It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

My solution is a FreeBSD NAS - 8 8T drives in raid6 (raidz2) with 2 1T drives for cache (l2arc) connected by 10gE. It's more than fast enough for just about anything that I do (including 4k prores). The NAS sits in another room where the sound of a pile of hard drives won't bother me. If you don't want to deal with FreeBSD directly, you can use FreeNAS which has it under the hood, but gives you a nice GUI front-end for it. It's not an extremely cheap solution, but it is very effective.

On the other hand, there was a deal posted here for Micron 2T SSD's for pretty cheap - I don't remember if it was 4T worth for less than 400 euros, but if not, it was still pretty close.

-

https://www.personal-view.com/talks/discussion/19691/2tb-micron-1100-2.5-ssd-for-only-268#Item_1

$268 it is, 223 EUR. Very close to target.

-

Bad news again

NAND flash prices started falling at the end of 2017, but the price drops have slowed to about 10% in the second quarter, said the sources. With end-market demand picking up on seasonality, the market oversupply will be less significant. NAND flash prices may continue to trend downward but at a much slower pace in the third quarter, with a possibility that prices may stop falling.

SSD prices had fallen about 50% from November 2017 to the end of the first quarter, Phison Electronics chairman Khein Seng Pua remarked recently. Prices are likely to rebound before or after the Computex 2018 trade show, and the supply of NAND flash will become tight again.

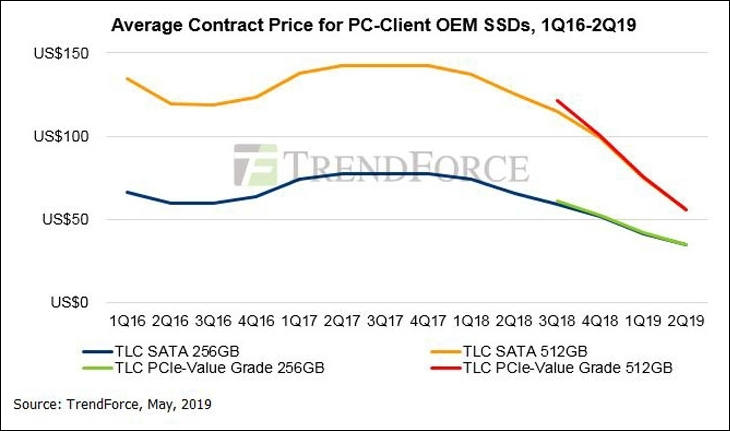

Client SSDs are expected to transition from SATA to PCIe NVMe in 2018.

-

NAND flash prices will rebound in the third quarter if prices "fall extremely" in the second quarter, Chang noted. Otherwise, NAND flash prices should register only flat growth sequentially in the third quarter,

As chip firms improve gradually their 3D NAND production yield rates NAND flash prices will trend downward in the long term. NAND flash prices will fall to as low as US$0.20 per Gb when 3D NAND production becomes mature.

-

More good news

NAND flash prices will continue to drop in the third quarter of 2018 as suppliers scale up their 3D NAND chip output.

NAND flash demand has not been strong enough to digest the industry's capacity, which will likely persist through the third quarter.

Judging from the continued oversupply, the sources expressed concerns NAND flash prices will still be on their downward trend in the second half of 2018. The market oversupply will become severe between the fourth quarter and the first quarter of 2019, when seasonal factors are taken into account.

-

Chip suppliers continue to scale up their output thanks to further improvement in their 64- and 72-layer 3D NAND flash technologies. Hence NAND flash contract prices already fell for the second consecutive quarter in the second quarter of 2018. Chip suppliers may cut further their quotes in order to stimulate demand, which will lead to a steeper-than-expected decline in NAND flash contract prices for the third quarter,

-

NAND flash contract prices fell between 15% and 20% sequentially in the second quarter, but bit shipments bounced back thanks to a pick-up in demand for high-density products from China-based smartphone vendors.

-

NAND flash contract prices are likely to fall by a larger-than-expected 10-15% sequentially in the third quarter and another 15% in the fourth.

-

Chairman of Adata Technology, a Taiwan maker of DRAM modules and NAND flash chips, said that globally leading NAND flash makers have yet to slow down capacity expansions, and prices may see a larger drop in 2019 than in 2018.

Industry sources said that there are now 6-7 leading makers of NAND flash products around the world, all devoted to developing new-generation production processes. Among them, Samsung, Toshiba Memory/Western Digital, Mircon/Intel and SK Hynix have released their respective 96-layer 3D NAND technologies for volume production in the first half of 2019.

-

Chinese are coming

China's Yangtze Memory Technology (YMTC) started delivering samples of its 64-layer 3D NAND chip with volume production in the third quarter of 2019. The company also plans to move directly to the 128-layer generation with volume production scheduled for 2020.

YMTC has no plans to provide 96-layer 3D NAND chips as the company intends to skip the generation and jump directly to 128 layers.

-

More Chinese coming

Tsinghua Unigroup has signed a strategic alliance with memory module firm Shenzhen Longsys Electronics in a move to accelerate its ambition in the NAND flash sector.

