-

to War !! :)

-

Biden Campaign Ad: Trump gets blamed for outbreak, Not Tough enough on China :)

-

‘No mass exodus’: Most US firms don’t want to wind down operations in China over pandemic

Large US companies operating in China don’t want to move production and supply chains from the country in the near future, even though the coronavirus may force them to adjust their business strategies, a recent survey found.Around 70 percent of 25 firms with global revenue of over half a billion dollars have no relocation plans, despite the effect the coronavirus outbreak has had on their business, according to a joint poll conducted by the American Chamber of Commerce in China and the American Chamber of Commerce in Shanghai. The results of the March survey, published on Friday, also show that around 40 percent of the respondents would rather keep their long-term supply chain strategy for China unchanged.While more than half of the firms polled say it’s too early to make any decisions on relocation, only four percent of the companies are planning to shift all production outside China, while 12 percent of the respondents intend to move part of their facilities.“Companies are considering adjustments to their business strategy, but there is no mass exodus as a result of COVID-19,” Ker Gibbs, the president of AmCham Shanghai, said.However, one in five respondents believes the pandemic accelerated the US-China economic “decoupling.” Compared to a previous survey, less businessmen believe an economic breakup is impossible, with the number falling to 44 percent in the latest survey, from 66 percent in October.“Still, there is no escaping the fact that the current crisis adds a new and unwelcome dimension to the conversation about decoupling. This will be part of the discussion for months to come,” Gibbs added.Washington has long tried to encourage American firms to bring production back home from overseas. The calls to ditch China in particular were stronger in the midst of the trade war, which was halted by the ‘phase one’ trade deal at the beginning of the year. The issue was raised again last week, as the White House economic adviser, Larry Kudlow, told Fox Business that the US could “literally pay” the moving costs of every American company willing to move from China. -

