-

The international summit where Trump and Xi were planning to sign a trade deal has been suddenly canceled

Chile said it’s calling off the Asia-Pacific Economic Cooperation summit in Santiago in mid-November. President Donald Trump and Chinese leader Xi Jinping were scheduled to meet at the gathering to discuss a possible “phase one” deal that the two countries are close to finalizing.maybe someone doesn't want these APEC summits to happen, in New Zealand. the convention center built for APEC, a major fire may delay construction for a few years!

Fire still burning at New Zealand convention center, APEC hosting in doubt

Auckland’s mayor Phil Goff told the New Zealand Herald newspaper the center would now likely not be ready in time to host major world leaders and events for the Asia-Pacific Economic Cooperation (APEC) meeting in 2021. -

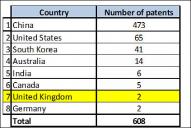

Something tells me that US love to patents and intellectual property won't last long

Expect soon twitter in usual place with something like:

"Copyright and patents are for morons! Great America does not need them! I plan to propose new emergency decree declaring all copyright lovers as enemies of the state and we need to start treating them as dangerous terrorists!"

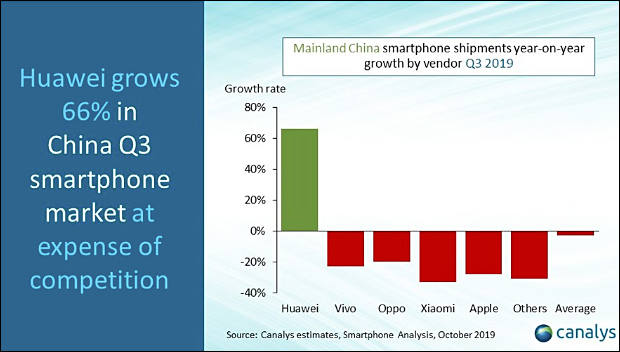

sa10690.jpg423 x 284 - 33K

sa10690.jpg423 x 284 - 33K -

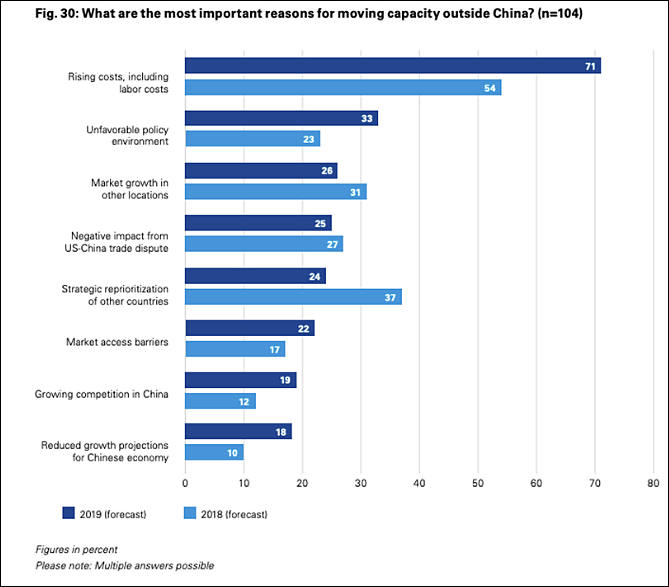

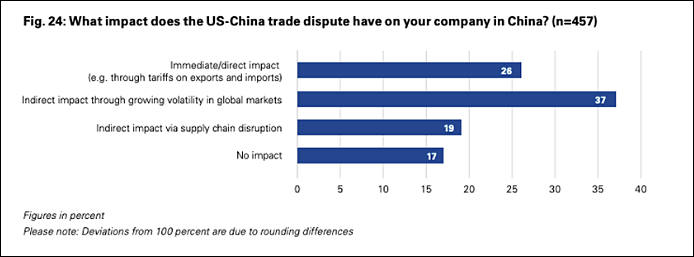

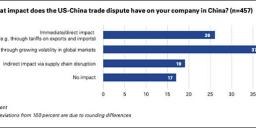

Germany companies feelings:

