It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Watch another criminals in action

Micron Technology has reiterated plans to idle up to 5% of DRAM wafer starts in 2019, but said the company will reduce its total NAND flash wafer starts by a larger 10% compared to the previously-planned 5%.

-

Cartel want to fight back

NAND flash prices are expected to rebound in the near future, as Samsung Electronics is reportedly considering raising its quotes by as much as 10% and other peer makers including Micron Technology may follow suit.

-

Taiwan memory modules makers including Adata Technology, Phison Electronics and Team Group are mulling a 10-15% hike in SSD prices and enforcing a limited-supply policy amid growing expectations that both NAND flash and DRAM chip prices may rebound.

Cartels, cartels.

-

Samsung will do 300 layers NAND, but do not expect them to lower prices

Samsung Electronics, the world leader in advanced memory technology, today announced that it has begun mass producing 250-gigabyte (GB) SATA solid state drive (SSD) that integrates the company’s sixth-generation (1xx-layer) 256-gigabit (Gb) three-bit V-NAND for global PC OEMs. By launching a new generation of V-NAND in just 13 months, Samsung has reduced the mass production cycle by four months while securing the industry’s highest performance, power efficiency and manufacturing productivity.

“By bringing cutting-edge 3D memory technology to volume production, we are able to introduce timely memory lineups that significantly raise the bar for speed and power efficiency,” said Kye Hyun Kyung, executive vice president of Solution Product & Development at Samsung Electronics. “With faster development cycles for next-generation V-NAND products, we plan to rapidly expand the markets for our high-speed, high-capacity 512Gb V-NAND-based solutions.”

The Only Single-stack 3D Memory Die With a 100+ Layer Design

Samsung’s sixth-generation V-NAND features the industry’s fastest data transfer rate, capitalizing on the company’s distinct manufacturing edge that is taking 3D memory to new heights.

Utilizing Samsung’s unique ‘channel hole etching’ technology, the new V-NAND adds around 40-percent more cells to the previous 9x-layer single-stack structure. This is achieved by building an electrically conductive mold stack comprised of 136 layers, then vertically piercing cylindrical holes from top to bottom, creating uniform 3D charge trap flash (CTF) cells.

As the mold stack in each cell area increases in height, NAND flash chips tend to become more vulnerable to errors and read latencies. To overcome such limitations, Samsung has incorporated a speed-optimized circuit design that allows it to achieve the fastest data transfer speed, at below 450 microseconds (μs) for write operations and below 45μs for reads. Compared to the previous generation, this represents a more than 10-percent improvement in performance, while power consumption is reduced by more than 15 percent.

Thanks to this speed-optimized design, Samsung will be able to offer next-generation V-NAND solutions with over 300 layers simply by mounting three of the current stacks, without compromising chip performance or reliability.

In addition, the number of channel holes required to create a 256Gb chip density has decreased to 670 million holes from over 930 million with the previous generation, enabling reduced chip sizes and less process steps. This brings a more than 20-percent improvement in manufacturing productivity.

Leveraging the high-speed and low-power features, Samsung plans to not only broaden the reach of its 3D V-NAND into areas like next-generation mobile devices and enterprise servers, but also into the automotive market where high reliability is extremely critical.

Following today’s introduction of the 250GB SSD, Samsung plans to offer 512Gb three-bit V-NAND SSD and eUFS in the second half of this year. The company also expects to expand production of higher-speed and greater-capacity sixth-generation V-NAND solutions at its Pyeongtaek (Korea) campus starting next year to better meet demand from global customers.

-

With suppliers cutting back production and end-market demand picking up on seasonality, NAND flash contract prices have stopped falling in the third quarter and will rise 10% in the fourth quarter, according to industry sources.

Cool.

-

Samsung will post an operating profit of around 7.7 trillion Korean won (US$6.44 billion). That's higher than the 6.6 trillion won (US$5.5 billion) profit Samsung made in the second quarter, but it's also down 56 percent from the same period in 2018 when the company made 17.57 trillion won (US$14.7 billion) in profit.

Note that Samsung makes enormous profits on NAND and DRAM (on good years they made 6-10x profit compared to cost to manufacture).

-

Watch the methods cartel uses to hold prices from falling further:

Worldwide silicon wafer area shipments totaled 2.93 billion square inches in the third quarter of 2019, down 1.7% from the 2.98 billion square inches shipped in the prior quarter, and 9.9% lower than year-ago levels

My talk show that biggest concern now are Chinese SSD's manufacturers as they almost tripled production of NVMe and other advanced drives and started to wipe out old established companies in OEM PCs and even some countries.

