It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

https://investorplace.com/2017/12/gpro-stock-undervalued-territory/#.WjArLkqnGUk

"My research suggests that GoPro is not having a good holiday season. Consequently, I don’t think fourth quarter numbers will be that good. Considering more than a third of this year’s revenues are expected to be generated in the fourth quarter, bad Q4 numbers could send the stock to new lows."

"GoPro’s Bad Holiday 2017 It doesn’t look like GoPro cameras and drones are selling that well this holiday season. While GoPro cameras are the best-selling action camcorders at Best Buy Co Inc (NYSE:BBY), it looks like this whole action camera space is shrinking.

Just look at search interest trends for GoPro’s cameras over time. Each new product launches to less fanfare than prior products. The Hero4 had higher search interest than the Hero5, which had higher search interest than the Hero6. This is a bearish trend that only accelerated this year, implying GoPro action cameras aren’t a popular gift item this year."

Here in Norway the biggest consumer electronics retailers have started a price dump on the Hero6 which is now rebated by more than 100 euro.

-

The Yi 4k+ costs around half the price (with about 95% of the features) of the Hero 6 and is not plagued by random lockups/video corruption - and modern phones have decent 4k video and are waterproof. The Karma drone costs close to the same as the Mavic and is generally seen as being inferior... it's not surprising that GoPro are having some trouble.

-

The Yi is quite amazing. I am not surprised by this turn of events for GoPro. Their NAB booth was a lot smaller. They never have been the best bang for the buck.

-

Of course there are several factors: action cam market might be shrinking, competition is growing etc. But the 50% price increase of the Hero6 compared to the Hero5 here in Europe is probably not helping. But apparently this premium pricing is GoPros move into profitability. Or so they belived. All this by switching SOC from Ambarella to an custom design by Socionext. Which is rumored to be cheaper. Never mind the endless complaints about more noise and other issues which seems to prevail even with the latest 1.60 firmware update.

-

https://techcrunch.com/2018/01/04/gopro-cuts-200-300-jobs-largely-impacting-its-drone-division/

"GoPro is in the process of laying off around 200-300 employees this week, TechCrunch has learned from sources close to the company. The hits to the company were largely concentrated in its aerial division, the segment of the company responsible for its Karma drone.

In a letter to impacted employees GoPro explained these cuts are part of a larger restructuring “to better align our resources with business requirements”.

TechCrunch has been informed by sources that the company relieved impacted employees of duties today but will keep them on the payroll until February 16, likely planning to hold this news for after CES and perhaps tie it to an upcoming earnings report as in past instances."

Is this the end of the GoPro Karma drone?

-

Permanent 100 USD price drop on the Hero6 today. Now 400 USD.

I looks like an disaster in the making. Cash flow is probably catastrophic for the company.

https://gopro.com/news/gopro-hero6-is-now-399-99

If you add up the 300 person layoffs and recent price cuts on the hardware the total is not nice for the strugling company.

-

https://techcrunch.com/2018/01/08/gopro-confirms-layoffs-exit-from-drone-business/

"GoPro today released preliminary fourth quarter 2017 results which paints the company in struggling situation. The company says it plans to reduce its headcount in 2018 from 1,254 employees to fewer than 1,000. It also plans to exit the drone market and reduce CEO 2018 compensation to $1."

“As we noted in our November earnings call, at the start of the holiday quarter we saw soft demand for our HERO5 Black camera,” said GoPro founder and CEO Nicholas Woodman in a released statement. “Despite significant marketing support, we found consumers were reluctant to purchase HERO5 Black at the same price it launched at one year earlier. Our December 10 holiday price reduction provided a sharp increase in sell-through.”

"GoPro says in today’s announcement that it expects its fourth quarter revenue to be $340 million, a roughly 37% decline over 2016 levels. The company says a the revenue includes negative impact of approximately $80 million for price protection for its Hero, Session and Karma products."

-

AN MATEO, Calif., Jan. 8, 2018 /PRNewswire/ – GoPro, Inc. (NASDAQ: GPRO) today reported certain preliminary financial results for the fourth quarter ended December 31, 2017. GoProexpects revenue to be approximately $340 million for the fourth quarter of 2017. Fourth quarter revenue includes a negative impact of approximately $80 million for price protection on HERO6 Black, HERO5 Black and HERO5 Session cameras, as well as the Karma drone.

