-

Chinese smartphone maker, Oppo, is reportedly working on introducing its mobile application processors soon. A Chinese publication citing an official statement from an Oppo executive claims that component will be used in its in-house mobile APUs and could be called the Oppo M1 chipset.Oppo has also trademarked the processor at the European Union Intellectual Property Office (EUIPO) certification website. The company has hired some previous engineers of MediaTek and Spreadtrum to work on the chipset. Tony Chen, Oppo founder, and CEO has also highlighted that the company would spend around CNY 50 billion into R&D. One of the biggest impacts of Oppo introducing its processors will be a threat in the demand of Qualcomm-based chipsets as well as Samsung made Exynos SoCs.It will be interesting to see how Oppo will cut its reliance on Qualcomm. Given the company’s long-time partnership with the leading processor chip marker.

-

Intel is in talks to sell a unit that makes chips for home internet access gear to MaxLinear Inc.

No final decision has been made and Intel could keep the connected home division,

No, it won't. As Intel is short on money and they need money to stay among leading manufacturers and try to really make mythical 7nm.

We'll see big cuts in all departments this year also, as well as attempts to sell other parts.

-

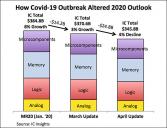

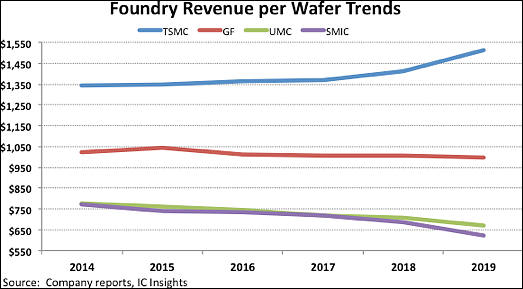

In 2019, TSMC was the only pure-play foundry manufacturing ICs using 7nm process technology. Not coincidentally, its overall revenue per wafer increased significantly as leading fabless IC suppliers lined up to have their newest designs manufactured on the 7nm process. TSMC was the only pure-play foundry that enjoyed higher revenue-per-wafer in 2019 (13%) compared to 2014. In contrast, 2019 revenue per wafer figures at GlobalFoundries, UMC, and SMIC—whose smallest process node is 12/14nm—were down by 2%, 14%, and 19% respectively, compared with 2014.

It is 2 players on the market already - TSMC and Samsung. Intel has around 20-25% last chance with their 7nm process, but they'll need to sell a lot of their empire for this.

sa12286.jpg523 x 289 - 28K

sa12286.jpg523 x 289 - 28K

sa12285.jpg547 x 376 - 49K

sa12285.jpg547 x 376 - 49K -

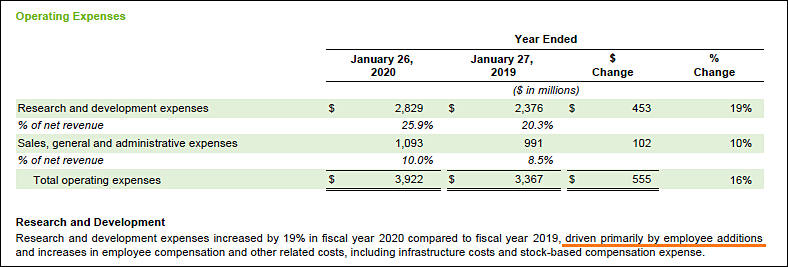

Nvidia expanses increased

And it is bad sign, as they need more and more people to do each new generation of GPUs.

sa12292.jpg788 x 267 - 53K

sa12292.jpg788 x 267 - 53K -

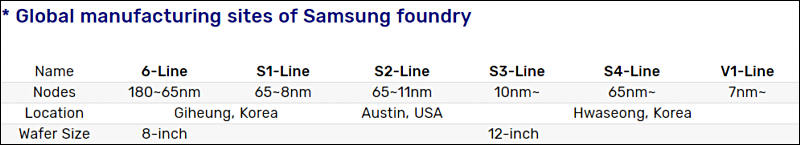

Samsung Electronics, a world leader in advanced semiconductor technology, today announced that its new cutting-edge semiconductor fabrication line in Hwaseong, Korea, has begun mass production.