-

Samsung Electronics' NAND flash bit supply growth is expected to drop below 30% and even 25% in 2020, down from 35-40% this year.

-

The global NAND flash memory industry grew 10% in output value sequentially in the third quarter, when bit shipments registered a nearly 15% increase. The industry output value came to US$11.9 billion in the third quarter of 2019, up 10.2% sequentially.

-

The memory sector is expected to resume growth momentum in 2020 thanks to steady increase in demand for 5G and server applications, with DRAM and NAND flash to see supply shortfalls (double-digit ones) in second-half 2020, according to industry sources.

-

Consumer NAND flash memory prices in China have rallied about 3% since the end of November.

-

Consumer NAND flash memory prices in China have rallied about 3% since the end of November, showing signs of market stabilit

-

NAND flash contract market prices are expected to rise 10-15% in the first quarter of 2020, thanks to suppliers' output controls and a pick-up in demand for datacenter applications

Cartel finally preparing second price wave.

-

NAND flash contract prices are forecast to rise by up to 40% in 2020, according to sources at memory chipmakers.

"Good" news.

-

Kioxia fab fire may send NAND flash prices soaring: A brief fire that broke out at Kioxia's Yokkaichi plant in Japan on January 7 may send NAND flash prices surging, according to industry observers.

-

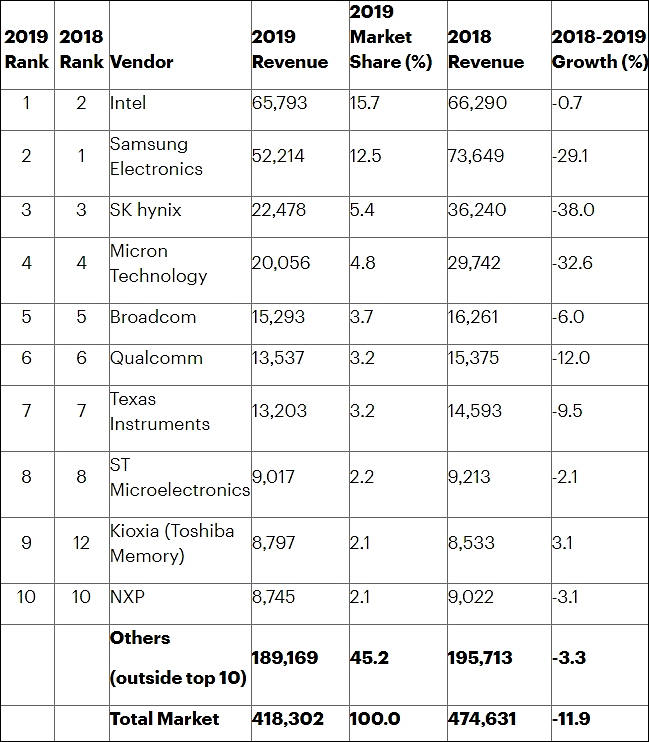

Results of DRAM and NAND prices movements.

Cartel now formed again and things stopped and went back.

sa11784.jpg649 x 742 - 89K

sa11784.jpg649 x 742 - 89K -

NAND flash demand for new-generation gaming consoles featuring 1TB and higher-density SSDs is set to grow robustly in the second half of 2020, according to industry sources.

Of course, if you have cartel agreement.

-

Yangtze Memory Technologies Co., Ltd. (YMTC), a budding Wuhan-based manufacturer of 3D NAND flash, issued a statement this week, saying that it is taking steps to protect employees. It claims that current operations “are normal and orderly.”

Very handy that it is in Wuhan, don't you think?

-

SSD retail prices in China have been rising unexpectedly, as channel distributors have become reluctant to sell amid worries about possible supply chain disruptions caused by the coronavirus outbreak

Bad.

-

Samsung Electronics is striving to lower its SSD inventory levels, a move which has raised concerns about the NAND flash market outlook for the second half of 2020.

I tis very hard to get Samsung SSD now for dealers, delays can cause 2-3 months.

-

On April 8, Wuhan officially lifted the lockdown after the new coronavirus outbreak. Many were wondering if the research and development progress of Yangtze Memory in Wuhan had been impacted by the new coronavirus epidemic.

According to the Securities Times, Yangtze Memory CEO Yang Shining said that the research and development progress of Yangtze Memory’s most advanced 128-layer 3D NAND technology was indeed affected in the short term.

However, he said that at the present Yangtze Memory has achieved full resumption of work, and all progress is being pursued. In the medium and long term, the outbreak will not affect the overall progress and the 128-layer technology will be launched as planned in 2020.