GoPro expects GAAP gross margin for the fourth quarter of 2017 to be between 24% and 26%. Non-GAAP gross margin for the fourth quarter of 2017 is expected to be between 25% and 27%. Non-GAAP gross margin for the same period, excluding the price protection impact of $80 million and other charges of between $19 million and $21 million, is expected to be between 44% and 46%. GoPro expects GAAP operating expenses to be between $136 million and $140 million for the fourth quarter of 2017 and non-GAAP operating expenses to be between $118 million and $122 million for the same period.

GoPro ended the fourth quarter with cash and cash equivalents of $247 million, up $50 million over the third quarter of 2017.

"As we noted in our November earnings call, at the start of the holiday quarter we saw soft demand for our HERO5 Black camera," said GoPro founder and CEO Nicholas Woodman. "Despite significant marketing support, we found consumers were reluctant to purchase HERO5 Black at the same price it launched at one year earlier. Our December 10 holiday price reduction provided a sharp increase in sell-through."

Globally, HERO5 Black sell-through more than doubled in the two weeks following the December 10 price reduction, while HERO5 Session sell-through roughly tripled.

Sales of the newly introduced flagship HERO6 Black camera performed as expected during the fourth quarter. On January 7, GoPro lowered the price of its premium model, HERO6 Black from $499 to $399 to align with its good, better, best product strategy.

Initial uptake of GoPro's newly launched spherical camera, Fusion, was better than expected during the quarter.

"GoPro is committed to turning our business around in 2018," said Nicholas Woodman. "We entered the new year with strong sell-through and are excited with our hardware and software roadmap. We expect that going forward, our roadmap coupled with a lower operating expense model will enable GoPro to return to profitability and growth in the second half of 2018."

2018 Products and Operating Expenses

In 2018, GoPro will continue to innovate with several new products aimed at new and existing customers. GoPro's sharper focus will enable an $80 million reduction in operating expenses compared to 2017 levels, resulting in a target operating expense level of below $400 million for 2018 on a non-GAAP basis.

The lower non-GAAP operating expense target will be achieved through a variety of strategies, including:

- GoPro is reducing its global workforce from 1,254 employees as of September 30, 2017 to fewer than 1,000 employees worldwide.

- GoPro founder and CEO Nicholas Woodman will reduce his 2018 cash compensation to $1.

- Although Karma reached the #2 market position in its price band in 2017, the product faces margin challenges in an extremely competitive aerial market. Furthermore, a hostile regulatory environment in Europe and the United States will likely reduce the total addressable market in the years ahead. These factors make the aerial market untenable and GoPro will exit the market after selling its remaining Karma inventory. GoPro will continue to provide service and support to Karma customers.

- A restructuring of GoPro's business will result in an estimated aggregate charge of $23 million to $33 million, including approximately $13 million to $18 million of cash expenditures as a result of a reduction in force, substantially all of which are severance and related costs, as well as approximately $10 million to $15 million of other charges, consisting primarily of non-cash items. GoPro expects to recognize most of the restructuring charges in the first quarter of 2018. GoPro will provide more detail on its 2017 results and 2018 outlook in its fourth quarter earnings report which will take place in early February.

-

https://techcrunch.com/2018/01/08/where-gopro-goes-next/

"My call? GoPro is bought by DJI or Samsung this year, runs for a brief moment as a standalone product, and then is folded into the company proper. It’s a respectful end to a wonderful product whose golden days are past."

-

GoPro (NASDAQ:GPRO) announces that COO Charles Prober will leave the company effective February 16.

SVP and General Counsel Sharon Zezima resigned from the company effective March 30.

-

Just in:

https://www.cnbc.com/2018/01/08/gopro-has-hired-jp-morgan-to-put-itself-up-for-sale.html

"GoPro (GPRO -10.9%), one of today's top losers after slashing its Q4 revenue forcast, heavily discounting its Hero6 cameras and planning layoffs, is trimming losses after CNBC reports the company has hired JPMorgan to put itself up for sale."

-

GoPro, Inc. (NASDAQ: GPRO) is building on the success of its Plus subscription service with the introduction of new benefits that deliver significant value to GoPro customers at no additional cost.

Today, the company announced details of the expanded Plus monthly service:

- Camera replacement -- If you break your GoPro we'll replace it, no questions asked

- Mobile cloud backup -- The GoPro App now automatically backs up your photos and videos, eliminating the need to connect to a computer or buy new SD cards

- Unlimited photo storage

- 35 hours of video storage

- 20% off accessories at gopro.com

- Front-of-the-line priority phone and chat support

Mobile cloud backup will be available on iOS February 20 and on Android in the spring.

"Plus streamlines the GoPro experience and delivers outsized value for our customers," said GoPro Founder and CEO Nicholas Woodman. "Our subscription business, Plus, has proven popular with consumers and the roll out of our enhanced service marks the first of several subscription initiatives we will introduce this year."

