-

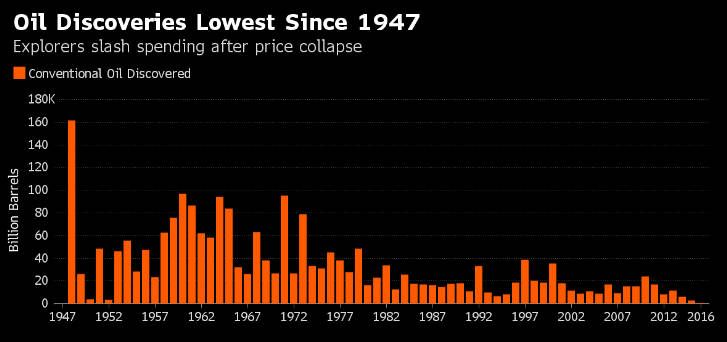

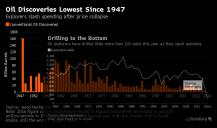

Explorers in 2015 discovered only about a tenth as much oil as they have annually on average since 1960. Just 2.7 billion barrels of new supply was discovered in 2015, the smallest amount since 1947.

In 2016 decrease continues, with half year discoveries equal to 736 million barrels.

For perspective - we consume around 95 millions barrels per day.

-

No one is investing much in discovering new wells with oil at <US$50 / barrel.

-

There's a reason it is so low. There is an energy glut at the moment. There are serious people in Houston, the energy business capital of the world, who do not believe oil will ever go above $60 again. With both Thorium fission reactors and Lithium-Tritium fusion reactors coming on line in the next 20 years, oil and gas as energy sources will disappear, except for jet fuel. Even that might go away with the advent of new engine technologies.

-

It is sad to disappoint you, but reality bites. While investment really decreased most of issues are not related to it.

There is an energy glut at the moment. There are serious people in Houston, the energy business capital of the world, who do not believe oil will ever go above $60 again. With both Thorium fission reactors and Lithium-Tritium fusion reactors coming on line in the next 20 years,

Thorium reactors won't be build in next 20 years, as even research reactors are not finished. And all of them have huge issues.

And, of course, there is no "energy glut" at the moment.

-

Don't hold your breath waiting for a fusion reactor. They still have no clue how to contain the reaction.

-

It is really scary.

-

@Vitaliy_Kiselev - Of course decreased investment is a major factor in why so little new oil was discovered last year. There may be other factors involved, but you can't discount the record low investment in exploration for new reserves. ("It was a terrible year for mushrooms--I didn't find a single one." "How much time did you spend hunting them?" "None at all, but that's not a factor.")

If those numbers came in during a year of US$70-100/b prices, they would be extremely sobering, however, as it is, the low exploration is a real outlier from previous years and makes it difficult to extrapolate any real trend in new proven reserves out of these numbers. (In my opinion.)

There certainly is a glut of pumped oil right now, compared to current demand and storage capacity. It's a little upsetting to see so many oil nations open the pumps to maximum in an attempt to make up for revenue lost due to the low oil price. They're undermining their own efforts and increasing wasteful consumption at the same time.

-

Of course decreased investment is a major factor in why so little new oil was discovered last year. There may be other factors involved, but you can't discount the record low investment in exploration for new reserves.

Check my previous response.

Real issue is not investments, recent big oil prices did not help discoveries much. Issue is natural limits.

There certainly is a glut of pumped oil right now, compared to current demand and storage capacity. It's a little upsetting to see so many oil nations open the pumps to maximum in an attempt to make up for revenue lost due to the low oil price. They're undermining their own efforts and increasing wasteful consumption at the same time.

Believe me, and I check this things for many years, it is now shortage of oil. And issues are severe. In normal economics you can not have "too much" energy and basic resources, it is nonsense.

