-

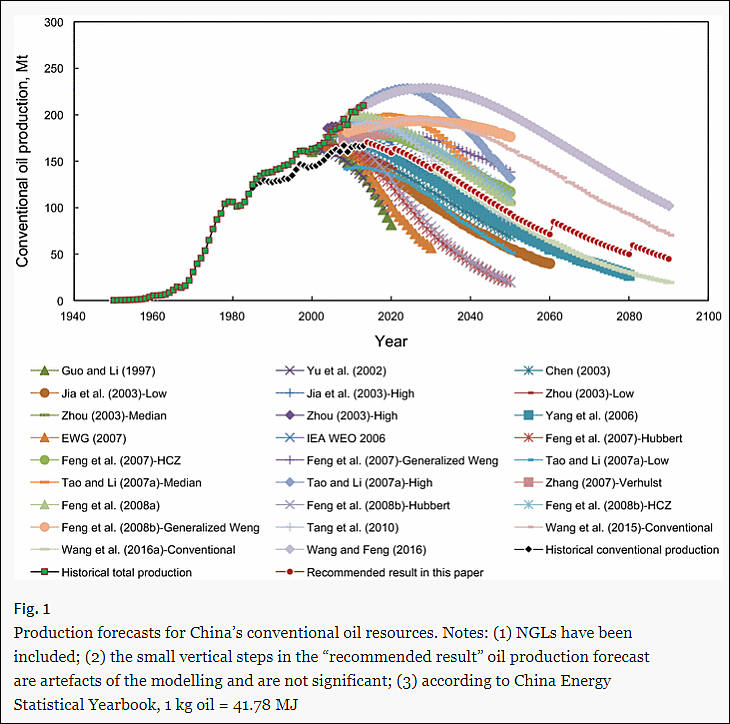

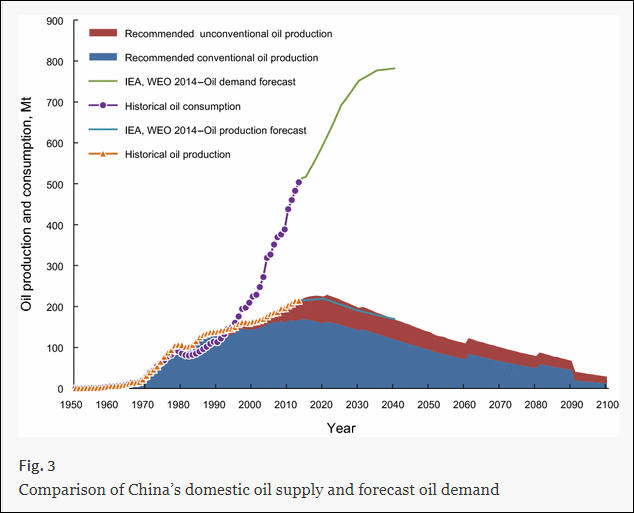

Oil

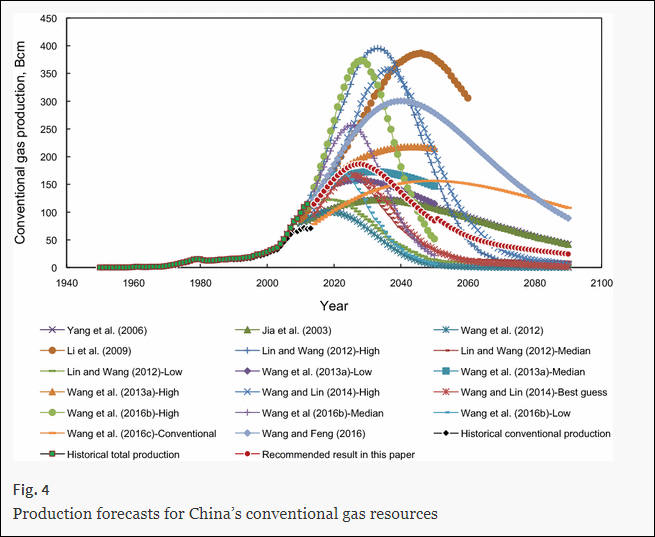

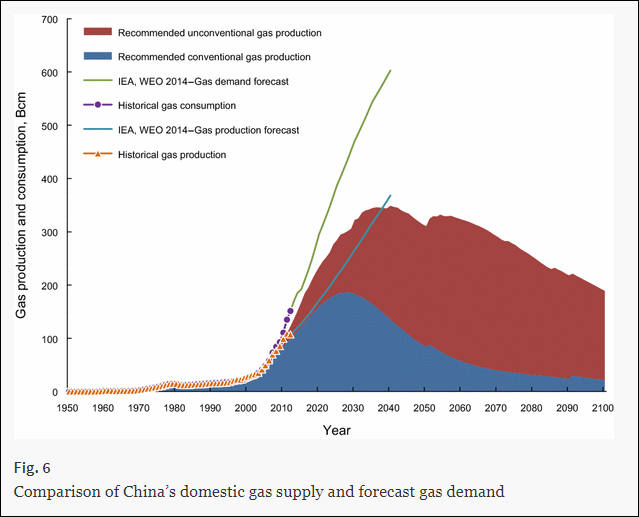

Gas

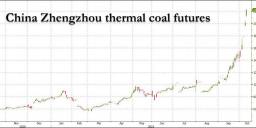

