It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Chinese tech giant Alibaba has announced that it will ban all devices and services related to cryptocurrency mining on its marketplaces.

The Chinese company announced that from October 8, it will prohibit the sale of not only the devices for mining cryptocurrency themselves, but also educational materials on this topic, as well as the corresponding software on its online trading platforms.

-

Reuters reports the country has added crypto mining to a draft "negative list" that limits or outright bans investments in a given industry, whether by Chinese or foreigners. Would-be investors would need to get approvals, and those are unlikely given China's anti-crypto stance.

-

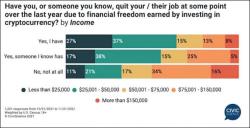

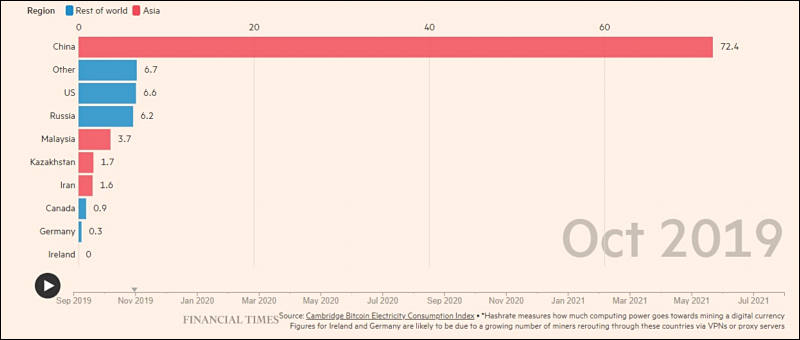

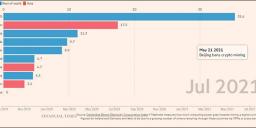

Changes in mining:

sa18505.jpg800 x 348 - 35K

sa18505.jpg800 x 348 - 35K

sa18504.jpg800 x 340 - 29K

sa18504.jpg800 x 340 - 29K -

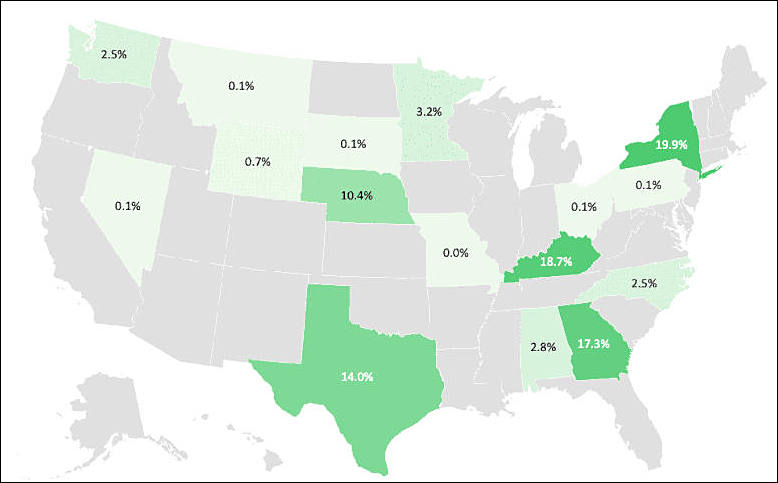

A war is brewing between the American states to attract miners, with New York, Kentucky, Georgia and Texas leading the way. According to the mining pool Foundry USA, 19.9% of the American hashrate of bitcoins - that is, the total computing power of miners - is in New York, 18.7% in Kentucky, 17.3% in Georgia and 14% in Texas.

sa18553.jpg778 x 483 - 34K

sa18553.jpg778 x 483 - 34K -

The analysis was published yesterday by Luxor Technologies, a cryptocurrency mining company. It says that after a "staggering" halving, global production has now recovered to 103% of April values.

-

On Thursday, the National Development and Reform Commission of China (NDRC) published a draft resolution on the inclusion of cryptocurrency mining and processing of other digital tokens in the list of industries subject to liquidation. Within a month, the NDRC will wait for public responses to this initiative, after which the changes will either be canceled or they will take the force of the law for implementation.

