Please, support PV!

It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

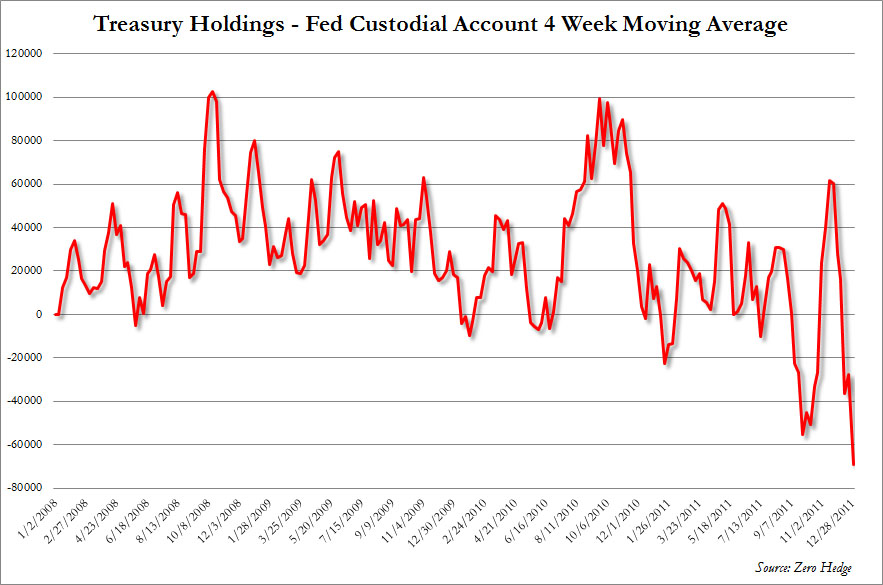

Foreigners Dump Record Amount Of US Treasurys

-

In the week ended December 28, foreign investors sold the second highest amount of US bonds in history, or $23 billion, bringing total UST custodial holdings to $2.67 trillion, a level first crossed to the upside back in April. This number peaked at $2.75 trillion in mid-August, and as the chart below shows the foreign holdings of US paper have been virtually flat in all of 2011, something which is in stark contrast with what the price of the 10 Year would indicate vis-a-vis investor demand. And going back further, the last week is merely the latest in a series of Custodial account outflows. In fact, in the last month (trailing 4 weeks), foreigners have sold a record $69 billion in US paper, a monthly outflow that was approached only once - in the aftermath of the US downgrade (when erroneously it is said that a surge in demand for US paper pushed rates lower - obviously as the chart shows nothing could be further from the truth).

Via: http://www.zerohedge.com/news/foreigners-dump-record-amout-us-treasurys-past-month

UST Holdings Custody Account_0.jpg883 x 585 - 128K

UST Holdings Custody Account_0.jpg883 x 585 - 128K -

So where are foreigners putting their money now? The conventional wisdom was/is allegedly that despites its problems, the dollar was still the safest bet in town.

-

I think it is because this wisdom Japan and China few days ago agreed to transfer all their contracts to their currencies, avoiding any dollars :-) Or may be not :-)

-

It is , they met on December 26,they decided to use their own currencies for bilateral trade,by the way Japan will invest in chinese bonds, they will probably convice South Korea to join them.

"Hey Yoshihiko"

"yes Hu ?"

"they are probably drunk now, lets throw up this toxic green paper"

"Can i keep some for private use ? You know how wasabi is"

"hmm ?.... use this red paper "

Maybe Wisdom is putting money in gold...

Start New Topic

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320

Tags in Topic

- economics 319