Xinhua: After historic downgrade, U.S. must address its chronic debt problems

-

The days when the debt-ridden Uncle Sam could leisurely squander unlimited overseas borrowing appeared to be numbered as its triple A-credit rating was slashed by Standard & Poor's (S&P) for the first time on Friday.

Though the U.S. Treasury promptly challenged the unprecedented downgrade, many outside the United States believe the credit rating cut is an overdue bill that America has to pay for its own debt addition and the short-sighted political wrangling in Washington.

Dagong Global, a fledgling Chinese rating agency, degraded the U.S. treasury bonds late last year, yet its move was met then with a sense of arrogance and cynicism from some Western commentators. Now S&P has proved what its Chinese counterpart has done is nothing but telling the global investors the ugly truth.

China, the largest creditor of the world's sole superpower, has every right now to demand the United States to address its structural debt problems and ensure the safety of China's dollar assets.

To cure its addiction to debts, the United States has to reestablish the common sense principle that one should live within its means.

S&P has already indicated that more credit downgrades may still follow. Thus, if no substantial cuts were made to the U.S. gigantic military expenditure and bloated social welfare costs, the downgrade would prove to be only a prelude to more devastating credit rating cuts, which will further roil the global financial markets all along the way.

Moreover, the spluttering world economic recovery would be very likely to be undermined and fresh rounds of financial turmoil could come back to haunt us all.

The U.S. government has to come to terms with the painful fact that the good old days when it could just borrow its way out of messes of its own making are finally gone.

It should also stop its old practice of letting its domestic electoral politics take the global economy hostage and rely on the deep pockets of major surplus countries to make up for its perennial deficits.

A little self-discipline would not be too uncomfortable for the United States, the world's largest economy and issuer of international reserve currency, to bear.

Though chances for a full-blown U.S. default are still slim now, the S&P downgrade serves as another warning shot about the long-term sustainability of the U.S. government finances.

International supervision over the issue of U.S. dollars should be introduced and a new, stable and secured global reserve currency may also be an option to avert a catastrophe caused by any single country.

For centuries, it was the exuberant energy and innovation that has sustained America's role in the world and maintained investors' confidence in dollar assets. But now, mounting debts and ridiculous political wrestling in Washington have damaged America's image abroad.

All Americans, both beltway politicians and those on Main Street, have to do some serious soul-searching to bring their country back from a potential financial abyss.

From: http://news.xinhuanet.com/english2010/indepth/2011-08/06/c_131032986.htm -

JEFFREY TOOBIN, CNN SENIOR LEGAL ANALYST: Well, I think it's also important to recognize that Standard & Poor's is not the voice of God here. Standard & Poor's itself had an appalling record during the -- what led to the financial collapse of 2008. They were the ones who were giving clean bill of health to all these investment banks and banks that had invested in these horrible mortgage-backed securities. So the idea that they have perfect insight into who is sound and who is not is simply incorrect. As for what this will mean, I mean, obviously, it will be a political football. I don't think most voters have heard of this issue. I don't think most voters care. Most voters care about what they see in the real world, unemployment, whether houses are selling, whether the economy is moving. I think this is likely to be a big sideshow.

-

@brianluce

And?

May be ride S&P offices as Italy did recently?

They must be blamed for all the problems.

And China of course. Because it urged the United States to cut military and social welfare expenditure.

This is one of US habits - blame and then nuke motherfuckers who gave money and resources to US. -

The article points out the S&P's credibility issues, not to mention the two trillion dollar accounting error in the downgrade. And the SP does have culpability in all this since their corrupt and incompetent rating system backed the junk paper that caused the financial crisis. S&P isn't some objective, no-horse-in-the-game oracle that sits on the sideline and makes thoughtful and fairminded judgements. That's not their record as of late. The political consequences or the downgrade are murky as well since it's an esoteric subject. The economists I've listened to cannot agree on the real world consequences of the downgrade, some say a blip, some say Debtageddon. Too early for obituaries.

And I haven't heard one person in the USA blame China for the downgrade. Pure hyperbole. -

>The article points out the S&P's credibility issues,

I see.

For me it looks like alhogolic who blame his wife for making too loud sound because his head can't take it. :-)

And pointing out that last year she weared not so good dress.

>And I haven't heard one person in the USA blame China for the downgrade. Pure hyperbole.

No one said about blame for downgrade specifically.

But Chine will be blamed for upcoming problems soon.

Like rising inflation, cuts in medical sector and rising unemployment. -

"International supervision over the issue of U.S. dollars should be introduced"---LOL - yeah, don't hold your breath on that one. This is interesting advice from a country that artificially pegged it's currency to the dollar to keep it weak for years and told anyone who complained it was a domestic decision and no one else's business.

China has a right to be fearful, their economy is built partly on an articially weak currency and substantially on the US and Europe having a penchant for cheap consumer goods. The risk (for now at least) of the US not paying back debt is low, but if the US and European economies tank further and people stop consuming China can kiss their enviable growth rate goodbye...