This is Samsung’s first semiconductor production line dedicated to the extreme ultraviolet (EUV) lithography technology and produces chips using process node of 7 nanometer (nm) and below. The V1 line broke ground in February 2018, and began test wafer production in the second half of 2019. Its first products will be delivered to customers in the first quarter.

The V1 line is currently producing state-of-the-art mobile chips with 7 and 6nm process technology and will continue to adopt finer circuitry up to the 3nm process node.

By the end of 2020, the cumulative total investment in the V1 line will reach USD 6 billion in accordance with Samsung’s plan and the total capacity from 7nm and below process node is expected to triple from that of 2019. Together with the S3 line, the V1 line is expected to play a pivotal role in responding to fast-growing global market demand for single-digit node foundry technologies.

It is all fuzzy with Samsung, as their own chart above shows that they did not have any functioning 7nm line (that also poor Nvidia and other clients figured out hard).

sa12304.jpg800 x 145 - 26K

sa12304.jpg800 x 145 - 26K -

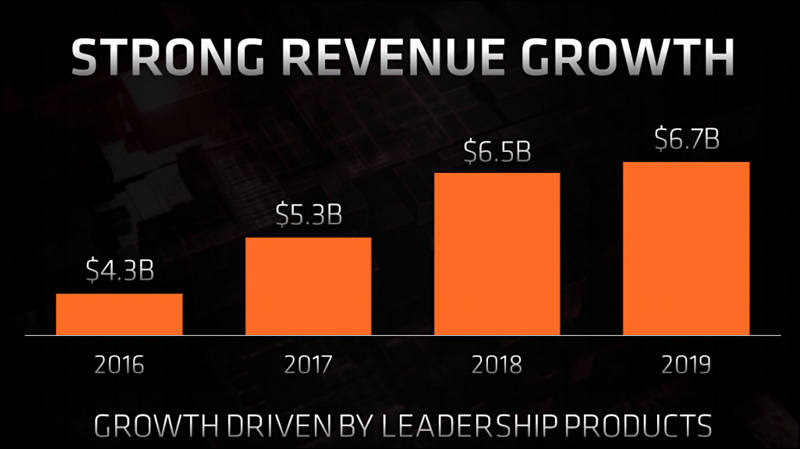

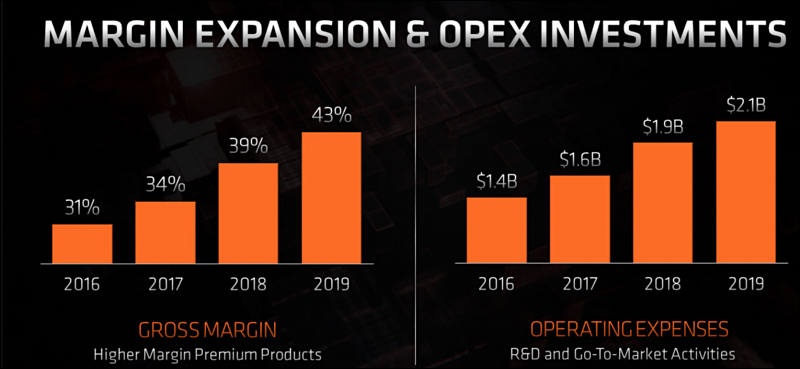

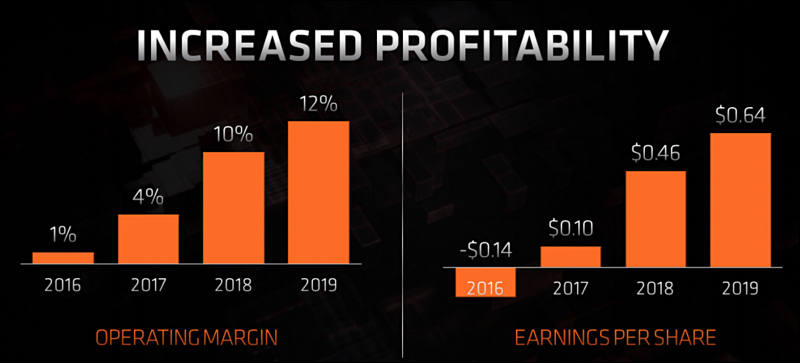

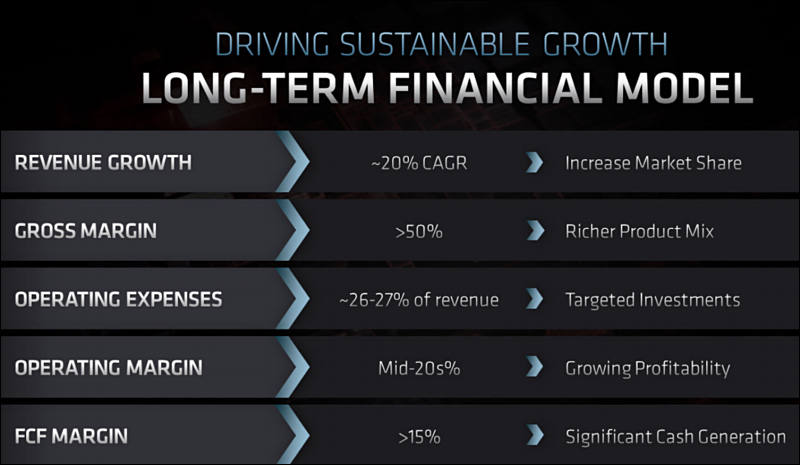

AMD Finances

