-

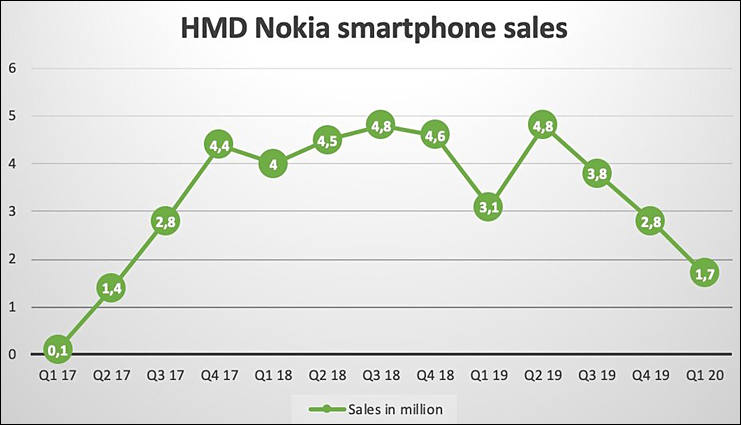

Sales of smartphones in the China market slumped by 51.9% sequentially and 38.9% on year to their lowest quarterly levels of recent years in the first quarter of 2020 due to the impacts of coronavirus pandemic and seasonality,

Up to 60% of all TSMC and similar firms expenses had been financed from buyers of top smartphones.

-

Samsung said in today's financial report that it will conduct mass production of 5nm EUV by the second quarter of this year, that is, before July, and thereby strengthen its leading position in the field of EUV technology. In addition, Samsung will focus on the development of 3nm GAA (surrounding the gate transistor), and talk about the FinFET (fin field effect transistor) technology used by TSMC.

https://www.chinatimes.com/realtimenews/20200429002735-260410?chdtv

Samsung actually lost 7nm orders from Nvidia being unable to make reliable chips for more than a year using it.

Now they claim big things about 5nm, but it can also fail miserably.

-

From Samsung PR

In the second half, to address current uncertainties, the Foundry Business will focus on diversifying applications beyond mobile to include areas such as consumer and computing applications. It will also continue investing in advanced processes for the future and will start mass-producing 5nm products this year and focus on the development of GAA 3 nm process.

-

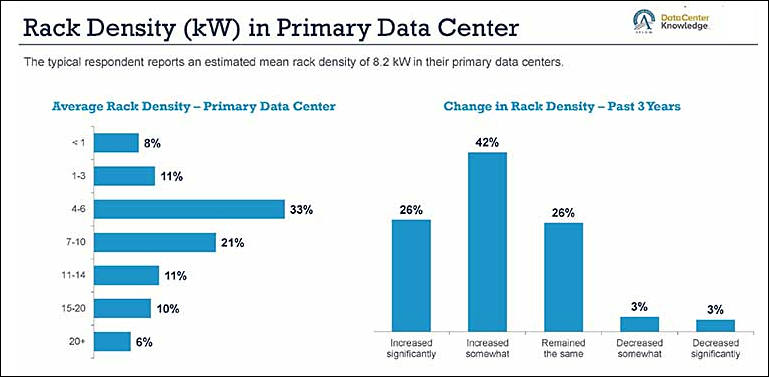

Datacenters badly need less power hungry things.

Especially neural network based things are very inefficient.

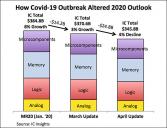

sa12871.jpg769 x 377 - 40K

sa12871.jpg769 x 377 - 40K -

Huawei paid to TSMC more than $5,1 billions for mostly smartphone chips. Only Apple paid more to chipmaker ($8,24).

Hence problems of smartphone makers can lead to huge issues of TSMC, as chipmaker now inject huge profits it get from premium smartphone to finance expensive equipment (due to total monopoly profits on it also are astronomical).

Destruction of TSMC leadership can be very good to market.

-

Due to coronavirus Intel will delay 10nm production of some products.

7nm will be also delayed, up to1 year in practice (in reality Intel do not have any real functioning 7nm and due to EUV usage it is not clear if they will ever have).

-

TSMC has kicked off its 2nm process R&D, and is progressing in research and exploratory studies for nodes beyond 2nm, the foundry has diclosed in its annual report to shareholders.

