It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

NAND flash prices are being pushed up by Micron's and Western Digital's latest moves to increase their NAND flash prices by about 10%. While memory chip makers have been cautious about increasing output, semiconductor foundry house UMC has announced a plan to expand its fab in Singapore. Despite the Russia-Ukraine conflict, Taiwan's chipmakers see little impact on their supply chains.

-

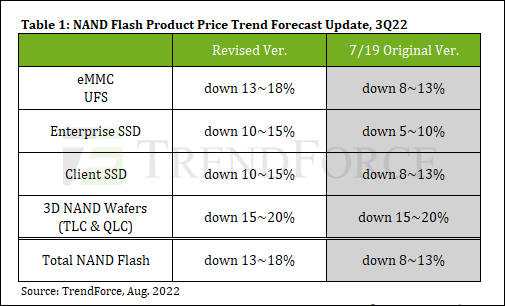

Analysts from TrendForce revised their forecast for a decrease in the cost of 3D NAND flash memory. If earlier a fall of 8–13% was predicted, now analysts are talking about a collapse to 13–18% by the end of Q3 2022.

In the client SSD segment, prices for 3D NAND flash memory are falling by 10-15%, analysts say. This will be supported by weak demand in the market for Chromebooks and laptops for educational purposes, as well as the growing consumption of more affordable products (SSD) based on 176-layer memory chips of the likely company YMTC, which, due to the rationale for their production costs, realizes output volumes.

The same 10-15% price reduction for 3D NAND flash is expected in the SSD market.

sa7231.jpg505 x 306 - 42K

sa7231.jpg505 x 306 - 42K -

This year, the third quarter was not associated with an upturn in business activity, and demand for solid-state memory continues to remain low. At the same time, manufacturers do not have time to proportionally reduce production volumes, and prices for NAND memory chips in the contract market, according to TrendForce experts, may fall by 30-35% in the second half of this quarter.

Previously, TrendForce analysts included in their forecast a decrease in prices in the futures market ranging from 15 to 20%. Decline in demand for consumer electronics, according to the authors of the forecast, next year will force manufacturers of flash memory chips to increase their activity to capture market positions. It will no longer be possible to increase revenue only by increasing production volumes, since the market is oversaturated with this type of product.

-

Yantze Memory Technologies Co (YMTC) manufactures flash memory for various manufacturers. The company was founded in 2016, it is growing rapidly and, according to the Biden administration, poses a “direct threat to American companies.” No one even tries to pretend that there is no question of ousting a successful competitor, everything is done extremely brazenly and openly. That is, American officials directly declare that they are hindered by YMTC, since it is eating away the market from the United States, and it is honestly impossible to compete with it.

So.... NAND is not much profitable for US companies.... And because of this they want to kill competition... Yeah.

-

State-owned Yangtze Memory Technologies Co. has seen US chip semiconductor equipment companies, including KLA Corp. and Lam Research Corp., halt business activities at the facility. This includes installing new equipment to make advanced chips and overseeing highly technical chip production.

The US suppliers have paused support of already installed equipment at YMTC in recent days and temporarily halted installation of new tools, the people said. The suppliers are also temporarily pulling out their staff based at YMTC, the people said. --WSJ

-

Micron will reduce the production of DRAM and NAND memory chips, writes The Wall Street Journal. The current market situation and, in particular, the decline in demand for this type of product, forced the American manufacturer of operational and flash memory to make such a decision.

Real face of capitalist scum.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List24,045

- Blog5,725

- General and News1,378

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,384

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras132

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,332