It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

On September 10, the benchmark coal traded at $ 177.50 per tonne. This is more than a twofold increase in prices since the beginning of the year and an even larger increase in prices compared to $ 50 per tonne a year earlier.

-

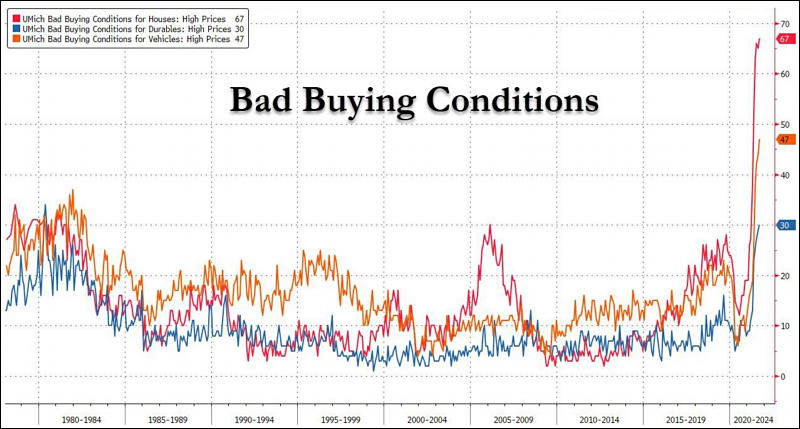

There was a complete rout of net favorable views of buying conditions: household durables fell to the lowest level since 1980, vehicles fell to the lowest level since 1974, and homes to the lowest level since 1982. These record drops were all due to complaints about high prices: homes had the highest negative ratings of home prices ever recorded, vehicles had the most negative price references since 1974 (in response to the first oil embargo), and durables had the worst price rating since 1980.

sa18306.jpg800 x 429 - 70K

sa18306.jpg800 x 429 - 70K -

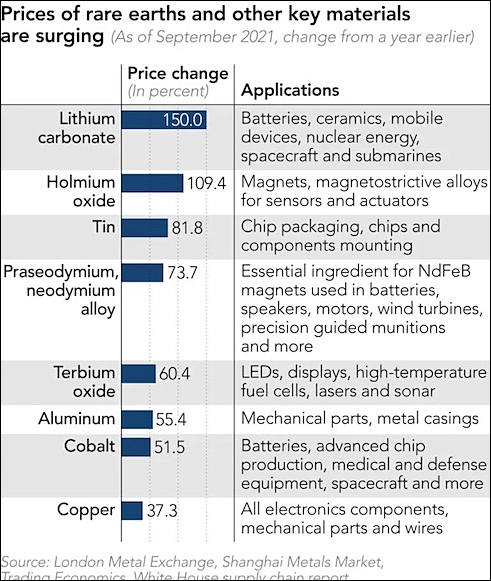

Manufacturers are worried about rising prices for rare earth metals. For example, the cost of neodymium used in speaker production has doubled since last year to $ 117,300 per ton in August.

China is the only country that has a complete supply chain for rare earths, from mining to processing. Last year, the Celestial Empire controlled 55% of the world's production capacity and 85% of the total processing of rare earth elements.

The cost of neodymium oxide, a key resource for electric motors and wind turbines, rose 21.1%. Holmium, which is used in magnets for sensors and mechanisms, has risen in price by almost 50% this year.

It is reported that the price of tin has almost doubled compared to last year.

sa18283.jpg491 x 581 - 71K

sa18283.jpg491 x 581 - 71K -

Uranium contracts have been steadily getting more expensive since 17 August. During this time, they added 32.8%. At the same time, just over the past week, the growth was almost 15%, which was the best weekly increase in more than ten years - since the accident at the Fukushima nuclear power plant in 2011.

-

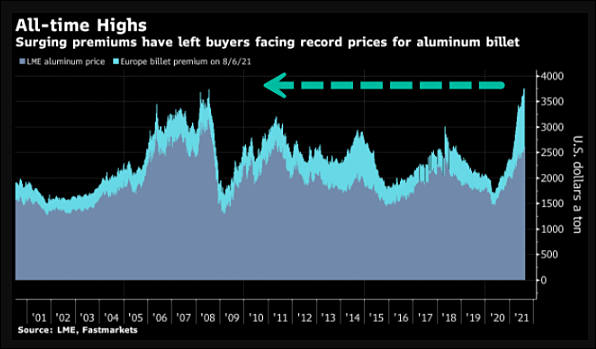

Aluminum prices have reached their highest level in the last 13 years. On Monday, September 13, the COMEX contract for the metal for November delivery rose 3.5% to $ 3,025.75 a tonne. Aluminum was last traded at these levels in 2008.

Aluminum prices have continued to rise for the past three consecutive weeks. During this time, they added 15%.

