It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Intel has reported second-quarter 2019 financial results. It generated US$7.6 billion in cash from operations, paid dividends of US$1.4 billion and used US$3 billion to repurchase 67 million shares of stock.

"Second quarter results exceeded our expectations on both revenues and earnings, as the growth of data and compute-intensive applications are driving customer demand for higher performance products in both our PC-centric and data-centric businesses," said Bob Swan, Intel CEO. "Based on our outperformance in the quarter, we are raising our full-year guidance. Intel's ambitions are as big as ever, our collection of assets is unrivaled, and our transformation continues."

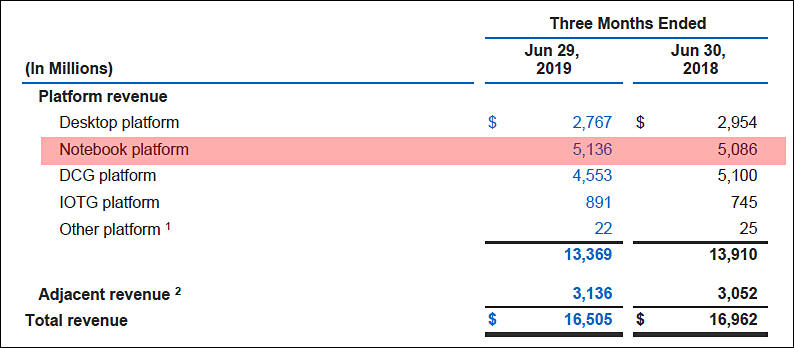

Intel's second-quarter revenues of US$16.5 billion were US$900 million higher than April guidance. Intel achieved 1% growth in the PC-centric business while data-centric revenues declined 7%.

Extremely inefficient money making machine for rich (who get all money via stock buybacks directly or via investment funds.

-

Notice how big money notebooks CPUs/chipsets are bringing to Intel.

Yes, they are leaders in it, but margins are also astonishing.

Chipset margins can be 500-900%, and top mobile CPUs margins can reach 1000%.

Low end mobile CPUs are still extremely profitable.

sa9365.jpg794 x 348 - 48K

sa9365.jpg794 x 348 - 48K

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,983

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,362

- ↳ Panasonic992

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras115

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,419

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319