-

Samsung will post an operating profit of around 7.7 trillion Korean won (US$6.44 billion). That's higher than the 6.6 trillion won (US$5.5 billion) profit Samsung made in the second quarter, but it's also down 56 percent from the same period in 2018 when the company made 17.57 trillion won (US$14.7 billion) in profit.

Note that Samsung makes enormous profits on NAND and DRAM (on good years they made 6-10x profit compared to cost to manufacture).

-

With suppliers cutting back production and end-market demand picking up on seasonality, NAND flash contract prices have stopped falling in the third quarter and will rise 10% in the fourth quarter, according to industry sources.

Cool.

-

Samsung will do 300 layers NAND, but do not expect them to lower prices

Samsung Electronics, the world leader in advanced memory technology, today announced that it has begun mass producing 250-gigabyte (GB) SATA solid state drive (SSD) that integrates the company’s sixth-generation (1xx-layer) 256-gigabit (Gb) three-bit V-NAND for global PC OEMs. By launching a new generation of V-NAND in just 13 months, Samsung has reduced the mass production cycle by four months while securing the industry’s highest performance, power efficiency and manufacturing productivity.

“By bringing cutting-edge 3D memory technology to volume production, we are able to introduce timely memory lineups that significantly raise the bar for speed and power efficiency,” said Kye Hyun Kyung, executive vice president of Solution Product & Development at Samsung Electronics. “With faster development cycles for next-generation V-NAND products, we plan to rapidly expand the markets for our high-speed, high-capacity 512Gb V-NAND-based solutions.”

The Only Single-stack 3D Memory Die With a 100+ Layer Design

Samsung’s sixth-generation V-NAND features the industry’s fastest data transfer rate, capitalizing on the company’s distinct manufacturing edge that is taking 3D memory to new heights.

Utilizing Samsung’s unique ‘channel hole etching’ technology, the new V-NAND adds around 40-percent more cells to the previous 9x-layer single-stack structure. This is achieved by building an electrically conductive mold stack comprised of 136 layers, then vertically piercing cylindrical holes from top to bottom, creating uniform 3D charge trap flash (CTF) cells.

As the mold stack in each cell area increases in height, NAND flash chips tend to become more vulnerable to errors and read latencies. To overcome such limitations, Samsung has incorporated a speed-optimized circuit design that allows it to achieve the fastest data transfer speed, at below 450 microseconds (μs) for write operations and below 45μs for reads. Compared to the previous generation, this represents a more than 10-percent improvement in performance, while power consumption is reduced by more than 15 percent.

Thanks to this speed-optimized design, Samsung will be able to offer next-generation V-NAND solutions with over 300 layers simply by mounting three of the current stacks, without compromising chip performance or reliability.

In addition, the number of channel holes required to create a 256Gb chip density has decreased to 670 million holes from over 930 million with the previous generation, enabling reduced chip sizes and less process steps. This brings a more than 20-percent improvement in manufacturing productivity.

Leveraging the high-speed and low-power features, Samsung plans to not only broaden the reach of its 3D V-NAND into areas like next-generation mobile devices and enterprise servers, but also into the automotive market where high reliability is extremely critical.

Following today’s introduction of the 250GB SSD, Samsung plans to offer 512Gb three-bit V-NAND SSD and eUFS in the second half of this year. The company also expects to expand production of higher-speed and greater-capacity sixth-generation V-NAND solutions at its Pyeongtaek (Korea) campus starting next year to better meet demand from global customers.

-

Taiwan memory modules makers including Adata Technology, Phison Electronics and Team Group are mulling a 10-15% hike in SSD prices and enforcing a limited-supply policy amid growing expectations that both NAND flash and DRAM chip prices may rebound.

Cartels, cartels.

-

Cartel want to fight back

NAND flash prices are expected to rebound in the near future, as Samsung Electronics is reportedly considering raising its quotes by as much as 10% and other peer makers including Micron Technology may follow suit.

-

Watch another criminals in action

Micron Technology has reiterated plans to idle up to 5% of DRAM wafer starts in 2019, but said the company will reduce its total NAND flash wafer starts by a larger 10% compared to the previously-planned 5%.

-

And stuff started happening

Western Digital Corp. (NASDAQ: WDC) announced that on Saturday, June 15, an unexpected power outage occurred in the Yokkaichi region in Japan, affecting production operations at the flash fabrication facilities operated by the company's joint venture partner, Toshiba Memory Corporation. The power outage impacted both the facilities and process tools and Western Digital is working closely with its joint venture partner to bring the facilities back to normal operational status as quickly as possible.

Western Digital continues to assess the impact of this event. The company currently expects the incident will result in a reduction of Western Digital's flash wafer availability of approximately 6 exabytes, the majority of which is expected to be contained in the first quarter of fiscal year 2020.

-

Drops in NAND flash contract prices are expected to narrow in the third quarter, compared to nearly 20% decreases in the previous two quarters. An approximately 10% drop in third-quarter contract prices for eMMC and SSD devices is also expected.

