-

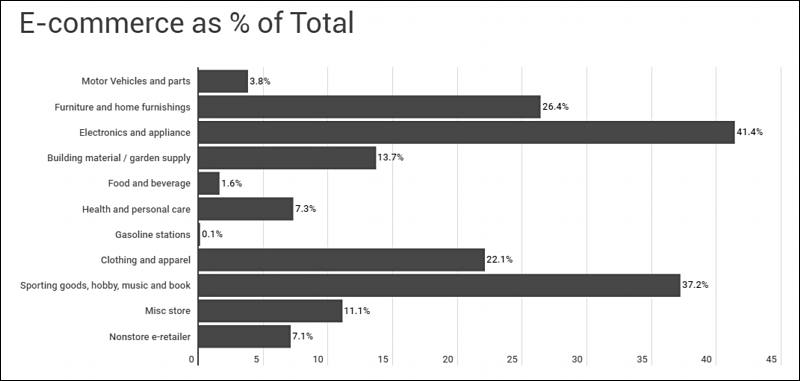

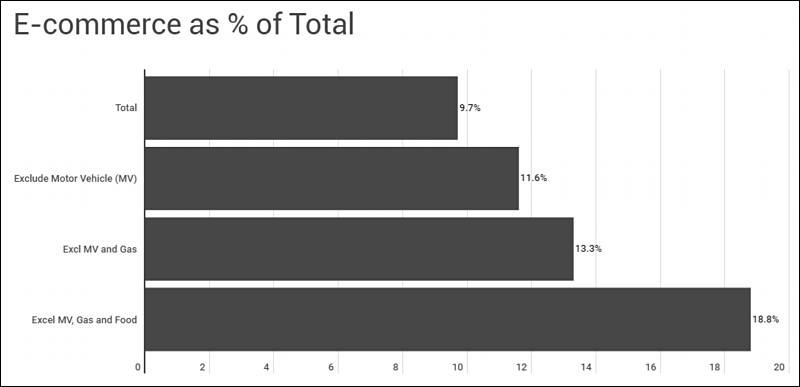

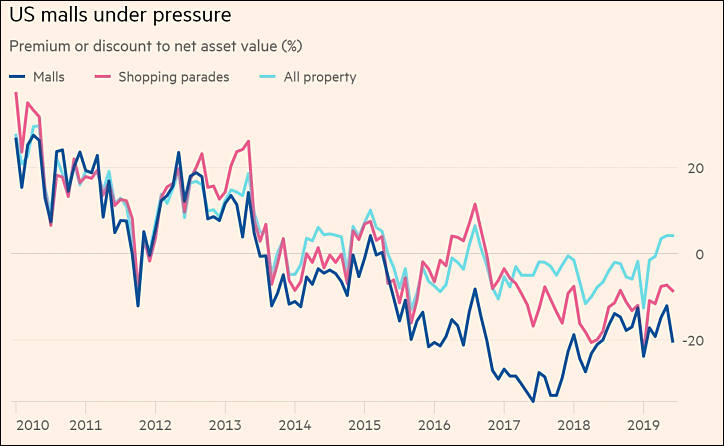

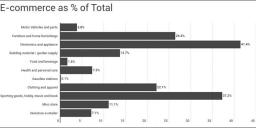

The UK commercial property market has found itself at the centre of the storm affecting high streets and shopping centers. Online shopping, high costs for retailers, outdated buildings and high debt levels have sent prices and rents plunging for landlords, as well as pushing well-known names such as Debenhams and House of Fraser to the point of collapse.

“The UK is ground zero. That’s where you have the greatest [level] of online sales as a proportion of total sales, and between that and the reality that occupation costs for retailers were particularly high in the UK, you’ve got the perfect recipe for significant retail disruption”.

Rents agreed in UK shopping centers in the first quarter of 2019 dropped by a third compared with last year — using a measure that takes account of concessions such as rent-free periods — according to the estate agents Savills. In some of the worst affected centers, they plunged by 40 to 60 per cent in just three months.

In Europe, vacancy rates are rising across the retail sector, according to the Royal Institution of Chartered Surveyors. In the US, retailers have announced more than 6,900 store closures so far this year, more than in the whole of 2018

sa8888.jpg724 x 446 - 48K

sa8888.jpg724 x 446 - 48K -

Well, formally they made that had been requested, but as capitalists are ruling class - they turned this into little nightmare so scum won't attempt to demand anything like this anymore.

-

Welcome to Amazon Hell on Earth ! :)

Whole Foods cuts workers' hours after Amazon introduces minimum wage

The Illinois-based worker explained that once the $15 minimum wage was enacted, part-time employee hours at their store were cut from an average of 30 to 21 hours a week, and full-time employees saw average hours reduced from 37.5 hours to 34.5 hours. The worker provided schedules from 1 November to the end of January 2019, showing hours for workers in their department significantly decreased as the department’s percentage of the entire store labor budget stayed relatively the same.“We just have to work faster to meet the same goals in less time,” the worker said. -

Amazon expansion can only happen with simultaneous closure of retail shops.