Short summary - more marketing expenses, more profits for shareholders, much more expensive CPUs for consumers.

sa12434.jpg800 x 449 - 37K

sa12434.jpg800 x 449 - 37K

sa12435.jpg800 x 369 - 38K

sa12435.jpg800 x 369 - 38K

sa12436.jpg800 x 363 - 33K

sa12436.jpg800 x 363 - 33K

sa12437.jpg800 x 465 - 45K

sa12437.jpg800 x 465 - 45K -

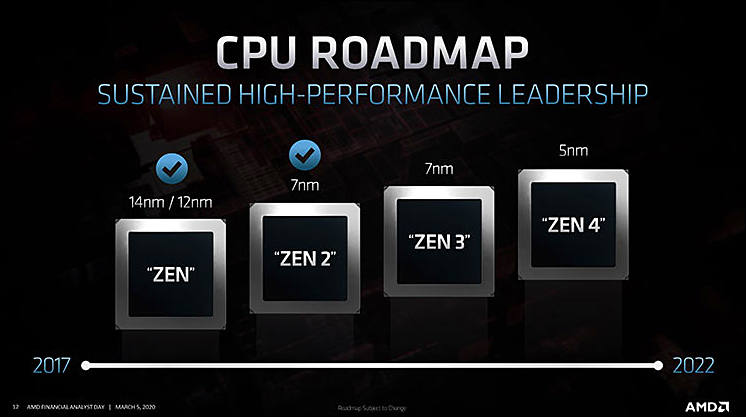

AMD also won't use 7nm+ EUV process for Zen 3, as it seems like it is not ready at all

Same is true for their GPUs.

Sad news for TSMC, while marketing "5nm" can work, they can be last process before long pause similar to Intel one.

Early leaks talk about only 3-5% speed improvement assisted with 10-15% price hike.

sa12441.jpg746 x 417 - 37K

sa12441.jpg746 x 417 - 37K -

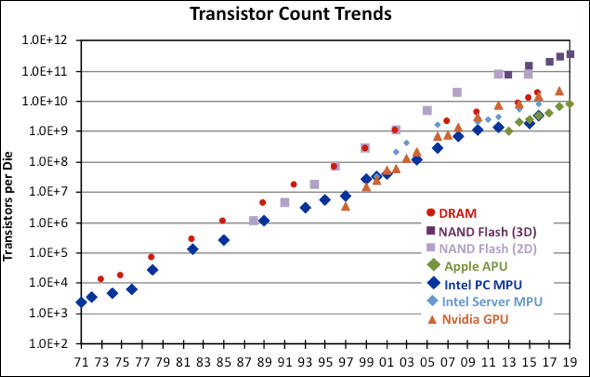

Power consumption and challenges associated with scaling limitations have cut into the transistor growth rates of some IC products during the last 10-15 years. DRAM transistor counts were increasing at the average rate of about 45% per year through the early 2000s but slowed to about 20% through the 16Gb generation that appeared in 2016. Samsung began volume production with single-chip 16Gb DRAM devices near the end of 2016. One year earlier Samsung initiated volume production of 12Gb DRAM chips, and 8Gb devices one year before that. The DDR5 standard still being finalized by JEDEC includes monolithic 24Gb, 32Gb, and 64Gb devices.