It is very bad news for western companies. And it seems like Yangtze had been one of main reasons of why Wuhan had been center of outbreak.

-

China-based Yangtze Memory Technologies (YMTC) will be striving to kick off volume production of 128-layer 3D NAND flash chips later this year.

Nice.

-

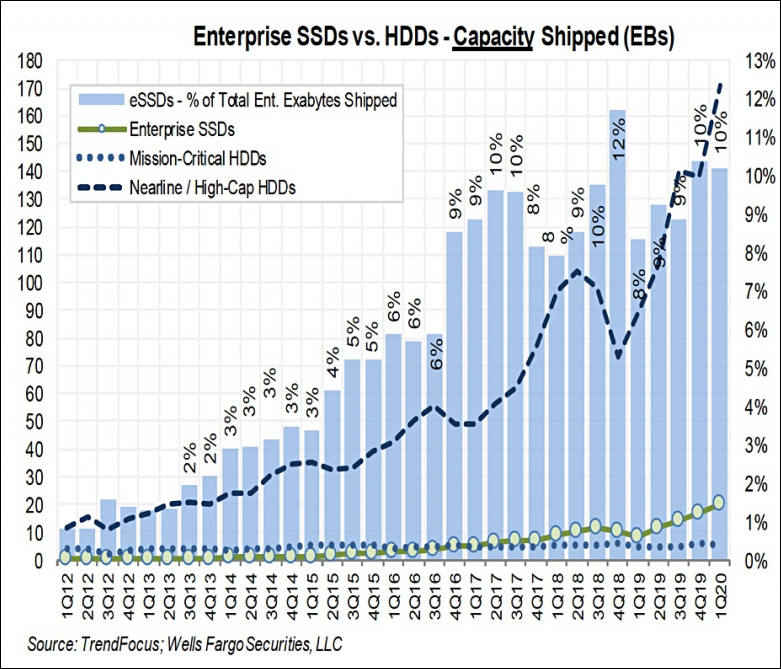

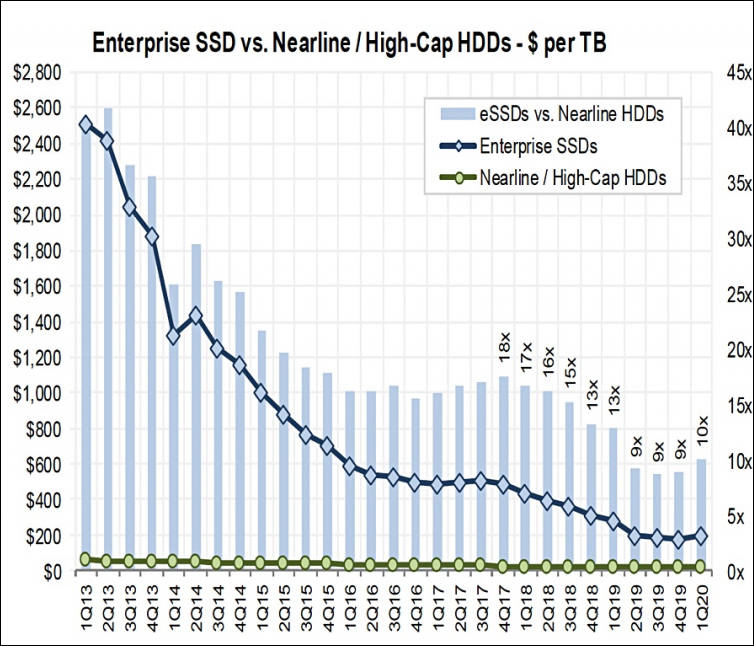

Enterprise SDDs situation

Now how in second chart it is easy to see NAND chips manufactrers cartel actions.

sa13090.jpg781 x 669 - 108K

sa13090.jpg781 x 669 - 108K

sa13091.jpg754 x 646 - 95K

sa13091.jpg754 x 646 - 95K -

NAND flash memory contract prices are expected to stay flat in the third quarter, as demand for notebooks remains stable, according to Wallace Kou, president and CEO of Silicon Motion Technology.

Coronavirus clearly showled how cartel now precisely control prices of NAND and DRAM.

We need biggest legal process, 100% extra profits fines, and 20-30 years of prison for all leading managers for this thing to be remembered.

-

Smartphones are expected to increasingly come with 256GB or even 512GB of storage in 2020, thanks to brand vendors' launches of new 5G models and a gradual recovery in China's smartphone market,

Manufacturers love making NAND for smartphones, as most of it is slow and bad memory that is sold at 1.5-2x profit compared to faster chips made for NVMe and similar SSDs.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320