And even large guys can't compete, as Amazon get unlimited cash and instead of paying taxes it gets bonuses and stimulus :-) And all of big guys tell us how it created new workplaces, fucking idiots.

-

Retail apocalypse? JCPenney, Payless, LifeWay announce 3,000+ combined store closures

More than 41,000 people have lost their jobs in the retail industry so far this year — a 92 percent spike in layoffs since the same time last year, according to a new report. And the layoffs continue to mount, with JCPenney announcing this week it would be closing 18 stores in addition to three previously announced closures, as part of a “standard annual review.”Walmart is quietly closing stores — here's the full list

Walmart is closing at least 11 US stores across eight states. The closing stores include one Walmart Supercenter in Lafayette, Louisiana, and Walmart Neighborhood Market stores in Arizona, California, Kansas, South Carolina, Tennessee, Virginia, and Washington.The closing date for most of the affected stores is April 19, according to employees of those stores, who confirmed the closings to Business Insider.https://www.businessinsider.com/walmart-stores-closing-list-2019-3

-

Fox 5 NY is reporting that major chains such as Gap, JCPenney, Victoria's Secret and Foot Locker have all announced massive closures, totaling more than 465 stores in the last 48 hours.All four companies reported its fourth-quarter results last week for the holiday period, with three of them (Gap, JCPenney and Victoria's Secret) reporting a sizeable decline in same-store sales, while Foot Locker had modest growth.With somewhat decent growth, because apparently, consumers still need to walk, Foot Locker shocked investors Friday with 165 store closures across the country. That comes less than 24 hours after Gap told investors it would close 230 over the next several years after the company's same-store sales plunged 7% during the holiday quarter.

http://www.fox5ny.com/news/gap-jcpenney-victoria-s-secret-foot-locker-465-store-closures-in-48-hours

-

Payless shoe stores plans to close 2,100 U.S. locations

NEW YORK— Payless ShoeSource is shuttering all of its 2,100 remaining stores in the U.S. and Puerto Rico, joining a list of iconic names like Toys R Us and Bon-Ton that have closed down in the last year. The Topeka, Kansas-based chain said Friday it will hold liquidation sales starting Sunday and wind down its e-commerce operations. All of the stores will remain open until at least the end of March and the majority will remain open until May.The debt-burdened chain filed for Chapter 11 bankruptcy protection in April 2017, closing hundreds of stores as part of its reorganization. At the time, it had over 4,400 stores in more than 30 countries. It remerged from restructuring four months later with about 3,500 stores and eliminated more than $435 million in debt.https://www.nbcnews.com/news/us-news/payless-shoe-stores-plans-close-2-100-u-s-locations-n972366

-

sa6621.jpg800 x 381 - 33K

sa6621.jpg800 x 381 - 33K

sa6622.jpg800 x 387 - 27K

sa6622.jpg800 x 387 - 27K -

American companies have a curious habit of running up massive debts while the executives of the companies pay themselves millions of dollars in bonuses. I guess it can only work for so long with retail companies.

-

Shockingly, it looks like Gymboree was bought by Bain Capital in 2010. Yet another instance of a private equity firm latching like a parasite onto an established retail brand and sucking it dry, only for idiot reporters to blame the demise primarily on e-commerce.

-

For the second time in two years, children’s clothing retailer Gymboree Group Inc. has filed for Chapter 11 bankruptcy protection, offering the latest sign of the looming bloodbath in the retail space following stagnant foot-traffic during the holiday sales season (which was dominated by e-commerce), and the strain from higher interest rates. Gymboree, which filed late Wednesday, wasn't the only retailer to file within the last 24 hours: Department Store Shopko also filed on Wednesday.

Gymboree will close 800 Gymboree- and Crazy 8-branded stores in the US and Canada. In its press release, the retailer said it's planning to sell its high-end children's fashion line Janie and Jack, its online platform and its intellectual property - though all of these will remain open for now as the restructuring continues.

-

Sears Holdings Corp. is preparing to potentially wind down the iconic retailer after Chairman Eddie Lampert’s bid to buy several hundred stores out of bankruptcy fell short of bankers’ qualifications, people with knowledge of the matter said.

The retailer started laying the groundwork for a liquidation after meetings Friday in which its advisers weighed the merits of a $4.4 billion bid by Lampert’s hedge fund to buy Sears as a going concern, said the people, who asked not to be identified because the discussions are private.

-

Lowe's is closing 51 stores in the US and Canada

...Lowe's is struggling to keep up with Home Depot. Last year, Home Depot's revenue hit more than $100 billion, while Lowe's sales were below $70 billion.

