It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

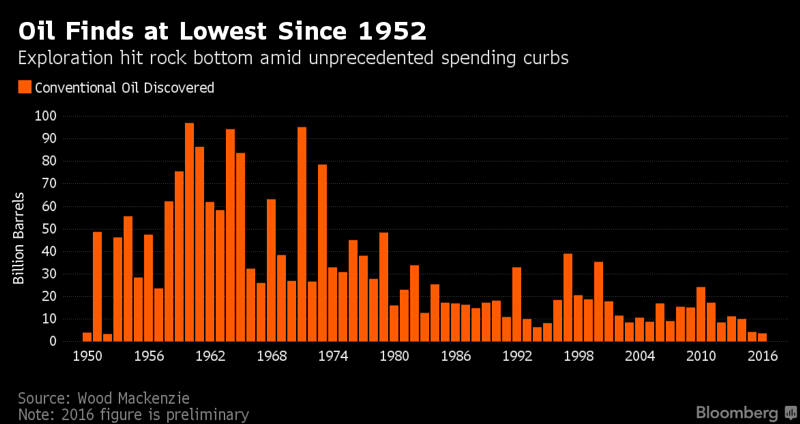

Oil companies found only 3.7 billion barrels of so-called conventional crude in 2016, 14 percent less than the previous year and the lowest amount since 1952.

teechart3.jpg800 x 424 - 56K

teechart3.jpg800 x 424 - 56K -

This is bad.

-

How do we know that these oil companies are telling the truth about the discovered amount?

-

We discussed this before :-) Unfortunately it is bleak reality as everything around you had been explored many many times, so just small fields are sometimes found.

-

If the new Prez has his way, we'll be shovelling coal in our tanks.

-

If the new Prez has his way, we'll be shovelling coal in our tanks.

Good idea, you can check the consequence - http://www.personal-view.com/talks/discussion/12504/under-the-dome-investigating-chinas-haze-/p1

-

The biggest problem facing Mexico’s much diminished oil giant, Pemex, in 2017 will be finding a way to service a growing debt pile of over $100 billion – most of it denominated in foreign currency – from the proceeds of a continually shrinking revenue base.

Btw, their oil production is at 26 year low.

-

unPrecidented Trump drills for oil in Yellowstone National Park, triggering Supervolcano eruption and wipes out U.S.A. :)

Big Oil Cheers as Trump Plans to Open National Parks for Drilling

http://www.ecowatch.com/big-oil-drill-national-parks-2188885054.html

Inside Yellowstone's Supervolcano

-

Well, he don't have much options. And volcano part has not much use here.

-

Exxon disclosed the deepest reserves cut in its history. Reserves changes in 2016 reflect new developments as well as revisions and extensions to existing fields resulting from drilling, studies, analysis of reservoir performance and application of the methodology prescribed by the U.S. Securities and Exchange Commission. 19 percent drop amounts to the largest annual cut since at least the 1999 merger that created the company in its modern form. That includes 1.5 billion barrels of reserves that were pumped from wells. The previous record cut was a 3 percent reduction.

-

Mexico’s existing oil reserves are dwindling so fast the country could go dry within nine years without new discoveries.

That’s the message from the National Hydrocarbons Commission, which said Friday that the reserves fell 10.6 percent to 9.16 billion barrels in 2016, from 10.24 billion barrels a year earlier. Once the world’s third largest crude producer, Mexico’s proven reserves have declined 34 percent since 2013.

He set 8.9 years as a time frame for the reserves to run out.

Sad truth.

-

Is it possible natural gas availability is reducing the need to explore?

-

Looking at Mexica and Brazil internal economic and political things it is clearly not the case.

-

"Our analysis shows we are entering a period of greater oil price volatility (partly) as a result of three years in a row of global oil investments in decline: in 2015, 2016 and most likely 2017," IEA director general Fatih Birol said, speaking at an energy conference in Tokyo.

"This is the first time in the history of oil that investments are declining three years in a row," he said, adding that this would cause "difficulties" in global oil markets in a few years.

-

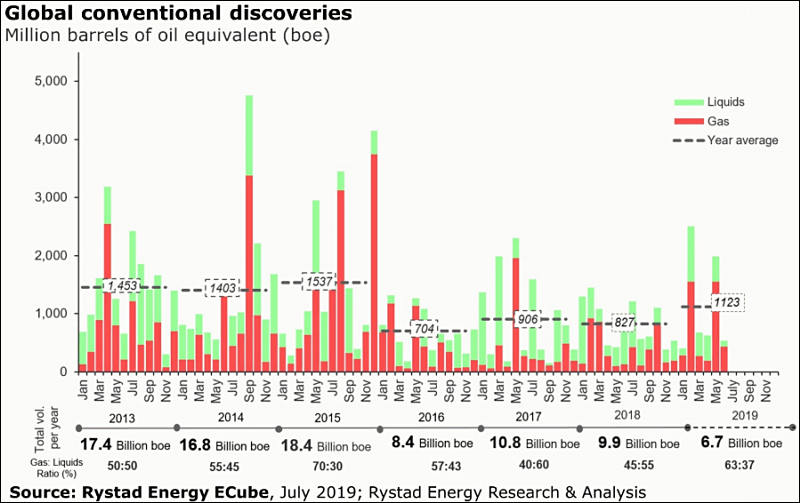

Recent rate of commercial volumes found gives little confidence that there will be enough new discoveries to fill the gap. Spend on exploration globally has collapsed from US$60 bn p.a. in 2014 to just US$25 bn p.a. in 2018. The drop has fed directly through to significantly lower volumes of reserves discovered. Exploration found 8 bn bbls p.a. of commercial liquids on average in the early part of this decade; it’s only delivered around 2 bn bbls p.a. in the three years since 2014.

The oil market could be running short of oil capacity by the late-2020s at the current, low discovery rate. That’s worryingly near at hand given it takes the best part of 10 years for the average new discovery to build to peak production even with a marked improvement in project execution post-downturn. Should new volumes discovered recover to pre-crash levels of 8 bn bbls p.a. the gap opens up in the early 2030s and climbs to 6 million b/d by 2040. This will have to be filled by presently sub-commercial discoveries with implications for price.

https://www.woodmac.com/news/the-edge/the-case-for-investing-more-in-exploration/

-

Conventional oil and gas discoveries during the past three years are at the lowest levels in seven decades and a significant rebound is not expected, according to a new report by global business information provider IHS Markit

The low levels in discoveries come as a result of a pullback during the past 10 years in the wildcat drilling that targets conventional oil and gas plays—most drastically after oil prices collapsed in 2014.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320