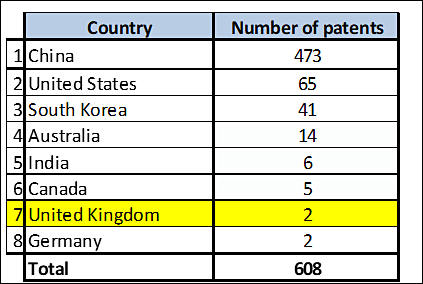

sa10991.jpg669 x 587 - 48K

sa10991.jpg669 x 587 - 48K

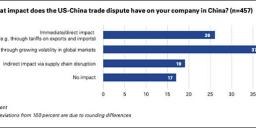

sa10992.jpg694 x 257 - 25K

sa10992.jpg694 x 257 - 25K -

Neighbourly love-in Japan Inc has thrived in China of late

In 1977, five years after China and Japan re-established diplomatic relations, Miyakoshi, an electronics manufacturer, became the first Japanese firm to receive a business permit from the Communist Party, to make cassette-tape recorders. In 2017 around 32,000 Japanese companies had investments worth $117bn on the mainland, one of the biggest foreign corporate footprints. Last year they poured close to $11bn into China, up by half since 2010 and not far off America’s long-stagnating tally. Big listed Japanese firms derived 17% of their overseas profits from China, according to calculations by Jesper Koll, a fund manager in Tokyo.The rapport between the world’s second- and third-biggest economies has never been better. Last year Chinese officials paid a visit to Panasonic, Canon and Toyota in Japan to meet executives and lure their firms to new free-trade zones. A year ago Shinzo Abe, Japan’s prime minister, travelled to China, to a forum attended by 1,000 businesspeople. During the trip the two countries announced 500 deals worth more than $18bn. Yet for all the bonhomie, it is also an unusually delicate time for Japanese businesses in the People’s Republic.Between the eagle and the dragon

Then there is the spectre of Sino-American rivalry. Japanese firms have long benefited from geopolitical proximity to America and geographical closeness to China. The two are the most important markets for many Japanese companies, whose supply chains criss-cross both. As the superpowers jostle over everything from trade to technology, this blessing looks ever more like a curse. Because Japan’s firms are more exposed to China than American ones are—China is Japan’s largest trading partner—they would find it harder to give up on the Chinese market. It would be “a nightmare” to have to choose between Japan’s biggest neighbour and its chief strategic ally, says Ichiro Hara of Keidanren, a Japanese business lobby. As geopolitics impinges on globalised commerce, the choice may become inevitable.■https://www.economist.com/business/2019/11/09/japan-inc-has-thrived-in-china-of-late

-

Get ready for two decades of a US-China trade war and the peak of globalization, Jack Ma, the co-founder and former chairman of Alibaba Group, told Bloomberg TV Thursday evening in an exclusive interview.

Ma warned that Sino-American relations could experience 20-years of "turbulence" if trade disputes aren't solved in a timely fashion.

"We have to be very, very careful," Ma said. "We have to solve problems, and we should not create more problems."

Ma is still idealist, thing is not about "solving problems" thing is in the fundamental conflicting interests.

-

Mood is Beijing about trade deal is pessimistic, government source tells me. China troubled after Trump said no tariff rollback. (China thought both had agreed in principle.) Strategy now to talk but wait due to impeachment, US election. Also prioritize China economic support.

If Trump gets wind of the fact that China is ignoring him, or even has the perception Beijing is working against him politically, it must surely raise the risk of higher US tariffs -at least on 15 December -rather than the risk-on imminent decrease so many have said so loudly for oh-so long.

-

The Federal Communications Commission (FCC) has voted 5-0 on a new rule that would ban service providers from using government subsidies to buy China's Huawei and ZTE equipment.

Clear sign of nearby agreement :-)

-

Chinese bosses are close to make fatal errors

China said on Sunday it would seek to improve protections for intellectual property rights, including raising the upper limits for compensation for rights infringements.

An opinion document released by the State Council and Communist Party’s Central Office on Sunday evening called for a strengthening of protections through both the civil and criminal justice systems and an effective enforcement of penalties.

The document said that by 2022, China should be making progress in issues that have affected intellectual property rights enforcement, such as low compensation, high costs, and the difficulty of proof. By 2025, there should be a better system of protection in place.

Proper way to make NO system and NO protection for any "intellectual property rights" right now.

But having real capitalist corporations make such already impossible without blood.

-

US vows 100% tariffs on French Champagne, cheese, handbags over digital tax

The US Trade Representative’s office said its “Section 301” investigation found that the French tax was “inconsistent with prevailing principles of international tax policy, and is unusually burdensome for affected US companies,” including Alphabet Inc’s Google, Facebook Inc, Apple Inc and Amazon.com Inc.

US Trade Representative Robert Lighthizer said the government was exploring whether to open similar investigations into the digital services taxes of Austria, Italy and Turkey.

“The USTR is focused on countering the growing protectionism of EU member states, which unfairly targets US companies,” Lighthizer said. His statement made no mention of proposed digital taxes in Canada or Britain.

Improvements all around.

-

After Dec. 10, one of the most important parts of the World Trade Organization will cease to function. The Appellate Body, you can think of it as a supreme court of trade, will effectively be no more.

As its members’ terms have expired, the Trump administration has blocked the vacancies from being filled (all member countries have this kind of veto power). After Dec. 10, when two “judges’” terms expire, there will be just one left out of an original seven. Under the rules, that’s not enough members.

