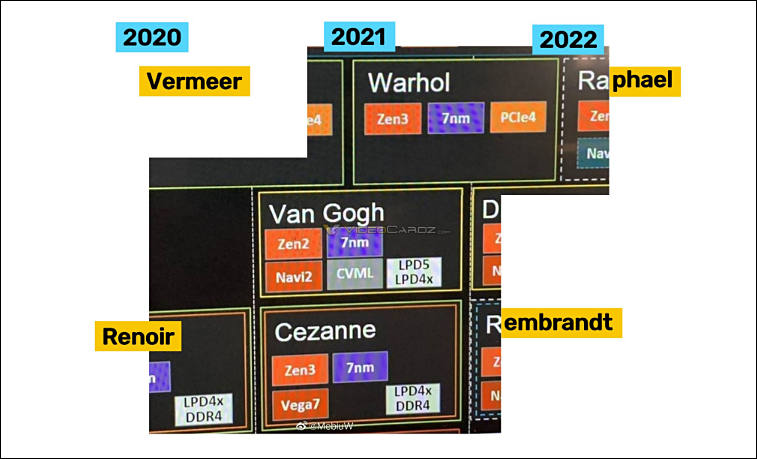

sa14195.jpg757 x 459 - 57K

sa14195.jpg757 x 459 - 57K

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,986

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,364

- ↳ Panasonic993

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319