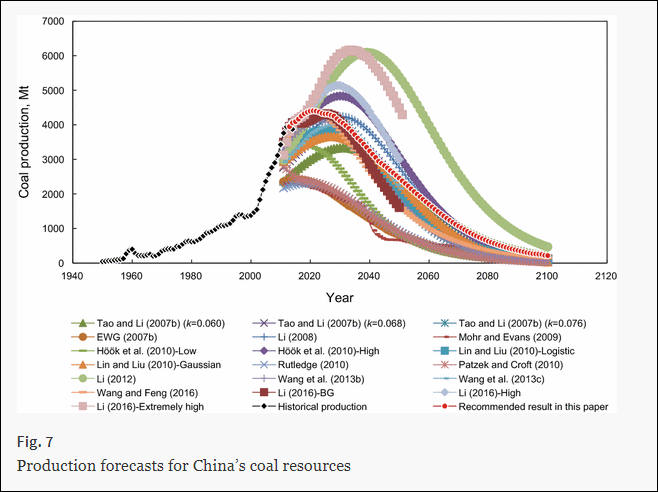

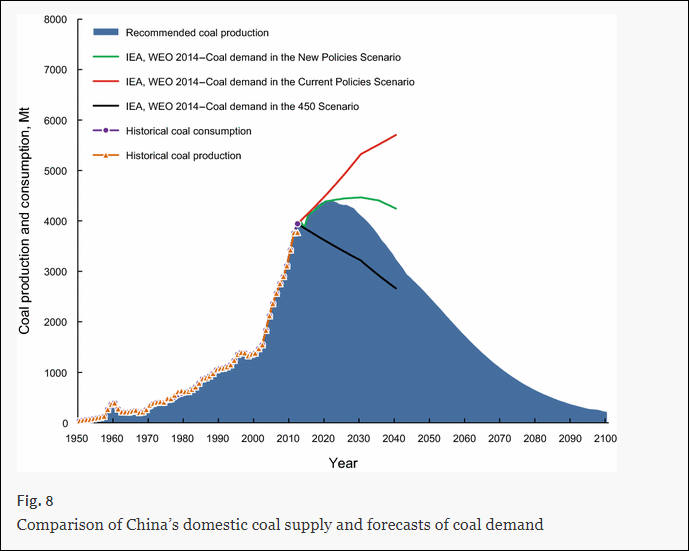

Coal

And reality beats predictions - https://www.personal-view.com/talks/discussion/13867/peak-coal

