-

Bitmain, one of the largest manufacturers of special purpose integrated circuits (ASICs) for mining and a supplier of products such as Antminer, has confirmed that Taiwan Semiconductor Manufacturing Co. (TSMC) has notified customers of a price increase for the production of chips.

"On August 25, TSMC announced to all its customers that it is raising the price by 20% for all technological processes," Bitmain said in a statement.

TSMC needs lot of money.

-

Samsung still faces hurdles in 3nm GAA process development, they have several technology issues, such as leakage and other crucial issues, in the development of 3nm gate-all-around (GAA) process technology, according to industry sources. Samsung's 3nm GAA process could also be less competitive than TSMC's 3nm FinFET technology in terms of performance and costs

-

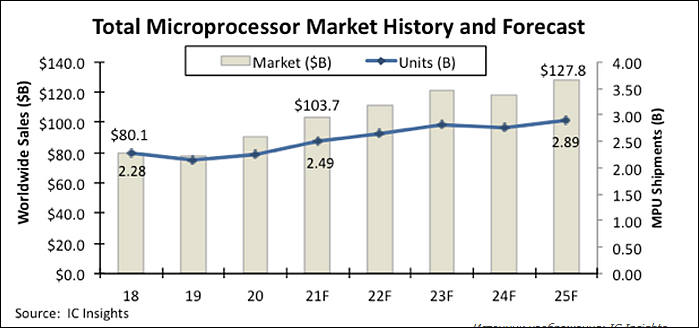

According to the latest report from analysts IC Insights, sales of microprocessors (MPU) amid increased demand for CPUs and SoCs this year will set a record and exceed the figure of $ 100 billion. Experts predict that shipments of these chips this year will reach 2.49 for the first time. billion units. Consumer and server processors account for 46.7% of all microprocessor sales.

sa18082.jpg699 x 328 - 38K

sa18082.jpg699 x 328 - 38K -

TSMC has confirmed that the mass production of chips using the 3nm process technology will not begin until 2023. This will affect customer product lines. In particular, the iPhone 2022 will be released with 4nm processors.

As reported by Nikkei Asia, citing its own sources, the first customers for 3-nm solutions from TSMC will be jointly Apple and Intel.

TSMC marketing machine also started to make issues.

-

Samsung and Key Foundry are set to raise prices for contract manufacturing of semiconductor chips in the second half of this year, South Korean newspaper TheElec reported. Both companies have already notified their clients that they are going to increase the cost of their services by 15-20%.

Issues are severe.

-

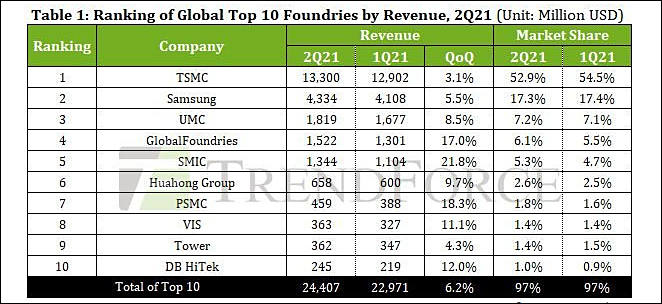

Monopolization is severe and became worse.

sa18137.jpg662 x 304 - 59K

sa18137.jpg662 x 304 - 59K -

The quarterly report of Broadcom, as noted by Bloomberg, revealed a rather modest increase in the company's revenue against the background of competitors. In annual comparison, it grew by only 16%, to $ 6.78 billion, although Qualcomm increased its revenue by 63%, and NVIDIA - by all 68%. Broadcom CEO Hock Tan was forced to admit that the company is carefully filtering the volume of shipped products and their recipients, so as not to leave them without goods in the future.

We see real criminal scam here.

-

Samsung Electronics has not stayed away from this trend, and therefore over the past 12 months has invested approximately $ 238 million in the capital of small South Korean suppliers of materials and equipment to reduce dependence on imports.

Of the nine companies that Samsung has invested in, eight are public and the ninth is considered a division of another public company. In most cases, Samsung became a shareholder in these companies through the issue of new shares, the share of the Korean conglomerate in their capital does not exceed 10%. Directly the companies that received funds from Samsung intend to direct them to development and research.

Examples of activities that Samsung is interested in include the production of industrial gases used in lithography, as well as the production of protective coatings for photo masks or chemicals for etching silicon wafers.

The South Korean authorities are also ready to support domestic producers, the budget for next year provides for an increase in targeted subsidies by 9%

All of them need money, free money.

