-

As you know issues rise in desktop computers sectors and they become worse each month.

- http://www.personal-view.com/talks/discussion/17612/capitalism-mosfet-prices-to-follow-dram-and-nand#Item_1

- https://www.personal-view.com/talks/discussion/17041/capitalism-planning-and-dram

Consumer GPUs are quite big margin, so products firms had been able to hold wholesale price, but no more.

First-tier vendors are expected to raise their Nvidia GeForce GTX 1080/1070/1060/1050 graphics card pricing by 3-10% at the end of August, according to sources from the upstream supply chain.

August quotes for RAMs used in graphics cards have risen to US$8.50, up by 30.8% from US$6.50 in July.

-

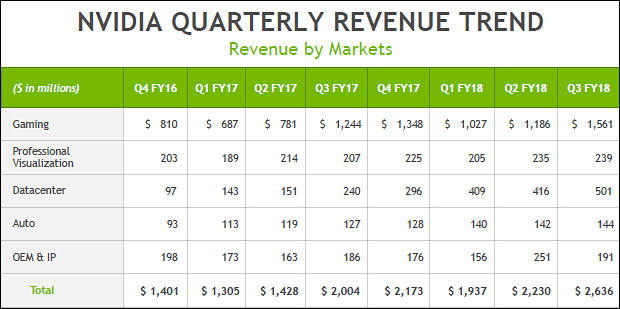

NVidia feels good

-

And here it all goes

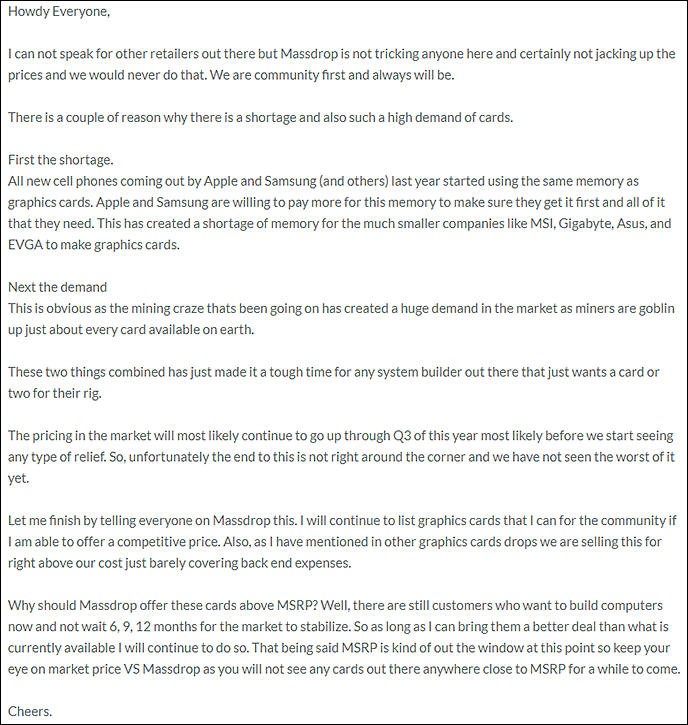

Multiple contacts within our global supply chain are saying the shortage of cards is because of a shortage of memory used on the cards. A video card manufacturer sources GPUs from AMD or Nvidia, and memory from Samsung, Micron, or Hynix. Samsung and Micron are, according to what we are told, quality leaders, while Hynix is typically bought as a last resort.

Our card manufacturers are saying they can get GPUs all day long, but not enough of the GDDR5(X) VRAM memory used with high-end GeForce. Card manufacturers have a primary memory supplier (Samsung or Micron), a secondary supplier (Samsung or Micron), and a third emergency supplier (Hynix). All memory suppliers are manufacturing full stop, so it is reported to us that there isn't any current slack in the process to meet additional demand.

To exacerbate problems further, there is also an IC packaging bottleneck problem currently brewing, where major vendors of IC packaging are experiencing full capacity production volumes and are unable to keep up with increased demand.

This guys are busy with Bitcoin miners chips, read last posts.

sa1582.jpg676 x 447 - 40K

sa1582.jpg676 x 447 - 40K -

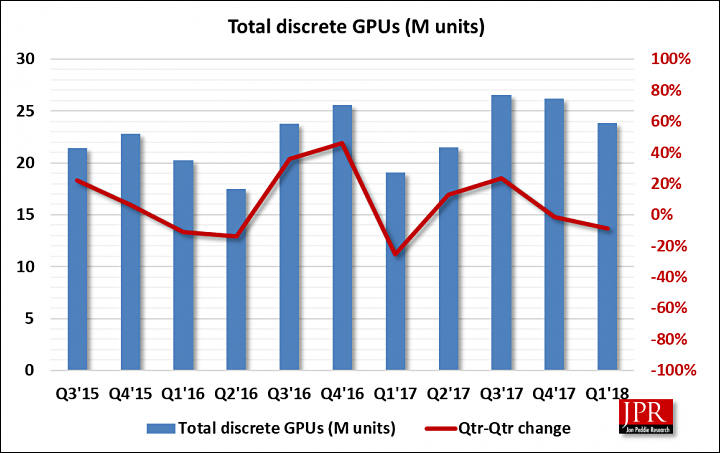

GPU prices are expected to rise most of 2018

Also Nvidia 2xxx launch can be delayed due to staggering profits.