The Appellate Body is the highest trade court on the planet, where cases from lower down in the WTO are appealed. Once it’s out of the picture, there will be no final say when one country sues another.

-

China's administration has ordered all government offices and public institutions to remove foreign computer equipment and software within three years.

Clearly it must be all resolved happily soon, as Trump says, he can't lie.

-

"China talks are going very well" - Trump, 12/7/18

"We're getting into the final laps" - Mnuchin, 4/29/19

"We are coming down to the short strokes" - Kudlow, 11/15/19

New shit

"Getting VERY close to a BIG DEAL" - Trump, 12/12/19

-

President Donald Trump signed off on a phase-one trade deal with China, averting the Dec. 15 introduction of a new wave of U.S. tariffs on about $160 billion of consumer goods from the Asian nation, according to people familiar with the matter.

An announcement is expected Friday Washington time, according to people familiar with the plans.

-

The United States and China have reached an historic and enforceable agreement on a Phase One trade deal that requires structural reforms and other changes to China’s economic and trade regime in the areas of intellectual property, technology transfer, agriculture, financial services, and currency and foreign exchange. The Phase One agreement also includes a commitment by China that it will make substantial additional purchases of U.S. goods and services in the coming years. Importantly, the agreement establishes a strong dispute resolution system that ensures prompt and effective implementation and enforcement. The United States has agreed to modify its Section 301 tariff actions in a significant way.

“President Trump has focused on concluding a Phase One agreement that achieves meaningful, fully-enforceable structural changes and begins rebalancing the U.S.-China trade relationship. This unprecedented agreement accomplishes those very significant goals and would not have been possible without the President’s strong leadership,” said United States Trade Representative Robert Lighthizer.

“Today’s announcement of a Phase One agreement with China is another significant step forward in advancing President Trump’s economic agenda. Thanks to the President’s leadership, this landmark agreement marks critical progress toward a more balanced trade relationship and a more level playing field for American workers and companies,” said Secretary of the Treasury Steven Mnuchin.

The United States first imposed tariffs on imports from China based on the findings of the Section 301 investigation on China’s acts, policies, and practices related to technology transfer, intellectual property, and innovation. The United States will be maintaining 25 percent tariffs on approximately $250 billion of Chinese imports, along with 7.5 percent tariffs on approximately $120 billion of Chinese imports.

New thing - secret private deal for Chinese obligations, but public for US ones.

-

As China’s dictator Xi Jinping has consolidated his power and sought to expand China’s global influence, the Trump administration has struggled to articulate clear U.S. policy towards a non-democratic country that it trades heavily with but sees as a long-term military threat.

America’s response to threats from Beijing has become a growing concern among national security community that has spilled into mainstream headlines, from Hong Kong protests to high-profile anti-China statements from NBA and Premier League superstars. Three of the seven candidates on stage for the primary debate argued that the United States needs to resist President Donald Trump’s inclination to deal with foreign policy disputes bilaterally and form an international coalition to address China’s military, technology, and economic rise.

-

According to reports out of Taiwan, the US plans to lower the standard of “derived from American technology” from 25% to 10% to block non-US companies such as TSMC from supplying to Huawei.

It is clear sign of improvements in relations.

-

China will reduce import tariffs on 859 items from 1 January. Tariff changes would be made to "increase imports of products facing a relative domestic shortage, or foreign speciality goods for everyday consumption".

China now has lot of issues from energy shortages to shortages in many items, including pork.

-

Trade War = Real War?

( Iraqi Prime Minister ) Abdul-Mehdi spoke angrily about how the Americans had ruined the country and now refused to complete infrastructure and electricity grid projects unless they were promised 50% of oil revenues, which Abdul-Mehdi refused.This is why I visited China and signed an important agreement with them to undertake the construction instead. Upon my return, Trump called me to ask me to reject this agreement. When I refused, he threatened to unleash huge demonstrations against me that would end my premiership.Huge demonstrations against me duly materialized and Trump called again to threaten that if I did not comply with his demands, then he would have Marine snipers on tall buildings target protesters and security personnel alike in order to pressure me.I refused again and handed in my resignation. To this day the Americans insist on us rescinding our deal with the Chinese.After this, when our Minister of Defense publicly stated that a third party was targeting both protestors and security personnel alike (just as Trump had threatened he would do), I received a new call from Trump threatening to kill both me and the Minister of Defense if we kept on talking about this “third party”.