-

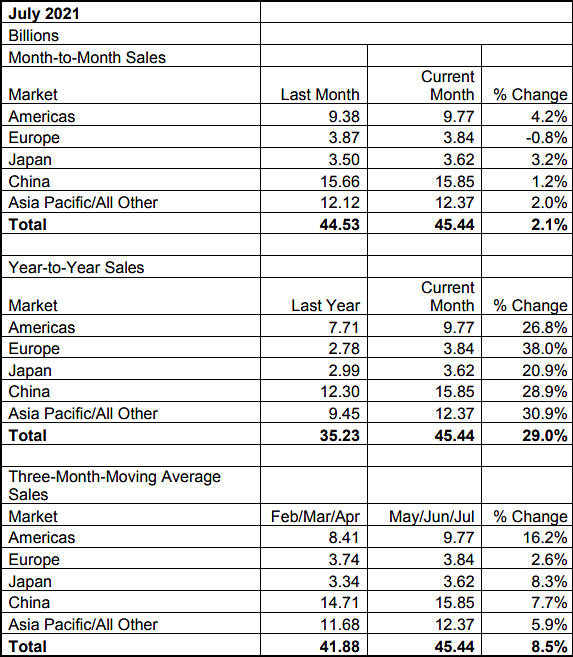

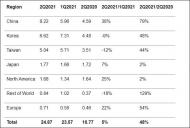

Huge inflation on semiconductors market got out of control

sa18177.jpg573 x 657 - 109K

sa18177.jpg573 x 657 - 109K -

Analysis of Qualcomm's quarterly reports showed that in the period from October last year to June, the company's current production costs increased by 60%, for MediaTek the increase was 64%. The revenues of both companies in this interval grew stronger, and only this allowed them to maintain acceptable business profitability.

-

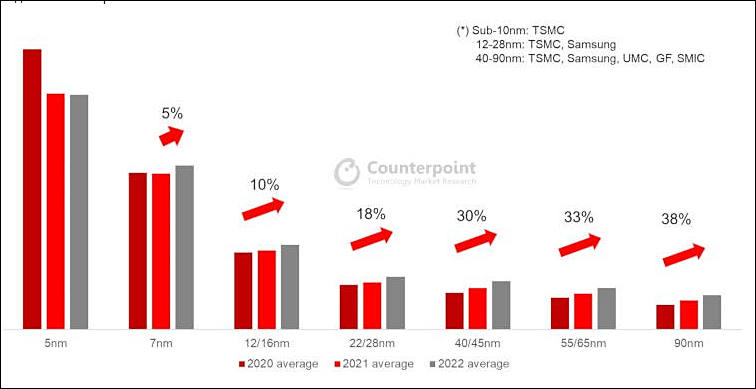

TSMC price hike - some are more equal than others

A number of resources note that for the largest customers of TSMC, the increase in prices will not be so significant. As the Taiwanese resource TechNews reports with reference to the information of the industry analyst Lu Xingzhi, Apple, being the largest customer of TSMC for the most advanced production processes, received special conditions - an increase in the cost of production by only 3%. Specific information about the conditions for other customers is not given, allegedly even AMD will face an increase of 10 ... 20%. However, the Liberty Times reported that the price increase for AMD will be 5%.

Monopolies.

-

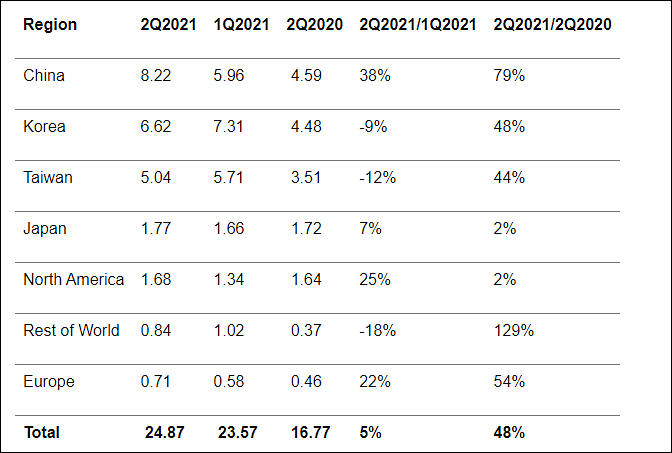

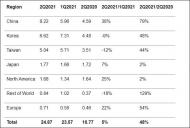

According to the SEMI association, which unites more than 2,400 companies involved in the development and production of semiconductor products, the cost of chip manufacturers for the purchase of equipment in the second quarter increased by 5%, and in annual comparison, the increase was an impressive 48%. If a year ago $ 16.77 billion was spent on these needs, then in the second quarter of this year, costs increased by 48% to $ 24.9 billion.

