It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

New report out this week from Coresight Research estimates 25% of America’s roughly 1,000 malls will close over the next three to five years, with the pandemic accelerating a demise that was already underway before the new virus emerged.

The malls most at risk of going dark are classified as so-called B-, C- and D-rated malls, meaning they bring in fewer sales per square foot than an A mall. An A++ mall could bring in as much as $1,000 in sales per square foot, for example, while a C+ mall does about $320.

-

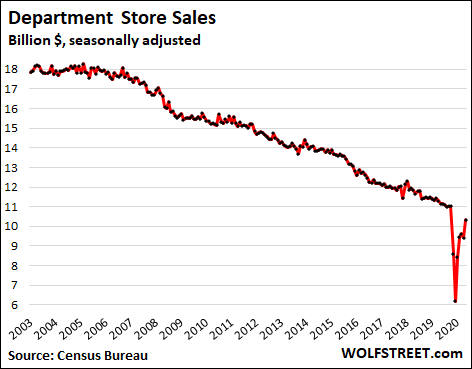

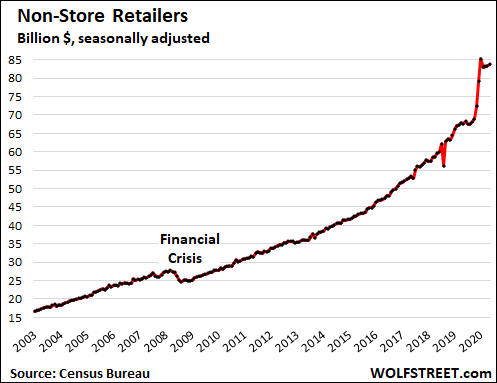

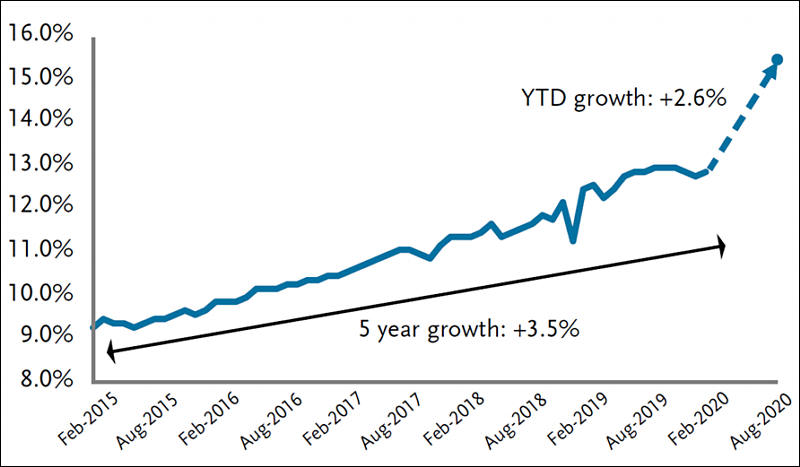

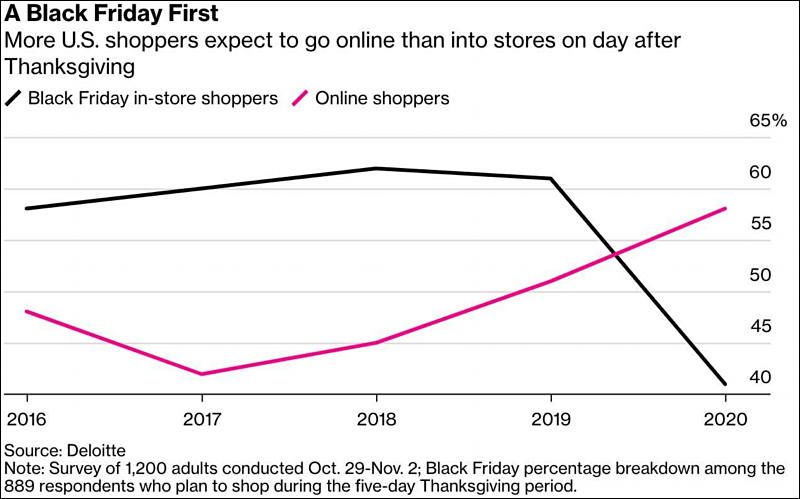

Retail and logistics analysts say the unprecedented level of digital commerce has pulled forward 10 years of expected growth in the span of six months.

