It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

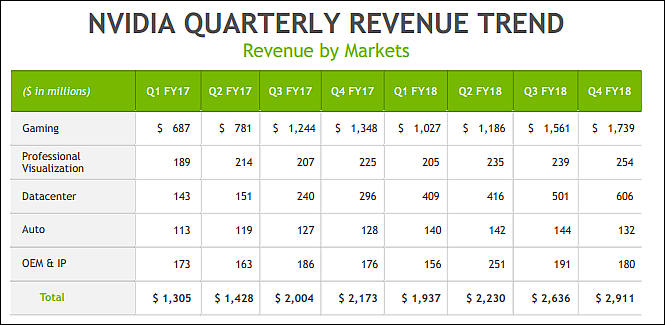

Best progress is due to miners and rising cards cost.

Second biggest gain is due to ban on using more affordable cards in datacenters.

sa1678.jpg665 x 325 - 53K

sa1678.jpg665 x 325 - 53K

sa1679.jpg653 x 311 - 59K

sa1679.jpg653 x 311 - 59K -

It's a problem buying a new graphic adapter now. Price went to the stars.

-

Crypto currency teach that people do not want to learn from history

First they came for the Socialists, and I did not speak out—

Because I was not a Socialist.Then they came for the Trade Unionists, and I did not speak out—

Because I was not a Trade Unionist.Then they came for the Jews, and I did not speak out—

Because I was not a Jew.Then they came for me—and there was no one left to speak for me.

I still remember lot of people here telling how cool it is and how it won't affect anything.

-

I hope this bubble dissolves and we could find a bunch of hi end used gpu on the market.

Sort of dream...

-

If cryptocurrency values crash (and they're already down significantly in recent weeks) then the graphics card shortage of recent months could rapidly become a graphics card glut. Not only would cryptocurrency-related demand dry up, but Nvidia could find its new cards competing with thousands of cheap and powerful used cards being unloaded by miners who can no longer turn a profit from mining.

So while Nvidia and AMD have been happy to see their products fly off the shelves in recent months, they've been reluctant to make big investments in manufacturing capacity to meet that surging demand. As a result, the graphics card shortage has dragged on for months—and it might drag on for months to come.

-

Crypto is here to stay for a long while I think. The bubble burst, and may drop a bit more very soon, but the turnaround should be fairly swift in the coming weeks I believe.

-

Strange coincidence

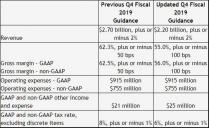

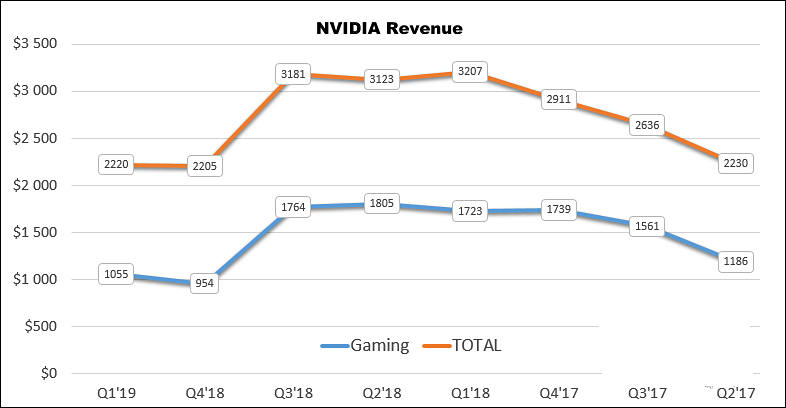

As soon as crypto mining boos was started by media Nvidia business become much better.

