It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

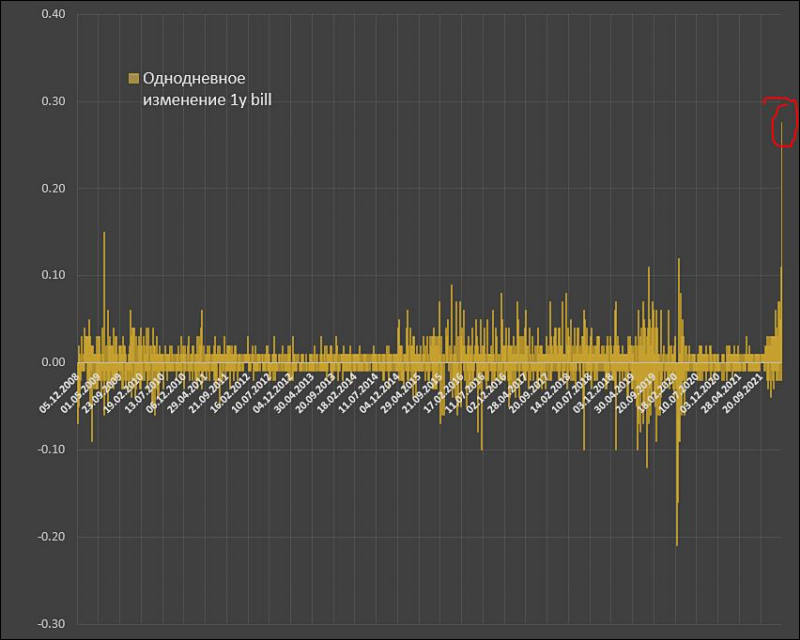

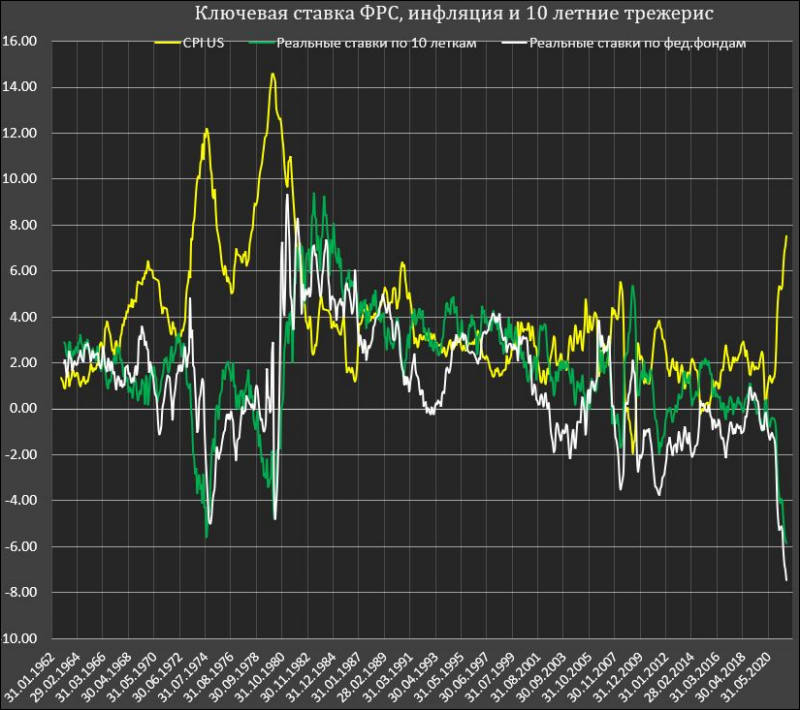

A one-percentage-point rise in interest rates – which is likely to happen this year – would boost the amount of money paid on interest on the federal government debt to $530 billion.

And a two-percentage-point increase – entirely possible by 2023, under current projections – would raise it to $750 billion. That's about as much as all government spending on defense. And it's completely unsustainable.

Three percentage points higher, and the government would be spending nearly $1 trillion on interest expense alone... which is around 20% of total federal tax revenue and is approximately as much as what's spent on Social Security benefits every year.

At this point, no one is talking about interest rates at the 3% level. But it's hardly otherworldly: As recently as 2008, interest rates were at 4%.