Thing that you want to express is that in current capitalist economics we have crisis of demand that exceed crisis of production.

img1302.jpg727 x 342 - 38K

img1302.jpg727 x 342 - 38K -

@Vitaliy_Kiselev - I've been reading your posts about peak oil for several years now. I'm very interested in that topic though not yet entirely convinced. One of the reasons I keep checking in on PV is for this point of view that is very different from what I typically get. (I thoroughly read four papers and news services each day, plus copious other reading.) From my other posts, you may have noticed that I seek out multiple sources and try to apply critical thinking. So my main point on this low is simply that I don't think one can extrapolate a useful trend from it simply because of the unusual circumstances of the low oil price last year. To me that neither supports nor refutes the idea of a peak oil scenario -- it simply is a useless data point.

If you look at the Bloomberg chart you cite ( http://www.bloomberg.com/news/articles/2016-08-29/oil-discoveries-at-a-70-year-low-signal-a-supply-shortfall-ahead ), the past few years definitely drop off precipitously, but then, you can also see a cyclical pattern with a fairly flat trendline since 1980. (Note, 2016 is only showing figures through August, not all year.) If you look at the next chart in the Bloomberg report, it shows a precipitous drop in spending on exploration.

I was curious how these charts corresponded, so I overlaid one on the other with the same year scale (attached). A couple of things seem clear from the chart. First, there is a very clear reduction of new reserves discovered compared to the number of exploration wells sunk -- in other words, we're getting much less oil from each exploration well dig (which supports your peak oil theory to a degree. I do recall the charts you've shared about diminishing returns of energy extraction costs versus energy received, which is frightening.) Also, there is some mild correlation between number of wells sunk and new reserves discovered. But the huge drop in new exploration since 2014 can't help but play a significant role here.

One thing that's missing from the discussion though is that these new discoveries shown in the chart are only conventional drilling -- the chart does not include Canadian tar sands or fracking, so it doesn't tell the whole story.

oil-correlation.jpg1200 x 707 - 131K

oil-correlation.jpg1200 x 707 - 131K -

Thanks for detailed answer.

Peak oil (and peak resources) is not my theory, it is scientific theory that for now proven be very accurate. You can even get conventional US oil and see good match.

You did not get any point of view from newspapers or big news sites. It is just well paid articles depicting various interests of big capital with some small spice of some editorial stuff made after bad day full of vodka. :-)

You continue to focus on obvious statement that lower oil prices in capitalism lead to less proven oil discoveries. I never told that it is not true, quite opposite. I just stated that it is not important on general scale.

Chart also does not include coal, wood remains and old vine bottle discoveries. :-)

-

Yes, but fortunately, there was just a chart up on the site about the low fuel densities of batteries, flywheels, and old vine bottles, so I figured they were safe to omit. :-)

-

@Vitaliy_Kiselev i'm confussed. "in current capitalist economics we have crisis of demand that exceed crisis of production." wouldn't this cause prices to rise based on basic economics of demand > supply? How does "crisis" change economics.

-

i'm confussed. "in current capitalist economics we have crisis of demand that exceed crisis of production." wouldn't this cause prices to rise based on basic economics of demand > supply? How does "crisis" change economics.

Any reason for confusion? I mean that current capitalism has crisis of demand for oil caused by multiple issues one of them is huge debt. But it also have crisis of production caused not only by nature (it is main cause), but as we discussed here - also by financial issues.

Capitalists used their universal weapon to mitigate previous crisis times, to fix overproduction crisis with printing money and adding new debt. Unfortunately now it does not work, due to natural limits and also due to huge debt.

-

when you say crisis of demand that exceed crisis of production, simplified, is demand is exceeding production correct?

-

when you say crisis of demand that exceed crisis of production, simplified, is demand is exceeding production correct?

You got things reverse. Crisis of demand means falling or stalling demand, same for production. Demand crisis, as I said, exceed production crisis, hence low prices.