The new GoPro Plus is now available in the US for $4.99 a month with a 30-day free trial and will expand to global markets later this year. Visit The Inside Line for more details on all the benefits of becoming a subscriber and the GoPro Plus page to sign up.

-

GoPro dominates the US with 80 percent of the market by unit volume and 44 percent of Europe. It saw its business grow in China by 28 percent in 2017 and posted a 96 percent year-over-year growth in Japan.

GoPro posted net loss for 2017 of approximately $183 million, or $1.32 per share, down from a net loss in 2016 of $419 million.

sa1608.jpg730 x 523 - 59K

sa1608.jpg730 x 523 - 59K -

Don't belive the Woodman hype! The sales are BAD and price seems to be the only marketing slogan. The best GoPro ever. At the cheapest price ever. If Apple resorted to this tactics you would though that the company was gooing down.

Is there any reason to belive that Q4 2018 will be a better quarter than Q4 in 2017 or 2016 for GoPro?

33427965-15176750991415715.png640 x 346 - 163K

33427965-15176750991415715.png640 x 346 - 163K -

NEW YORK and SAN DIEGO, Feb. 07, 2018 (GLOBE NEWSWIRE) -- Wolf Haldenstein Adler Freeman & Herz LLP reminds all investors that a class action has been has been filed against GoPro, Inc. (“GoPro” or the “Company”) (NASDAQ:GPRO) in the United States District Court for the Northern District of California on behalf of a class consisting of investors who purchased or otherwise acquired the securities of GoPro between August 4, 2017 and January 5, 2018, both dates inclusive (the “Class Period”).

Investors who have incurred losses in GoPro, Inc. are urged to contact the firm immediately at classmember@whafh.com or (800) 575-0735 or (212) 545-4774. You may obtain additional information concerning the action on our website, www.whafh.com.

If you have incurred losses in the shares of GoPro, Inc. and would like to assist with the litigation process as a lead plaintiff, you may, no later than March 12, 2018, request that the Court appoint you lead plaintiff of the proposed class. Please contact Wolf Haldenstein to learn more about your rights as an investor in GoPro, Inc.

The filed Complaint alleges that throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operational and compliance policies. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that:

demand for the GoPro brand had dramatically declined and retailers were not stocking up for 2017 holiday sales to the extent GoPro had budgeted for;

demand for GoPro’s Karma drones was sufficiently weak that the Company could no longer afford to manufacture and sell them profitably;

the Company would be forced to dramatically slash prices on its newly launched HERO6 Black and its dated HERO5 Black and HERO5 Session cameras, as well as its Karma drone, during the quarter and would need to further slash HERO6 prices in January 2018; and

as a result of the foregoing, GoPro was not on track to achieve the financial results it had led the market to believe it was on track to achieve during the Class Period. On Monday, January 8, 2018, prior to the commencement of trading, GoPro issued a press release filed on Form 8-K with the Securities and Exchange Commission (SEC) entitled “GoPro Announces Preliminary Fourth Quarter 2017 Results,” revealing that its fourth quarter 2017 sales were $340 million, significantly below analysts’ projections of over $470 million. GoPro blamed the results on the slashing of prices for its HERO6 Black, HERO5 Black, and HERO5 Session cameras, as well as its Karma drone, during the quarter, which the Company had been forced to engage in to move inventory and which had a negative $80 million impact on revenues.

GoPro also disclosed it was cutting more than one-fifth of its workforce and exiting the drone market altogether, requiring it to liquidate the rest of its Karma drone inventory. GoPro had cut the price for its HERO5 Black camera in December 2017 and announced it was now reducing the price of its newly launched HERO6 model to $399 from $499. The workforce reduction would cost GoPro $33 million, mainly in severance costs.

Following this news, GoPro’s stock price declined, falling over 12%, to close at $6.56 per share, a market capitalization loss of over $100 million.

Wolf Haldenstein Adler Freeman & Herz LLP has extensive experience in the prosecution of securities class actions and derivative litigation in state and federal trial and appellate courts across the country. The firm has attorneys in various practice areas; and offices in New York, Chicago and San Diego. The reputation and expertise of this firm in shareholder and other class litigation has been repeatedly recognized by the courts, which have appointed it to major positions in complex securities multi-district and consolidated litigation.

If you wish to discuss this action or have any questions regarding your rights and interests in this case, please immediately contact Wolf Haldenstein by telephone at (800) 575-0735, via e-mail at classmember@whafh.com, or visit our website at www.whafh.com.

