-

Kioxia Holdings (former Toshiba Memory) will be listed on Japanese market, Toshiba want to sold most stock to tthird party buyers.

Reason can be lack of funds for required investments to go into 3D QLC and PLC chips.

2021 year must be year of phasing out TLC from the consumer market and replacing it with 128-256 layers QLC memory that must hike profits of leading manufacturers by 1.5-2 times. They are expecting to allow only 10-15% price slide, while write performance will degrade 2-5 times.

-

Some good news

Yangtze Memory's 128-layer QLC flash memory debuts with highest I/O speed

Yangtze Memory Technologies, China's top memory chipmaker under the umbrella of Tsinghua Unigroup, publicly demonstrated its 128-layer QLC 3D NAND flash memory chip at the China Electronic Information Expo held today.

Yangtze Memory showcased a 64-layer, a 128-layer stack of flash memory this time, of which the former is the first 64-layer flash memory developed and mass-produced by a Chinese company. It is based on the Xtacking stacking architecture, and the storage density per unit area is the largest in its class.

At present, the main product of Yangtze Memory's mass production is 64-layer TLC flash memory, which has been adopted by a large number of manufacturers' SSD hard drives.

The 128-layer QLC flash memory shown by Yangtze Memory is the next generation product after 64-layer flash memory, based on the Xtacking 2.0 architecture.

Yangtze Memory revealed that the two products have 1.6Gbps I/O read and write performance, and the single 3D QLC capacity is as high as 1.33Tb, which is 5.33 times that of the previous generation of 64 layers.