-

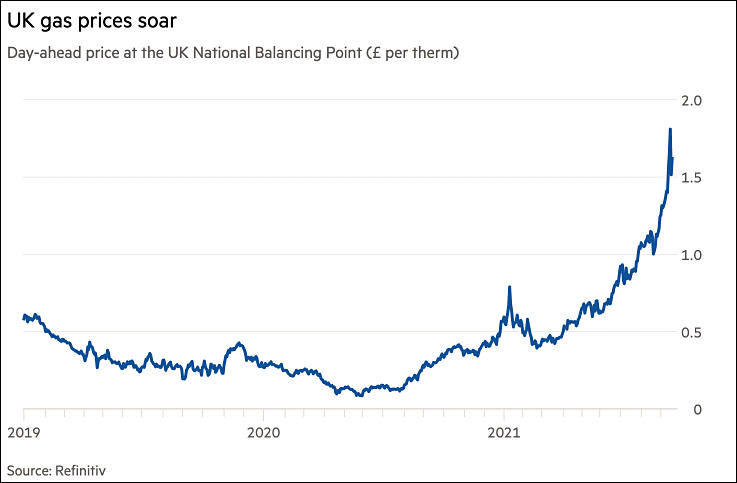

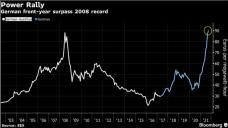

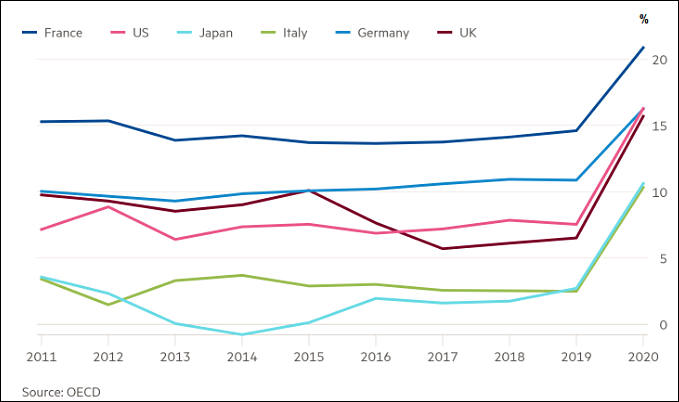

Electricity inflation

Electricity prices from the UK to Spain have jumped to all-time highs, people in Spain have taken to the streets, while prices so high across Europe could be a drag on economic recovery from the pandemic.

In Spain, day-ahead electricity prices soared to a new record this week, which is a "huge political issue." Consumers in Spain are protesting against utilities as households now pay about double what they paid for electricity at that time last year.

Electricity prices also hit records this week in the UK, Germany and France.

-

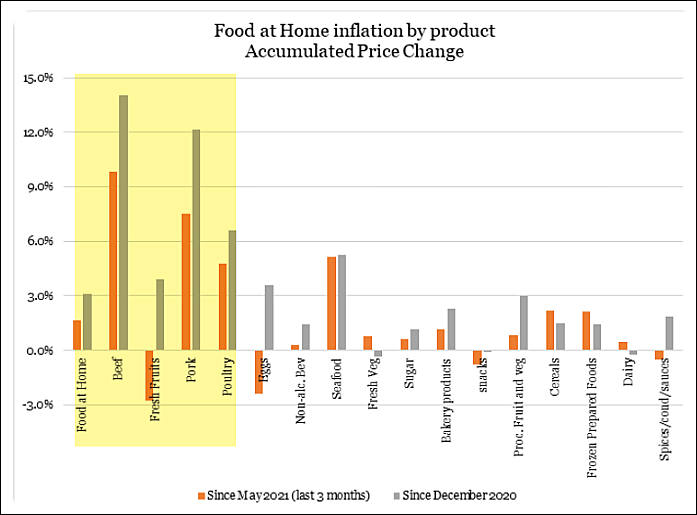

FAO released a statement Thursday that detailed after two consecutive months of declines, world food prices in August jumped due to solid gains in sugar, vegetable oils, and cereals.

<FAO’s food price index, which follows international prices of globally traded food commodities, averaged 127.4 points in August, up 3.9 points (3.1%) from July and 31.5 points (32.9%) from the same period last year.

