-

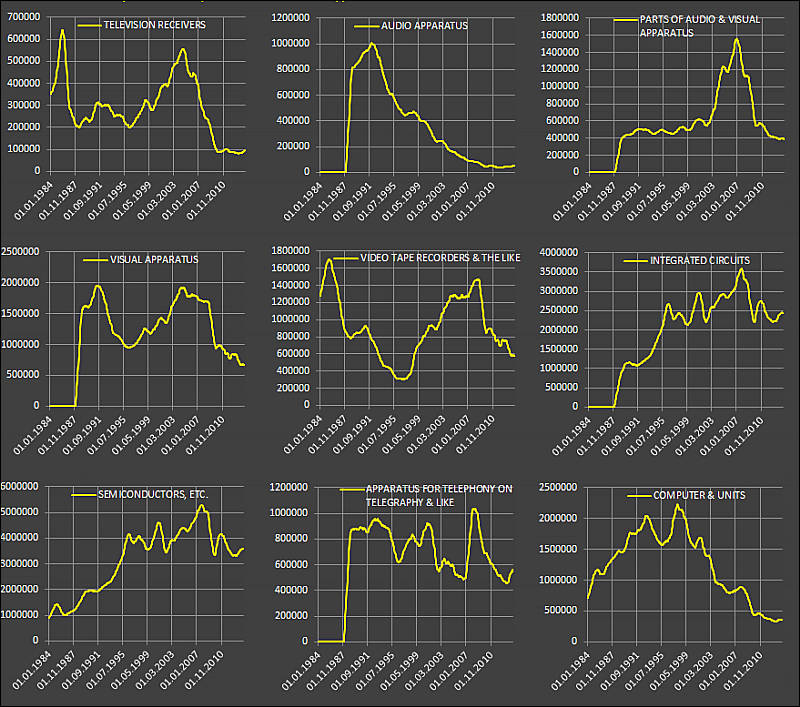

Japan posted its biggest October trade deficit on record, mainly because of soaring costs for imported fuel in the wake of the nuclear industry’s shutdown.

The shortfall of 1.09 trillion yen ($10.9 billion) extended a record run of deficits to 16 months, and was larger than all 28 forecasts in a Bloomberg News survey, a finance ministry report showed today in Tokyo. Imports climbed 26.1 percent from a year earlier

Fossil fuels contributed to nearly half of the gain in imports, with the value of petroleum shipments to Japan soaring 67.8 percent from the previous year, and liquefied natural gas rising 39.4 percent. The large gain in October this year may partly reflect depressed imports a year earlier following a tax change for some fossil-fuel imports.

-

Get out the extra blankets.

-

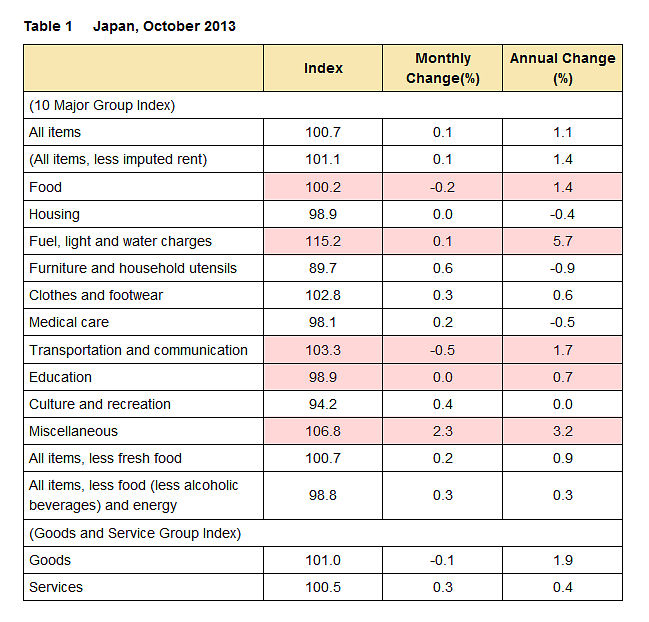

Inflation, especially on energy, food and other stuff.

gh3_6.jpg649 x 622 - 115K

gh3_6.jpg649 x 622 - 115K -

Japan will craft an economic stimulus package this week worth about $53 billion to bolster the economy ahead of an increase in the national sales tax in April, people familiar with the process said on Tuesday.

The size of the package, ordered in October by Prime Minister Shinzo Abe, will be between 5.4 trillion yen ($52.43 billion)and 5.6 trillion yen, the sources told Reuters on condition of anonymity.

Government ministers have said the package needs to be at least 5 trillion yen to soften the economic blow of the tax hike - Japan's biggest step in decades toward curbing its enormous debt.

Yuk.

http://www.reuters.com/article/2013/12/03/us-japan-stimulus-idUSBRE9B206020131203

-

Japan should continue to use nuclear power as a key energy source despite the Fukushima power plant disaster, a government panel said Friday in a reversal of a phase-out plan by the previous government. The draft energy plan issued by the panel underscores Prime Minister Shinzo Abe’s push to restart as many nuclear reactors as possible under new, stricter safety requirements that took effect this past summer.

Oops!

-

I wonder which safety measures there are against serious earthquakes…

-

Bank of Japan officials see significant scope to boost government bond purchases if needed to achieve their inflation target, according to people familiar with the discussions, signaling little concern with perceptions of underwriting fiscal deficits.

While no decision will be made until the central bank has more time to assess price trends, the current pace of asset purchases -- equivalent to 70 percent of new government-debt issuance -- isn’t a limit for many officials, according to the people, who asked not to be named as the talks are private.