10xx cards also, of course added to income, but crypto role can't be undermined.

sa4273.jpg743 x 369 - 37K

sa4273.jpg743 x 369 - 37K -

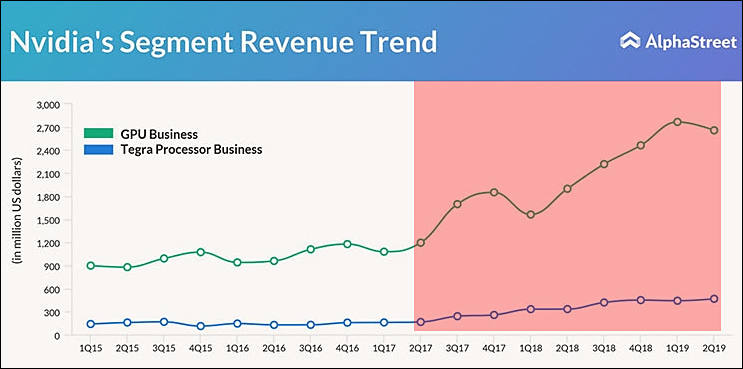

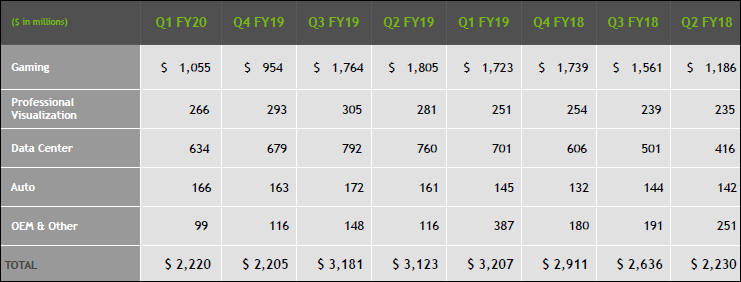

Yet now they published warning, RTX is not selling good

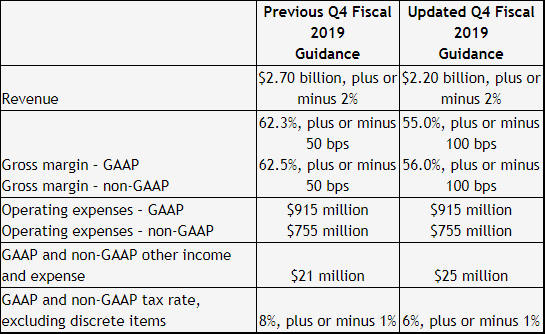

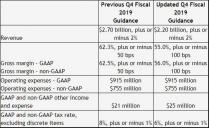

NVIDIA today updated its financial guidance for the fourth quarter of fiscal year 2019, reflecting weaker than forecasted sales of its Gaming and Datacenter platforms.

In Gaming, NVIDIA’s previous fourth-quarter guidance had embedded a sequential decline due to excess mid-range channel inventory following the crypto-currency boom. The reduction in that inventory and its impact on the business have proceeded largely inline with management’s expectations. However, deteriorating macroeconomic conditions, particularly in China, impacted consumer demand for NVIDIA gaming GPUs. In addition, sales of certain high-end GPUs using NVIDIA’s new Turing™ architecture were lower than expected. These products deliver a revolutionary leap in performance and innovation with real-time ray tracing and AI, but some customers may have delayed their purchase while waiting for lower price points and further demonstrations of RTX technology in actual games.

In Datacenter, revenue also came in short of expectations. A number of deals in the company’s forecast did not close in the last month of the quarter as customers shifted to a more cautious approach. Despite these near-term headwinds, NVIDIA has a large and expanding addressable market opportunity in AI and high performance computing, and the company believes its competitive position is intact.

“Q4 was an extraordinary, unusually turbulent, and disappointing quarter,” said Jensen Huang, founder and CEO of NVIDIA. “Looking forward, we are confident in our strategies and growth drivers.

“The foundation of our business is strong and more evident than ever – the accelerated computing model NVIDIA pioneered is the best path forward to serve the world’s insatiable computing needs. The markets we are creating – gaming, design, HPC, AI and autonomous vehicles – are important, growing and will be very large. We have excellent strategic positions in all of them,” he said.