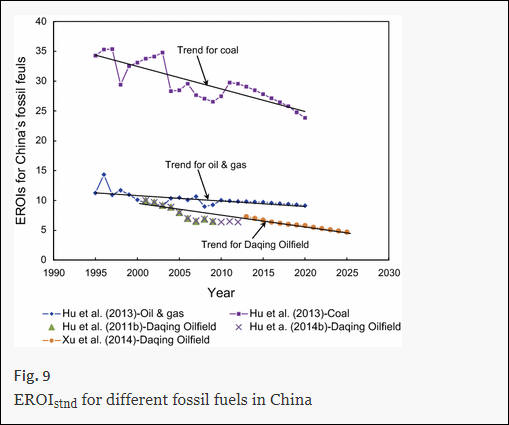

EROI

-

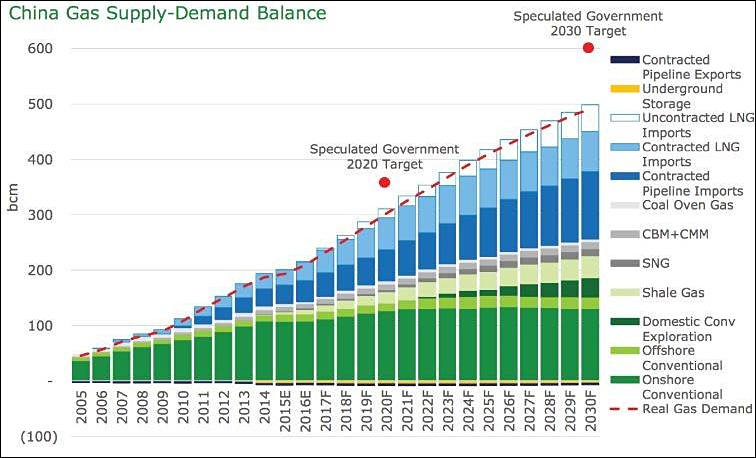

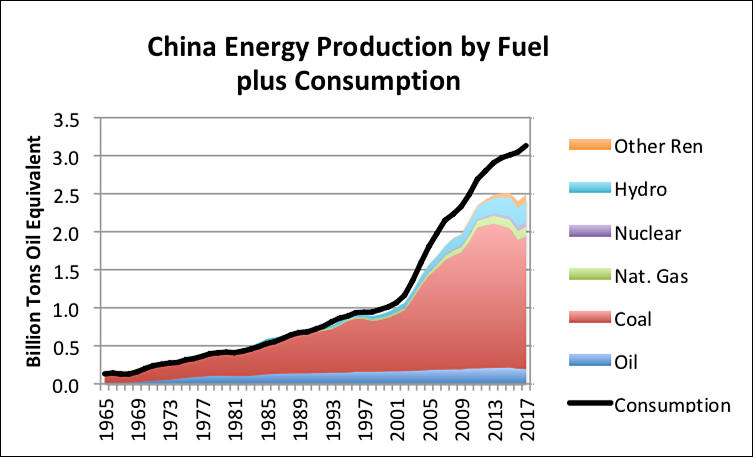

China January-September 2017 energy imports:

- oil - 12,2% rise

- gas - 22,3%

- coal - 10,8%

-

More updates

China’s natural gas imports in November rose to a record. November gas arrivals, including pipeline imports and liquefied natural gas (LNG) shipments, hit 6.55 million tonnes, breaking a previous record of 6.1 million tonnes last December.

An aggressive government campaign to heat millions of homes and fuel industrial boilers with gas has pushed domestic LNG prices to record highs, with some industrial and commercial users facing shortages or unable to afford the high cost.

Crude oil imports rose to 37.04 million tonnes in November, or 9.01 million barrels per day (bpd), up from 7.3 million bpd the previous month, and the second-highest level in history.

Stronger imports have been supported by firm refining margins after China raised domestic fuel prices twice in November.