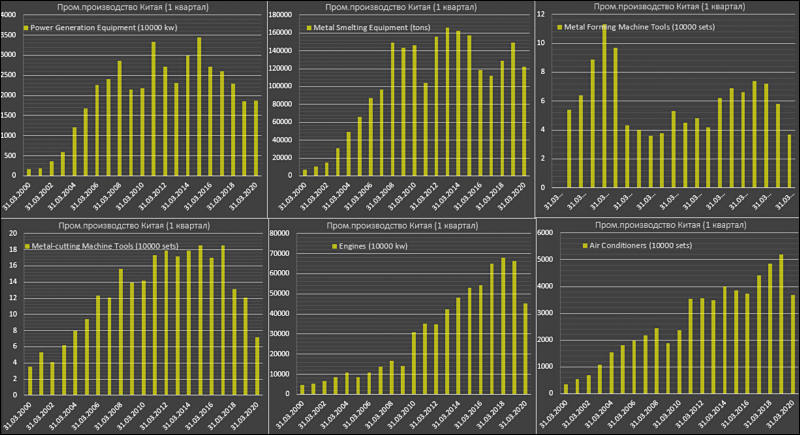

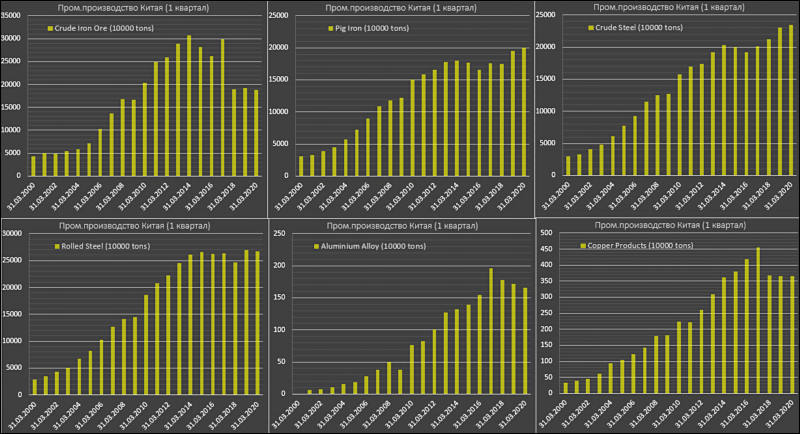

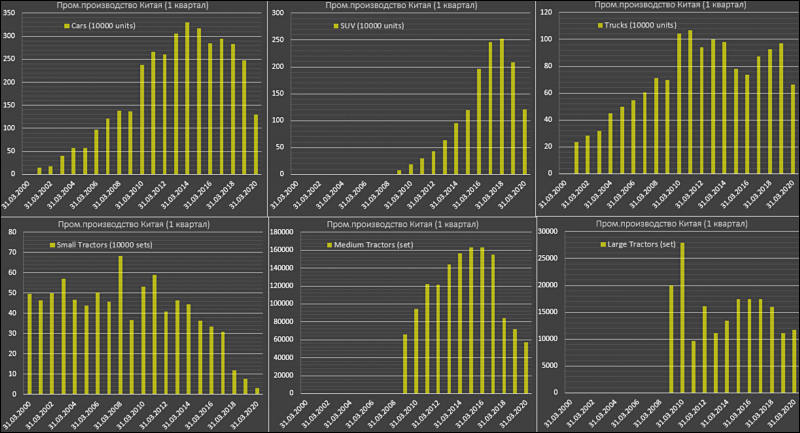

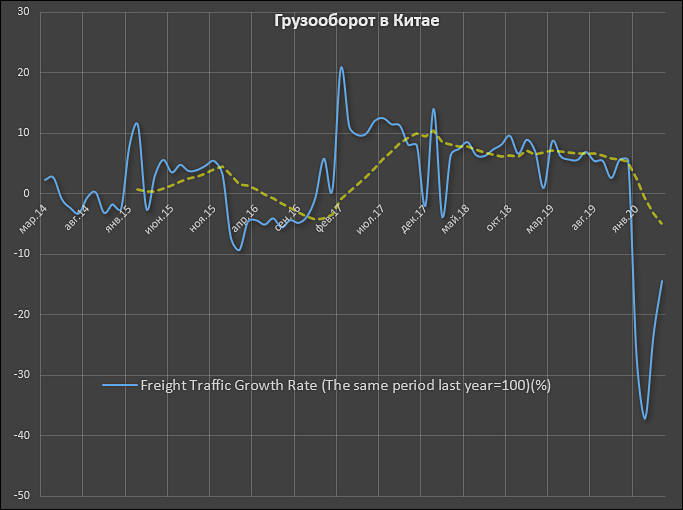

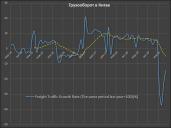

Chinese manufacturing data

sa12906.jpg800 x 435 - 98K

sa12906.jpg800 x 435 - 98K

sa12907.jpg800 x 434 - 94K

sa12907.jpg800 x 434 - 94K

sa12908.jpg800 x 433 - 90K

sa12908.jpg800 x 433 - 90K -

Shippers turn to Belt and Road trains to beat coronavirus shutdowns

HAMBURG, Germany -- With few international flights operating and many cargo ships knocked off course by the coronavirus pandemic, businesses sending goods between Asia and Europe have turned in desperation to trains linked to China's Belt and Road project."These days, many European customers are exploring rail freight on the New Silk Road as an alternative and attractive transport mode," Tim Scharwath, chief executive of global freight forwarding at German logistics operator DHL, told the Nikkei Asian Review. "We are seeing a strong increase in volumes in both directions."Until recently, trains that arrived in Europe with nearly every freight car in use might head back east with dozens empty. But the relative cheapness and dependability of train services are now too compelling to ignore. -

And it is dangerous, as US do not control this way of shipping. Contrary to ability to control key points of sea routes.

-

And it is dangerous

probably more "terrorism" and "piracy" wlll suddenly happen along the route. Although Blackwater founder Erik Prince, a Trump supporter, is helping with security.

(Erik) Prince, a former US Navy Seal, is best known for founding the armed security services firm formerly known as Blackwater, whose employees were found guilty for the killing of 17 unarmed Iraqis in Baghdad in 2007. After selling Blackwater in 2010 and relocating to Abu Dhabi—where he reportedly set up a mercenary force (paywall) for the government—Prince has turned his sights on China.He is now chairman of Frontier Services Group (FSG), which announced in December that it is setting up a “forward operating base” in Yunnan to provide logistics and unarmed security training services to facilitate OBOR-related projects in Southeast Asia. Just as he positioned himself to profit from George W. Bush’s military adventurism in Iraq more than a decade ago, he is poised to benefit from this decade’s dominant theme: a global realignment around China’s economy.Powerful partners

