It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Qualcomm is currently in the process of absorbing NXP Semiconductor… which acquired Freescale Semiconductor a few years ago.

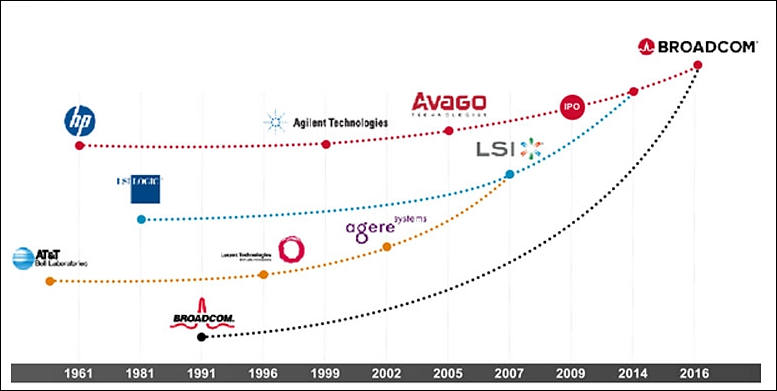

Broadcom Limited was formerly a California-based business known as Broadcom Corporation until it was acquired last year by the Singapore-based Avago Technologies.

Broadcom Ltd. is considering a bid of more than $100 billion for Qualcomm Inc., according to people familiar with the matter, in what would be the biggest-ever takeover of a chipmaker. The offer of about $70 a share would include cash and stock and is likely to be made in the coming days, the people said. A final decision on whether to proceed has not been made, they said.

Some prior history

sa363.jpg777 x 391 - 36K

sa363.jpg777 x 391 - 36K -

Official now

Broadcom Ltd. offered about $105 billion for Qualcomm Inc., kicking off an ambitious attempt at the largest technology takeover ever in a deal that would rock the electronics industry.

Broadcom made an offer of $70 a share in cash and stock for Qualcomm, the world’s largest maker of mobile phone chips. That’s a 28 percent premium over the stock’s closing price on Nov. 2, before Bloomberg first reported talks of a deal. The proposed transaction is valued at approximately $130 billion on a pro forma basis, including $25 billion of net debt.

Buying Qualcomm would make Broadcom the third-largest chipmaker, behind Intel Corp. and Samsung Electronics Co. The combined business would instantly become the default provider of a set of components needed to build each of the more than a billion smartphones sold every year.

-

Broadcom is famous for taking over and removing a third of the workers of the companies it acquires. It is an automatic figure that is fixed in Tan's head. In the last four years and five acquisitions by Broadcom, around 30 percent of the employees of the five companies bought – some 5,000 people – have lost their jobs. It includes figures for business units which are sold off.

Patrick Moorhead of Moor Insights and Strategy said: "Broadcom would slice, dice, destroy" Qualcomm and his colleague Anshel Sag added: “Buy. Chop up. Sell off. Raise prices. Rinse. Repeat." So no innovation or new chips. There will be a milking of existing technology.

-

That said, our Board found the meeting to be constructive in that the Broadcom representatives expressed a willingness to agree to certain potential antitrust-related divestitures beyond those contained in your publicly filed merger agreement. At the same time, Broadcom continued to resist agreeing to other commitments that could be expected to be required by the FTC, the European Commission, MOFCOM and other government regulatory bodies. Broadcom also declined to respond to any questions about its intentions for the future of Qualcomm’s licensing business, which makes it very difficult to predict the antitrust-related remedies that might be required. In addition, Broadcom insists on controlling all material decisions regarding our valuable licensing business during the extended period between signing and a potential closing, which would be problematic and not permitted under antitrust laws.

https://www.qualcomm.com/news/releases/2018/02/16/qualcomm-provides-update-meeting-broadcom

-

Trading continues

Broadcom reiterated in the February 23 meeting that its reduced $79.00 per share proposal is its best and final proposal. The Qualcomm Board is unanimous in its view that each of Broadcom's proposals, including its prior $82.00 per share proposal, materially undervalues Qualcomm, and the Board encourages Broadcom to enter into mutual due diligence and price negotiations.

-

And US president interferes with blocking of takeover

-

The lengthy White House response attributed to President Trump says “there is “credible evidence” that Broadcom “might take action that threatens to impair the national security of the United States.”

The statement today appears to close the door on the deal, would have brought together two of the biggest companies in building processors that power phones and other computers and connected devices. The deal has been in play for months amid resistance from Qualcomm and more recently the US government, whose Committee on Foreign Investment in the United States last week said it would be investigating the deal on the grounds of national security.

-

Actually it does not close the door. As Broadcom is moving their head office to US and after it will be completed Trump won't have authority to stop it.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320