It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

It seems to me that the new government of Greece is making progress in improving their financial situation... their personal, individual wealth, that is, of course, following the tradition of corruption:

http://www.tovima.gr/politics/article/?aid=688036

Google translation: https://translate.google.com/translate?hl=en&sl=el&tl=en&u=http%3A%2F%2Fwww.tovima.gr%2Fpolitics%2Farticle%2F%3Faid%3D688036

-

You can't improve much with such debt and full lack of energy and resource independence.

-

Ensure a primary surplus (revenue exceeding spending before debt costs) Default while staying in the euro Much of the world is shifting away from the EU and USA towards China. They are setting up an alternative payment clearing system to SWIFT and infrastructure bank - no reason why Greece cannot realign towards China and Russia for monetary and energy needs.

-

Ensure a primary surplus (revenue exceeding spending before debt costs)

Why all leading countries do the opposite?

Much of the world is shifting away from the EU and USA towards China. They are setting up an alternative payment clearing system to SWIFT and infrastructure bank - no reason why Greece cannot realign towards China and Russia for monetary and energy needs.

LOL

-

If they don't have a primary surplus, they have to raise debt so cannot default.

-

If they don't have a primary surplus, they have to raise debt so cannot default.

Do not get that this means in relation to question I asked.

-

Your point about 'leading countries' is irrelevant as none of them are contemplating debt default. Greece cannot default while running a deficit as it would need to raise debt to finance that deficit while repudiating earlier debt

-

To put this into perspective, Greek was literally bankrupt from day one - 170 years ago. 1842 they borrowed 20 million Franc from France, a year later they where not even able to pay the interest, let alone the debt. 1832 King Ludwig I. of Germany (Bavaria) hat to rescue Greek with three more million Gulden (Greek never payed it back of course). In a 120 year old German lexicon you can read the sentence: "The financial state of Greek is a mess and totally nontransparent. Corruption is common amongst the administration, everybody works only for their own pockets".

-

@FrankGlencairn: Yes, here's another reference from times long ago.

-

Huge cuts to the healthcare budget, amid the economic turmoil which made millions unemployed, have left than 2.5m Greeks uninsured, up from 500,000 in 2008.. Healthcare spending has fallen by 25 per cent since 2009, creating shortages of the most basic surgical equipment and leaving too little money to pay nurses' salaries.

Reports have surfaced of patients being turned away from hospital because there was no meter to measure their high blood pressure, while others have had to do without painkillers during medical procedures. One patient was even asked to bring their own sheets to hospital.

A trainee surgeon at KAT, a respected state hospital in Athens, said the situation was at “breaking point”.

“There is no money to repair medical equipment, no money for ambulances to use for petrol, no money to hire nurses and no money to buy modern surgical supplies."

Progress.

-

It seems that times up.

Monday starts bank holidays and big EU turmoil.

-

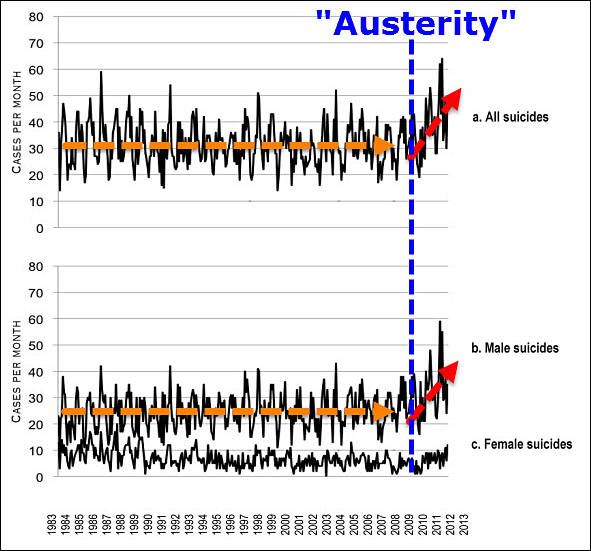

Like many, I am dumbfounded why Greece is being asked to adopt austerity measures which have been proven time and time again to be failed policies. Nobel prize winning economist Krugman laid all this out years ago, no one can claim that they don't know that the policies will fail. Therefore, there must be a reason why the EU is pushing failed policy, it could be currency speculation, it could be any number of things. In America, the most likely reason for such a scenario of failed policy is that one company will leverage another to ransack the pension, which is the largest stealable cash pile in a company. The situation in Greece could be a sort of leveraged buyout on a gigantic, nationwide level.

Greece has a permanent tourist endowment. No matter what Greece does, there is an enormous influx of hard cash that just rolls in, just like sitting on an oil well, and this money must be spent wisely. The EU needs a real plan that is not based on fraudulent "austerity voodoo economics." So far, they have not shown any interest in a real plan.