Annual growth in flash memory densities remained at 55-60% per year through about 2012 but has since been around 30-35% per year. For conventional 2D planar NAND flash, the highest density on a single die available in January 2020 was 128Gb. The maximum density for a 3D NAND chip is currently 1.33Tb for a 96-layer quad-level-cell (QLC) device. QLC combined with new 96-layer technology should enable 3D NAND to reach 1.5Tb density in 2020 with 128-layer technology leading to 2Tb chips.

Transistor counts in Intel’s PC microprocessors grew approximately 40% per year through 2010, but the rate dropped to half that in the years following. Transistor count increases for the company’s server MPUs paused in the mid- to late-2000s but then started growing again at the rate of about 25% per year. Intel stopped revealing details of transistor counts in 2017.

Transistor counts for Apple’s A series application processors used in its iPhones and iPads have increased at the annual rate of 43% since 2013. That rate includes as the most recent endpoint the A13 processor, with its 8.5 billion transistors. In the first half of 2020, Apple is expected to unveil an iPad Pro based on a new A13X processor.

sa12455.jpg590 x 377 - 41K

sa12455.jpg590 x 377 - 41K -

It turns out that the next step to TSMC N7, the company's current-generation 7 nm DUV silicon fabrication node, isn't N7+ (7 nm EUV), but rather it has a nodelet along the way, which the foundry refers to as N7P. This is a generational refinement of N7, but does not use EUV lithography, which means it may not offer the 15-20 percent gains in transistor densities offered by N7+ over N7.

AMD clarified that "7 nm+" in its past presentations did not intend to signify N7+, and that the "+" merely denoted an improvement over N7.

Bad days of TSMC.

-

TSMC is set to kick off volume production of chips built using 5nm process technology in April, and has already seen the process capacity fully booked by clients, according to industry sources.

-

Intel’s options include stopping operating its own NAND foundry and buying in chips, or even sourcing complete SSDs from a third party. Alternatively, it could sell chips to third parties.

Intel need to sale parts to stay afloat, this is why such talks began.

-

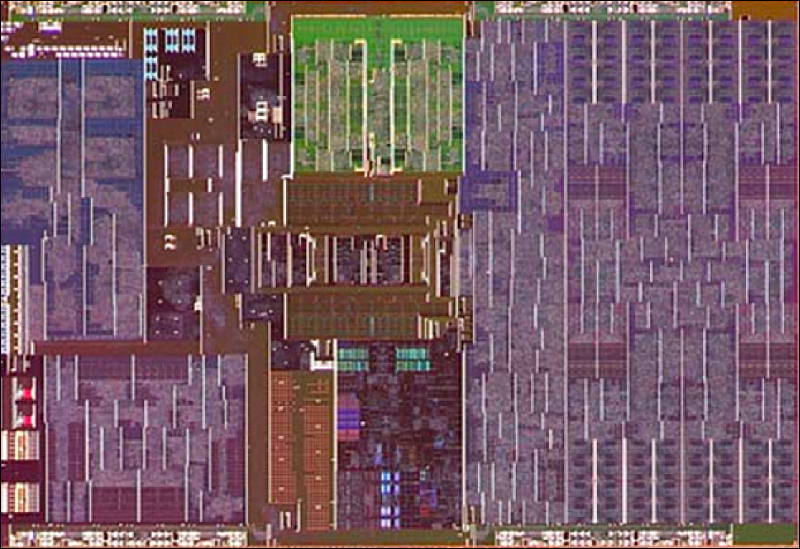

Lakefield chip

4x Atom (green) + 1x Core (dark area at bottom center) + GPU (right ~40%) + uncore (left ~30%)

sa12495.jpg800 x 549 - 100K

sa12495.jpg800 x 549 - 100K -

Semiconductor Manufacturing International (SMIC) has moved 14nm FinFET process to volume production with orders from Huawei's chip arm HiSilicon, and is gearing up for its next-generation FinFET process manufacturing - 7nm.