If you're doing the math, it's clear... The numbers don't add up.

The Federal Reserve could, in theory, print as many dollars as the government needs to make its interest payments. But Uncle Sam having to bail itself out will likely lead right back to – you guessed it – more inflation.

Or, the government could put in place a cataclysmic tax hike... also known as "political suicide," which seems unlikely.

Another alternative is to cut spending. But there's not a lot of wiggle room... If we subtract "mandatory spending" and defense spending, there's only 20% of the budget left. That 20% left to pay for, well, everything else.

https://www.zerohedge.com/news/2022-01-21/fed-lying-interest-rates-cant-go-much-higher

-

The US Federal Reserve announced that it will continue to reduce the purchase of bonds from the market and will complete their purchase in early March. This is stated in a statement following the first meeting of the Federal Open Market Committee (FOMC) in 2022, which was held on January 25-26. In addition, the Fed decided to leave the base rate unchanged at 0-0.25%.

“Given inflation well above 2% and a strong labor market, the Committee expects that it will soon be appropriate to raise the target rate band,” the statement said.

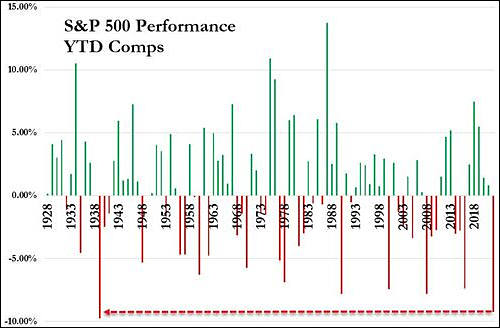

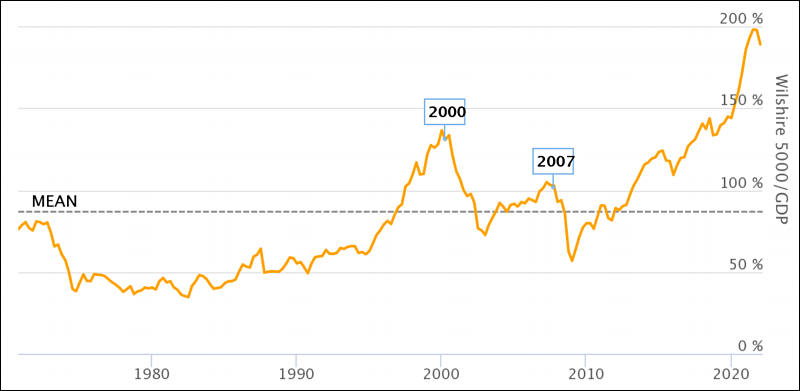

They can't rise rate, just can't due to debt issues and stock market huge bubble.

-

To understand the catastrophic situation more textured, there are now 45 trillion non-financial sector market debt in bonds in the United States (24.3 trillion treasuries, 4 trillion municipal bonds, 6.7 trillion corporations, 10.5 trillion agency papers) and 28.3 trillion in loans (6.4 trillion corporate loans, 4.4 trillion consumer loans and the rest are mortgages, of which 12.3 trillion for the population). A total of 73.3 trillion of debt in bonds and loans for the non-financial sector, approximately 15% of which is refinanced annually, including for scheduled repayments of obligations, i.e. about 11 trillion a year is refinanced. A 1% rate hike costs more than $110 billion in additional service costs. This does not take into account the new debt, which under normal conditions grows by 3-3.5 trillion a year, therefore already under 150 billion and only for one percentage point.

The problem is that you can't get off with one percentage point.

It is huge issues.

-

Moments ago, the NY Fed announced that "due to technical difficulties, today’s Treasury outright purchase operation - scheduled for 10:10 AM - will be rescheduled. It is now scheduled to take place Friday, February 25, 2022 at 10:10 AM. Additionally, today’s MBS outright purchase operations – scheduled for 10:00 AM and 11:30 AM - will also be rescheduled to Friday, February 25th, 2022 and Monday, February 28th, 2022 respectively. Information on Treasury securities operations and MBS purchase operations can be found on the New York Fed’s webpage. This does not impact any other operations scheduled for today."

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320