-

Mastercard has signed a deal with cryptocurrency firm Bakkt to make crypto options available to merchants and banks across its payments network, the company announced Monday.

-

Chinese authorities are stepping up measures to counter cryptocurrency mining, calling it an "extremely harmful practice" that threatens to jeopardize the country's efforts to reduce its carbon footprint. National Development and Reform Commission spokesman Meng Wei criticized Bitcoin mining during a press conference in Beijing on Tuesday.

Man Wei said the NDRC - the country's main economic planning authority - will take full-scale action to curb cryptocurrency mining, focusing on commercial mining and the role of state-owned enterprises in this activity. She also stated that there are huge risks associated with mining and trading cryptocurrencies and called the industry "blind and disorganized."

The NRDC said it will raise electricity prices for any institution caught using subsidized electricity to mine cryptocurrencies.

-

Mordor as new place for Chinese mining machines

sa18842.jpg703 x 465 - 30K

sa18842.jpg703 x 465 - 30K -

It is now becoming clear why cryptocurrency had been required.

It will be used to initially hike energy prices and later ration energy consumption of everyone, under pretense of saving you from only bad crypto miners.

-

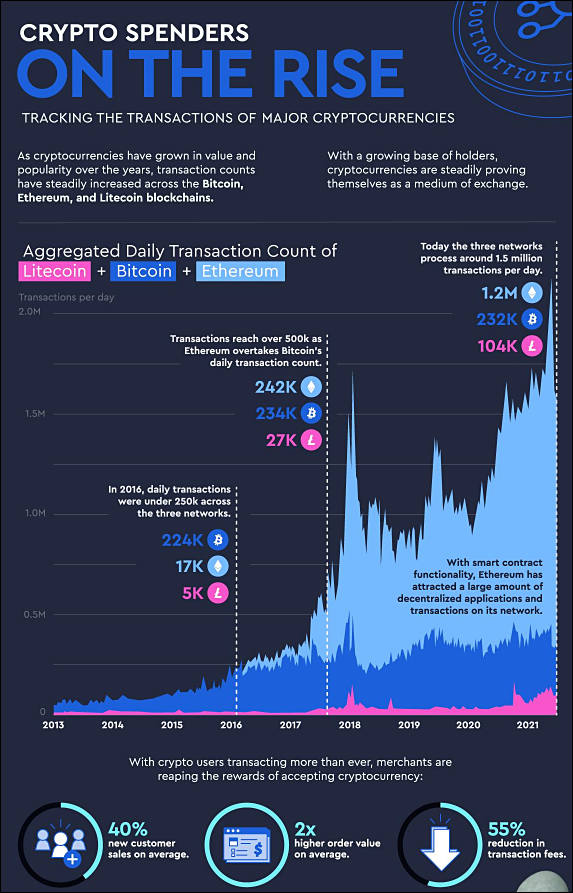

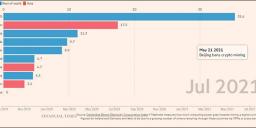

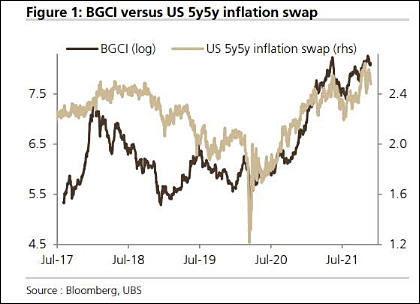

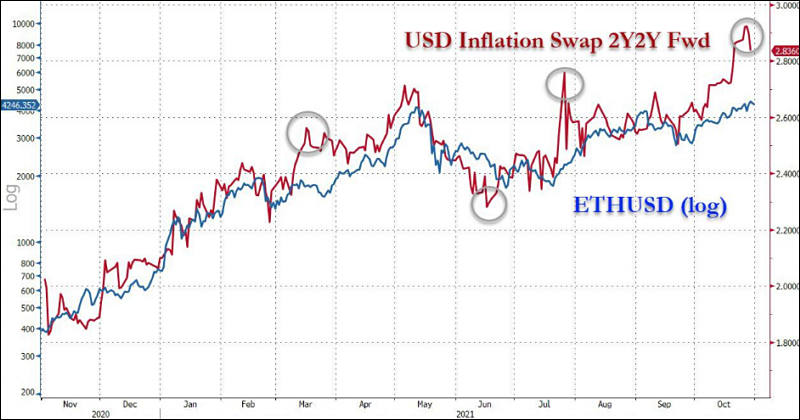

Crypoto scam is now way to park money to avoid inflation

sa18919.jpg420 x 304 - 23K

sa18919.jpg420 x 304 - 23K

sa18920.jpg800 x 420 - 57K

sa18920.jpg800 x 420 - 57K -

Meta, formerly Facebook, on Wednesday announced its decision to end the ban on advertising of cryptocurrency companies on its platforms.

Meta says its decision is driven by “the cryptocurrency landscape has continued to mature and stabilize in recent years. More government regulations have been passed that set clearer rules for the industry. "

Without their support it is hard to keep scam valuation.

-

“Cryptocurrencies are likely to remain under pressure as the Fed reduces its liquidity injections,” said Jay Hatfield, chief executive of Infrastructure Capital Advisors. “Bitcoin could end 2022 below $20,000.”

“Tighter Fed policy affects not only interest rates but the equity risk premium as the Fed withdraws funds from the capital markets. Riskier investments such as unprofitable tech, meme stocks and cryptocurrency are disproportionately affected relative to the rest of the market since those investments are approximately twice as volatile as the overall market so have double the risk premium as the average stock,” said Hatfield.

In reality FED totally controls main crypto scam.

-

In order to reduce the threats caused by the spread of cryptocurrencies, the Bank of Russia proposes to ban the issuance, mining and circulation of cryptocurrencies in Russia.