sa18214.jpg672 x 453 - 55K

sa18214.jpg672 x 453 - 55K -

Prices inflation

sa18233.jpg756 x 389 - 36K

sa18233.jpg756 x 389 - 36K

sa18234.jpg747 x 461 - 58K

sa18234.jpg747 x 461 - 58K -

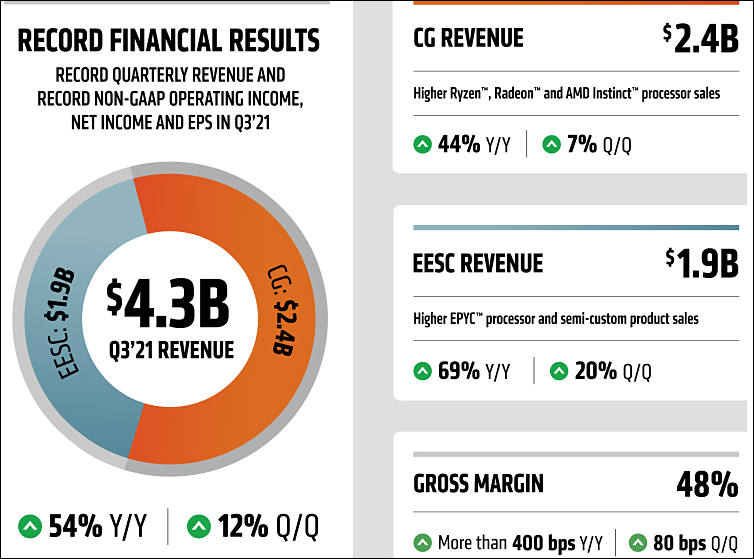

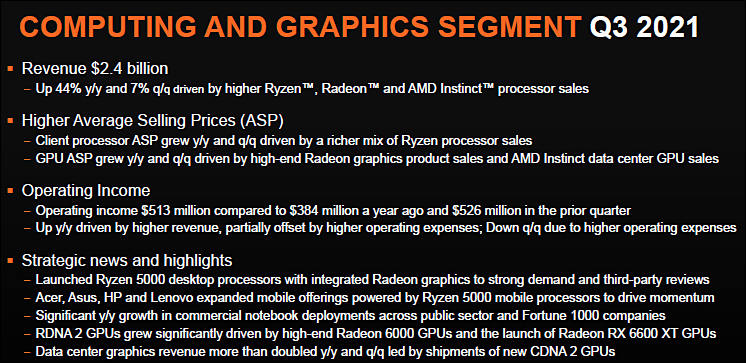

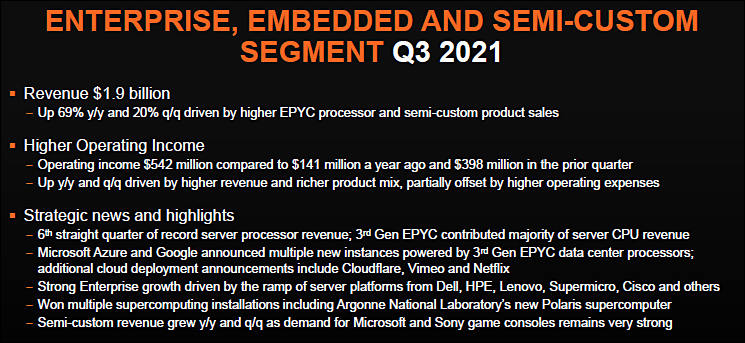

AMD progress in ripping clients

Devinder Kumar took part in the Deutsche Bank technology conference, expressing confidence that the phased increase in the forecast for revenue growth this year from 37% to 60% is adequate to the capabilities of contractors producing brand products for AMD. Not confident in TSMC's ability to increase production volumes, AMD would not improve its forecast for revenue growth this year, as a company spokesman explained.

In fact, AMD is confident in its suppliers, and expects the trend of revenue growth to continue not only in 2022, but also in 2023.

-

TSMC is forecast to see its revenue in the second half of this year grow 14% from the level in the first half, with revenue for all of 2021 set to represent a 24% on-year surge, according to IC Insights.

IC Insights released recently its compilation of third-quarter sales growth expectations for the top-25 semiconductor suppliers. For the third quarter of this year (ending in September), sales growth outlooks for the top-25 suppliers range from 16th-ranked Sony's 34% increase at the high end, to Intel's 3% decline on the low end.