-

Consequences

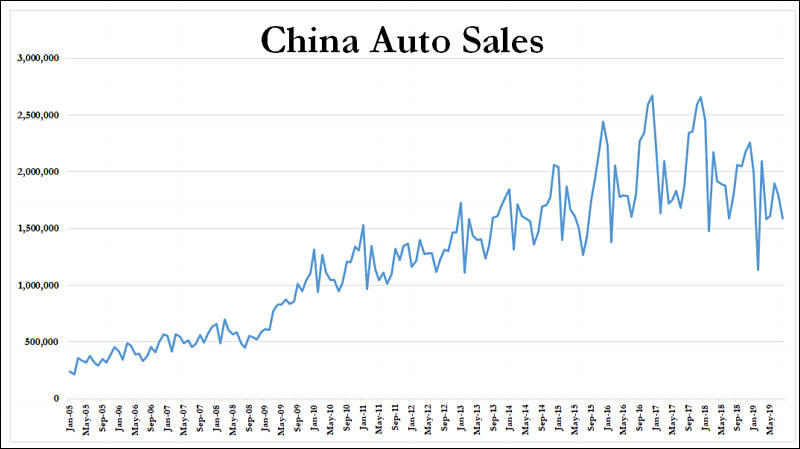

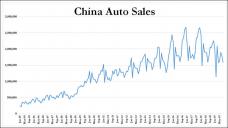

As of January 1st, China has suspended production of 553 car models that didn't meet its fuel efficiency standards.

China hopes to hold gas and oil prices using such measure. Even if it won't all last long.

-

China's factories sputter as gas shortage bites

Chemical maker Yunnan Yuntianhua was forced to halt a majority of operations at a plant in the southern province of Yunnan last month after its natural gas supply stopped.

Hubei Yihua Chemical Industry also halted operations at plants in the Inner Mongolia Autonomous Region and Guizhou Province.

Energy and chemicals supplier Inner Mongolia Yuan Xing Energy stopped production of methanol in its home region in December. German chemical group BASF also took production lines in Chongqing offline.

Over 80% of ceramics makers in the Hebei Province city of Shijiazhuang switched from coal- to gas-fired kilns last summer. But staying profitable using the more expensive fuel has been difficult, and many have suspended production.

https://asia.nikkei.com/Politics-Economy/Economy/China-s-factories-sputter-as-gas-shortage-bites

-

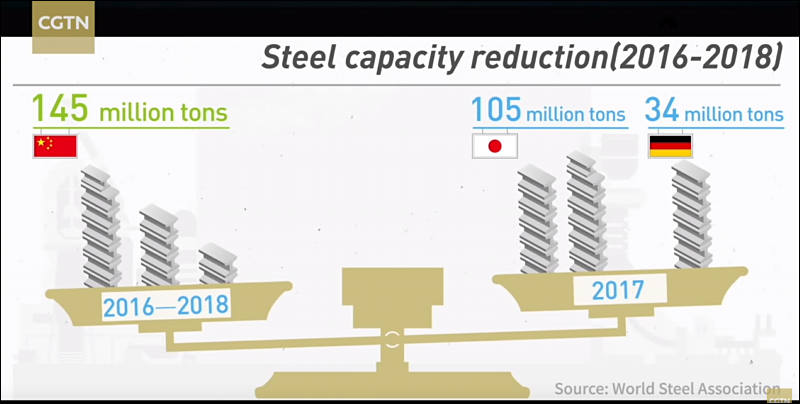

Coal and steel production drops

In 2017 China had been forced to reduce steel production by 50 million tons, due to coal production drop of 150 million tons.

In 2018 steel production to further drop by 30 million tons , and coal will drop another 150 million tons.

Situation becomes quite dangerous.