Pretty strange statements, as they first need to get equipment for it somewhere (blocked by US now).

-

Published reports that SMIC is preparing a 7-nanometer production process are incorrect. The error is understandable, however, as it is based on favorable comparisons SMIC has been making between its newest process technology (called N+1) and rivals’ 7nm processes.

Now more clear.

https://www.eetimes.com/smic-graduating-from-14nm-to-something-sort-of-akin-to-7nm/#

-

Intel, AMD and Nvidia can delay their new products. Initially up to 6 months, but this can extent to 1-1.5 years.

During this time we can see Intel being sold or merged with other company.

-

Remember Xiaomi’s first-ever self-developed processor, the Surge S1? The chip made headlines back in 2017 as it pushed the Chinese smartphone maker into the elite group of tech companies like Samsung and Huawei that could develop their own chipsets. However, after the Surge S1, we didn’t hear much about its chip development progress. The latest information from China suggests that Xiaomi has likely abandoned its chipset project.

Reason here can be ARM licensing issue, as it can be next move in trade war. So Xiaomi can secretly trying to use another architecture.

-

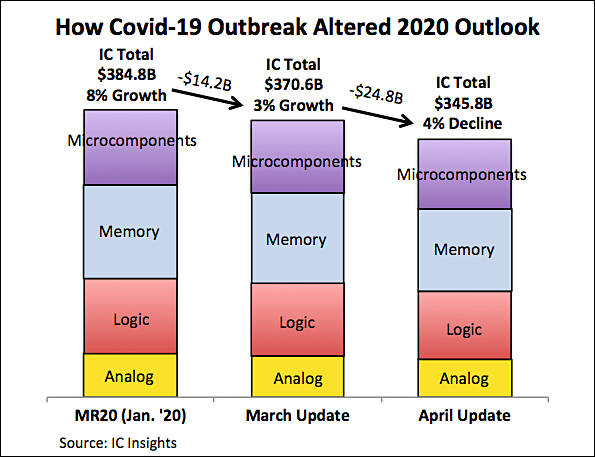

IDC identified an 80% chance for significant contraction in worldwide semiconductor revenues in 2020, instead of a previously expected minor overall growth of 2%. There is still a one-in-five chance that a fast, strong bounce back from COVID-19 in 2020 is possible, IDC continued.

Not all companies will make it past COVID.

-

TSMC will likely revise its sales outlook this year despite its advanced technology leadership, according to market sources.

Surprise.

-

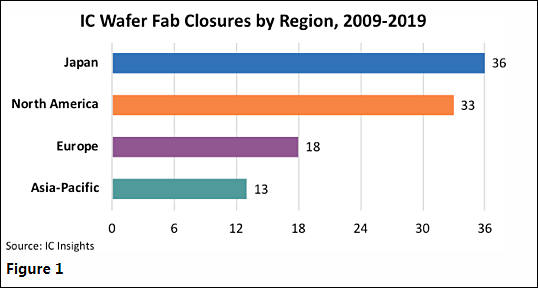

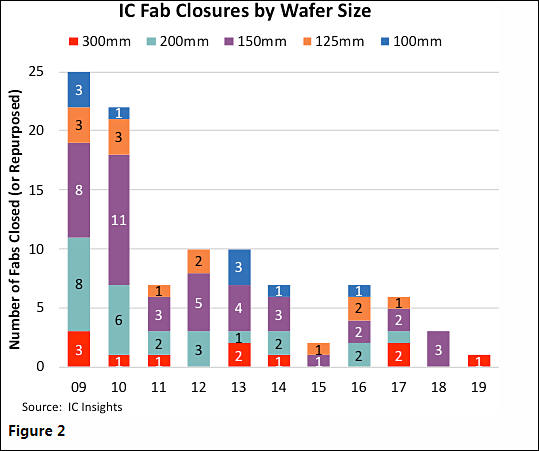

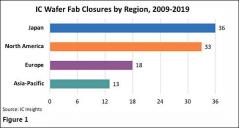

IC industry has been paring down its older capacity as manufacturers have consolidated or transitioned to the fab-lite or fabless business models. In its recently released Global Wafer Capacity 2020-2024 report, IC Insights shows that due to the surge of merger and acquisition activity in the middle of this decade and with more companies producing IC devices using sub-20nm process technology, suppliers have eliminated inefficient wafer fabs. Since 2009, semiconductor manufacturers around the world have closed or repurposed 100 wafer fabs.