YMTC is expected to build a close relationship with Longsys after growing its production yield rates to mature and stable levels, the sources continued. YMTC's in-house developed 64-layer 3D NAND flash will be adopted in Longsys' SSD and UFS products.

-

Citi expects NAND pricing to fall 45% in 2019 while DRAM falls 30% and doesn't see a bottom in pricing until Q2 at the earliest.

-

NAND flash prices are expected to fall over 15% sequentially in the first quarter of 2019, and will suffer another sequential drop in the second quarter,

-

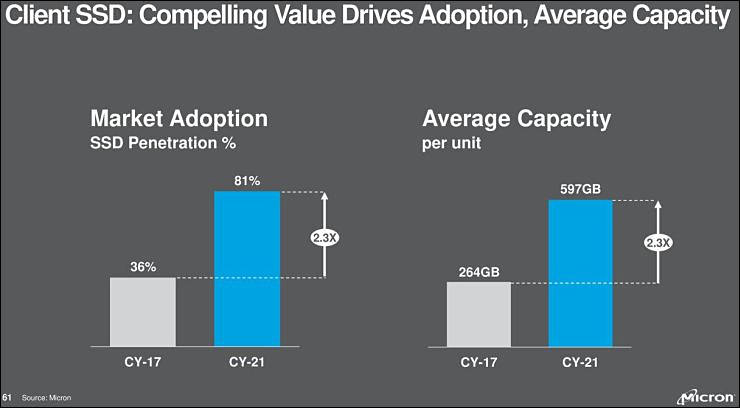

"We expect NAND prices to continue falling through 2019, which will drive meaningful increase in client SSD adoption in PCs starting in the middle of this year," Kou noted. Such positive development resulting from the chip price fall "does not happen immediately," .

-

NAND flash prices are unlikely to fall further given major chipmakers' control over capacity, said the sources, adding that the firms are also slowing down their transition to 96-layer 3D NAND chip technology. NAND flash prices should reach their lowest levels for 2019 in the first quarter.

So, we have our cartel tightly controlling stuff.

My talks show that it is still huge profits in NAND market. And prices could fall around 2-3 times without any damage to manufacturers (outside top management bonuses and investor profits).

-

Revenues of the global NAND flash industry declined 16.8% sequentially to US$14.16 billion in the fourth quarter of 2018, but still hit a record high of US$63.2 billion in the whole year.

-

Drop slowing down

With Samsung lowering its quotes substantially, the NAND flash market prices have fallen even more in the first quarter of 2019, the sources said. Nevertheless, the price drops are expected to narrow to less than 10% in the second quarter, and may begin to rally in the third quarter when demand particularly that for servers picks up, the sources noted.

-

SK Hynix saw its DRAM bit shipments and ASPs decrease 8% and 27%. So guys already cut shipments silently for DRAM.

For NAND - the company's total NAND wafer produced this year is expected to be more than 10% lower than the 2018 level, SK Hynix.

It is just one big criminal cartel.

-

NAND flash memory prices are expected to continue trending down in the second half of 2019, the sources warned. The prices have already approached cash costs for many manufacturers, but remain under downward pressure, the sources indicated.

Do not see much real trend now. And this false stories about "cost of manufacturing". This guys can eat another 2.5x drop without any serious consequences (except for their greedy owners).

-

Average contract prices for 512GB and 1TB SSDs will likely fall below US$0.10 per GB and reach their record-low levels by the end of 2019.

Average contract prices for SATA SSDs are expected to fall 15-26% sequentially in the second quarter, while those for PCIe SSDs will see a larger 16-37% drop.

This change will cause 512GB SSDs to replace their 128GB counterparts and become market mainstream, second only to 256GB SSDs

PCIe SSDs are expected to achieve 50% market penetration, since PCIe SSDs and SATA SSDS are nearly identical in price.

-

Chipmakers have stepped up development of their respective 120/128-layer 3D NAND flash process technologies for cost competitiveness, and are gearing up to have the technology transitions kick off in 2020, according to industry sources.

Major NAND flash chipmakers have delivered samples of their 128-layer chips targeting the first half of 2020 for volume production, said the sources. Continued falls in NAND flash prices coupled with rising uncertainty on the demand side have prompted the players to accelerate their technology advancements for cost reasons, the sources continued.

Yield rates for 90/96-layer 3D NAND process technology remain unstable which may bring more variables to the market and prices this year.

-

Cheap PCIE SSDs price matched SATA ones

-

Drops in NAND flash contract prices are expected to narrow in the third quarter, compared to nearly 20% decreases in the previous two quarters. An approximately 10% drop in third-quarter contract prices for eMMC and SSD devices is also expected.

-

And stuff started happening

Western Digital Corp. (NASDAQ: WDC) announced that on Saturday, June 15, an unexpected power outage occurred in the Yokkaichi region in Japan, affecting production operations at the flash fabrication facilities operated by the company's joint venture partner, Toshiba Memory Corporation. The power outage impacted both the facilities and process tools and Western Digital is working closely with its joint venture partner to bring the facilities back to normal operational status as quickly as possible.

Western Digital continues to assess the impact of this event. The company currently expects the incident will result in a reduction of Western Digital's flash wafer availability of approximately 6 exabytes, the majority of which is expected to be contained in the first quarter of fiscal year 2020.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320