Prince’s Washington connections, cultivated via his time in the military and his wealthy, well-connected family—he is the brother of US education secretary Betsy DeVos—were helpful to Blackwater in securing an estimated $2 billion in contracts, primarily in Iraq and Afghanistan. Similarly, through FSG, he is tightly connected to China’s state-owned conglomerate CITIC Group, which owns 20% of the company and was ranked 156th on Fortune’s Global 500 list last year. CITIC has major subsidiaries involved in banking, securities, construction, real estate, technology, and more. Prince has denied that he’s gone from being Washington’s favorite mercenary to a Chinese gun-for-hire.“We’re not serving Chinese foreign policy goals,” Prince told the Financial Times in a March interview. “We’re helping increase trade.” says FSG. Prince was unavailable to comment for this piece. -

US now return China into same unstable state.

With new attack on Huawei and their LSI industry in general, as well as due to emerging second wave of coronavirus.

Idea not to develop their own machines for litography for so long can cost China up to 100-200 billions USD.

Yet US already made some terrible errors showing hidden control schemes they had over manufacturers and licenses. Now they will slowly be loosing soft but tight grip they had over different countries. Not fast, of course.

-

Neither Coronavirus Nor Trade Tensions Can Stop U.S. Companies’ Push Into China

Businesses are betting that the country’s long-term growth potential outweighs the mounting case against expansion

SHANGHAI—Relations between the U.S. and China are at their lowest point in decades, and the Covid-19 pandemic has rattled consumers the world over. U.S. companies and brands are doubling down on China anyway.To understand why, look no further than the hundreds lined up around the block in central Shanghai, many of them defying coronavirus social-distancing advice, to get their hands on chicken sandwiches from Popeyes Louisiana Kitchen. Popeyes, the latest U.S. brand to plant its flag in China, opened on Friday, the first of 1,500 planned locations in China.From Popeyes to Walmart Inc., WMT -2.12%▲ Tesla Inc. TSLA -0.69%▲ to Exxon Mobil Corp., companies are betting that the country’s long-term growth potential still outweighs the mounting case against further expansion—including geopolitical tensions and slowing growth. While the pandemic has spurred businesses to rethink supply chains to reduce dependency on China, companies that are producing in China for Chinese customers are bulking up their local presence. -

Do not worry, it'll all reverse fast. Can even check South Korean businesses.