NVIDIA expects its GAAP and non-GAAP gross margin to be impacted by approximately $120 million in charges for excess DRAM and other components associated with the updated revenue guidance and current market conditions.

The company will provide Q4 fiscal 2019 financial results and Q1 fiscal 2020 guidance on its earnings call scheduled for Feb. 14.

This update is an estimate, based on information available to management as of the date of this release, and is subject to further changes upon completion of the company’s standard quarter and year-end closing procedures. This update does not present all necessary information for an understanding of NVIDIA’s financial condition as of Jan. 27, 2019, or its results of operations for the quarter and fiscal year ended Jan. 27, 2019. As NVIDIA completes its year-end financials close process and finalizes its financial statements for the quarter and year ended Jan. 27, 2019, it will be required to make significant judgments in a number of areas. It is possible that NVIDIA may identify items that require it to make adjustments to the financial information set forth above and those changes could be material. NVIDIA does not intend to update such financial information prior to release of its fourth quarter and year-end financial statement information, which is currently scheduled for Feb. 14, 2019.

sa6666.jpg545 x 334 - 61K

sa6666.jpg545 x 334 - 61K -

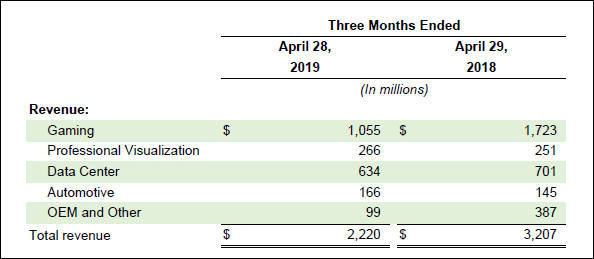

Jon Peddie Research, the market research firm for the computer graphics industry, has released its quarterly Market Watch report on worldwide GPU shipments used in PCs for Q4'18.

Overall GPU shipments decreased -2.65% from last quarter, AMD shipments decreased -6.8% Nvidia decreased -7.6% and Intel's shipments, decreased -0.7%.

AMD's market share from last quarter decreased -0.6%, Intel's increased 1.4%, and Nvidia's market share decreased -0.82%.

Year-to-year total GPU shipments decreased -3.3%, desktop graphics decreased -20%, notebooks increased 8%.

Although overall GPU shipments declined PC sales saw an uptick of 1.61% which is a positive sign for the market overall.

-

New report

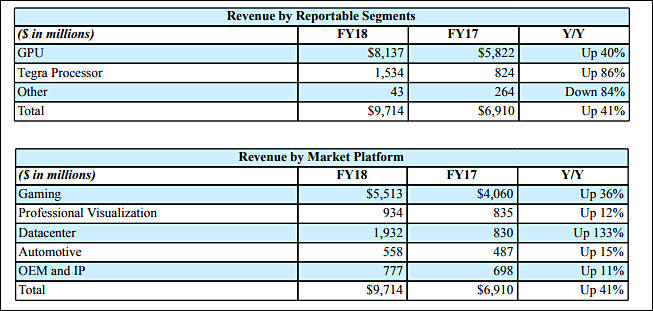

Thanks to amazing press work Nvidia sold around 70% more thanks to miners during craze.

Part of data center rise had been miners also.

-

Nvidia lost around $1 billion USD / month compared to last year (OEM also had been mostly for mining).

Add here around 30-50% higher price for new generation of GPUs and you can see one of main sponsors of mining, who paid hundreds of millions (via affiliated firms, not directly) to press to keep it running.

sa8340.jpg594 x 259 - 28K

sa8340.jpg594 x 259 - 28K -

Considering mining. Rough estimate is that around 80% cards never returned not only full cost, but even did not return price difference between new card and used sell price you can get for now.

Nvidia is among the biggest profit makers from specially inspired hype.

sa8348.jpg786 x 408 - 38K

sa8348.jpg786 x 408 - 38K

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,970

- Blog5,724

- General and News1,346

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras117

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319