-

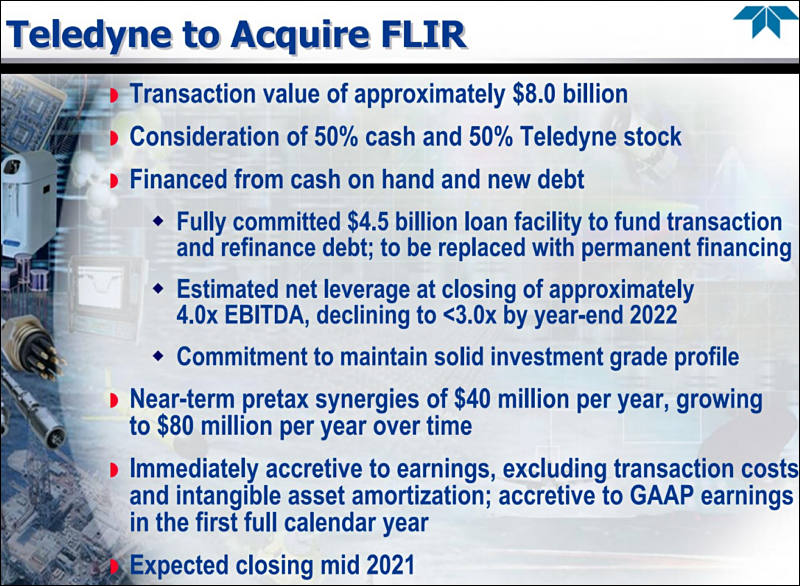

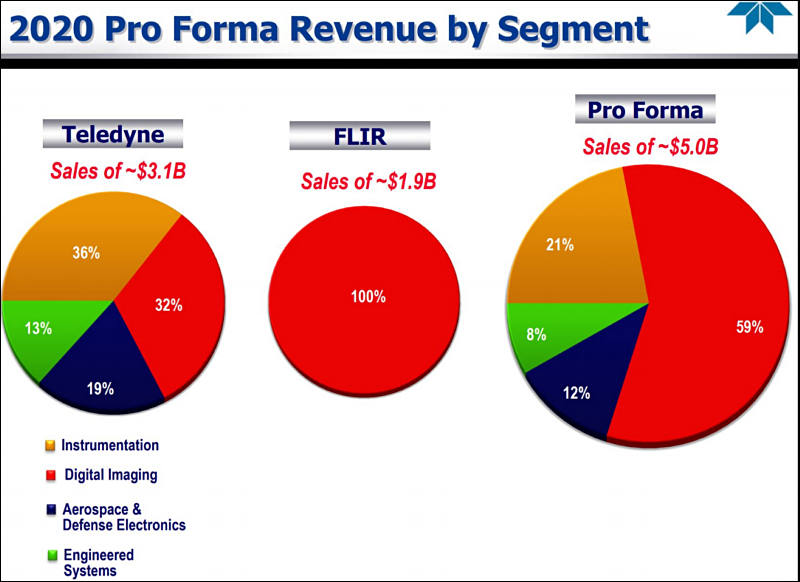

Teledyne Technologies Incorporated (NYSE:TDY) (“Teledyne”) and FLIR Systems, Inc. (NASDAQ:FLIR) (“FLIR”) jointly announced today that they have entered into a definitive agreement under which Teledyne will acquire FLIR in a cash and stock transaction valued at approximately $8.0 billion.

Under the terms of the agreement, FLIR stockholders will receive $28.00 per share in cash and 0.0718 shares of Teledyne common stock for each FLIR share, which implies a total purchase price of $56.00 per FLIR share based on Teledyne’s 5-day volume weighted average price as of December 31, 2020. The transaction reflects a 40% premium for FLIR stockholders based on FLIR’s 30-day volume weighted average price as of December 31, 2020.

As part of the transaction, Teledyne has arranged a $4.5 billion 364-day credit commitment to fund the transaction and refinance certain existing debt. Teledyne expects to fund the transaction with permanent financing prior to closing. Net leverage at closing is expected to be approximately 4.0x adjusted pro forma EBITDA with leverage declining to less than 3.0x by the end of 2022.

Teledyne expects the acquisition to be immediately accretive to earnings, excluding transaction costs and intangible asset amortization, and accretive to GAAP earnings in the first full calendar year following the acquisition.

“At the core of both our companies is proprietary sensor technologies. Our business models are also similar: we each provide sensors, cameras and sensor systems to our customers. However, our technologies and products are uniquely complementary with minimal overlap, having imaging sensors based on different semiconductor technologies for different wavelengths,” said Robert Mehrabian, Executive Chairman of Teledyne. “For two decades, Teledyne has demonstrated its ability to compound earnings and cash flow consistently and predictably. Together with FLIR and an optimized capital structure, I am confident we shall continue delivering superior returns to our stockholders.”

“FLIR’s commitment to innovation spanning multiple sensing technologies has allowed our company to grow into the multi-billion-dollar company it is today,” said Earl Lewis, Chairman of FLIR. “With our new partner’s platform of complementary technologies, we will be able to continue this trajectory, providing our employees, customers and stockholders even more exciting momentum for growth. Our Board fully supports this transaction, which delivers immediate value and the opportunity to participate in the upside potential of the combined company.” Jim Cannon, President and Chief Executive Officer of FLIR, said, “We could not be more excited to join forces with Teledyne through this value-creating transaction. Together, we will offer a uniquely complementary end-to-end portfolio of sensory technologies for all key domains and applications across a well-balanced, global customer base. We are pleased to be partnering with an organization that shares our focus on continuous innovation and operational excellence, and we look forward to working closely with the Teledyne team as we bring our two companies together to capitalize on the important opportunities ahead.”

-

Cool! Teledyne also shoots with guns & bullets, in addition to cameras. Teledyne is the one that has invented EXACTO self-steering bullets that can strike hidden targets (e.g. personnel behind a wall), moving targets, etc. Now they want to see through total darkness and through obstacles.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320