-

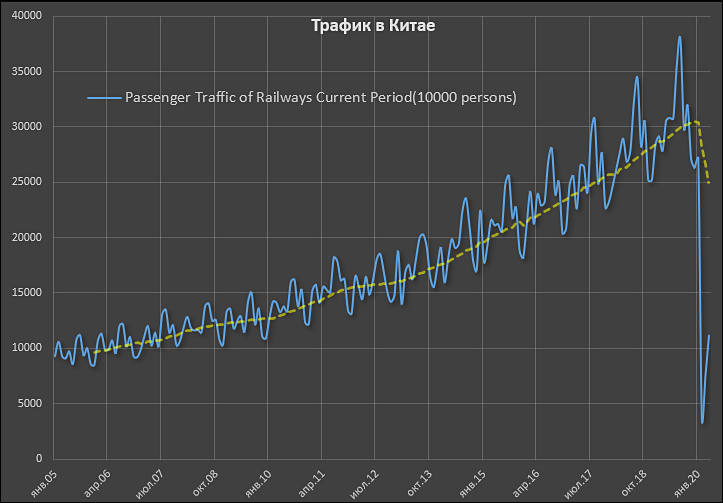

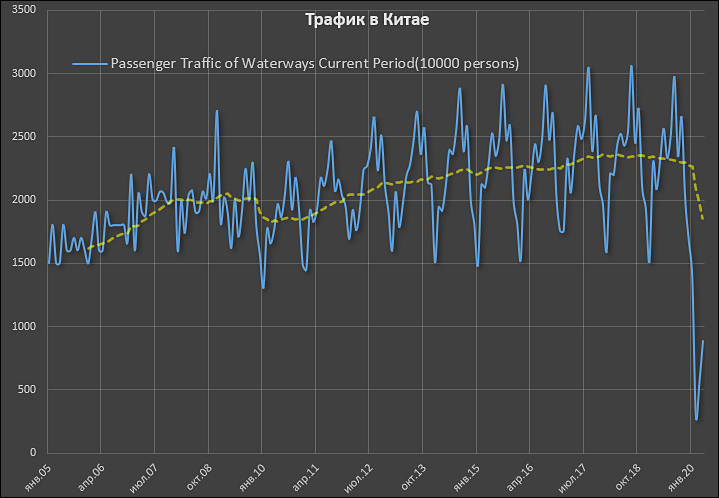

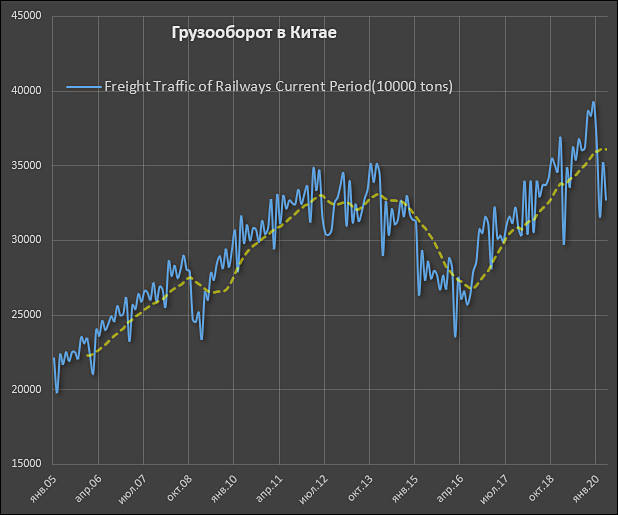

China restoration

sa13207.jpg723 x 503 - 48K

sa13207.jpg723 x 503 - 48K

sa13208.jpg719 x 498 - 52K

sa13208.jpg719 x 498 - 52K

sa13209.jpg618 x 515 - 43K

sa13209.jpg618 x 515 - 43K

sa13210.jpg683 x 510 - 45K

sa13210.jpg683 x 510 - 45K -

Samsung sends 500 Engineers and Managers to China for chip unit expansion

Seoul, May 24 (IANS) Samsung Electronics has sent 300 more South Korean engineers and workers to China to complete the expansion of its second chip manufacturing facility there amid the novel coronavirus pandemic. The move came a month after Samsung dispatched 200 engineers to the Xian plant in Shaanxi Province.Samsung said the workers will be exempted from 14-day mandatory isolation under the "fast-track" entry system approved by South Korea and China, but they still need to be quarantined for three days even after they all test negative for the virus. Last week, Samsung Electronics Vice Chairman Lee Jae-yong returned home from his trip to the Xian plant.The Xian plant is Samsung''s only foreign memory chip factory that makes 3D NAND flash products. The South Korean tech giant last year revealed it will invest an additional $8 billion in the plant for expansion. Also, SK Innovation Co. and Kia Motors Corp. sent a combined total of 220 workers to their manufacturing facilities in Yancheng, in the northeastern Jiangsu province, through the fast-track entry system.Samsung is also adding a foundry production line in South Korea to expand its presence in the contract chipmaking sector dominated by Taiwan Semiconductor Manufacturing Company (TSMC) Ltd. and reduce its heavy reliance on its memory chip business. The new foundry manufacturing line using the extreme ultraviolet (EUV) lithography technology will be established at its chip plant in Pyeongtaek, some 70 km south of Seoul, said the company. Foundry refers to the contract chip manufacturing business for fabless chipmakers that design and sell semiconductors for various types of electronics, reports Yonhap news agency. -

Loose lips sink ships :)

The United States threatens to CUT OFF Australia after Victoria ignored security advice to join a controversial trade deal with China

The U.S. warns it will 'simply disconnect' from Australia if Victoria sucking up to China becomes a security risk. Premier Daniel Andrews signed up to the controversial Belt and Road Initiative that provides loans and investment in infrastructure projects. Victoria is the only Australian state to sign the agreement and has been widely criticised for doing so. U.S. Secretary of State Mike Pompeo threatened to cut Australia off from vital intelligence sharing if the deal compromised telecommunications.US backs down from Pompeo's Belt and Road remarks

