It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

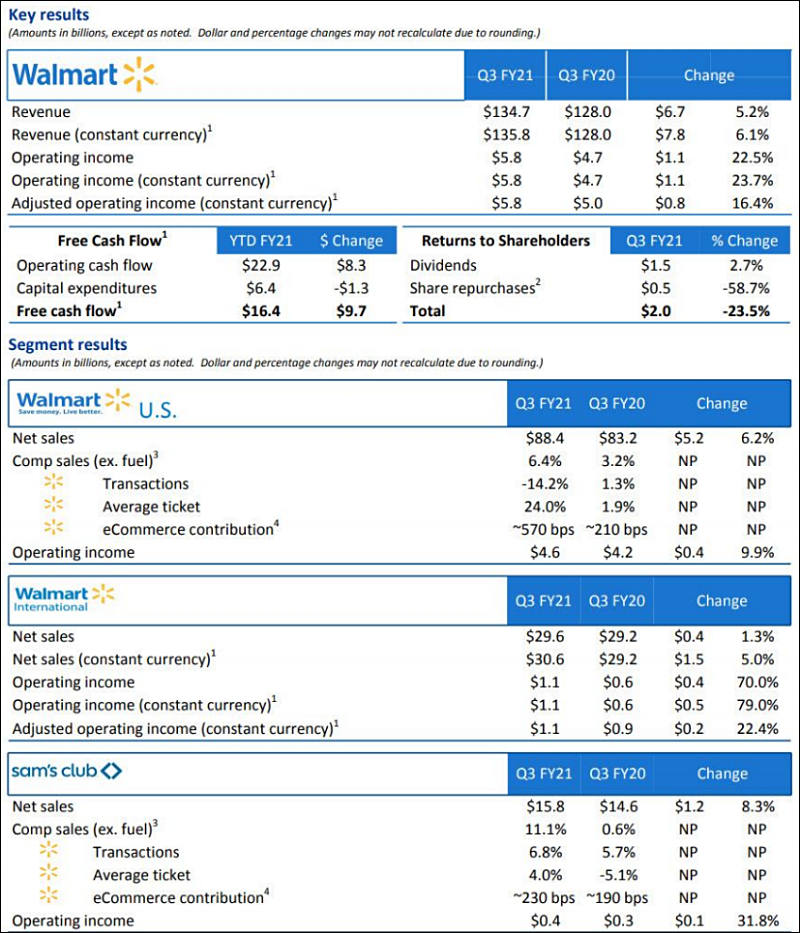

Hundreds of thousands of small and medium businesses are going down or already perished but Amazon and Walmart are setting records and welcome new lowest salary employers.

sa15484.jpg800 x 933 - 141K

sa15484.jpg800 x 933 - 141K -

Target isn't just growing; it's eating other retailers' lunch. On a call with analysts, CEO Brian Cornell said his company made "meaningful share gains across every one of our core categories as guests increasingly rely on Target to reliably and safely serve their wants and needs."

Its operating income nearly doubled year over year, coming to $1.9 billion in Q3, and net earnings grew by 41.9%.

Moody's retail analyst Charlie O'Shea said that "[p]ast and continuing strategic investments are paying off in a big way, which combined with Target's superior execution resulted in significantly improved operating margin." He added that, "Target has built up sufficient margin cushion such that it can absorb the meaningful levels of promotions which will be necessary to compete effectively with the likes of Walmart and Amazon."

Target posted stronger growth in Q3 than its larger peer, Walmart, which posted strong but slowing sales gains for the quarter. Notably, while Walmart relied on growing ticket values to make up for traffic declines — a beneficial byproduct for mass merchants as consumers consolidate trips in the pandemic era — Target saw both ticket value and traffic growth during the same period.

Small guys die at the same time.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320