"The status of the Russian ruble, which is not a reserve currency, makes it impossible to apply a soft approach in Russia and ignore the increase in risks. In our opinion, additional measures are appropriate," the document says.

In particular, the regulator proposes to make several changes to the legislation.

"Introduce a ban on organizing the issuance and (or) issuing, organizing the circulation of crypto-currencies (including by crypto-exchanges, crypto-exchangers, P2P platforms) on the territory of the Russian Federation and establish liability for violating this ban," such a proposal from the regulator is contained in the document .

It is also proposed to establish liability for violation of the legal ban on the use of cryptocurrencies as a means of payment for goods, works and services sold and bought by legal entities and individuals - residents of the Russian Federation.

"Introduce a ban on investments by financial organizations in cryptocurrencies and related financial instruments, as well as on the use of Russian financial intermediaries and Russian financial infrastructure to carry out transactions with cryptocurrencies and establish liability for violation of this ban," the report suggests. The regulator also considers the introduction of a ban on cryptocurrency mining in Russia to be the best solution.

-

In response to a written request from Barron’s, Intel representatives did not deny that the company has been exploring the issue of creating a specialized solution for cryptocurrency mining for several years, and will be ready to share the first details in the near future. At the same time, analysts do not believe that the appearance of mining equipment on Intel chips can significantly affect the company's revenue.

As you know, at the February ISSCC conference, Intel is going to present a new ASIC chip under the symbol Bonanza Mine, which is designed for bitcoin mining at low energy costs.

Rumors are that Intel already allocated big resources on production to make this crypto scam, and they already made some pile of it.

-

The Bank of Russia has prepared a package of amendments to the law on digital financial assets and the Code of Administrative Offenses, which propose strict regulation of cryptocurrencies and fines for citizens and legal entities for settlements in cryptocurrencies. The documents are at the disposal of Interfax. The Central Bank sent them to the Ministry of Finance.

The Central Bank proposed to establish an administrative fine for settlements in crypto-currencies currently prohibited in Russia in the amount of 30,000 to 50,000 rubles for citizens and from 700,000 to 1 million for companies, follows from the draft amendments to the Code of Administrative Offenses.

They are preparing for something.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320