-

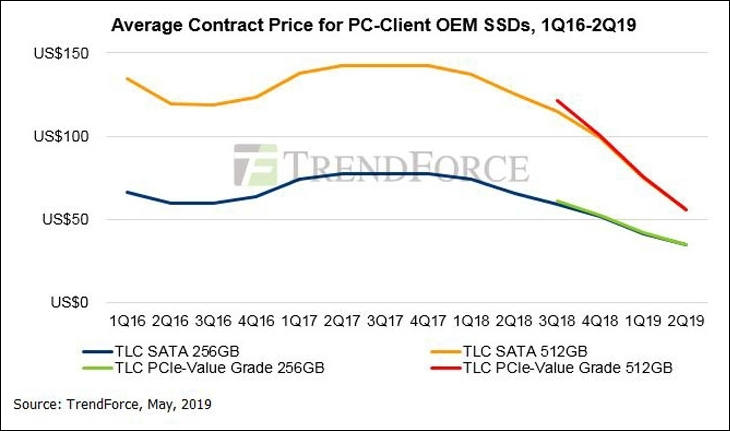

Cheap PCIE SSDs price matched SATA ones

-

Chipmakers have stepped up development of their respective 120/128-layer 3D NAND flash process technologies for cost competitiveness, and are gearing up to have the technology transitions kick off in 2020, according to industry sources.

Major NAND flash chipmakers have delivered samples of their 128-layer chips targeting the first half of 2020 for volume production, said the sources. Continued falls in NAND flash prices coupled with rising uncertainty on the demand side have prompted the players to accelerate their technology advancements for cost reasons, the sources continued.

Yield rates for 90/96-layer 3D NAND process technology remain unstable which may bring more variables to the market and prices this year.

-

Average contract prices for 512GB and 1TB SSDs will likely fall below US$0.10 per GB and reach their record-low levels by the end of 2019.

Average contract prices for SATA SSDs are expected to fall 15-26% sequentially in the second quarter, while those for PCIe SSDs will see a larger 16-37% drop.

This change will cause 512GB SSDs to replace their 128GB counterparts and become market mainstream, second only to 256GB SSDs

PCIe SSDs are expected to achieve 50% market penetration, since PCIe SSDs and SATA SSDS are nearly identical in price.

-

NAND flash memory prices are expected to continue trending down in the second half of 2019, the sources warned. The prices have already approached cash costs for many manufacturers, but remain under downward pressure, the sources indicated.

Do not see much real trend now. And this false stories about "cost of manufacturing". This guys can eat another 2.5x drop without any serious consequences (except for their greedy owners).

-

SK Hynix saw its DRAM bit shipments and ASPs decrease 8% and 27%. So guys already cut shipments silently for DRAM.

For NAND - the company's total NAND wafer produced this year is expected to be more than 10% lower than the 2018 level, SK Hynix.

It is just one big criminal cartel.

-

Drop slowing down

With Samsung lowering its quotes substantially, the NAND flash market prices have fallen even more in the first quarter of 2019, the sources said. Nevertheless, the price drops are expected to narrow to less than 10% in the second quarter, and may begin to rally in the third quarter when demand particularly that for servers picks up, the sources noted.

-

Revenues of the global NAND flash industry declined 16.8% sequentially to US$14.16 billion in the fourth quarter of 2018, but still hit a record high of US$63.2 billion in the whole year.

-

NAND flash prices are unlikely to fall further given major chipmakers' control over capacity, said the sources, adding that the firms are also slowing down their transition to 96-layer 3D NAND chip technology. NAND flash prices should reach their lowest levels for 2019 in the first quarter.

So, we have our cartel tightly controlling stuff.

My talks show that it is still huge profits in NAND market. And prices could fall around 2-3 times without any damage to manufacturers (outside top management bonuses and investor profits).

-

"We expect NAND prices to continue falling through 2019, which will drive meaningful increase in client SSD adoption in PCs starting in the middle of this year," Kou noted. Such positive development resulting from the chip price fall "does not happen immediately," .

-

NAND flash prices are expected to fall over 15% sequentially in the first quarter of 2019, and will suffer another sequential drop in the second quarter,

-

Citi expects NAND pricing to fall 45% in 2019 while DRAM falls 30% and doesn't see a bottom in pricing until Q2 at the earliest.

-

More Chinese coming

Tsinghua Unigroup has signed a strategic alliance with memory module firm Shenzhen Longsys Electronics in a move to accelerate its ambition in the NAND flash sector.

YMTC is expected to build a close relationship with Longsys after growing its production yield rates to mature and stable levels, the sources continued. YMTC's in-house developed 64-layer 3D NAND flash will be adopted in Longsys' SSD and UFS products.

-

Chinese are coming

China's Yangtze Memory Technology (YMTC) started delivering samples of its 64-layer 3D NAND chip with volume production in the third quarter of 2019. The company also plans to move directly to the 128-layer generation with volume production scheduled for 2020.

YMTC has no plans to provide 96-layer 3D NAND chips as the company intends to skip the generation and jump directly to 128 layers.

-

Chairman of Adata Technology, a Taiwan maker of DRAM modules and NAND flash chips, said that globally leading NAND flash makers have yet to slow down capacity expansions, and prices may see a larger drop in 2019 than in 2018.

Industry sources said that there are now 6-7 leading makers of NAND flash products around the world, all devoted to developing new-generation production processes. Among them, Samsung, Toshiba Memory/Western Digital, Mircon/Intel and SK Hynix have released their respective 96-layer 3D NAND technologies for volume production in the first half of 2019.

-

NAND flash contract prices are likely to fall by a larger-than-expected 10-15% sequentially in the third quarter and another 15% in the fourth.

-

NAND flash contract prices fell between 15% and 20% sequentially in the second quarter, but bit shipments bounced back thanks to a pick-up in demand for high-density products from China-based smartphone vendors.

-

Chip suppliers continue to scale up their output thanks to further improvement in their 64- and 72-layer 3D NAND flash technologies. Hence NAND flash contract prices already fell for the second consecutive quarter in the second quarter of 2018. Chip suppliers may cut further their quotes in order to stimulate demand, which will lead to a steeper-than-expected decline in NAND flash contract prices for the third quarter,

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320