-

There are two emerging classes in Australia: those who own their homes (and sometimes own investment homes) and those who'll never own their homes - and try to find affordable rental housing.

Quite naturally, those who cannot come up with the rent are starting to spill onto city streets, much to the embarrassment of the well-heeled shoppers.

Police move in on homeless people and supporters at Melbourne camp

-

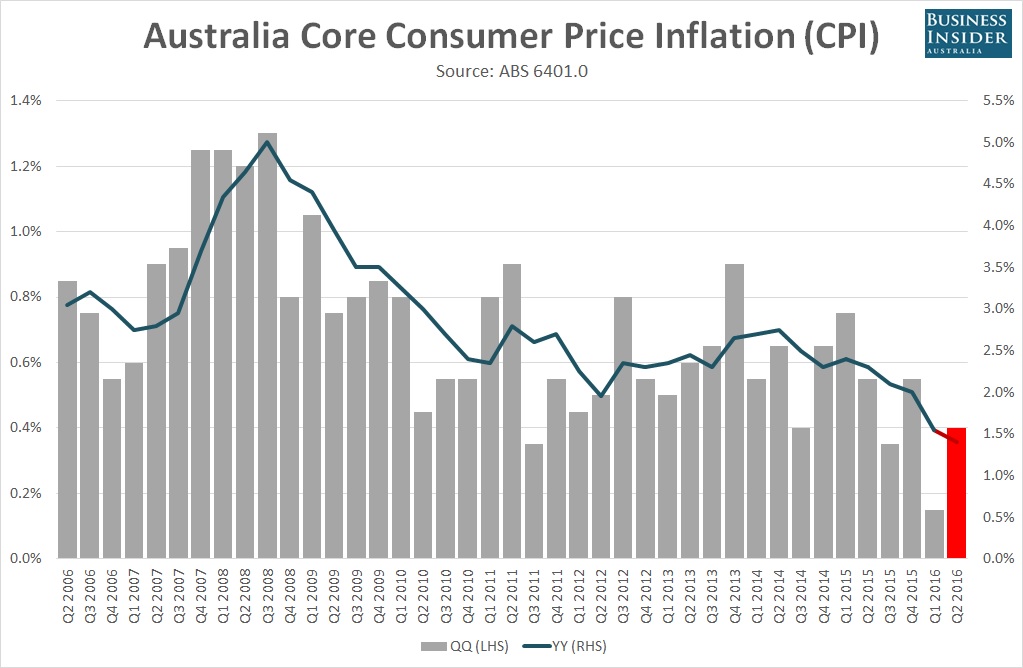

from Business Insider Australia http://www.businessinsider.com.au/heres-what-economists-are-saying-before-this-weeks-crucial-australian-inflation-report-2016-7

tmp_13962-Core-Australian-inflation-rate-preview-q2-20161282369683.jpg1023 x 668 - 136K

tmp_13962-Core-Australian-inflation-rate-preview-q2-20161282369683.jpg1023 x 668 - 136K -

I think interest rates will be heading North by the end of the year, and Philip Lowe is on the front foot with it all. He's all but come out and said "the party is over with any further cuts" Negative gearing seems to be only part of the problem if those articles I linked are correct.

-

AFAIK nobody at the Reserve Bank has mooted an interest rate rise any time soon. OTOH their new Governor has come out and pointed to ending the elephant in the room, "Negative Gearing" as being the only way house prices can slow "for a while. " (Negative gearing law allows people who buy an investment home to claim their loan interest as a tax deduction).

With the possible end of Negative Gearing, the end or slowing of Australia's housing bubble will not need any interest rise to get ordinary home owners into trouble : as soon as your house is worth less than your mortgage you can default and banks will foreclose - the same as in the States.

-

@Vitaliy_Kiselev Agreed, and I would add Government to list of middleman. Like I said housing boom has been rivers of gold for them. Infact it is keeping my state goverment in the black.