-

Coal and steel production drops

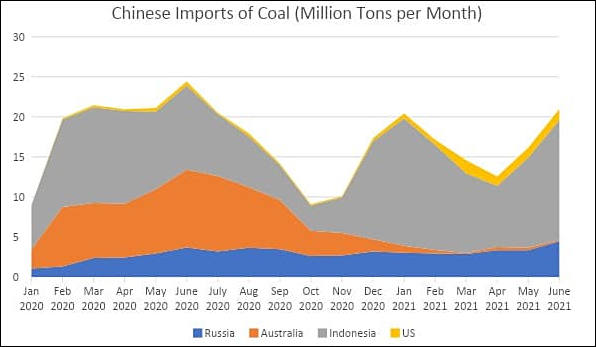

And that is why Australia's economy has been moving backwards

-

China Tragedy and fairy tales

sa6100.jpg650 x 474 - 38K

sa6100.jpg650 x 474 - 38K

sa6101.jpg650 x 379 - 35K

sa6101.jpg650 x 379 - 35K

sa6102.jpg650 x 442 - 32K

sa6102.jpg650 x 442 - 32K

sa6103.jpg650 x 499 - 66K

sa6103.jpg650 x 499 - 66K

sa6104.jpg650 x 362 - 30K

sa6104.jpg650 x 362 - 30K -

Such peaks make conflict (initially trade one, but later military) inevitable. No matter the good will.

sa7131.jpg753 x 457 - 46K

sa7131.jpg753 x 457 - 46K -

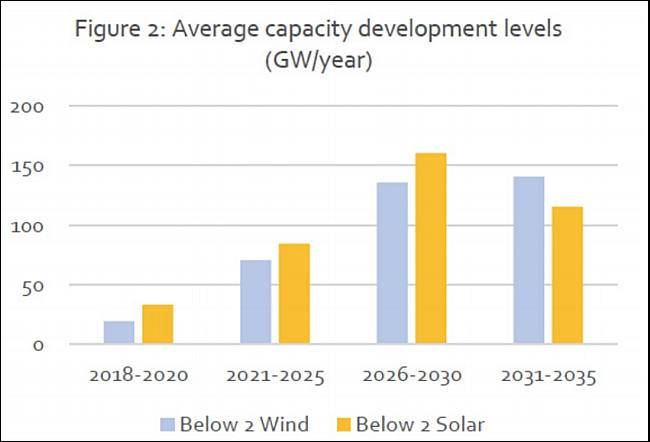

Zhejiang Province in eastern China is slated to install more than 300,000 smart charging stations for electric vehicles by 2025, the Provincial Development and Reform Committee said.

During this period, the province will build about 50,000 chargers for public use and over 250,000 for personal use to increase clean energy consumption.

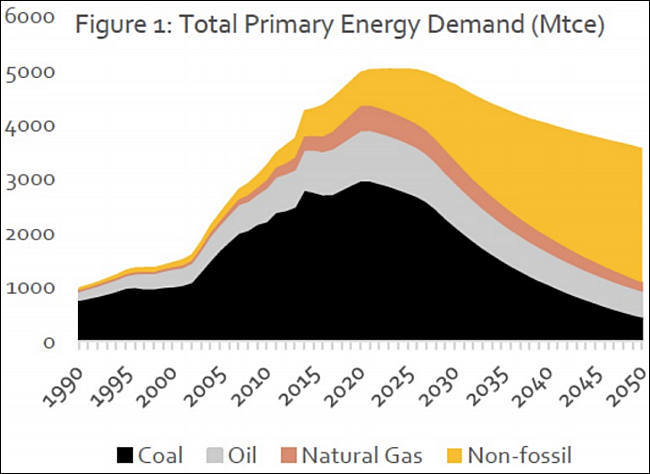

To meet the requirements for achieving the country's carbon neutral target, it is planned to increase the share of non-fossil energy sources in primary energy consumption from the current 20% to 20%. up to 24 percent by 2025, and to bring the total installed capacity of wind power and photovoltaic power to about 34 million kWh, said Zhou Weibing, head of the Provincial Energy Administration.

