It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Previous report - http://www.personal-view.com/talks/discussion/9536/camera-sales-including-december-2013-reports#Item_2

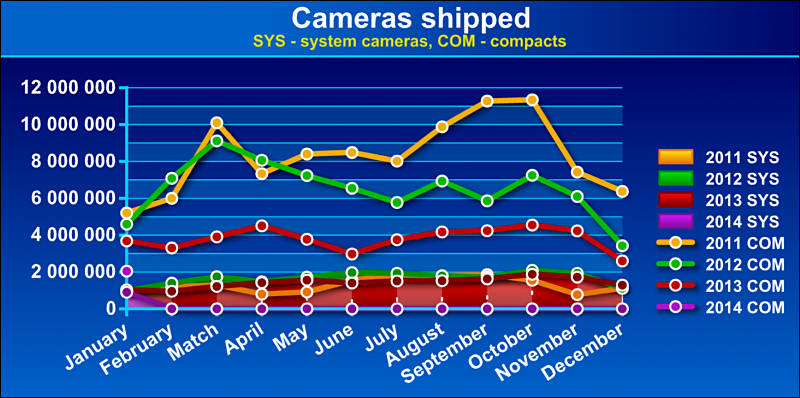

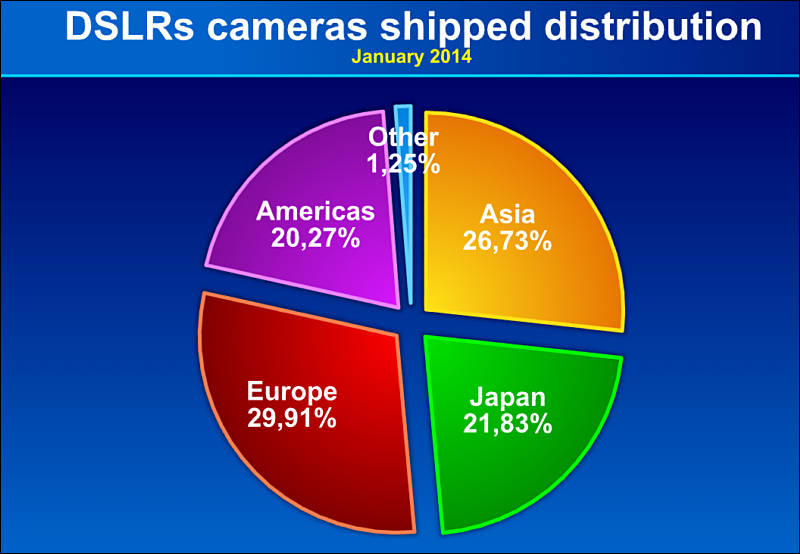

sales.jpg800 x 398 - 89K

sales.jpg800 x 398 - 89K

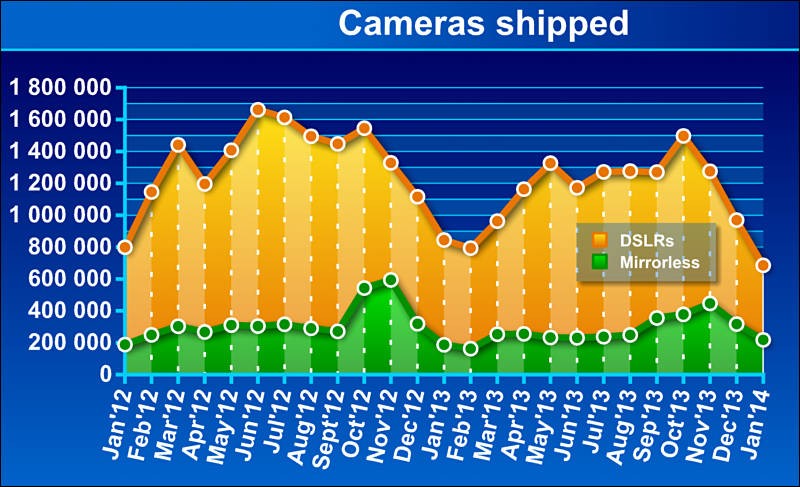

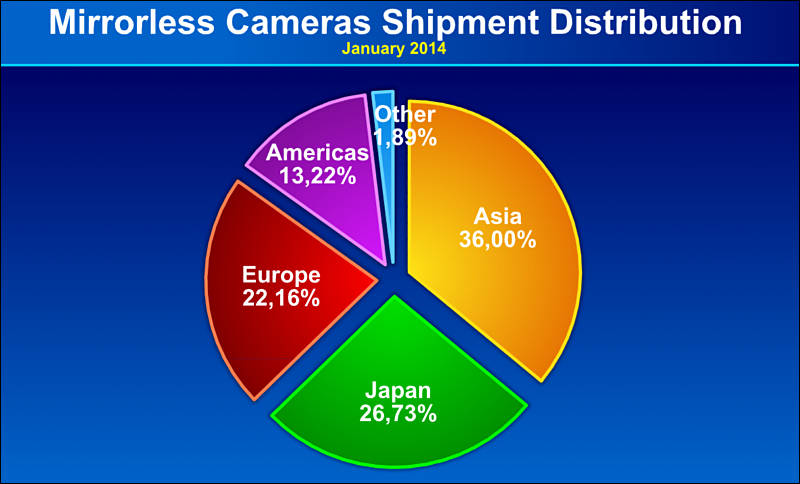

sales1.jpg800 x 487 - 108K

sales1.jpg800 x 487 - 108K

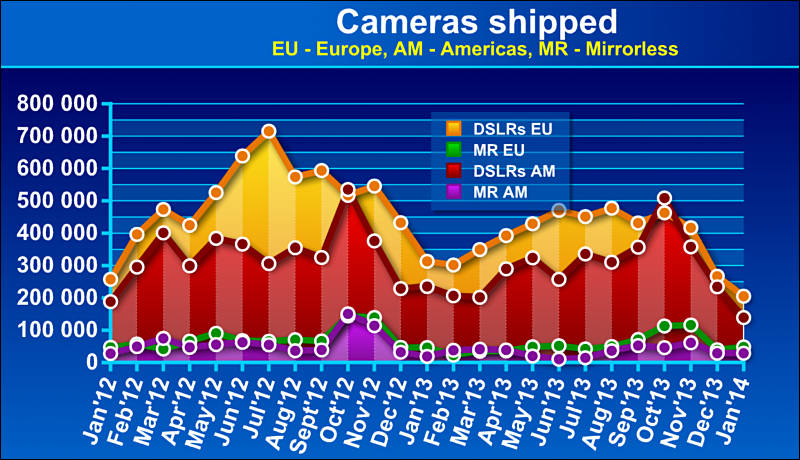

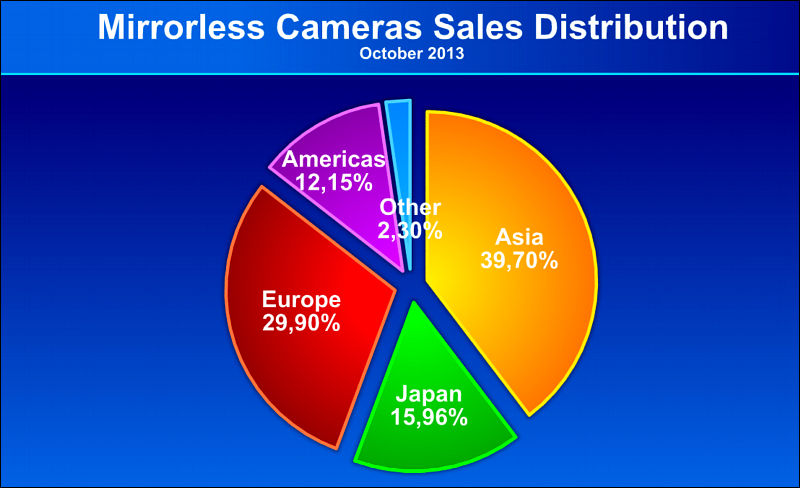

sales2.jpg800 x 460 - 112K

sales2.jpg800 x 460 - 112K -

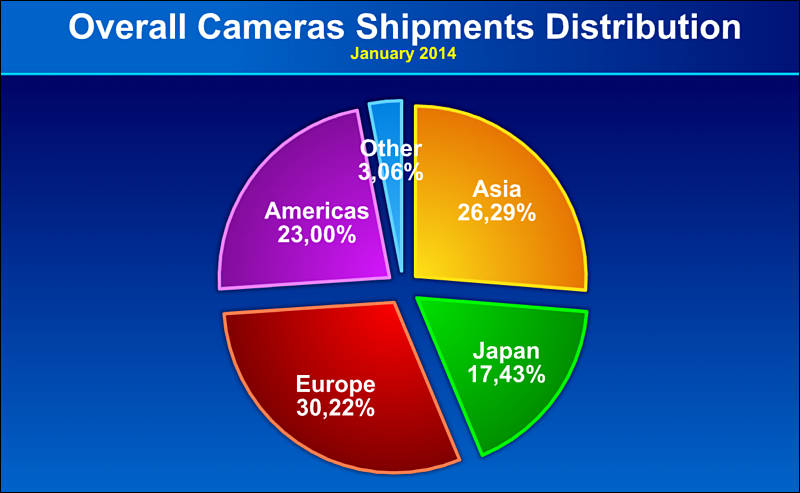

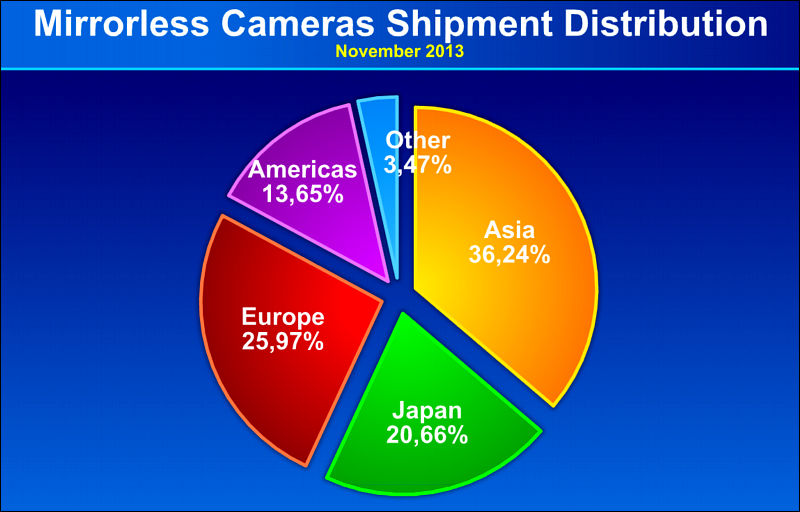

sales3.jpg800 x 493 - 57K

sales3.jpg800 x 493 - 57K

sales4.jpg800 x 554 - 61K

sales4.jpg800 x 554 - 61K

sales5.jpg800 x 484 - 58K

sales5.jpg800 x 484 - 58K -

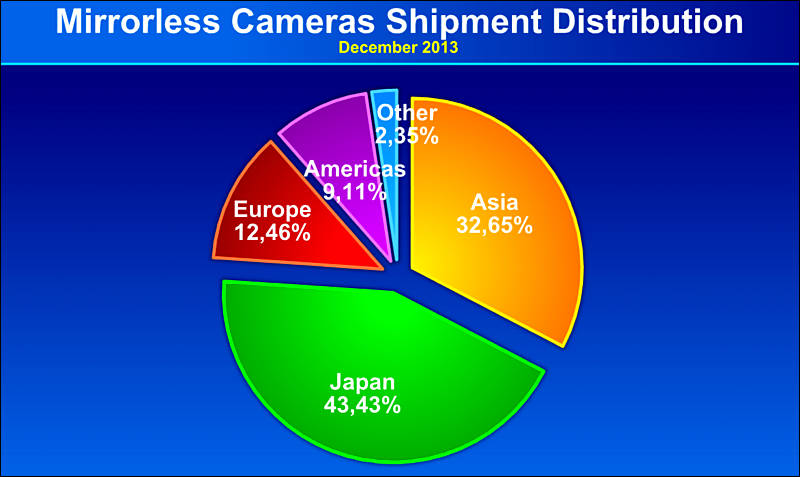

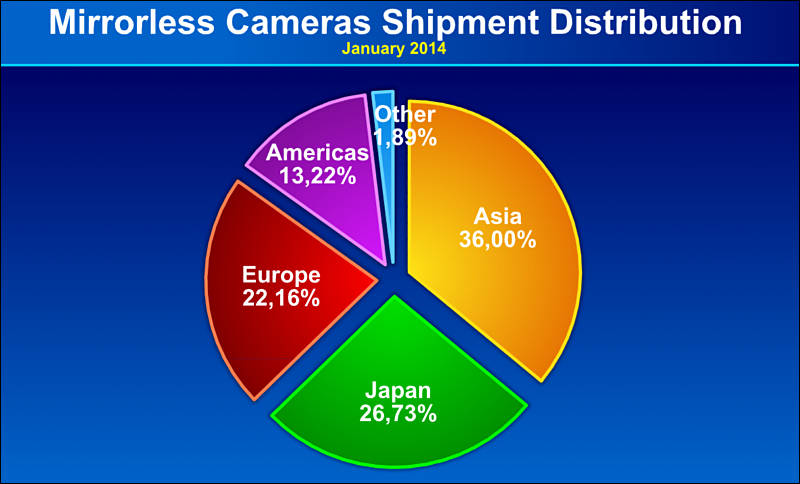

Mirrorless distribution history

-

What should concern them is not what the graph below shows. What this graph doesn't show is what should concern them. If those sales don't start to come back in March, April, and May like they have done in the past the manufacturers will be in trouble.

-