And I don't understand this passage "This is one of US habits.. ..who gave money and resources to the US" - sorry, a loan is not a gift, and countries invest in US debt as a (relatively) safe bet for a fair return and they wll continue to do so until they feel otherwise. You seem to have quite an axe to grind against the US. -

>This is interesting advice from a country that artificially pegged it's currency to the dollar to keep it weak for years and told anyone who complained it was a domestic decision and no one else's business.

Chinese advice is good, really.

And where you got this bullshit that China can't hold artifical exchange rate?

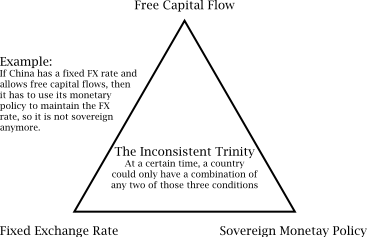

Look at the picture below:

As you can see, real debate is not about exchange rate (as China has all the rights to do so controlling capital flow).

Real debate is about free capital flow, or in other words, to allow world bank system not only to give some limited credits but to move inside and control key areas of Chinese economy.

>The risk (for now at least) of the US not paying back debt is low, but if the US and European economies tank further and people stop consuming China can kiss their enviable growth rate goodbye...

It is common myth. Made for average Joe so he could feel better.

China is doing the only right thing it can do.

They are using knowledge and resources of US and EU economies to their advantegr, to build modern economy.

Most people do not live in US or EU.

And this part is quickly moving away from dollar.

I constantly see local news about rising percentage of direct ruble/yuan contracts.

All contracts in upcoming few years are planned to move to using local currencies.

Same is happening is Africa, Asia and South America.

>And I don't understand this passage "This is one of US habits.. ..who gave money and resources to the US" - sorry, a loan is not a gift, and countries invest in US debt as a (relatively) safe bet for a fair return and they wll continue to do so until they feel otherwise.

If you look at FED reports you'll see that you are far from reality.

US is already in such a state that slight cut in FED interventions in bond sales will lead to bond market collapse.

Impossible_trinity.png367 x 237 - 26K

Impossible_trinity.png367 x 237 - 26K -

China has PLENTY of problems brewing itself. Talk about a bubble. And it's such a bad joke for them to take pop shots like this. Where the hell else are they going to park their cash? If you have an alternative, move your money there. But YOU DON'T or you would (China, that is), so shut the hell up and be glad you've got a relatively open marketplace where you can park your intentionally undervalued Yuan.

Everybody enjoys seeing the US in a pickle. Fine. But for the love of god, people, take a look at your own governments/nations too. -

@TempTag. V's 'Axe to grind with the US' is quite clear, and makes these conversations much less interesting or helpful than they might otherwise be. And, in fact, takes away much from what is otherwise a remarkable site, a remarkable collaboration of ideas.

But... whatever. We love you for what you've done for us personally, Vitaliy, the hatin' notwithstanding. -

@cosimo_bullo

I don't know why we need so big amount of emotions not backed up by even single fact.

In fact, I am expecting Chinese officials agencies to start talking in much worse terms.

>V's 'Axe to grind with the US' is quite clear, and makes these conversations much less interesting or helpful than they might otherwise be.

So, you expect me to say how good and prosperious will be economic future of US?

To make conversation more interesting.

Fuck the facts, we are for interesting, easy life.

I see. -

I never said China "can't hold an artificial exchange rate" in fact they can and they did. I was merely pointing out the hypocrisy of having that position and suggesting the US submit to international supervision towards the issuing of dollars.

Russia and China signed an aggreement to trade in local currencies (plenty of countries do it) and it sure makes sense for both countries. Agreements like this certainly suggest a potential to move away from the dollar as a reserve currency but your contention that US and EU consumers are not important to China ("myth" I think you call it) is not rooted in reality. Sure "most people do not live in the US or EU" but trade with the US and EU account for 5 of China's top 10 export destinations.

No one in the US needs to be told our economy is bad, we see it and are living it. The articles out of China and much of the non-hack tone of this blog are simply gamesmanship politics and schadenfreude...

-

I don't give a rat's arse what stupidity the greedy, self indulgent political/economic buffoons in the USA get up to...BUT the problem is their incompetence caused GFC #1 and now #2...maybe...which then buggers up retirement superannuation investment returns here in Australia (where we know how to run our own economy).

-

Easy to blame this nation state or that while the corporations are taking over the world. Governments should be of the people for the people but such is not the case these days. Easy to see our political overlords hitting the revolving door into the board room when we fire their ass for being the capitalists that we know they are. The fact that their worldview and economic system sucks is just becoming ever more apparent.

Start New Topic

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,976

- Blog5,724

- General and News1,351

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,361

- ↳ Panasonic991

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319

Tags in Topic

- economics 319