-

Their new trade-in stuff

-

I jost don't get it. I bought my Hero 6 new for 329.- Euros. I love it. It has canon like skin tones and a image quality far superior to any other action cam i had in my hands. Sonys are great too, but have zombie skin tones. A good color grader could correct these, but straight out of the box the hero 6 has simply the best image. I also liked the Yi 4k+, but slomo and stabilization looks better on the gopros. The price difference is just 50 Euros and totally worth it. I don't understand, why they struggle that hard. The fusion is great too.

-

I think main competition is not Yi 4k+, but cheaper Chinese cameras, including made by Yi.

-

I got curious about the trade-in program since a Hero 6 for $350 might actually be worthwhile. I nearly killed a Yi 4k+ which was clamped to the front of my car as I drove through mud on a rainy day. I can put the Yi in its waterproof case, but that means no gimbal I bought a refurbed session 5 since it's waterproof, but the footage looks pretty shaky, even on a gimbal. I was thinking I'd go find a cheap toy digital camera at a thrift store for the trade-in program, but then I saw this footnote... guess I'll keep my eyes peeled for an old Powershot or similar.

Any GoPro or digital camera with an original retail value of at least $99.99 USD is eligible for trade-in.

-

PR

SAN MATEO, Calif., April 18, 2018 – GoPro, Inc. today announced the launch of its camera Trade-Up program, offering users in the United States the ability to trade up from any previous-generation GoPro, or any other digital camera, to experience its latest and greatest products. Starting today, anyone in the U.S. can receive $50 off a new HERO6 Black or $100 off Fusion by participating in the program at GoPro.com.

GoPro first introduced its Trade-Up program for a limited time in 2017, which only accepted previous-generation GoPro models in exchange for a discounted upgrade to a current model. Nearly 12,000 customers participated in the 60-day promotion. The new and improved Trade-Up program brings back the initiative with major enhancements, including the acceptance of any digital camera and making it an everyday offer.

The Trade-Up program is a great way for our fans and customers to upgrade to our newest products and experience how fun and convenient GoPro has become," said Meghan Laffey, senior vice president of product at GoPro.

To participate in GoPro's Trade-Up Program, customers should visit the Trade-Up website, select the new camera of their choice, and follow the instructions to return their old GoPro or digital camera. Upon receiving the returned camera, GoPro will process the discounted order and ship the new HERO6 Black or Fusion to the customer. Returned cameras will be recycled responsibly via zero landfill and recycling methods appropriate to material type.

To learn more about GoPro's Trade-Up Program, visit https://shop.gopro.com/tradeup .

-

New financial report

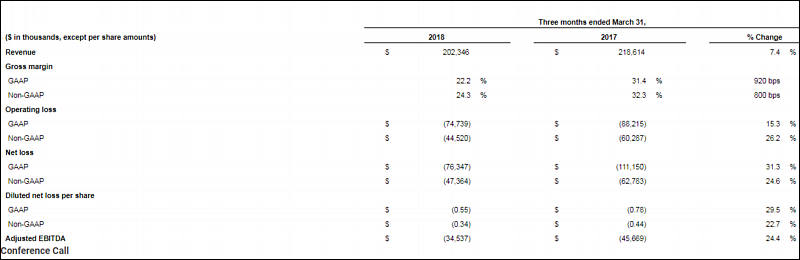

SAN MATEO, Calif., May 3, 2018 /PRNewswire/ -- GoPro, Inc. (NASDAQ: GPRO) announced financial results for its first quarter ended March 31, 2018.

"Our first quarter was driven by strong sell-through of HERO5 Black and HERO6 Black, along with the launch of our new $199 entry-level HERO. Initial demand for HERO is promising and we expect it to improve as large retail partners like Target and Walmart begin selling the product in the second quarter," said Nicholas Woodman, GoPro CEO and founder. "Our first quarter performance makes it clear that there is significant demand for GoPro, at the right price. We began to step up marketing programs in March which, coupled with overall expense controls, solid channel management and second half new product launches, gives us confidence for a successful 2018 for GoPro."

Highlights

- Revenue was $202 million, down 7% YoY, while unit growth was up 3% YoY. GoPro reduced GAAP operating expenses by $37 million, or 24%, year-over-year. GoPro reduced non-GAAP operating expenses by $37 million, or 28% year-over-year. In 2018, GoPro is targeting non-GAAP operating expenses below $400 million --- a cumulative reduction of more than $300 million since 2016.

- In the U.S., GoPro held 86% and 95% of the action camera category by unit and dollar volume, respectively, in Q1 2018 according to NPD.