-

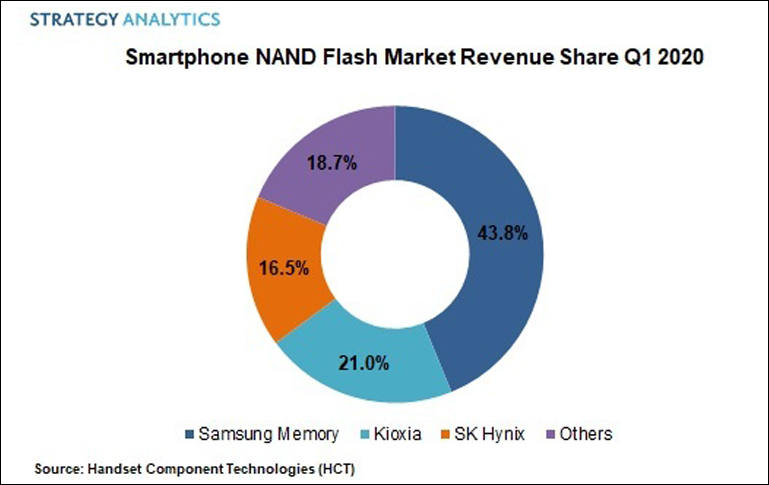

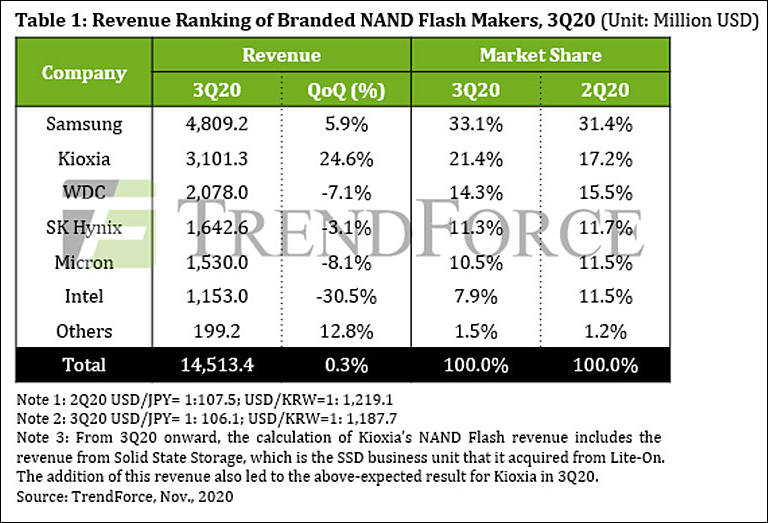

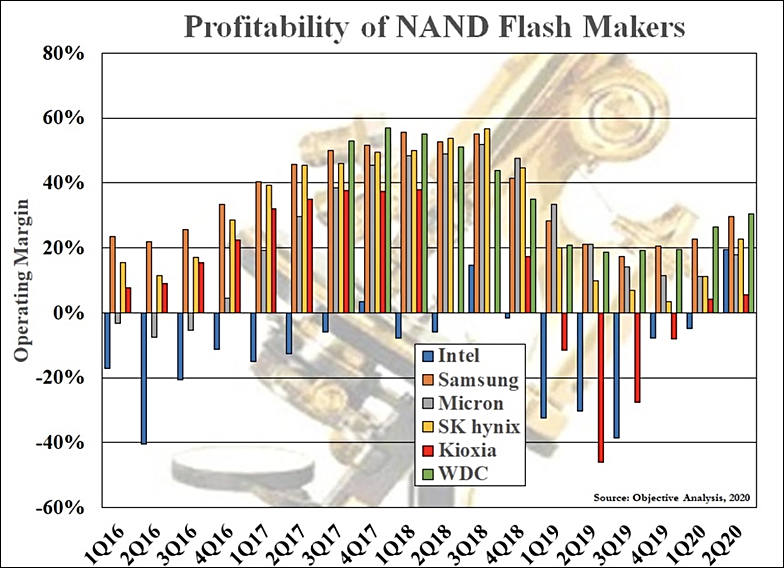

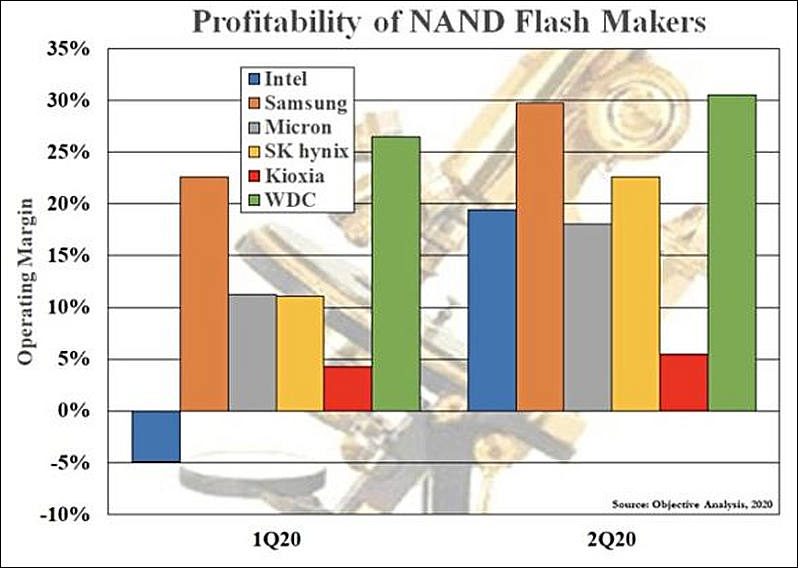

Lot of lies in numbers as profits are much much higher, but look at dynamics is useful

sa14502.jpg784 x 568 - 90K

sa14502.jpg784 x 568 - 90K

sa14503.jpg798 x 568 - 65K

sa14503.jpg798 x 568 - 65K -

NAND chips price is expected to fall in coming months due to huge surplus that formed after Huawei fiasco. As company not just no longer need NAND memory for their smartphones but manufacturer can't longer supply chips to company or any related entity.

-

Samsung’s guidance for its Q3 earnings is in, and the company expects an operating profit of $10.6 billion. That’s up 58 percent from the year before.

Most of this is due to NAND and DRAM cartels that managed to hold prices despite production costs dropped 30-40%.

-

Despite a continued rally in memory spot market prices, channel distributors in China continue to see disappointing SSD and DRAM module sales, according to sources at memory module makers

Who could have thought.