-

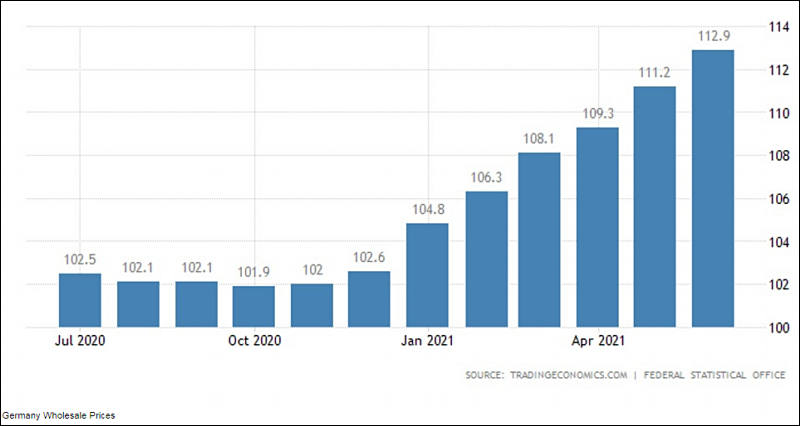

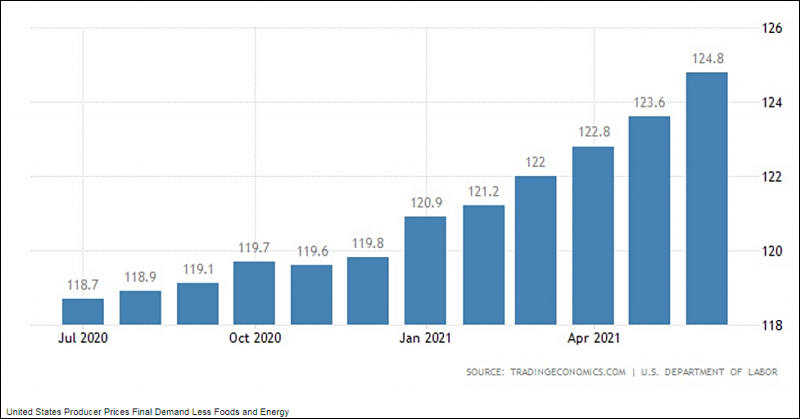

sa18067.jpg800 x 426 - 36K

sa18067.jpg800 x 426 - 36K

sa18068.jpg800 x 419 - 34K

sa18068.jpg800 x 419 - 34K

sa18069.jpg800 x 491 - 34K

sa18069.jpg800 x 491 - 34K

sa18070.jpg800 x 480 - 42K

sa18070.jpg800 x 480 - 42K -

Food prices in July were up 31% from the same month last year, according to an index compiled by the United Nations’ Food and Agriculture Organization.

Huge part of inflation comes from Chinese poor and medium class. As they go close to additionally $6 trillions in their hands from government subsidies directly and to firms.

As China can't much rise food production it started to wipe out everything from global market.

Local governments also got trillions and love to buy and store products in case of COVID outbreak event, so they can be sure be safe in their position.

-

Invest in copper, will be the new oil sooner than later.

-

Aluminum spot prices are up more than 30% on the London Metal Exchange this year. Buyers are paying an even higher premium over futures to obtain aluminum billets. Bloomberg shows in the chart below that combined price and premium for buyers in Europe now exceeds $3,750 a ton, the highest ever, taking out the highs in 2007-08.

sa17981.jpg596 x 349 - 31K

sa17981.jpg596 x 349 - 31K -

Transport expenses

In 2019, before the pandemic crisis, the cost of shipping a 40-foot container from China to Europe by sea ranged from $ 800 to $ 2,500. For the bulk of commodities such as textiles, pharmaceuticals or smartphones, ocean containers were clearly the best low-cost option for trade between Asia and Europe, despite the possibilities of railways. Today, with corona-related air travel declining by 50%, container ships are virtually the only long-haul option.

Port-to-port spot rates, such as Shanghai, China's largest container port, to Los Angeles, have now skyrocketed from about $ 1,500 for a 40-foot container just before the WHO pandemic in early 2020 to $ 4,000 in September 2020 and to $ 9,631 for the week ending July 8, 2021, according to Drewry Supply Chain Advisors. This is more than 600% more than in early 2020, before the pandemic.

It's not the worst yet. "We have heard reports of $ 15,000 from China to the West Coast and we know carriers are charging additional surcharges to give priority to late bookings over FAK [Freight All Kinds] regular shipments," Dr Drury said. From $ 1,500 to $ 15,000 in two years, that's a tenfold increase. And rates from Shanghai to Rotterdam also skyrocketed from less than $ 2,000 in early 2020 to over $ 12,000 in July, or 600%.

-

A couple of weeks ago, Edgar Dworsky walked into a Stop & Shop grocery store in Somerville, Mass., like a detective entering a murder scene.

He stepped into the cereal aisle, where he hoped to find the smoking gun. He scanned the shelves. Oh no, he thought. He was too late. The store had already replaced old General Mills cereal boxes — such as Cheerios and Cocoa Puffs — with newer ones. It was as though the suspect's fingerprints had been wiped clean.

Then Dworsky headed toward the back of the store. Sure enough, old boxes of Cocoa Puffs and Apple Cinnamon Cheerios were stacked at the end of one of the aisles. He grabbed an old box of Cocoa Puffs and put it side by side with the new one. Aha! The tip he had received was right on the money. General Mills had downsized the contents of its "family size" boxes from 19.3 ounces to 18.1 ounces

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,975

- Blog5,724

- General and News1,350

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,361

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras118

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319