When the words of the Iraqi prime minister are linked back to the geopolitical and energy agreements in the region, then the worrying picture starts to emerge of a desperate U.S. lashing out at a world turning its back on a unipolar world order in favor of the emerging multipolar about which I have long written.The US, now considering itself a net energy exporter as a result of the shale-oil revolution (on which the jury is still out), no longer needs to import oil from the Middle East. However, this does not mean that oil can now be traded in any other currency other than the U.S. dollar.The petrodollar is what ensures that the U.S. dollar retains its status as the global reserve currency, granting the U.S. a monopolistic position from which it derives enormous benefits from playing the role of regional hegemon.This privileged position of holding the global reserve currency also ensures that the U.S. can easily fund its war machine by virtue of the fact that much of the world is obliged to buy its treasury bonds that it is simply able to conjure out of thin air. To threaten this comfortable arrangement is to threaten Washington’s global power.Even so, the geopolitical and economic trend is inexorably towards a multipolar world order, with China increasingly playing a leading role, especially in the Middle East and South America.https://www.strategic-culture.org/news/2020/01/06/a-terrorist-attack-against-eurasian-integration/

-

Trade War = Real War?

First of all, a strike against Iran is equivalent to an attempt to sever a “petrol hose” linking it to China. After all, not everyone is fully aware of what the situation is actually like. China has invested $280 billion into Iran’s oil and gas industry and, in exchange, it will not pay for oil deliveries in U.S. dollars but instead in Yuan or soft currencies earned by doing business in Africa or in nations that were once part of the Soviet Union. The PRC will be able to purchase oil, gas and petrochemicals at a guaranteed discount of at least 12%, and to also take advantage of an up to 2-year grace period. In addition, China will have the right of first refusal in relation to any new or renewed projects in Iran’s oil and gas or petrochemical sectors. Chinese companies will be able to deploy approximately 5,000 of their own security personnel in Iran in order to protect investments there, as well as additional staff to ensure oil delivery lines (including those in the Persian Gulf) are secure.https://journal-neo.org/2020/01/12/usa-s-short-term-goal-iran-and-long-term-one-china/

-

The Trump administration is considering 100% tariffs on French goods, including wine and champagne, in response to the country’s planned digital services tax, reported Reuters.

EU and US relations are clearly improving.

-

The ongoing trade war between the US and China has been a hallmark of the Trump presidency. It has rocked the world’s two largest economies and there is no end in sight. It has involved billions of dollars in tariffs and accusations of currency manipulation and intellectual property theft. It has thrown telecommunications giant Huawei, its cutting edge 5G projects and its relationship with the Chinese government into the global spotlight. RT America’s Sara Montes de Oca traveled to China to explore new perspectives on the topic and now hosts a special report, with help from fellow correspondents Rachel Blevins and Natasha Sweatte.

-

During the two-year period from January 1, 2020 through December 31, 2021, China shall ensure that purchases and imports into China from the U.S. of the manufactured goods, agricultural goods, energy products, and services identified in Annex 6.1 exceed the corresponding 2017 baseline amount by no less than $200 billion.

The Parties affirm the importance of ensuring that the transfer of technology occurs on voluntary, market-based terms and recognize that forced technology transfer is a significant concern. The Parties further recognize the importance of undertaking steps to address these issues, in light of the profound impact of technology and technological change on the world economy.

The U.S. recognizes the importance of intellectual property protection. China recognizes the importance of establishing and implementing a comprehensive legal system of intellectual property protection and enforcement as it transforms from a major intellectual property consumer to a major intellectual property producer. China believes that enhancing intellectual property protection and enforcement is in the interest of building an innovative country, growing innovation-driven enterprises, and promoting high quality economic growth.

-

Reuters is reporting that the Trump administration is nearing publication of a rule that would expand its ability to block shipments of foreign-made goods to Huawei and other blacklisted Chinese companies.

Commerce Department has been discussing whether it should increase the De minimis Rule, which dictates how much U.S. content in a foreign-made product gives the U.S. government authority to regulate an export. The current rule can block the sale of products to Huawei if there are more than 25% of U.S. components in the good. The new rule will lower the threshold to 10% and significantly expand the list of foreign goods that the Trump administration can block.

Seems like US want to increase intensity of Huawei lovemaking...

-

The Trump administration mounted an extensive campaign to block the sale of Dutch chip manufacturing technology to China, with Secretary of State Mike Pompeo lobbying the Netherlands government and White House officials sharing a classified intelligence report with the country’s Prime Minister.

The pressure appears to have worked. Shortly after the White House visit, the Dutch government decided not to renew ASML’s export license, and the $150 million machine has not been shipped.

and

Trade relations between China and the Netherlands would be damaged if Dutch semiconductor equipment supplier ASML (ASML.AS) is not allowed to ship its newest machines to China, Beijing’s ambassador to the Netherlands was quoted.

Clearly it is full peace.

Despite that block of ASML (they are artificially made total monopoly in advanced chips production machines!) supplies will make tens of billions damages even in 2020 alone.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List24,042

- Blog5,725

- General and News1,377

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,384

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras132

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,330