Lowe's (LOW) will shut down 20 stores in the United States and 31 in Canada. The company said that a "majority" of the shuttered stores are within 10 miles of another Lowe's location. The stores will be closed before Feb. 1, 2019.

https://www.cnn.com/2018/11/05/business/lowes-closures/index.html

-

US Retail closings October 8, 2018

Mattress Firm – Up to 700 stores

Victoria’s Secret – 20 stores

Brookstone – 102 stores

The Fresh Market – 15 stores

Chipotle – 65 stores

Toys R Us – 735 stores

Starbucks – 150 stores closing in 2019

H&R Block – 400 locations

Subway – 500 restaurants

Bon-Ton Department Srore– 256 stores

GNC Nutrition – 200 stores

J. Crew – 20 stores

Abercrombie & Fitch – 60 stores

Best Buy cell phone stores – 250 stores

J.C. Penney – 8 stores

Sam’s Club ( Walmart) – 63 stores

Macy’s – 11 stores

Gap and Banana Republic – 200 stores

Teavana ( Starbucks )– 379 stores - All stores

Ascena Retail Group – At least 268 stores ( women clothing - Ann Taylor, Loft, Dress Barn, Lane Bryant, Justice etc)

Michael Kors – 100 to 125 stores

Foot Locker – 110 stores

Sears and Kmart – Several hundred stores

Orchard Supply Hardware – 99 stores

-

Lowe's closing Orchard Supply Hardware chain it acquired out of bankruptcy:

"Sears acquired the chain in 1996 when the Chicago retail giant was looking to expand its share of the home-improvement market. In 2012, it spun off OSH as a separate business, but the newly independent company declared bankruptcy less than two years later, crushed by hundreds of millions of dollars of debt it was saddled with as part of the spin-off."

http://www.latimes.com/business/la-fi-osh-closure-20180822-story.html

-

Sears is planning to close up to 150 of its department and discount stores and keep at least another 300 open, while the fate of Sears’ remaining 250 stores uncertain. 90,000 jobs are at stake, according to Sears filings.

Sears will likely file for bankruptcy protection in New York as soon as Sunday night,

-

Sears will file for bankruptcy

The neverending saga of the world's longest melting ice cube, that of Sears Holdings which has flirted with bankruptcy for years only to get bailed out in the 11th hour by its biggest investor and CEO Eddie Lampert each and every time, is finally coming to its logical end.

With its stock crashing to a new all time low, and with a $134 million in debt due on Monday on a bond issue that is currently yielding over 1,000% in the 3 or so business days left to maturity...

-

Future of Retail Shopping:

Flash mobs rob Lululemon and Apple as store clerks watch.

They didn't get any AC adapters! Maybe Lululemon will develop a kill switch for their pants!

https://losspreventionmedia.com/insider/retail-security/flash-mob-robbery-and-the-retail-threat/

-

Nope, me... or I should say "Us"... Another thing, the dude had major issues - he lost his cert. of occupancy due to the fact that he was a hoarder and his house was considered a health hazard. It took a crew 4 days to clear the stuff out of his modestly sized home. Maybe this is all his fault.

-

Ah, I thought you meant he was there from 2004-2012. :)

-

The neighbor had been there for years before I knew him. You are not wrong on the other counts, though.

-

I totally believe you that they weren't cutting-edge - but bear in mind that updating systems costs money. 2004 is right around the time they were acquired (2005) so most of your friend's time was there during the Romney age.

And from the article that I linked...

The company eliminated positions, loading responsibilities onto other workers. Schedules became unpredictable.

If the company was struggling with antiquated systems before, eliminating staff and offloading their responsibility on other workers without investing in upgrading the systems is not a recipe for future success... and one of the primary pitches of a private equity company is that they come in and improve bad systems. If they come in and explode a company's debt without either significantly decreasing costs or increasing profits, then they are acting exactly like a parasite that will eventually kill its host.

Had they not been there, Toys R Us could have presumably invested some of the profits that it was making in 2005 into modernizing and improving.

Ever since I learned about private equity companies during some other major retailers closing, I've looked them up every time I've heard of a major retailer shutting down. The vast majority have been strangled by trying to pay interest on private equity debt.

-

I lived 3 doors down from one of their head accountant guys 2004-12. Things weren't peachy before the ilk of Romney set in. I am not saying you are not wrong, just that they were running things in an antiquated fashion. They took over the market from other retailers, then they were taken over.

-

@rockroadpix Sorry, yeah. I grabbed Amazon from VK's post, but you mentioned their lack of a stronger online presence in yours which I conflated with that. That part was my mistake

Were there unprofitable stores that they should have proactively shut down? Maybe. I don't have any insight into store-by-store performance.

Should they have teamed up with another major online retailer? Maybe? There aren't a ton of successful partnerships like that to point to which are clearly/obviously contributing substantially to the classic retailer's bottom line.

Should they have had more online presence? Probably.

Was the management horrible? Maybe. I have no insight into that either.

There are a lot of contributing factors to the downfall, the weights of which could be debated at length, but one thing is for absolute certain - a recipe for continued health of a company is not to buy it, pay yourself a huge bonus for it, and increase their debt to the point where the interest accounts for 97% of operating profit. That gives them absolutely no margin for error or budget to innovate (without taking on additional debt).

-

I think Amazon is from my post.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,998

- Blog5,725

- General and News1,360

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320