Here's a good summary: http://www.businessinsider.com/krugman-europe-greece-2015-6

"For the past seven years, Krugman argues, the financial noose Europe has placed around Greece's neck has strangled the Greek economy. Each time Europe has loaned Greece money, it has demanded spending cuts in return. And these spending cuts — austerity — have further damaged the Greek economy.

In the past, every time the situation has come to a head, Greece has caved. And, in the process, it has transformed itself into little more than a financial slave state mired in an economic depression.

There is no way Greece will ever be able to cut its way to prosperity, Krugman argues. And history suggests that any argument to the contrary is crazy."

-

Like many, I am dumbfounded why Greece is being asked to adopt austerity measures which have been proven time and time again to be failed policies.

Because you read or watch too much mass media.

All proposals did not failed, but had been fully successful. They just had another goal. Each and every of them added more debt and reduced manufacturing and energy/resources consumption.

-

It seems that people said no to EU

-

They said no to this question:

"Should the proposal that was submitted by the European Commission, the European Central Bank and the International Monetary Fund at the Eurogroup of 25 June, 2015, and is comprised of two parts, which make up their joint proposal, be accepted? The first document is titled 'Reforms for the Completion of the Current Program and Beyond' and the second 'Preliminary Debt Sustainability Analysis." Voters are given the choice between "yes" and "no," in which "no" is the first option. pfd/sms (AP, Reuters, AFP)

-

It really doesn't matter that much whether Greece leaves the Euro or says "no" to whatever deal the other EU countries offer.

What matters is that Greece is not only bankrupt in the sense of "has more debt than they can pay interest for", they are bankrupt as in "Greece has a permanent, high demand of imports, and nothing worth enough to trade in for it". Regardless of their currency or EU membership, they simply do not produce enough goods or services to sustain their lifestyle of the last decades.

Greece will learn the hard way that when there's no more constant inflow of money from other countries (lended, gifted, whatever), most of their population will have to live a much simpler life.

If Tsipras thinks that other EU countries will be inclined to continue to fill his pockets after he called them "Terrorists" and what not, he's delusional. He and his party are continuing the horrible system or patronage and corruption that has ruined Greece also under its previous governments. If you think that Syriza is acting for the better of the "poor people", just have a look at this news of today on a tax amnesty for rich Greeks who evacuated their money to Swiss bank accounts to evade taxes.

-

@FrankGlencairn , seems that the books you read are full of propaganda, but here's an other side of the story: as Greece is a small, very small country, but full of valuable for the "helpers" stuff, they used to lent a 100, but the 90 was always kept by the "helpers"... Some as "taxes & fees", but also part of the agreement was always that from the 100 we give you, you'll have to spend the 50-80 to buy stuff from us, like guns, etc... Then, they also took (actually stole) valuable things like ancient treasures, like the ones they have in their museums, like, in Louvre (Paris, France), or in England, Germany, USA, etc. All this situation at least since 1821 and later. And from all these ancient treasures, they earn billions every year, by having them in their museums, where people from every corner on this planet goes seeing them, by paying admission of course... The value of those treasures though, can't really even counted in money. Greece, since ~300BC, is always under other empires: Romans, Ottoman and other in the long past (since a bit after 1820), but right after 1820, is always "occupied" by the Germans, the English, the French, etc. I hope that you, or anybody else, don't really need lessons of how capitalism works and how they "eat" entire countries, their sources and their people, in the name of profit, in the name of money. If anyone may believe the opposite, he's simply victim by a propaganda and a "history", that is written by the ones who rule this planet. This can also be called: Manipulation.

-

90% of greece debt is bankster bailout money.

Please post link to proof,

-

http://www.eurodad.org/files/pdf/54bfcb0f01b0b.pdf

http://america.aljazeera.com/articles/2015/7/1/greek-bailout-money-went-to-banks-not-greece.html

In a nutshell ( I thought most researchers knew this already ! ) the bankster bailouts to the imf are to bailout failed eurozone banks who made high risk loans ....again. It's the same old story. Banksters want to take the risks to get high interest paybacks, but when it goes south , they want pensioners to cover their asses. That's what the imf is all about.

david stockman sums up -

indeed, the purpose of the massive EU, ECB and IMF loans to Greece was just plain ignoble and corrupt. The European superstate deployed its vast fiscal and monetary powers to make whole the German, French, and Italian banks and other financial institutions which had gorged on Greece’s sovereign debt. For more than a decade, heedless gamblers and lazy money managers and bankers had loaded up on Greek debt bearing yields that superficially bore a premium relative to the German and US treasury benchmarks, but in fact did not remotely compensate for the self-evident credit risk embedded in Greece’s budgetary profligacy.

http://jubileedebt.org.uk/press-release/least-90-greek-bailout-paid-reckless-lenders

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320