-

Your curve charts show the cost of servicing debt, not cost of extraction. Between 2007 and 2014 mining companies took on a lot more debt to stay in operation while resource prices were low due to global economic meltdown. They are loaded down with debt but not because their costs to extract have risen. Instead, it's due to rapidly lowering demand and built up stockpiles that depress the price. In fact, the extraction price may have actually gone down due to new technology.

In the US, coal extraction dropped 10.3% in 2015 but coal consumption dropped 13.1% and as a result US stockpiles of coal rose 20.6% to 238.8 million short tons or 3.5 months-worth of current US consumption. Employment at US coal mines dropped 12.0% during this period indicating that productivity increased during that time. At the 2015 consumption rate of 798 million short tons, the US estimated recoverable reserves (the amount that could be mined using only present technology) of 255.8 billion short tons would last 320 years.

In the US at least, coal production is at its lowest levels since 1986, but is still outstripping consumption and leading to the highest year-end stockpiles ever recorded.

http://www.eia.gov/coal/annual/ http://www.eia.gov/energyexplained/index.cfm?page=coal_reserves

-

From what I read (including your article at the top) it's demand for coal that has peaked, not supply.

Well, even simple view on debt (curve is present in charts above) and money invested is enough to understand that it is wrong view.

Coal and oil production always start from big, easy to mine areas. They are depleted now. In such situations you see both attempts to push new money via almost free debt into sector and still fall of production (due to natural limits).

You can check present Brazil on where it all leads.

-

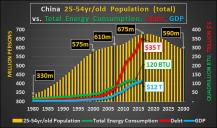

From what I read (including your article at the top) it's demand for coal that has peaked, not supply. Production has decreased in China because there was a general economic slowdown from previous over-stimulation. For example, in the previous years, Chinese firms used a lot of coal to make a lot of steel at a loss, now it's sitting waiting to be used and the steel plants are running at lower capacity. With Beijing having more and more days of unbreathable air each year, the Chinese government is under some pressure to reduce pollution. Also, China seeks to bolster their geopolitical image and they aren't going to do it on human rights, so they're working on environment. PRC has a lot of self-made problems to address in the next few years, but a lack of energy isn't one of them.

-

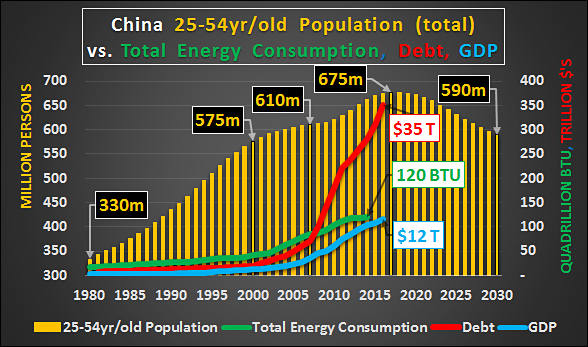

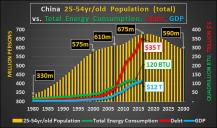

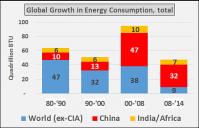

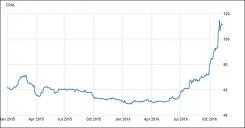

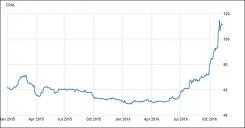

sample709.jpg588 x 347 - 73K

sample709.jpg588 x 347 - 73K

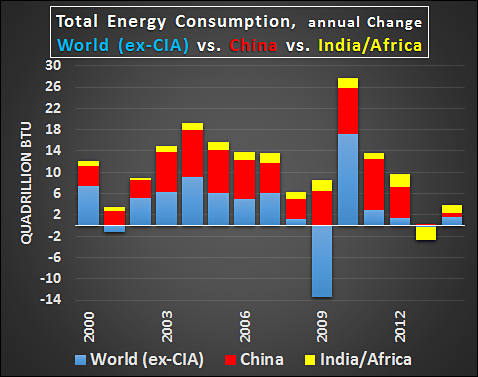

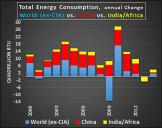

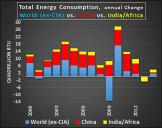

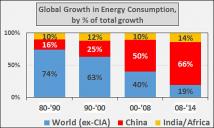

sample710.jpg478 x 377 - 39K

sample710.jpg478 x 377 - 39K

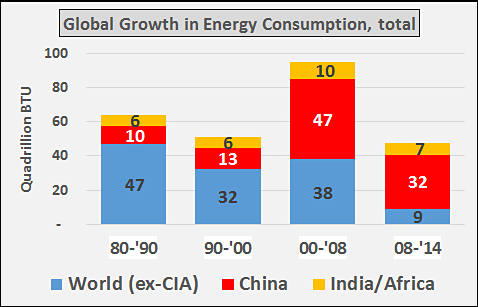

sample711.jpg478 x 307 - 31K

sample711.jpg478 x 307 - 31K

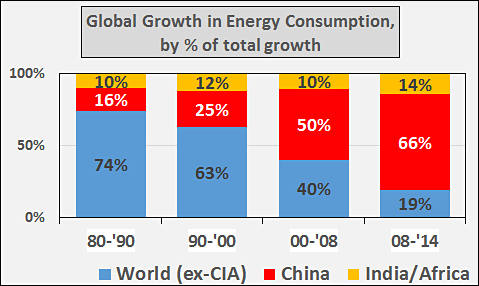

sample712.jpg479 x 286 - 34K

sample712.jpg479 x 286 - 34K -

The country's National Energy Administration is suspending 85 planned or in-progress coal power plants -- not because they're threats to the environment and public health (which they are), but because they don't fit in with China's latest Five Year Plan. It's targeting a coal capacity limit of 1,100GW, but the plants would have brought it to 1,250GW.

And now they tell us that they care for people health, they don't, just peak coal passed.

-

Oil things are not better in China

China's daily crude oil production in October fell to the lowest in more than seven years, statistics bureau data showed on Monday, as producers remain reluctant to drill new wells amid tepid oil prices and as output drops from aging wells.

Oil output last month in China, the world's second-largest crude consumer, dropped 11.3 percent from the same time a year ago to 16.05 million tonnes, the National Bureau of Statistics reported. The figure is up slightly from September's 15.98 million tonnes

-

And this is that happens if Chinese coal production starts to fall

img2890.jpg715 x 373 - 31K

img2890.jpg715 x 373 - 31K -

China important 1,557 billion tons of coal, 12.4% more comparing to one year ago.

And thing become much worse - August year to year rise is 52,1%.

All imports is caused by collapsing domestic coal production - by nine month reduction was 10,2%. And it goes with acceleration, in August it reached maximum - 11%.

China is also eating up coal deposits they had, they reduced by another 12.2%.

Winter is coming...

-

Does it mean what Chinese cheap product won't be so cheap?

Yes, and in long term it can even mean that it won't be any Chinese products for export.

-

Things are bad

China produced 263.75 million tonnes of coal in May, sliding 15.5% year on year, data from the National Bureau of Statistic (NBS) showed on June 13.

That dipped 1.6% on month, compared with the decline of 8.77% in April, data showed.

China’s raw coal output stood at 1.34 billion tonnes over January-May, dropping 8.4% from the year prior, compared with the decline of 6.8% in January-April.

Older useful topic - http://www.personal-view.com/talks/discussion/10581/energy-issues-in-china/p1

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320