- GoPro is the #1 selling camera in the overall digital imaging category for the 17^th^ straight quarter in North America.

- In Europe, GoPro held 44% and 72% of the action camera category by unit and dollar volume, respectively, in Q1 2018, according to GfK.

- In APAC, GoPro market share of the action camera category increased in unit and dollar volume from 45% to 52% and from 63% to 65% quarter-over-quarter, respectively, according to GfK.

- In Korea and Japan, unit sell-through grew by 46% and 22% respectively year-over-year, according to GfK.

- Fusion captured 41% of the spherical camera market on a dollar basis, according to NPD. Fusion also won gold at the 2018 Edison Awards.

- $199 entry-level HERO launched on March 29. Distribution will expand to Target, Walmart and others in Q2.

- 'Plus' subscription service has 147,000 active paying subscribers, up 17% since December 31^st^.

- Eve Saltman was appointed General Counsel and Vice President, Corporate/Business Development.

- GoPro content was viewed 148 million times on social media, up more than 8% year-over-year. GoPro's YouTube channel increased 4% in organic viewership year-over-year with 76 million views in Q1.

- On Instagram, GoPro added 245K new followers in Q1, reaching a total of 15 million. GoPro gained more than half a million new social media followers in Q1, growing its total following to 36 million across all platforms.

- Shorty Awards. GoPro won "Best Overall Brand on Instagram" at the coveted 2018 Shorty Awards.

- Instagram Stories Integration announced on May 1 at Facebook's F8 conference. GoPro and Instagram partnered to enable GoPro users to share their content directly from the GoPro App to Instagram Stories.

sa3093.jpg800 x 260 - 26K

sa3093.jpg800 x 260 - 26K -

New results

- Revenue for Q2 2018 was $283 million, down 5% year-over-year

- Q2 2018 GAAP net loss of $37 million

- Inventory decreased by $47 million from Q1 2018, GoPro's lowest level since Q2 2014

- In the US, GoPro held 97% dollar share of the action camera category.

- In the US, Fusion captured 48% dollar share of the spherical camera market

-

New stuff, positive

- Q4 is $528 million, up 40 percent YoY

- Profit of $102 million for October-December 2019 period, second most profitable quarter

- GoPro got 97 percent of every US dollar spent on action cameras and 87 percent of units sold in Q4

-

Summary

Not much of a surprise, GoPro delivered pitiful holiday quarter results that disappointed investors.

The camera company had its worst second half of units shipped since 2016 at least, although margins have been slowly improving.

GoPro (GPRO) has done it again. On February 6, the camera company delivered pitiful results that disappointed investors. The stock price dropped about 9% in post-earnings action, inching closer to all-time lows.

There was nothing about the headline numbers that looked encouraging. Revenues and earnings missed consensus expectations by a mile - the most since 2017, in fact. To make matters worse, the management team guided 2020 revenues at flat, missing even the low end of analysts' estimates, and warned of a rocky start to 2020.

First, in what pertains to GoPro's financial results, 4Q19 was a highly atypical quarter. The Hero8 Black had production delays around the model's launch date, in October 2019, which caused a large shift of revenues from the third to the fourth quarters. Despite the favorable timing, fourth period sales still failed to reach 2016 holiday quarter levels.

Only a couple of months ago, GoPro seemed satisfied with the success of its Black Friday and Cyber Monday efforts, the result of a Hero8 Black device that "sold at record levels". But it looks like top-line momentum fizzled out fast through the remaining of the holiday season. By the end of December, full quarter sales had failed to reach even the low end of management's guidance offered a mere three months earlier, and a bloated channel inventory meant that 1Q20 results were also shaping up to be disappointing.

All accounted for, GoPro had its worst second half in units shipped of the past four years at least (see graph above on the left). Even worse, management has guided camera unit sales to drop by 8% in 2020 at the mid-point of the range, suggesting that a sustainable return to top-line growth is still at least four quarters away.

-

The Instas could drastically take a larger portion of the market this year. I still love my GoPros, but I'm thinking about trying out the Insta 1R. That is Go Pros biggest issue, the reviews of the 360 cams has been lackluster.

-

GoPro, Inc. (NASDAQ: GPRO) today announced a strategic re-alignment to become a more efficient and profitable direct-to-consumer-centric business. Actions include a $100 million reduction to 2020 operating expenses including a workforce reduction of more than 20%, and plans to further reduce non-headcount related operating expenses to $250 million in 2021.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List24,063

- Blog5,725

- General and News1,387

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,390

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras138

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,335