-

TSMC has seen the installation of its advanced 3nm and 5nm process capacity disrupted by lifting equipment delivery delays.

-

Something is up with 3nm TSMC process

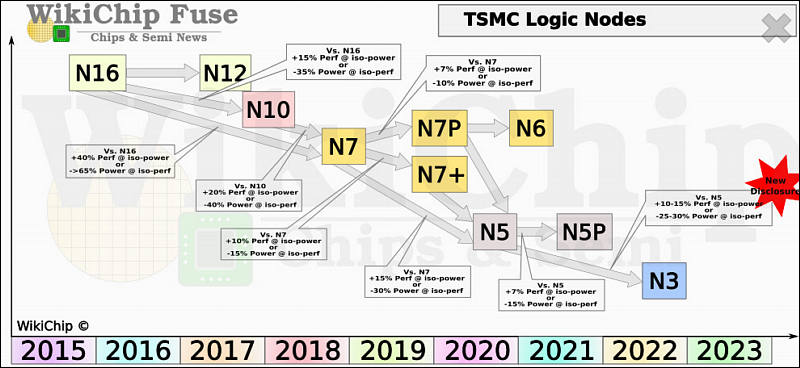

TSMC has decided to stick with FinFETs for N3 owing to the maturity of the technology. Experts are of the opinion that sub-5 nm nodes will require major innovations with materials and structures. TSMC claims that N3 will provide a 10-15% speed improvement at iso-power or 25-30% power reduction at iso-speed.

This year TSMC already fucked up 7nm+ EUV process being unable to provide working chips for AMD.

And here we can see their strange idea to use FinFET for 3nm. In reality we can see some marketing related bullshit instead of 3nm.

sa12784.jpg800 x 368 - 59K

sa12784.jpg800 x 368 - 59K -

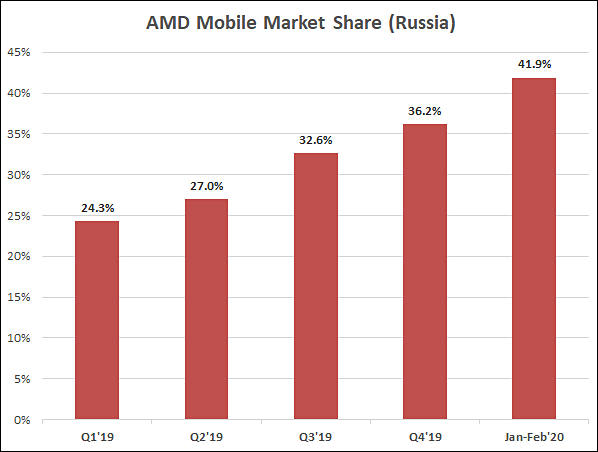

Bad news for Intel, and same thing happens in the server segment.

Coronavirus tripled AMD market share speed increase and it can reach 25% in September already (with >50% in the most competitive cloud and hosting contracts).

sa12756.jpg598 x 452 - 36K

sa12756.jpg598 x 452 - 36K -

AMSL

ASML Holding NV, a crucial supplier to Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co, refrained from providing guidance for the second quarter amid uncertainty following the coronavirus pandemic

First-quarter revenue came in at 2.4 billion euros ($2.6 billion) with net bookings of 3.1 billion euros, including 1.5 billion euros of EUV systems. First-quarter gross margin was 45.1 percent. ASML last month cut its revenue outlook for the first quarter and halted share buyback plans after complications from the novel coronavirus caused supply-chain problems and shipment delays. It had previously forecast revenue of as much as 3.3 billion euros with a gross margin of as much as 47%.

This can be interesting, being monopoly company now is major obstacle on mass dvelopment of latest technologies across the world. Breaking and crushing this company, as well as stealing all information can be top priority for number of countries now, including China.

-

3nm delayed by at least half a year

TSMC is said to face the same problems as reports recently reported on Samsung. Some items of equipment are currently difficult to access, and installation in the factories is being delayed accordingly. According to media reports, this should take place up to six months later, only in December this year the Fab 18 will be further equipped and trial production will begin. No chips from series production are to be expected at 3 nm before 2022.

5nm process is almost the same as existing 7nm (and TSMC failed with 7nm EUV this year).