-

I think current homes prices reflect first stages of marginal collapse. Big amount of people who are middleman and such are forced to increase prices on things you can not live without to keep average margins on level where system can sustain itself.

-

Reserve Bank of Australia governor can't change goverment policy, but he can control the interest rate on loans. Personally I think he will do more than just hold interest rates at current levels.

http://www.abc.net.au/news/2017-02-24/philip-lowe-house-committee-economics/8299714

In 1992-4 I was paying 18% interest on my mortgage and doing it hard, but because of the cost of a house on today's market I think I had it easier. So lower interest rates aren't the complete answer to housing affordability. The housing boom has been like rivers of gold to the state goverments with stamp duty on the purchase of a property, not to mention a money making tool for local councils, and government departments, when it comes to conveyancing disbursements costs. The important people in all of this are the young families, and the goverments just sucks every last penny out of them

-

Hi @tenjin, I have worked mainly in the television industry as a freelancer, AD, floor manager, assistant producer etc, in Melbourne. So my advice on work would come from that angle. But I’d rather stay on topic with the Australian economy, and advice concerning moving over here with wife and 2 children. It’s good that you are thinking about doing it in a couple of years because I firmly believe the good times here in Australia are historically going to go the same as all of our booms in the past. The cost of housing is reaching the point of madness, and the great Australian dream has always been home ownership, and young people have been borrowing insane amounts of money to compete against developers, people of my age buying 2nd properties as superannuation schemes with tax concessions, and their own demographic to get into the market. When interest rates start going up, as they will soon, a lot of people are going to be caught out with very little collateral in their house, and their property will be worth far less than what they purchased it for, so the Banks will move in and we’ll see fire sales all over the place because they can’t make repayments. You really need about $1.3-1.5 million AUS at the moment to buy with in 30k of Sydney or Melbourne, or else you’ll be travelling 4-5 hours a day to and fro from work, and living in the sticks. To work in your field you need to be pretty close to town. I haven’t been to Switzerland for 40 years, but stayed with a family in Dotzigen for a while and although they had a good standard of living, they were wise with their money and hard workers. So maybe you should evaluate your current worth and make a comparison as to how much it would cost to sell up and buy up in Oz on today’s market. As far as employment goes feel free to message me and I’ll be able to give advice on the freelance market here, but mainly concerning camera work as I work with quite a few good DOP’s. But in essence I think this is how it’s going to happen here in Australia very soon, “we will go to bed on a Saturday night after another day of record auction prices and clearances, and wake up on Sunday to news that the reserve bank is increasing the 1st of several rate increases”, and by Monday night’s News programme panic will have hit the market. Hope I haven't scared you off, but that's the way I'm seeing it at the moment and I hope I'm wrong. Cheers mate.

-

I live in Switzerland and I plan to move to Australia to live there. I went there 4 times but last time was more than 15 years ago! We just had our 2nd child so we'll wait a couple of years before moving out. I hope that I'll find work easily in Sydney, I am a motion designer and videographer. Any advice Haderdasher?

-

Cost of housing in Melbourne and Sydney is about equal 4th in the world, and intersest rates are still at lowest ever now. I think that's reflected in the first graph, or maybe it's showing that only repayments on principal are being paid? Auction clearances are still at all time high, and housing price boom still happening because of developers and baby boomers puffing the price. Young people getting into market want brand new house, new furniture, new car, and still travel the world...all on credit. Goverment spent our huge surplus after GFC (2008) on stupid initiatives to avoid slow down. Our mining boom is over, no local industries any more, and interest rates WILL go up. When interest rates go up employment could take a whack, housing prices will fall, young people will still have 90-95% debt in their property...the rest will be history repeating itself. I haven't mentioned business and the consequence of interest rises because it's a all a bit too academic (economics) for me to coment, but a lot of young people and young business people have never experienced high interest rates in their adult life. I'm holding on tight.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,990

- Blog5,725

- General and News1,353

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,366

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320