Sometimes you have to pay...

-

>"This obstacle will be overcome only when the arguments for monetary reform are more widely understood, when opposition to it is more widely recognised as mere defence of private privilege, and when its opponents accept that they risk losing more by continuing to oppose it than by losing the present subsidy. National and international advocacy and campaigning will be needed to bring that situation about."

Reminds me of "Veni, vidi, vici" :-)

Why "Veni, vidi, vici" ? (How do you relate the conquering of an emperor to this statement from Robertson?) -

>Why "Veni, vidi, vici"?

Because it sounds even more naive than Mother Teresa plans to become head of Goldman Sachs. -

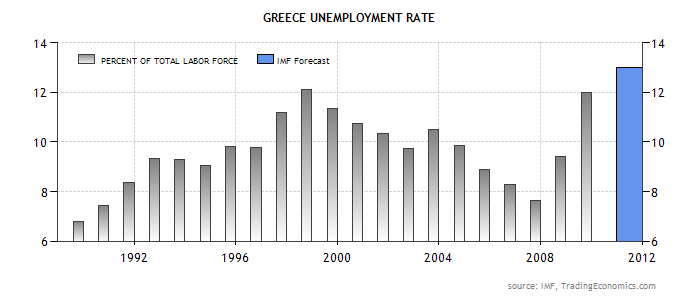

Some interesting charts:

As you can see, both countries already had problems with employment.

And both successfully used banks (and as you could see from their debt problems, not only local banks) to make bubbles and reduce unemployment inflating them (so, bubbles are made from good intentions, usually, but could result in big problems).

We can see that medication really worked.

ChartImg1.png700 x 300 - 21K

ChartImg1.png700 x 300 - 21K

ChartImg.png700 x 300 - 20K

ChartImg.png700 x 300 - 20K -

> why did the bubble burst? Is it not, because banks issued too much credit (hence too many people worldwide start defaulting on their loans)?

It burst because people are not machines, so they start to think that it is too much risk, too much debt.

So, banks could not find any more people to give them money (some do not want to get more and some can't be thrusted because they can't return even current amounts).

Back to my analogies.

You patient died due to extremely high temperature. Fast conclusion is that we used wrong medication and we must had fight this temperature using simple drugs. Under more detailed examination you'll see that it had sepsis and high temperature had been a way organism fights with the problem (unfortunately for patient, problem had been too large to handle). -

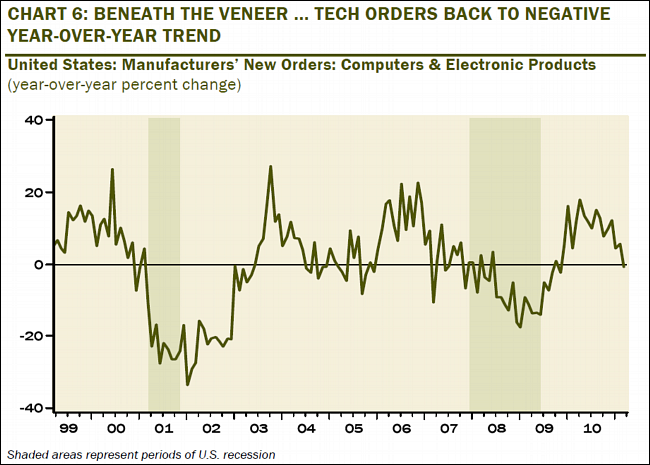

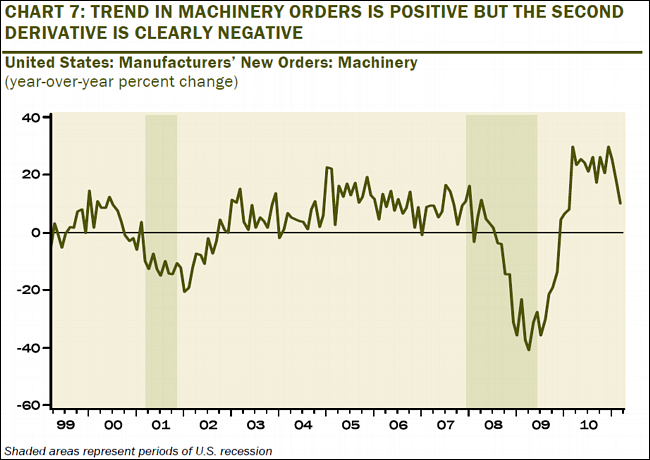

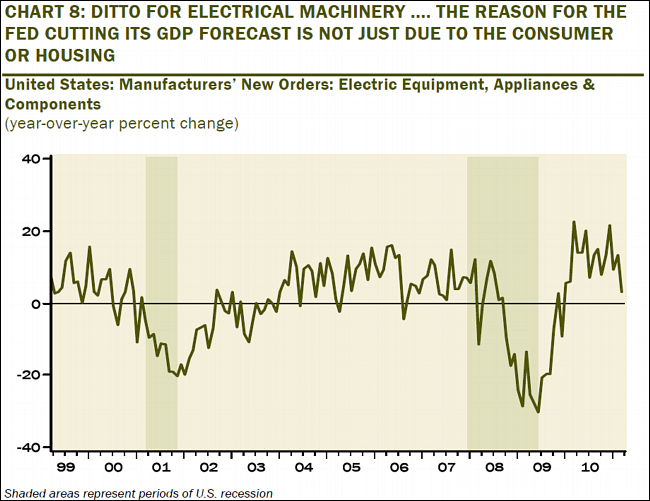

Another interesting data:

revers6.png650 x 465 - 155K

revers6.png650 x 465 - 155K

revers7.png650 x 460 - 137K

revers7.png650 x 460 - 137K

revers8.png650 x 501 - 152K

revers8.png650 x 501 - 152K -

>Hmmm... market crash this year?

This do not mean anything.

Except that it is simple technical analysys :-)

Having two lines (support and resistance) forming triangle could mean that probability for market trend change near intersection is larger. MA (and MACD below) are just toys really (and they are not leading indicators).

Big boys are looking at QE3 (in official or unofficial form). -

QE3 might be already being priced in.

Copper is the leading indicator. http://stockcharts.com/h-sc/ui?s=$COPPER&p=W&b=5&g=0&id=p86065272530

Not looking good. -

Look at the volatility. Refusing to make lower low.

http://stockcharts.com/h-sc/ui?s=$VIX:$VXV&p=W&b=3&g=0&id=p38246664063 -

I agree on the sepsis. The way money is injected into the economy is poisoned due to the way the money is levied (for private gain instead of social gain) before it is spent. You say the end of fractional reserve lending is too simple a solution. Yet as a solution it would take away the risk that banks can collapse, which i think caused the crisis. But i will look into it further to make sure this is correct. It is an interesting topic to study nonetheless.

-

Want to add small info:

Two year Greece notes, 25% :-)

Start New Topic

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320

Tags in Topic

- stupidity 27