sa1924.jpg688 x 725 - 122K

sa1924.jpg688 x 725 - 122K -

And consequences

Taiwan-based graphics card makers including Gigabyte Technology, Micro-Star International (MSI) and TUL are expected to see their shipments for April plunge over 40% on month, as many clients have suspended taking shipments in response to drastic slowdown in demand for cryptocurrency mining machines, according to industry sources.

In line with the shipment drops, gross margins for graphics card makers are expected to fall sharply to 20-25% from a high of 50% enjoyed earlier as makers and channel distributors are forced to slash prices for sales promotion.

One parasites to hurt due to fall of other parasites.

-

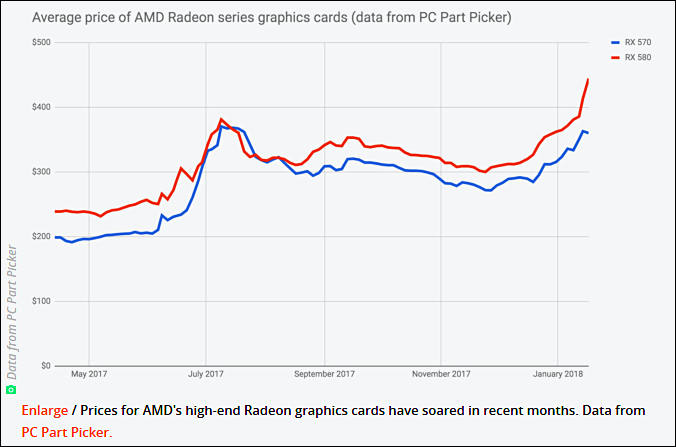

GPU prices history, now it is better, but it is really insane shit possible in terminal state of capitalism only.

sa3215.jpg800 x 402 - 68K

sa3215.jpg800 x 402 - 68K -

Taiwan graphic cards makers including Asustek Computer, Gigabyte Technology, Micro-Star International (MSI) and TUL have seen their inventories pick up significantly amid the drastic shrinkage in demand from cryptocurrency mining sector. But they have only slightly cut sales prices, maintaining gross margins at around 20%, which, though lower than the previous high of 40-50%, is still twice the level of 8-10% seen in early 2017.

So, capitalists just raised margins and did not do a thing.

-

Thing are not very good

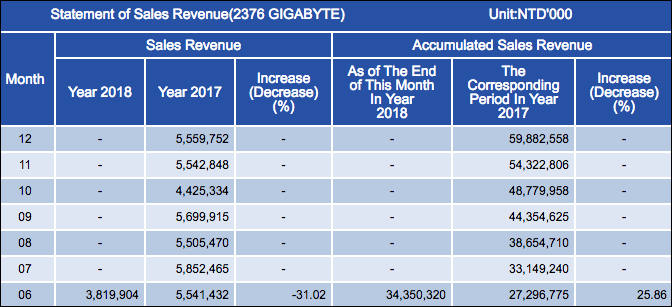

Gigabyte said its graphic card shipments for the second quarter are estimated at around one million units, down from 1.2 million of a quarter earlier.

Gigabyte's revenue ratio for graphic cards hit a high of 49% in the first quarter of 2018, compared to 36% for motherboards and 15% for servers. But the ratio for servers already soared to 20% in the second quarter amid the declining graphics card shipment momentum.

-

Gigabyte's June Revenue is down 30% M/M and 31% year on year.

sa3797.jpg672 x 307 - 60K

sa3797.jpg672 x 307 - 60K -

Most graphics card players currently still have high levels of GTX 1080/1070 graphics card inventory, but are not willing to lower prices to clear them, as they still hope cryptocurrency mining can regain its momentum.

Parasites hope for help from another parasites.

Graphics card sales are expected to be significantly undermined in the second half as demand from cryptocurrency miners has been declining, while consumers in the gaming area will continue to wait for prices to drop. With some miners having already begun selling their second-hand graphics cards in the PC DIY channels, demand for new cards is expected to be weakened further.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,990

- Blog5,725

- General and News1,353

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319