By 2025 Zhejiang will create more than 800 service stations for power supply and more than 1,000 hydrogen fuel cell vehicles will be commissioned.

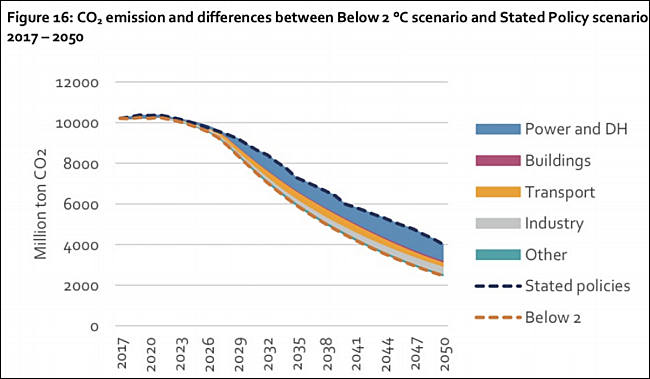

China has announced a commitment to peak carbon dioxide emissions by 2030 and carbon neutrality by 2060.

They just don't have any other options as coal availability is very bad.

-

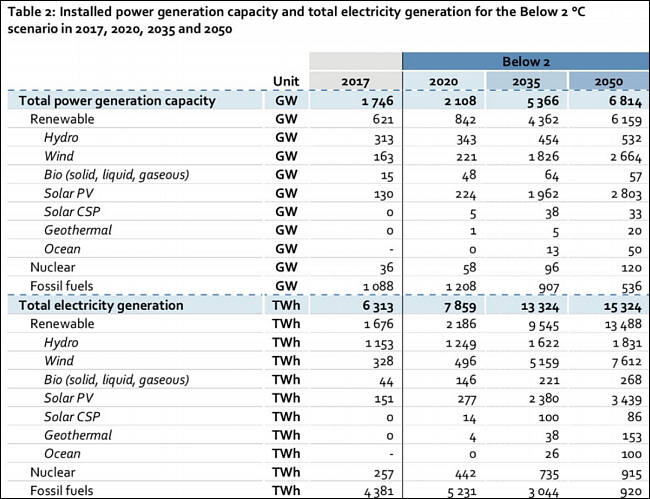

The PRC authorities will oblige regional grid companies to purchase at least 40% of the energy produced from renewable sources - wind and sun. This is stated in a government document referred to by Reuters. According to the project, grid companies will annually increase the volume of “green” electricity. At present, the volume of renewable energy sources is 28.2%. Despite plans to reduce carbon emissions, China built several new coal-fired power plants in 2020, with a total capacity of 38.4 GW, more than three times the size of new CHP plants worldwide. At the same time, China has more than doubled the construction of wind and solar power plants in 2020.

Huge injections are being made by EU, China and US into making renewable energy sources. Most of them are being build on government money or using money printed and credited by banks under COVID pretense.

Issue is horrible stability where you can have output dropping to 2-10% in single hour and it can keep at this for week or two.

-

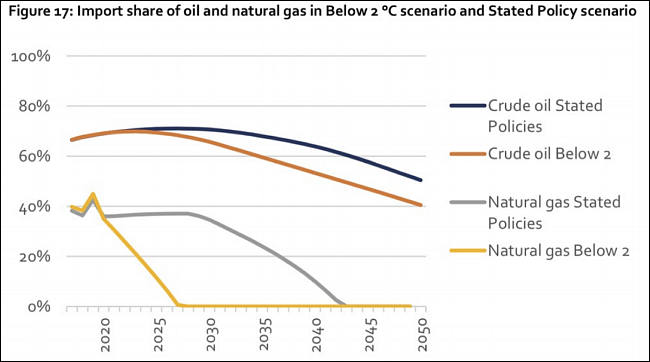

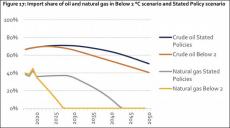

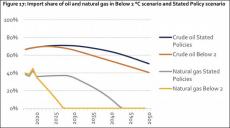

According to the General Administration of Customs of the PRC, in 2019, imports covered 70% of the total domestic consumption of oil, 46.4% of natural gas, and 45.8% of coal.