-

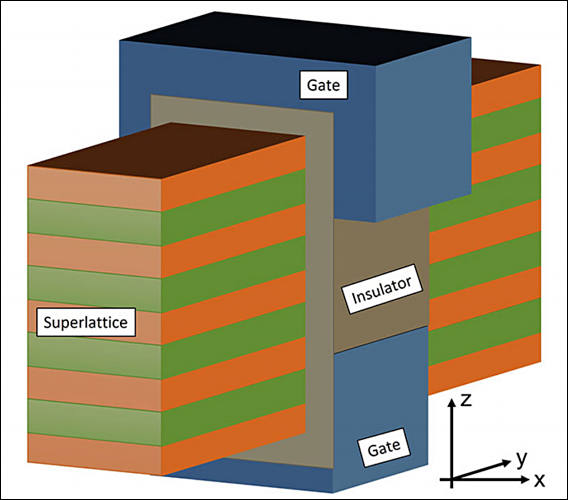

Scientists from the United States have proposed a technology for creating transistors with potentially better characteristics than current solutions. This can provide increased processor performance even in the "end of process" era. The idea of such a transistor was picked up by quantum cascade lasers.

In 1971, in the journal "Physics and Technology of Semiconductors", Soviet physicists Kazarinov and Suris in their article "Possibilities of amplifying electromagnetic waves in semiconductors with a superlattice" put forward the idea that when an electron flow passes through a heterogeneous structure, electromagnetic waves are amplified, which will make it possible to generate laser radiation from low energy consumption. In such a “puff pastry”, the signal is amplified without the manifestation of tunneling effects, which is easier to control.

A group of scientists from Purdue University in Indiana suggested that the amplifying principle of electron transport through the superlattice would also work for transistors if the superlattice - a "zebra" of alternating semiconductor materials - was placed in the path of the flow of electrons from one gate to another. This is how the concept of the CasFET cascade field effect transistor was born.

Theoretically, the CasFET transistor will operate with extremely low state switching currents, which will significantly increase the energy efficiency of the device.

sa18342.jpg568 x 500 - 36K

sa18342.jpg568 x 500 - 36K -

Taiwan-based TSMC managed to beat analysts' expectations by increasing its quarterly revenue to $ 14.88 billion, up 22.6% from the same quarter last year. Net profit grew by 13.8% YoY and 16.3% in sequential terms, to $ 5.56 billion. More than a third of revenue came from 7nm products, this share has consistently increased.

-

TSMC is on track to move N3 (namely 3nm process) technology to volume production in the second half of 2022, and plans to roll out an enhanced version of the process dubbed N3E with volume production scheduled for second-half 2023.

-

Foundry quotes are expected to continue rising but at a slower pace in 2022, according to sources at Taiwan-based pure-play foundries.

-

Fully-utilized fabs boosted pure-play foundry United Microelectronics' (UMC) gross margin to a 20-year high of 36.8% in the third quarter of 2021.

-

AMD is in perfect shape now, due to fake chip shortages they participate in

sa18630.jpg754 x 559 - 72K

sa18630.jpg754 x 559 - 72K

sa18631.jpg746 x 363 - 104K

sa18631.jpg746 x 363 - 104K

sa18632.jpg745 x 343 - 95K

sa18632.jpg745 x 343 - 95K -

Worldwide sales of semiconductors totaled US$144.8 billion during the third quarter of 2021, up 27.6% on year and 7.4% sequentially, according to the Semiconductor Industry Association (SIA).

Actual unit sales also increased, but only a little.

Semiconductor sales were US$48.3 billion in September 2021, rising 27.6% from a year earlier and 2.2% on month. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average.

"Semiconductor shipments reached all-time highs in the third quarter of 2021, demonstrating both the ongoing high global demand for chips and the industry's extraordinary efforts to ramp up production to meet that demand," said John Neuffer, SIA president and CEO. "Sales into the Americas led the way, increasing more than any other regional market both month-to-month and year-to-year."

So, we can see that all nice reports mean just huge price inflation. As well as we can see source of this inflation - US.

-

Many analysts predict that the 2022 iPhones will receive the Apple A16 chipset, which will be made according to TSMC's 3nm process technology. However, this may not happen. The Information publication reports that TSMC is facing production difficulties that threaten to disrupt the launch of mass production of 3nm products.

The new 3nm processors will not be ready by the time the hypothetical iPhone 14 is slated to launch. However, TSMC is expected to start producing 3nm chips ahead of its competitors anyway.

-

CNBC employees decided to summarize the available information on the plans of the current Intel leadership to expand production capacity in the coming years. Officially, the amount of $ 20 billion that the company will spend on the construction of two new enterprises in Arizona has been mentioned, but representatives of CNBC calculated that in the USA alone the company is ready to spend at least $26 billion on factories, and in aggregate with plans to expand the business elsewhere, this would translate into $ 44 billion in capital expenditures for the manufacturer.

-

TSMC is on track to move 3nm process technology (N3) to volume production in the second half of 2022 as scheduled

Information from Taiwan based PR.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320