-

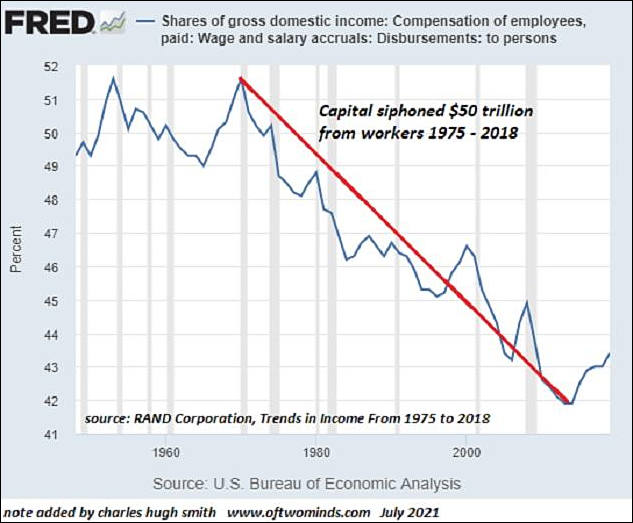

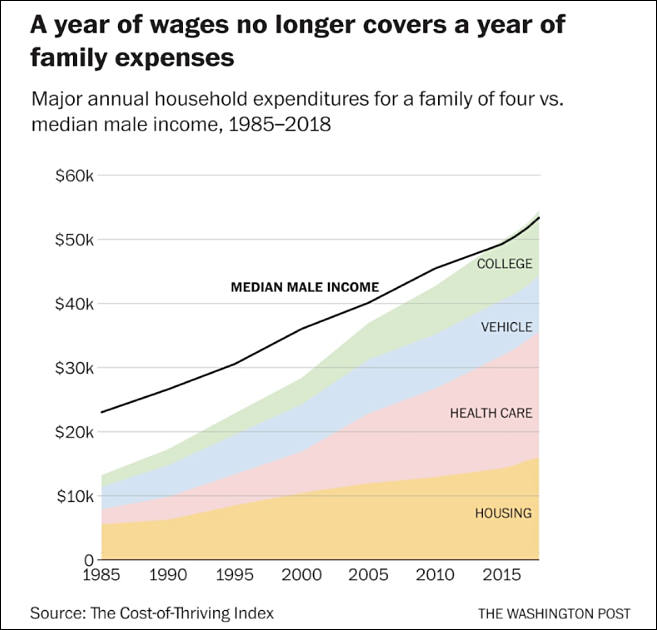

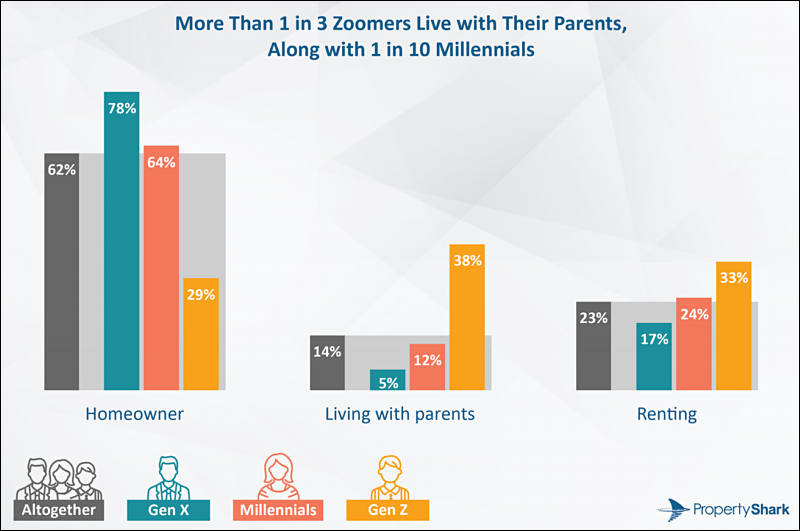

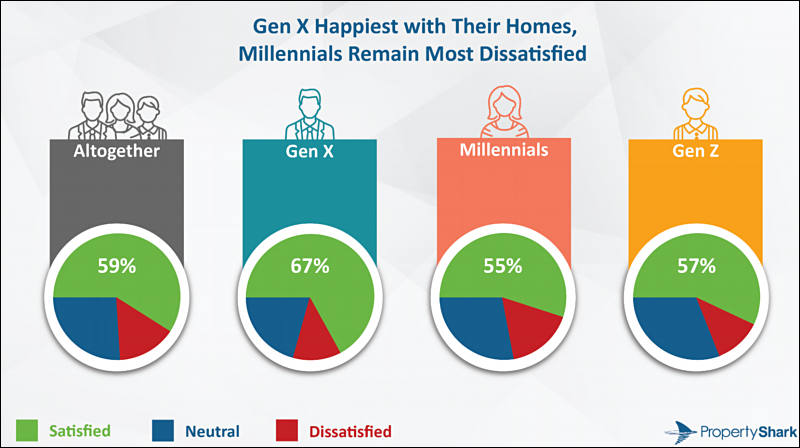

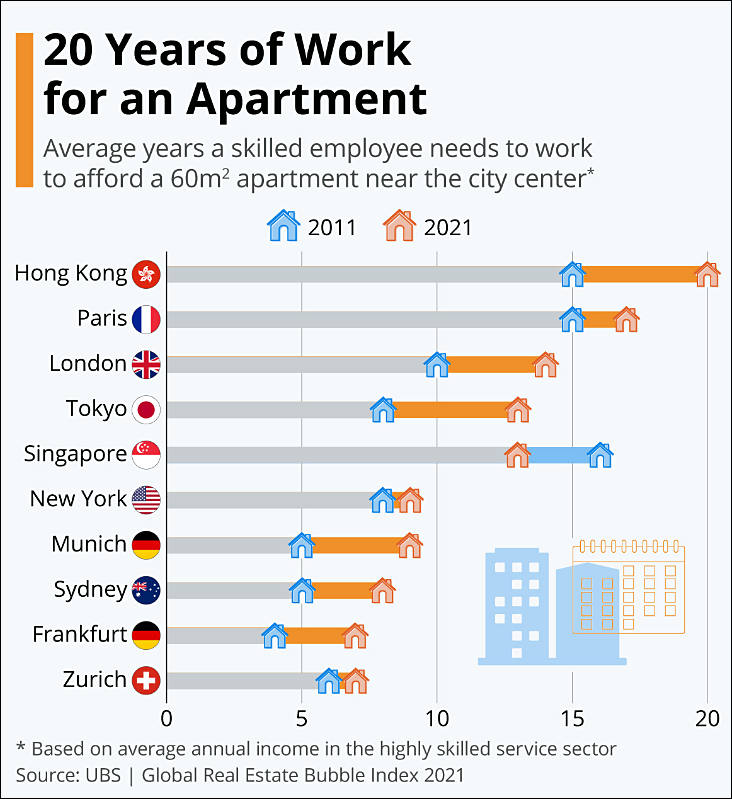

Inflating apartment prices allows to hide economy issues, so people get less goods for same income.

sa18628.jpg732 x 799 - 97K

sa18628.jpg732 x 799 - 97K -

Is there a definition of middle class? Earning 10 times minimum wedge?

-

Check this about definitions

https://www.brookings.edu/research/defining-the-middle-class-cash-credentials-or-culture/