-

@ DouglasHorn -

The short version is that until recently, output of fusion reactiors followed a curve steeper than Moore's law, then flatlined because of the limitations of early superconductors, source of the magnetic containment coils. A new generation of superconductors has enabled new designs, one of which the speaker presents. This is not some guy in a garage.@ Vitaliy_Kiselev - thorium reactors could be on line in ten years if a major government got on a stick. And thorium reactors could be made small enough to fit on an 18-wheeler with the designs in progress now. After several generations of development, this technology could conceivable sit in your garage or back yard.

-

It like religion of science, always believing in progress. I prefer to be in reality and check real things. I am sure we will see some research facilities, but in 10 years as we will have major energy issues none of this will be available as any serious solution.

-

@Vitaliy_Kiselev - +1 on not always believing in progress. For example, you are quite correct that Moore's law is now deprecated for silicon devices, and any replacement is in the distant future. But the underlying physics for both fusion and thorium reactors is sound, and the promise of a firm solution to global warming beckons. These technologies won't solve everything. We will still need fossil fuels for air travel and for long trips by automobile. There are a half-dozen nations that have the capability to do both. One of them will do it.

-

@4CardsMan - Thanks for sharing this. I try to follow developments in fusion closely as I believe that the most important race in the history of modern man is the one to try to develop productive fusion before we run out of fossil fuels. It seems to be a major inflection point in human history and the diverging paths between success and failure will be remarkable and may determine human history for the rest of time. (Since there will be no second chance if we fail.) Success would have an enormous impact on global warming, poverty, and other problems--probably more than any other single development. This is probably the last great bottleneck in the development of intelligent species. I'm fortunate to have retired nuclear scientists and engineers in my family and they help me (try to) understand these things.

I haven't watched your entire video, but I look forward to doing so. I am both circumspect about a major breakthrough and hopeful. They say that a major breakthrough in fusion has been just 10 years away for the past 50 years. I think there are reasons for that. But yes, material science and computing power are probably two big pieces of the equation.

Several world governments are working on some fusion moonshot projects. Personally, I think there can be no better investment, but the opportunity has to be solid. I think popular support is low because most people have lost their belief in this as something we can achieve and they don't see the dire need.

-

Personally, I think there can be no better investment, but the opportunity has to be solid.

Personally, I think that capitalism will never make any real progress in energy field and will collapse. Exactly because it "can be no better investment". As it will fall due to unsolvable to capitalism conflict between common good, interests of society and greed of investors seeking profits only.

-

@donniewagner - Some believe that the current production glut is a product of low (and underreported) actual demand due to low global growth. One way to look at current economic figures, failure of stimulus to produce inflation goals, and oil glut is as a result of a long period of de facto negative inflation and very low growth that had been masked by central bank monetary policies (QE, etc) and mis-reporting (e.g. years of growth over-estimation in China due to low transparency; US redefining key economic metrics) which is now failing to work to pump up the perceived economy--while the actual economy continues to flounder further in a way that gets harder to hide. Consumers spend less into this economic climate as do businesses which creates a cycle limiting growth (very much like the Japanese post-bubble economy, but now on a global scale). Therefore, the demand for energy resources (mostly oil) falls taking prices with it. A better functioning global economy would slash production to keep prices at reasonable levels and balance the system, however, several key oil producers are unable to agree on slashing prices due to mistrust and the fact that their economies rely primarily on this source of income. Russia, Iran, and Saudi Arabia are unable to trust one another due to mutual animosity and past broken deals and have failed to reach a meaningful agreement to cut production in two major rounds of talks. The US fracking industry--whose existence, some say, was the original target of Saudi oversupply efforts around the time of their new monarch took power--perseveres (though their output is reduced), while other producers like Venezuela have few other viable resources to support their floundering economies. As a result many of these oil producers, for various reasons, pump out all the oil they possibly can to keep their economies afloat, but the oversupply breaks the normal balances of supply and demand and prices continue to fall--particularly because there are finite amounts of storage for the oversupply that has been accumulating and this too is now approaching its limits. Anyway, that's one theory about why we have cheap oil right now and it completely takes the issue of long term oil supplies out of the question. Hard to say it's entirely correct, but it makes some strong arguments and if it is true, it probably spells an unpleasant global economic future for some time to come. (Again, look at Japan's languishing post-bubble economy.)