What this graph doesn't show is what should concern them. If those sales don't start to come back in March, April, and May like they have done in the past the manufacturers will be in trouble.

It'll start to rise, but it still won't be very good news. Issues are fundamental and visible on most markets now.

-

The fast zooms slated to come out this year from Olympus and Fuji finally have some of my buddies taking a more serious look at mirrorless. One told me he thinks his 7D looks cool sitting on a shelf (trophy gear) but he hates loading his pack and going out to shoot with the heavy zooms he normally uses because "its just not worth the trouble." That's not a very scientific indication of impending sales shift, but I hear this more often now from buddies who envy the smaller kit I work with when we go out street shooting - and these are the same friends that were too stubborn to even pick one up for a test fire two years ago (ewww an EVF!!).

-

Its the end of photography as we know it, and I feel fine... I forget who said it, but with technology, convenience always wins over quality. At least that was the case with audio, but it seems we're rapidly heading there with imaging. Soon everyone could be shooting with 36mp 4K cameras but whats the point if most everything is viewed on 4 inch screens. Yes, "let the markets decide" as if they run independently from human consumption habits.

-

According to those figures, 90% of all people who own mirrorless or DSLR cameras own only one lens, i.e. use the kit lens. Most probably, they only shoot JPEG, not raw (and most likely, just in auto mode). That means that they hardly getting any benefit out of their cameras in comparison to a point-and-shoot or good smartphone camera. It also means that they bought their expensive cameras only because of advertising having created false needs. The market correction will likely be as drastic as that for HiFi components (which everybody in Western countries bought for lots of money in the 70s and 80s, and which you can now buy second hand for a few bucks) in the past.

-

The market correction will likely be as drastic as that for HiFi components (which everybody in Western countries bought for lots of money in the 70s and 80s, and which you can now buy second hand for a few bucks) in the past.

Thing is that it is first necessary to understand that Hi-Fi sales volumes were people time related thing. People just had their free time spend on other things later :-)

And no, Hi-Fi can't be bough second hand for few bucks until it is non functional or damaged crap.

If someone shoot jpeg in auto mode and do it using best possible cameras it does not speak anything bad, really. As whole cameras progress was to save people time and improve result quality for masses. If think that pushing all people to shooting raw in manual mode and spending time processing results will result in some massive improvements, you are badly wrong. Most probably it'll be all in reverse.

-

There were 770,000-840,000 digital cameras sold in the Taiwan market in 2013, consisting of 500,000-550,000 consumer units (non-interchangeable-lens models, decreasing 35-40% on year), 130,000-140,000 DSLR units and 140,000-150,000 mirrorless interchangeable-lens camera (MILC) units, according to local retail channels.

In 2014, sales of consumer models will shrink to 400,000-450,000 units while DSLR and MILC models combined will roughly remain at 280,000-290,000 units, the sources said.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,970

- Blog5,724

- General and News1,346

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras117

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319

Tags in Topic

- sales 40