-

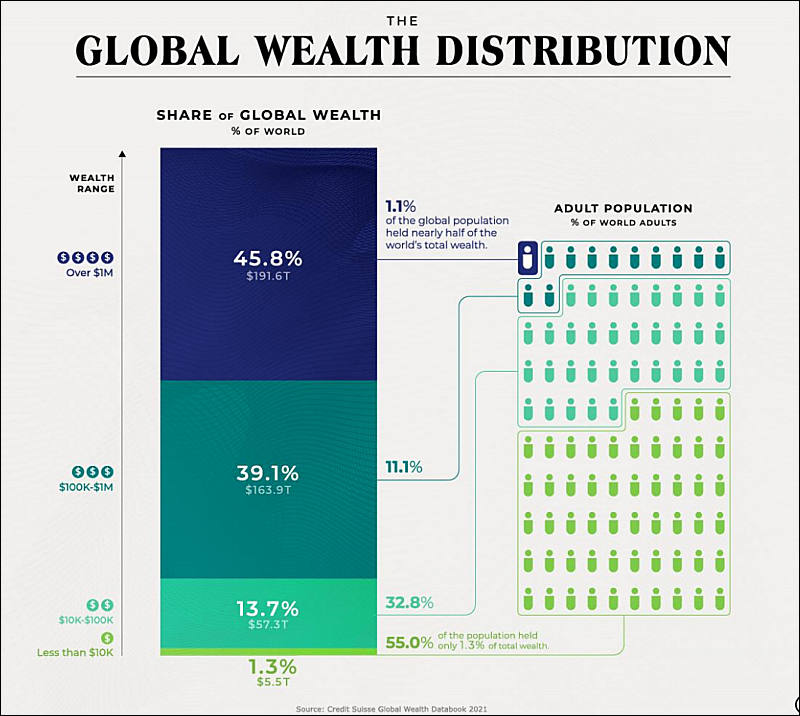

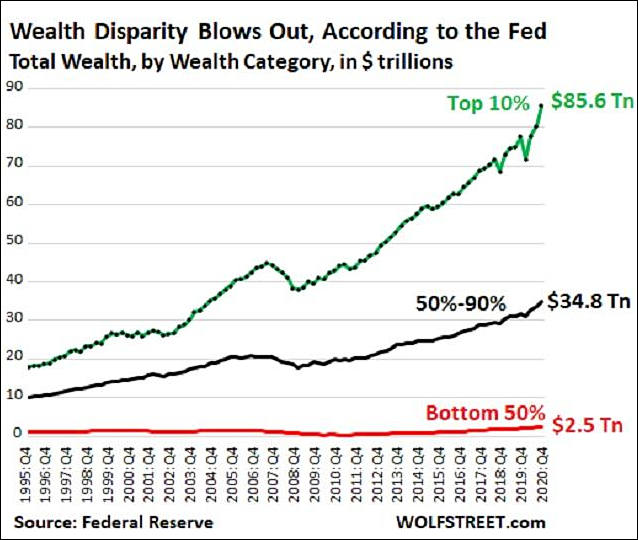

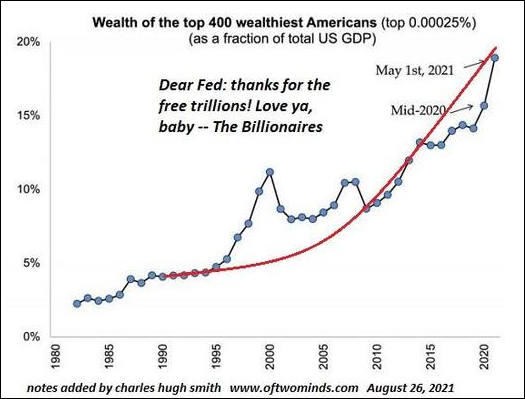

During the pandemic, the wealth of the ten richest people in the world, including Elon Musk, Jeff Bezos and Bill Gates, more than doubled to $1.5 trillion. Thanks to skyrocketing profits, they have become six times richer than the poorest 3.1 billion people on our planet, according to The Independent, citing a new study.

A report by the British charity Oxfam shows that since March 2020, a new billionaire has appeared in the world almost daily. At the same time, another 160 million people fell below the poverty line during this period.

The ranks of the super-rich have swelled, the organization says, thanks to abundant financial stimulus that has spurred stocks higher. At the same time, poor countries have suffered disproportionately from COVID due to unequal access to vaccines, which mainly went to first world countries.

-

Consumer debt jumped 11% year-on-year in November. It was the biggest single-month jump in consumer debt in 20 years. Total consumer debt now stands at over $4.41 trillion. And that doesn’t include mortgages.

Revolving debt – primarily credit card balances – grew by a staggering 23.4% year-on-year in November. That was the biggest increase since 1998.

More debt means more... prosperity.

-

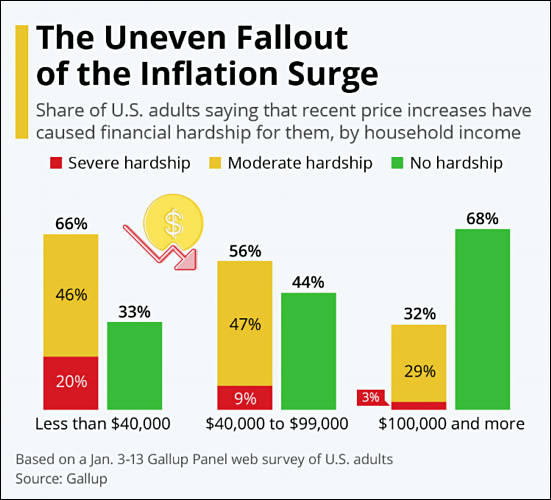

Just 18% of consumers said their wages were keeping pace with the higher cost of living.

Naturally, those with household incomes of $100,000 or more were better able to cope with inflation that hit a fresh 40-year high of 7.9%. Higher earners were about three times as likely to say their wages had kept pace with inflation, at 31%, said Melissa Bearden, head of consumer intelligence for Capital One. While 30% of higher earners said they got a non-performance-based raise or bonus over the past three months, just 10% of lower earners said that.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320

Tags in Topic

- economics 319