-

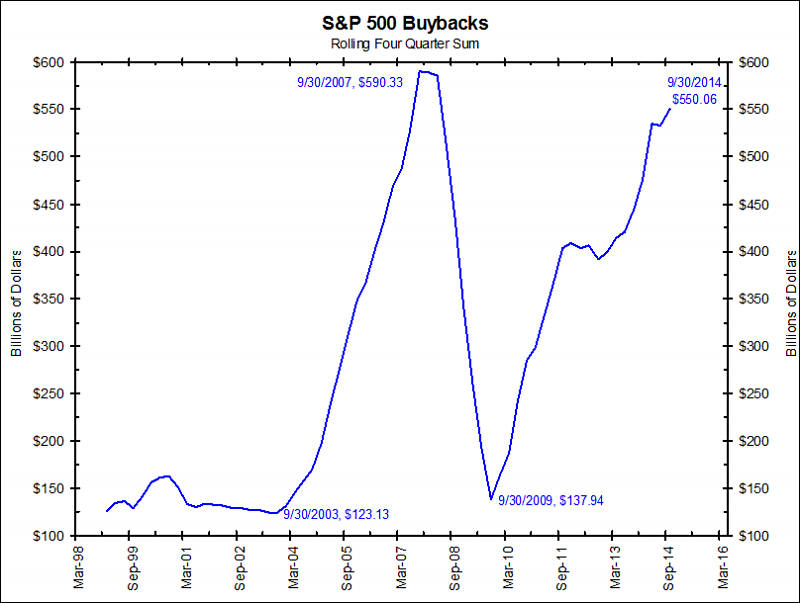

U.S. stock buy-backs, which "goose" the stock price (up) commonly accelerate in November and December, to increase the executives' year-end bonuses (which are tied to the price of the stock):

Goldman Sachs’ David Kostin believes a temporary pullback may explain why the S&P 500 has tumbled from its all-time high of 2,019 on Sept. 19.

“Most companies are precluded from engaging in open-market stock repurchases during the five weeks before releasing earnings,” Kostin notes. “For many firms, the beginning of the blackout period coincided with the S&P 500 peak on September 18. So the sell-off occurred during a time when the single largest source of equity demand was absent. Buybacks dip during earnings reporting months, which have seen 1.2 points higher realized volatility than in other months during the past 25 years.”…

“We expect companies will actively repurchase shares in November and December,” he writes. “Since 2007, an average of 25% of annual buybacks has occurred during the last two months of the year.”

This Goldman Sachs analyst comes right up and says that rising stock prices are dependent on these buy-backs -- the company boosting the price of its own shares by buying them.

-

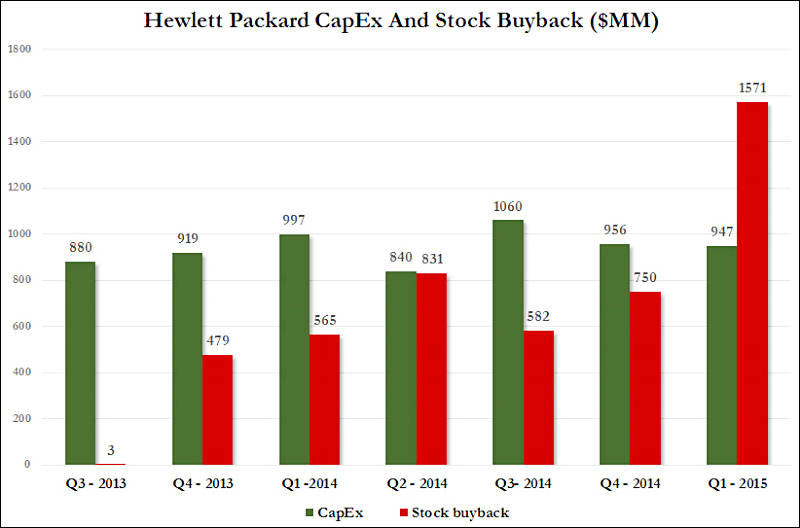

U.S. stock buy-backs, which "goose" the stock price (up) commonly occur in the last quarter of the year, to increase the executives' year-end bonuses (which are tied to the price of the stock):

Charts show quite other things.

the company boosting the price of its own shares by buying them.

You state extremely obvious thing, it just have no use :-).

Actual reason for buybacks is allowing to get more credit money, ratings, etc. If your stock will plummet consequences are numerous and many companies won't survive it. One of the other reasons - it is weird way to pay money to owners, if you rise the price and people know it in advance (insiders) it is same thing.

-

Your chart, limited in time-span though though it is, shows dips in the third quarter and rises in the fourth. Which is consistent with the explanation I quoted, the Goldman Sachs claim that 25% of buy-back purchases have been in the last two months of the year, for the last 7+ years.

It may be self-evident that buying the shares back rises prices, but there's evidently some difference of opinion about why, as your post demonstrates.....

-

It may be self-evident that buying the shares back rises prices, but there's evidently some difference of opinion about why, as your post demonstrates.....

Stating that they made buybacks to rise their bonuses can come only from lack of understanding how big companies work. While their executives get very good bonuses - they are just hired managers who do that is being told, and if they do it good - they get their bonuses.

-

It's hard to see the CEOs who make these decisions as "hired managers". The whole executive pay question -- e.g., poor performance CEOs getting big raises from board members they themselves appointed -- indicates that a lot of this is just self-dealing, at the expense of the shareholders and the company itself.

-

It's hard to see the CEOs who make these decisions as "hired managers".

They are hired guys with much less freedom than McDonalds worker. Big guys, funds, banks and real owners stand behind and order that to do and then.

Of course bonuses got out of proportions - but this is just because all else went out of them also. This guys just think that they are all powerful immortal geniuses. History shows that it usually ends with nearest tree and a rope.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List24,082

- Blog5,725

- General and News1,396

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,393

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras141

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,342