sa12613.jpg538 x 288 - 23K

sa12613.jpg538 x 288 - 23K

sa12614.jpg539 x 451 - 37K

sa12614.jpg539 x 451 - 37K -

According to Kuo, Apple is indeed prepping ‘several’ new ARM-based MacBooks and Macs for a 2021 launch. Kuo expects that Apple will save between 40 to 60 percent on processor costs by switching to its custom ARM-based chips over Intel’s x86 designs. Also, as we argued, it will give Apple greater product differentiation of most of its PC-based competition.

Intel is almost done. It is not clear how it'll manage to make their 7nm running having 3 huge issues - new cheap and fast Ryzen mobile chips, lack of huge profits that Apple provided and unprecedented economic collapse going one.

-

TSMC is on track to move 5nm process technology to volume production in second-quarter 2020 as scheduled, and continues to see the process capacity fully booked despite recent speculation claiming that the foundry has been requested by Apple to pospone making their 5nm chips.

TSMC is in very dangeoirus zone, as it invested lot of money in very risky venture.

It seems like 7nm EUV already failed this year (AMD fully removed any mention of it, and try to shift introduction of new CPUs and GPUs as far as possible now) and it is first major failure of TSMC.

-

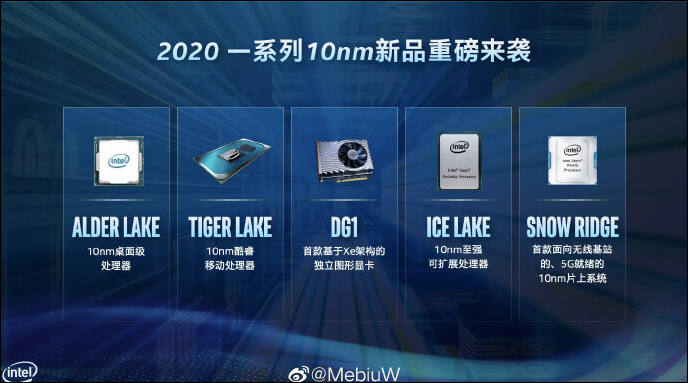

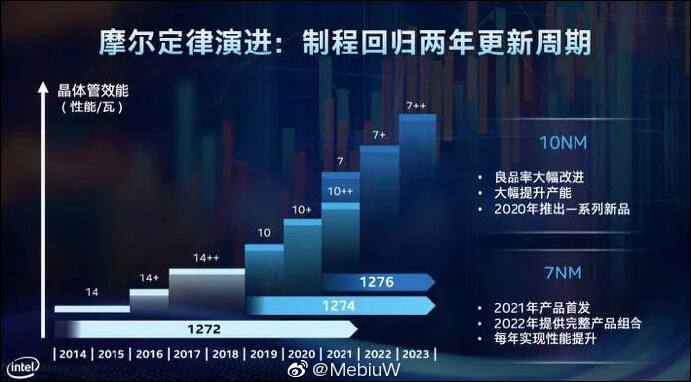

Intel 10nm plans for 2020

sa12721.jpg688 x 383 - 45K

sa12721.jpg688 x 383 - 45K

sa12722.jpg691 x 382 - 44K

sa12722.jpg691 x 382 - 44K -

3nm delayed by at least half a year

TSMC is said to face the same problems as reports recently reported on Samsung. Some items of equipment are currently difficult to access, and installation in the factories is being delayed accordingly. According to media reports, this should take place up to six months later, only in December this year the Fab 18 will be further equipped and trial production will begin. No chips from series production are to be expected at 3 nm before 2022.

5nm process is almost the same as existing 7nm (and TSMC failed with 7nm EUV this year).

3nm that must had been next (and most probably final) step can be delayed to 2022-2023.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,990

- Blog5,725

- General and News1,353

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,366

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320