-

The new iPhone 12 series that comes in 64GB, 128GB and 256GB options will consume 5-6% of the overall NAND flash memory produced in 2021, according to industry sources.

Overall smartphones take from 60 to 85% percentage.

-

NAND flash device controller suppliers including Phison Electronics and Silicon Motion Technology have stopped offering quotes for new orders, and are mulling a 10-15% price hike in the first quarter of 2021

Inflation coming.

-

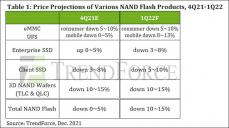

TrendForce analysts, who have a wealth of information on flash memory and SSD deals, have revised their previous outlook on prices for these products. They previously predicted that in the first quarter of 2021, the price of wafers with NAND chips will decrease by 10-15% in the quarter. The new forecast says that there will be no decline, and prices for flash platters will generally remain at the level of the fourth quarter of 2020.

-

PC OEMs are expected to increasingly adopt DRAM-less SSDs in their entry-level and mid-range models for cost reasons, according to industry sources.

DRAM-less SSDs are already being adopted by channel distributors, said the sources. With the supply of DRAM memory becoming tight, PC OEMs consider DRAM-less SSDs as an alternative to ordinary SSDs for their consumer-grade models including entry-level and mid-range notebooks, the sources indicated.

Major SSD controller suppliers including Marvell, Phison Electronics and Silicon Motion Technology have all offered solutions for DRAM-less SSDs, the sources said. Demand for such low-cost design is set to take off this year, when the overall SSD supply is constrained by shortages of related chips and components.

Most fun here is that almost all extra profits they will get by removing DRAM will go into useless things, instead of offering better products.

-

NAND flash prices are expected to register single-digit sequential increases in the second quarter of 2021, and then rise further modestly through the second half of the year, according to Silicon Motion Technology president Wallace Kou

-

The supply of NAND flash controllers remains tight, constraining shipments of eMMC storage devices and SATA SSDs, according to industry sources.

-

NAND flash device controller and module supplier Phison Electronics has raised its quotes for the second time this year to reflect rising foundry and backend costs, as well as costs of IC substrates and other related chip components.

-

Adata Technology has enjoyed a strong pull-in of SSD orders since the start of April, particularly high-capacity SSD order.

Most orders are coming from new crypto scam users.

-

Contract market prices for NAND flash memory are poised to rise faster than those for DRAM chips in the third quarter of 2021, according to industry sources.

-

DRAM and NAND flash prices are expected to rise about 10% sequentially in the third quarter of 2021.

-

The global NAND flash memory market is expected to reach the balance of supply and demand in 2022, when the overall bit supply growth is expected to stay at about 30%, according to Wallace Kou, president for flash device controller specialist Silicon Motion Technology.

-

NAND flash prices are expected to stay stable in 2022, but the supply of such chips is likely to turn tight in the second half of next year, according to Wallace Kou, president of Taiwan-based NAND controller vendor Silicon Motion Technology.

-

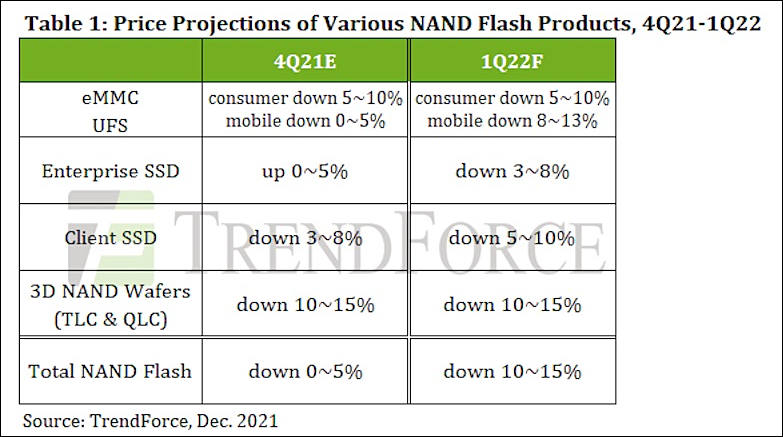

According to the results of the current quarter, TrendForce experts believe that the cost of eMMC and UFS flash memory modules may grow by 5% on a quarterly basis. Consumer SSDs are projected to rise in price by 3-8%, while enterprise-class SSDs are projected to rise by 13-18%. Overall, the NAND flash market is expected to increase average prices of 5-10% for the current quarter.