-

@Vitaliy_Kiselev - Perhaps you're right. Churchill called democracy, "the worst form of government, except for all the other forms of government," and I sometimes feel the same about capitalism as a form of economics. For all its problems, I don't know what functional system could replace it in a world of billions of humans. I think capitalism is certainly successful in the small to medium scale. I see a lot of businesses that people I know have started that do a lot of good for them, their workers, and others. So I can't ignore those positives of capitalism.

At the very large scale, I see more problems with what I'd call corporatism where corporations become too large to be bound by the rules that apply to individuals, and yet they are essentially viewed as individuals in terms of their privileges, but not in their responsibilities and where they grow so large that they can take on outsized quasi-governmental roles.

VK, I am curious what form of economics you think would be better than capitalism?

-

Wow.

One way to look at current economic figures, failure of stimulus to produce inflation goals, and oil glut is as a result of a long period of de facto negative inflation and very low growth that had been masked by central bank monetary policies (QE, etc) and mis-reporting (e.g. years of growth over-estimation in China due to low transparency; US redefining key economic metrics) which is now failing to work to pump up the perceived economy--while the actual economy continues to flounder further in a way that gets harder to hide.

You make thing so complex and literally drawn in this complexity.

Let's become clear again. We have imperialism - last stage of capitalism. It is similar to cancer as it requires exponential growth due to construction issues like debt based financial institutions.

The core cause of current crisis is nature limits on multiple energy sources and intolerable debt issues. Both are not some "errors" made, both are expected result. Solutions used to fix debt level did not work (and they will never will).

I understand huge intention to somehow put natural limits under the bed, together with capitalism nature, and with its inevitable collapse. Do not worry, thorium reactors, solar panels and wind won't help.

Question is how soon society will stop trying to fix thing that is broken beyond repair. Will it be too late and it will collapse on them?

-

Perhaps you're right. Churchill called democracy, "the worst form of government, except for all the other forms of government," and I sometimes feel the same about capitalism as a form of economics.

Well, you are not alone, ruling class try to constantly recall same poor quote and same argument for long time.

At the very large scale, I see more problems with what I'd call corporatism where corporations become too large to be bound by the rules that apply to individuals, and yet they are essentially viewed as individuals in terms of their privileges, but not in their responsibilities and where they grow so large that they can take on outsized quasi-governmental roles.

it is artificial problems translated to you by various media. As they replace capitalism research by bunch of hoopla colorful things.

VK, I am curious what form of economics you think would be better than capitalism?

I have no idea what is "form of economics" here.

Capitalism is a stage of society development. Now this stage is in cancer state.

-

I've haven't heard you suggest something to take its place--whatever you may call it. Human beings will always use some form of ownership and economic interaction. Even a system where everyone agrees that no one owns anything and they freely give and take as they desire is a system of ownership and economic interaction. But there will naturally be some form used by people. So if not capitalism, then what do you propose?

Just saying that capitalism is doomed isn't worth much. It's not actionable. If it simply fails, then what is left? anarchy, barbarism, and warlords? That's what emerges in most failed and failing states today. You're so strong in your beliefs that capitalism is cancerous that I had hoped you could propose something that would do better.

-

I've haven't heard you suggest something to take its place--whatever you may call it. Human beings will always use some form of ownership and economic interaction.

Well, I see no point to use self invented terms, this is that I mean. But you like this approach.

You're so strong in your beliefs that capitalism is cancerous that I had hoped you could propose something that would do better.

I really hope you are joking here :-) As you do not need to be genius to understand that I propose :-)

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320