-

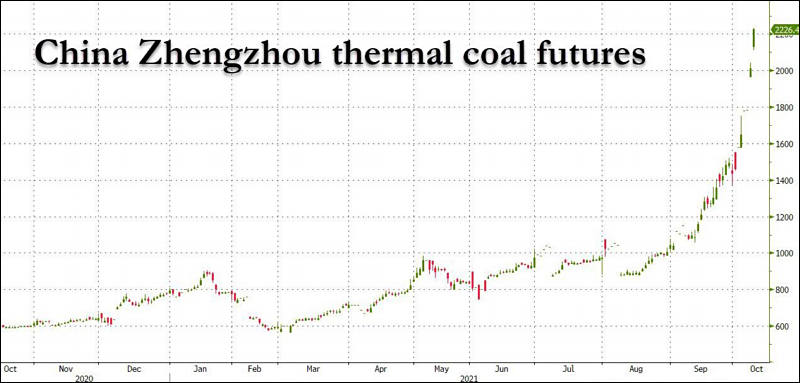

The confident recovery of the Chinese economy has led to power outages for dozens of industrial hubs in the south of the country.

Officials have ordered factories in Guangzhou, Foshan and Dongguan that make consumer and high-tech goods to cut their electricity use or even shut down their operations for one to three days a week.

These cities are located in Guangdong province, where the demand for electricity from enterprises exceeds supply. In January-April, electricity consumption in a number of Guangdong cities along the coastline between Hong Kong and Macau grew by 30% on an annualized basis.

The head of the EU Chamber of Commerce in southern China, Klaus Zenkel, said the problem affected about 100 companies that make up the organization, and further interruptions in power supply could negatively affect foreign investment in the region.

And it will be all much worse.

-

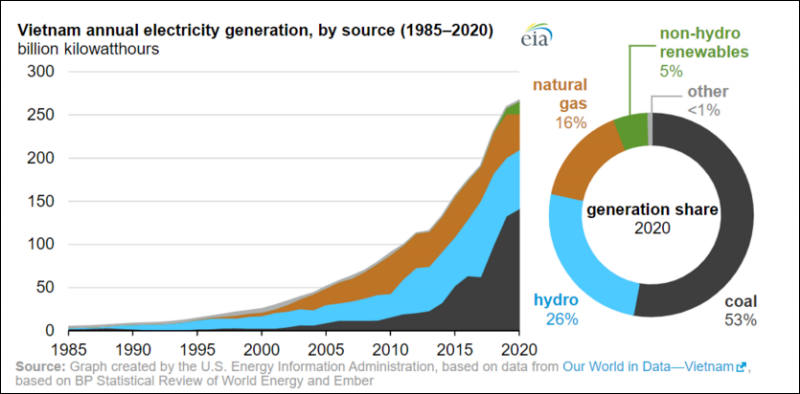

Lot of production moving from China to Vietnam where they still have some coal left

sa17920.jpg800 x 394 - 46K

sa17920.jpg800 x 394 - 46K -

Coal returns

Operations at 53 shuttered coal mines in China will once again come to life, as China struggles to keep up with increased power demand, according to a statement by the National Development Reform Commission in China.

Last week, China announced it would restart 38 coal mines in Inner Mongolia. Now, China has announced it will resume operations at 15 more coal mines, in the regions of Shanxi and Xinjiang. The mines will operate for a year and will produce as much as 44 million tons of coal, which China hopes will satisfy the growing calls for power amid an intense heatwave and tick up in industrial activity.

China has struggled to answer the calls for both increased power and decreased emissions.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320