The current gap between demand and supply is about 2.6 million packages a day, for a seven-day week, which will rise to 7.2 million during the upcoming peak season, according to data from Pittsburgh-based ShipMatrix.

And in next 6 months it can make another 10 years!

-

Eight months into the pandemic, clothing stores, restaurants, gyms and other businesses find themselves in a $52 billion hole.

That’s the total amount of retail rent that’s been missed since April, according to CoStar Group Inc. While some of the overhang has since been paid back, the remainder will be a drag on merchants as they try to rebuild and landlords demand their money. In some cases, the unpaid balances could drive them into bankruptcy.

“You’re going to have big bubbles that are going to be hitting next year or even in the fourth quarter,” said Andy Graiser, co-president of A&G Real Estate Partners, an advisory firm. “I’m not sure if they are going to be able to make those payments in addition to their existing rent.”

Overdue rent compounds the problems these companies have faced this year, including lost sales during shutdowns, consumers’ reluctance to return to stores and restaurants and the long-running migration of shoppers from brick-and-mortar locations to online venues.

Signet Jewelers Ltd., for one, deferred about $78 million of its rent payments, according to a September quarterly filing. In its most recent quarterly filing, Bed Bath & Beyond Inc. said it’s held back $50.6 million in rent payments and is in negotiations with landlords, while Francesca’s Holdings Corp. has said it owed $14.6 million in deferred rents and related costs as of Aug. 1. The women’s clothing chain has since said it plans to shutter about 140 locations by the end of January and that it’s in danger of financial collapse.

Red Robin Gourmet Burgers Inc., meanwhile, said that it’s received default notices from some landlords after it stopped making full payments in April. Chief Financial Officer Lynn Schweinfurth told investors on a Nov. 5 call that the restaurant chain had negotiated amendments for about half of its leases by the end of its third quarter and continues in talks for the rest.

Many of these unpaid bills won’t go away, but are instead being pushed into next year. Signet said it plans to pay back its overdue rent by the middle of next year, while Francesca’s plans to repay the amount over the course of next year, it said in a quarterly filing in September, and is asking landlords for more concessions.

-

Guitar Center going down

Guitar Center Inc, the largest US retailer of music instruments and equipment, announced Saturday that it has filed for Chapter 11 bankruptcy.

The Company has secured new financing to implement its bankruptcy plan, which they say “will deleverage the Company’s balance sheet, enhance financial flexibility and provide additional liquidity to continue to support its vendors, suppliers, and employees.”

The plan is intended to allow Guitar Center and its related brands (including Music & Arts, Musician’s Friend, Woodwind Brasswind and AVDG) to continue to operate as normal while the transaction is implemented. Guitar Center says it will continue to meet its financial obligations to vendors, suppliers, and employees, and make payments in full to these parties, without interruption in the ordinary course of business.

-

All existing Fry’s brick and mortar stores have closed. Tuesday night was the last day they were open. This was leaked to the interwebs by Fry’s employees. An official announcement is also already available…

Fry’s website will also go offline soon.

-

UBS analyst Michael Lasser told this week that more than 80,000 retail stores are estimated to close in the next five years as the virus pandemic has deeply scarred the economy and resulted in a permanent shift in how consumers shop, that is, online.

"An enduring legacy of the pandemic is that online penetration rose sharply," wrote Lasser.

"We expect that it will continue to increase, which will drive further rationalization of retail stores, especially as some of the unique support measures from the government subside," he said.

-

UK retail is also in bad shape

The UK retail sector will experience a closure tsunami unless the government extends its aggressive debt collection moratorium, the British Retail Consortium (BRC) said yesterday. Citing survey data, an industry lobbying group said that two-thirds of UK retailers have been informed by landlords that they will be subject to legal foreclosures from July 1, when the moratorium ends. unpaid rent.

If action is not taken, the end of the moratorium could lead to the closure of thousands of stores, said BRC chief executive Helen Dickinson. She called on the UK government to allow the rent arrears accumulated during the pandemic to be closed and to extend the moratorium on rent payments until the end of the year.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320