3nm that must had been next (and most probably final) step can be delayed to 2022-2023.

-

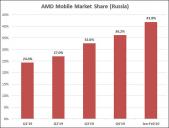

Intel 10nm plans for 2020

sa12721.jpg688 x 383 - 45K

sa12721.jpg688 x 383 - 45K

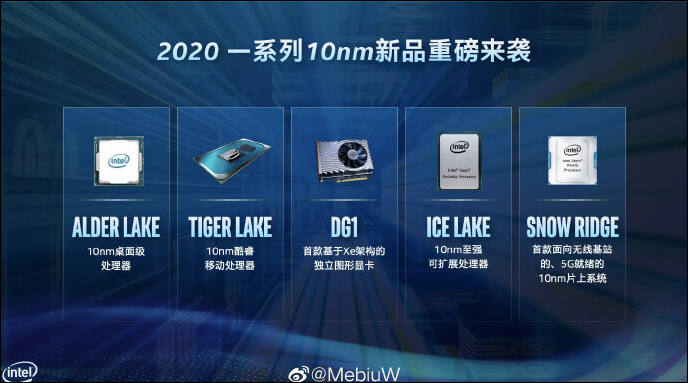

sa12722.jpg691 x 382 - 44K

sa12722.jpg691 x 382 - 44K -

TSMC is on track to move 5nm process technology to volume production in second-quarter 2020 as scheduled, and continues to see the process capacity fully booked despite recent speculation claiming that the foundry has been requested by Apple to pospone making their 5nm chips.

TSMC is in very dangeoirus zone, as it invested lot of money in very risky venture.

It seems like 7nm EUV already failed this year (AMD fully removed any mention of it, and try to shift introduction of new CPUs and GPUs as far as possible now) and it is first major failure of TSMC.

-

According to Kuo, Apple is indeed prepping ‘several’ new ARM-based MacBooks and Macs for a 2021 launch. Kuo expects that Apple will save between 40 to 60 percent on processor costs by switching to its custom ARM-based chips over Intel’s x86 designs. Also, as we argued, it will give Apple greater product differentiation of most of its PC-based competition.

Intel is almost done. It is not clear how it'll manage to make their 7nm running having 3 huge issues - new cheap and fast Ryzen mobile chips, lack of huge profits that Apple provided and unprecedented economic collapse going one.

