Capitalism: Largest gaming companies do not like to pay taxes

-

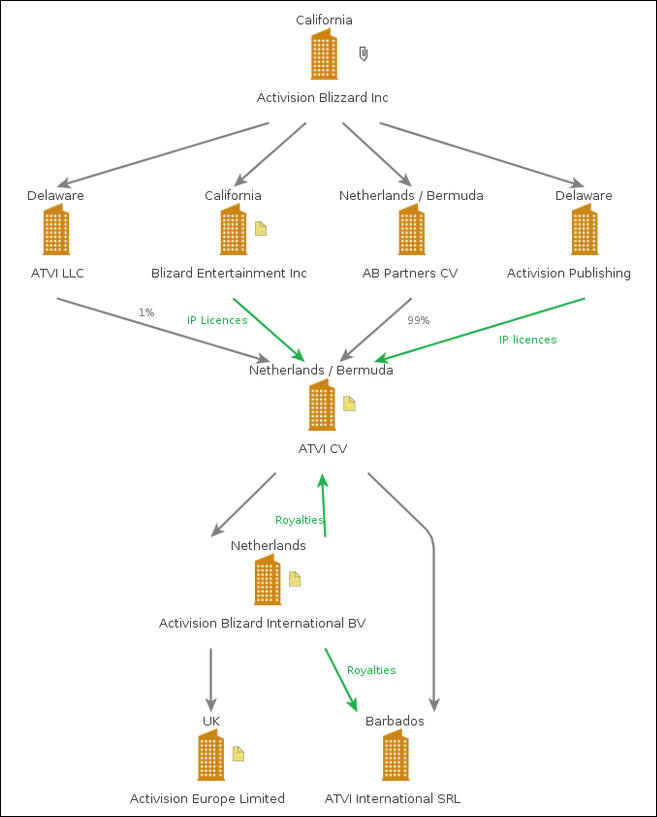

- Activision Blizzard, publisher of hit games Call of Duty, World of Warcraft and Candy Crush moved €5bn to companies in Bermuda and Barbados between 2013-2017, documents reveal.

- The company is currently under investigation by tax authorities in the UK, Sweden and France over alleged transfer pricing irregularities and is is facing a potential bill of over $1.1bn in back taxes and penalties.

- In the United States, Activision Blizzard has recently settled a transfer pricing dispute with tax authorities for $345m.

- The multinational company has a complex structure with subsidiaries in a number of tax havens including Malta, the Netherlands, Barbados and Bermuda.

sa9481.jpg657 x 817 - 45K

sa9481.jpg657 x 817 - 45K

Start New Topic

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,968

- Blog5,723

- General and News1,345

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners254

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,361

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony154

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm99

- ↳ Compacts and Camcorders299

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras121

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319