In the last quarter of the year, analysts expect prices to decline. In the consumer segment of eMMC and UFS, the decline may be 5-10% qoq, in the mobile segment - 0-5%. Client solid-state drives are expected to fall in price by 3-8%, while enterprise-class SSDs will continue to rise in price, showing growth of 0-5%.

Between October and December, inclusive, the overall average price reduction in the NAND flash market could be between 0% and 5% compared to the third quarter of the year.

-

Samsung Electronics reportedly is mulling raising quotes for its own-brand SSD products in the first quarter of 2022.

-

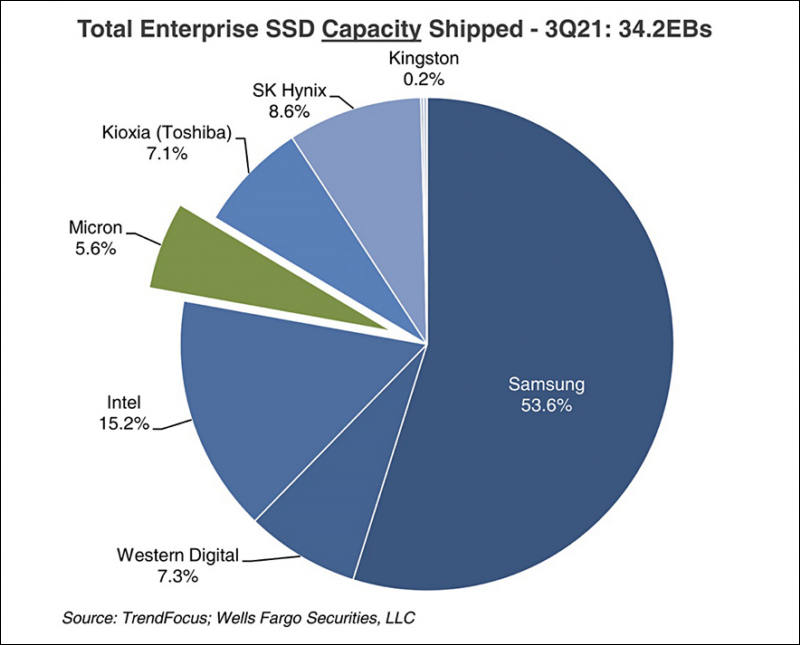

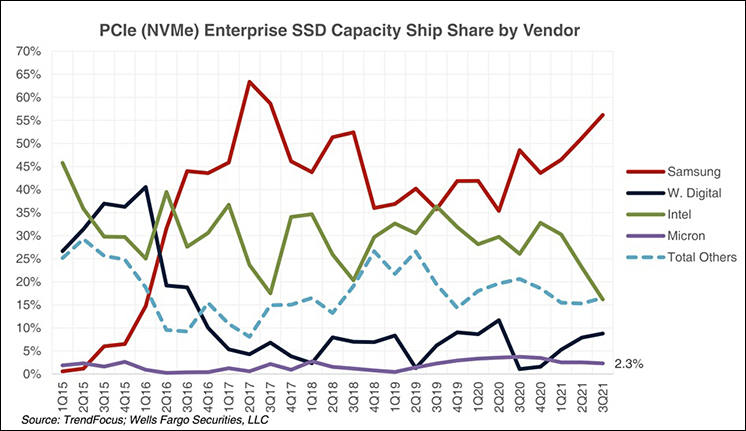

Samsung slowly becoming monopoly on enterprise SSD marker

sa19200.jpg800 x 645 - 47K

sa19200.jpg800 x 645 - 47K

sa19201.jpg746 x 431 - 57K

sa19201.jpg746 x 431 - 57K

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320