-

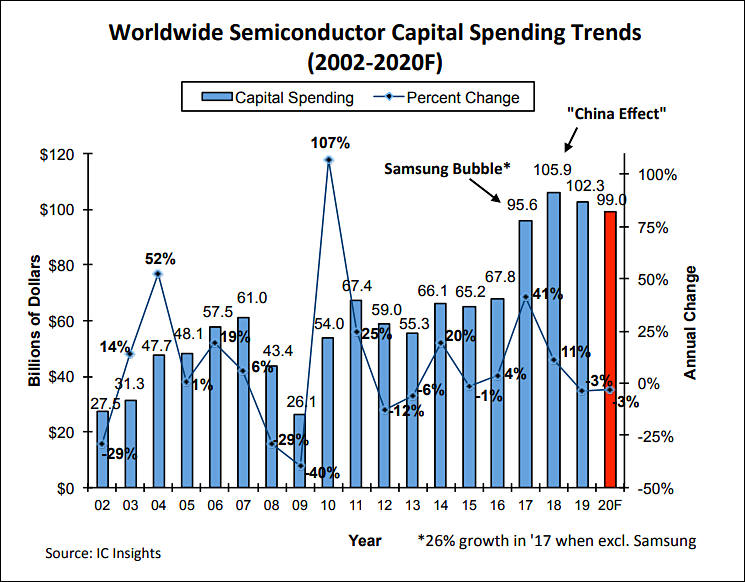

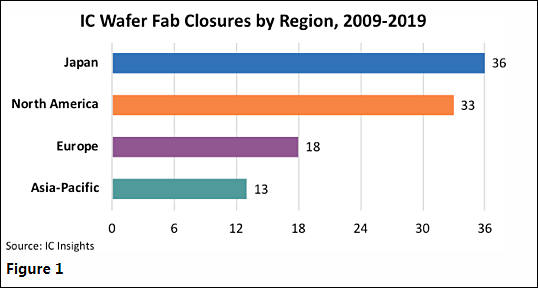

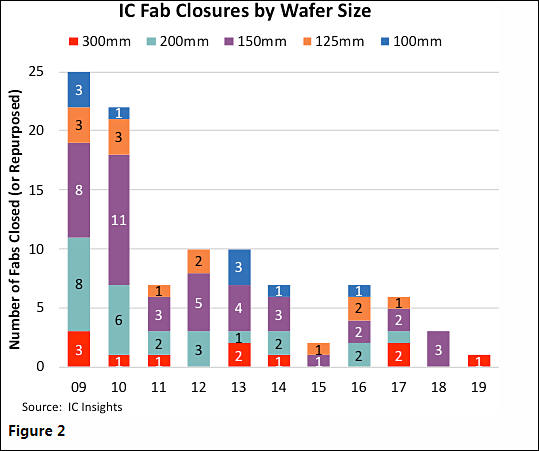

IC industry has been paring down its older capacity as manufacturers have consolidated or transitioned to the fab-lite or fabless business models. In its recently released Global Wafer Capacity 2020-2024 report, IC Insights shows that due to the surge of merger and acquisition activity in the middle of this decade and with more companies producing IC devices using sub-20nm process technology, suppliers have eliminated inefficient wafer fabs. Since 2009, semiconductor manufacturers around the world have closed or repurposed 100 wafer fabs.

sa12613.jpg538 x 288 - 23K

sa12613.jpg538 x 288 - 23K

sa12614.jpg539 x 451 - 37K

sa12614.jpg539 x 451 - 37K -

TSMC will likely revise its sales outlook this year despite its advanced technology leadership, according to market sources.

Surprise.

-

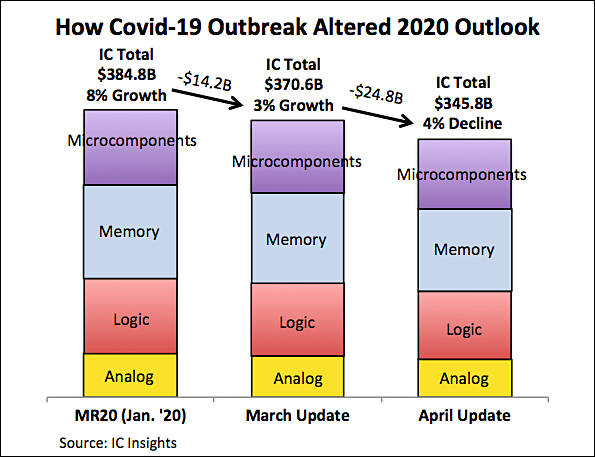

IDC identified an 80% chance for significant contraction in worldwide semiconductor revenues in 2020, instead of a previously expected minor overall growth of 2%. There is still a one-in-five chance that a fast, strong bounce back from COVID-19 in 2020 is possible, IDC continued.

Not all companies will make it past COVID.

-

Remember Xiaomi’s first-ever self-developed processor, the Surge S1? The chip made headlines back in 2017 as it pushed the Chinese smartphone maker into the elite group of tech companies like Samsung and Huawei that could develop their own chipsets. However, after the Surge S1, we didn’t hear much about its chip development progress. The latest information from China suggests that Xiaomi has likely abandoned its chipset project.

Reason here can be ARM licensing issue, as it can be next move in trade war. So Xiaomi can secretly trying to use another architecture.

-

Intel, AMD and Nvidia can delay their new products. Initially up to 6 months, but this can extent to 1-1.5 years.

During this time we can see Intel being sold or merged with other company.

-

Published reports that SMIC is preparing a 7-nanometer production process are incorrect. The error is understandable, however, as it is based on favorable comparisons SMIC has been making between its newest process technology (called N+1) and rivals’ 7nm processes.

Now more clear.

https://www.eetimes.com/smic-graduating-from-14nm-to-something-sort-of-akin-to-7nm/#

-

Semiconductor Manufacturing International (SMIC) has moved 14nm FinFET process to volume production with orders from Huawei's chip arm HiSilicon, and is gearing up for its next-generation FinFET process manufacturing - 7nm.

Pretty strange statements, as they first need to get equipment for it somewhere (blocked by US now).

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320