The US embassy in Australia has gone into damage control over controversial comments by Secretary of State Mike Pompeo that America would “simply disconnect” if Victoria’s decision to join China’s Belt and Road plan impacted telecommunications.Hours after Mr Pompeo appeared in an interview warning against Victoria’s involvement in China's backing of foreign infrastructure projects, the US government sought to clarify the remarks and insisted it had confidence in Australia’s ability to protect the security of its telecommunications. Mr Pompeo said the US would not take any risks regarding its telecommunications infrastructure or national security with regards to its "five eyes" security partners. Australia is one of those partners. “I don’t know the nature of those projects precisely but to the extent they have an adverse impact on our ability to protect telecommunications from our private citizens or security networks for our defence and intelligence communities we will simply disconnect,” he said.But several hours later US ambassador to Australia Arthur Culvahouse, issued a statement saying Mr Pompeo had been asked to “address a hypothetical” and he was unfamiliar with Victoria’s Belt and Road discussions. “We are not aware that Victoria has engaged in any concrete projects under BRI, let alone projects impinging on telecommunications networks, which we understand are a federal matter,” Mr Culvahouse said. A Victorian government spokeswoman said the Belt and Road Initiative was about creating opportunities for Victorian businesses and local jobs. “Telecommunications regulation is the responsibility of the Commonwealth government,” she said. “Victoria has not, and will not in the future, agree to telecommunications projects under the BRI." -

...Huawei seems to have a way around the U.S. latest ban. Besides TSMC, another major chip maker is Foxconn (another Taiwanese company) is ready to take Huawei’s orders. Recall that after the ban last year, Foxconn canceled all Huawei’s orders. However, Foxconn’s founder, Guo Taiming, has now said that the company is open to cooperate with Huawei and other Chinese companies. If TSMC does not take Huawei’s orders and Foxconn does, the U.S. new laws will be technically ineffective.This also means that Huawei has new partners, and in the face of the sudden drop in Apple’s mobile phone orders, Foxconn also needs Huawei’s orders. Presently, Huawei has orders worth $700 million with TSMC.

-

THE HONG KONG DRAMA IN ONE MINUTE from Pepe Escobar

Hong Kong is the interface between China and the West. It’s like the West set in southern China – the conduit for every sort of FDI ( Foreign Direct Investment) . I lived in HK and I saw how the system works in detail. Western FDI into China is roughly 1% of Chinese GDP. May not be much – but still that amounts to roughly $150 billion. Total stock may be between $1.5 to 1.7 trillion.I’ve also seen, over and over, since the handover, how HK is becoming more and more Cantonese – and less “Western”. It’s been turning into a wealthy, generic Chinese metropolis where most people happen to speak English (or at least 10 words or so, like most taxi drivers). Beijing has no interest in disturbing the financial system – or collapsing the Hang Seng index. The black block “protesters” last year were doing exactly that – as I saw for myself. Let’s assume this all would go down in smoke – it won’t. Beijing in this case would still need those $150 billion. Enter probably an extra stimulus package. No major problem.What we are seeing now is the result of what the task force sent to Shenzhen last year to examine every angle of the protests relayed back to the leadership in Beijing. The sources of financing for the hardcore black blocks have been cut. The local 5th columnist “leaders” have been isolated. Beijing was being VERY patient with all the mess. But then came Covid-19.FDI dropped by over 25% (that was a February figure – perhaps even more by now). The economic consensus in Beijing is that this will be an L-shaped recovery – actually veeeeeery slow on the “L”. So the West will buy much less from and invest much less in China. Thus HK is not gonna be much useful anyway. Its best bet has already been offered many times over: integrate with the Greater Bay Area and be part of a booming southern cluster. HK business wants it.Another conclusion was that whatever Beijing does the hysteria in the US – and in this case also the UK – remains on overdrive dementia mode. So now is the right moment to go for the national security law – which of course is against subversion but most of all against money laundering. A Global Times editorial cut to the chase: the national security law is the “death knell” for US intervention in HK. This is it. Enjoy the show. -

The draft rules, open for public comment until June 18, allow Shenzhen residents who cannot pay their debts to apply for personal bankruptcy if they have paid social insurance in the city for at least three years.

Once approved, applicants will spend at least three years in a supervised “probation” period before all or part of their debts are wiped clean. During this time their expenditure will be supervised, the draft rules said.

"After the epidemic, it’s unclear just how many business owners will be forced on to the country’s defaulter list if they fail," said Yin Yanrong, a partner in the Guangdong Baocheng law firm.

More capitalism by opportunistic Chines elites.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,980

- Blog5,725

- General and News1,352

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,362

- ↳ Panasonic992

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras115

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,417

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,580

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319