-

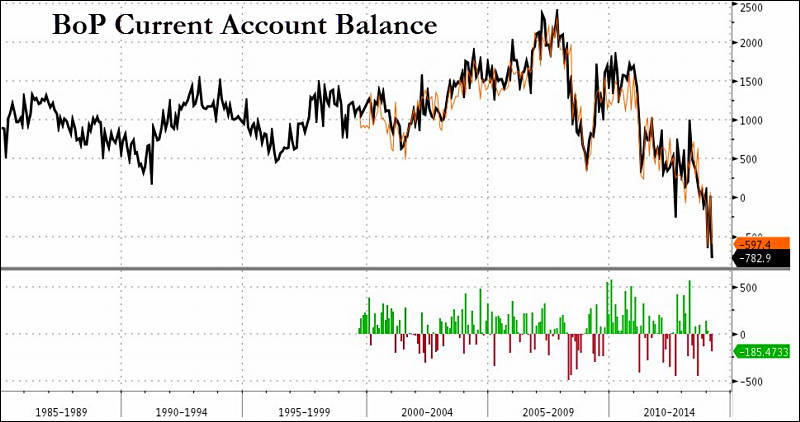

Japan has reported a record annual trade deficit after the weak yen pushed up the cost of energy imports.

Its deficit rose to 11.5 trillion yen ($112bn; £68bn) in 2013 - a 65% jump from a year ago.

-

Improvements continue.

More on japan:

sales49.jpg800 x 422 - 58K

sales49.jpg800 x 422 - 58K -

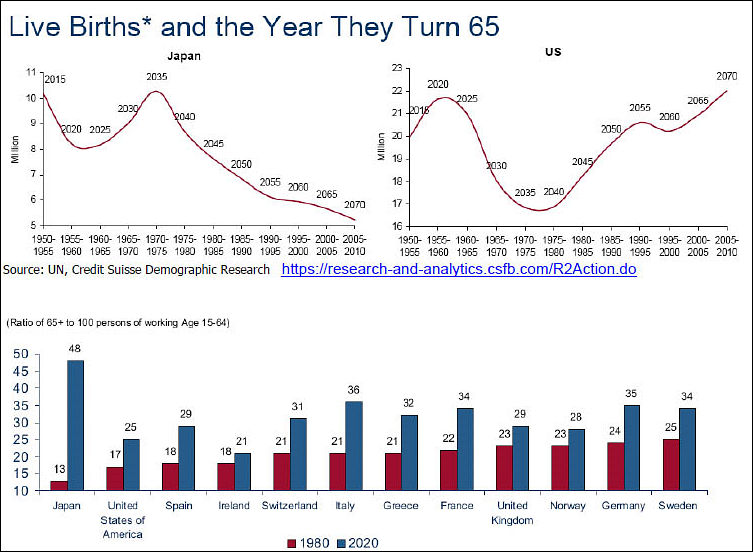

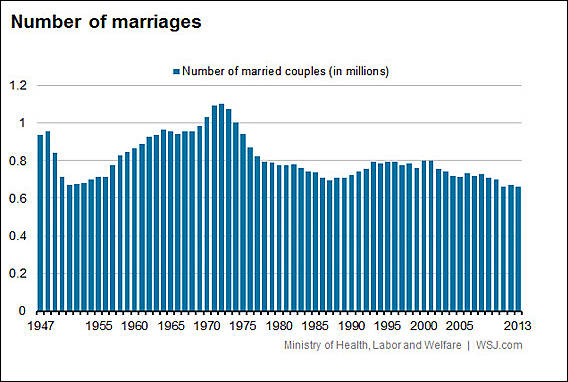

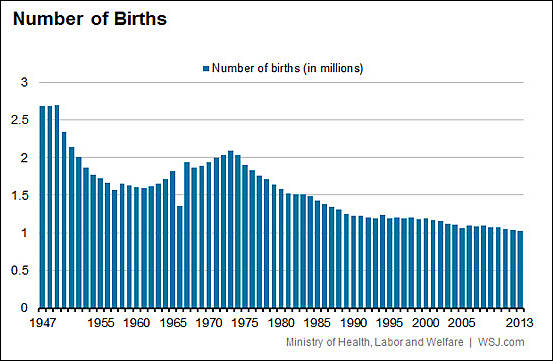

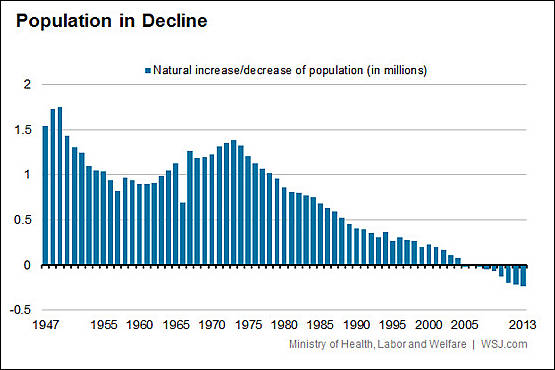

Population dynamics

http://blogs.wsj.com/japanrealtime/2014/06/06/japans-population-problem-in-five-charts/

v29.jpg568 x 382 - 57K

v29.jpg568 x 382 - 57K

v31.jpg555 x 370 - 41K

v31.jpg555 x 370 - 41K

v30.jpg553 x 361 - 47K

v30.jpg553 x 361 - 47K -

Energy costs are 9.1% higher YoY, TVs +8.0%, and Food +4.1%

Life is good.

gh4_16.jpg631 x 331 - 35K

gh4_16.jpg631 x 331 - 35K -

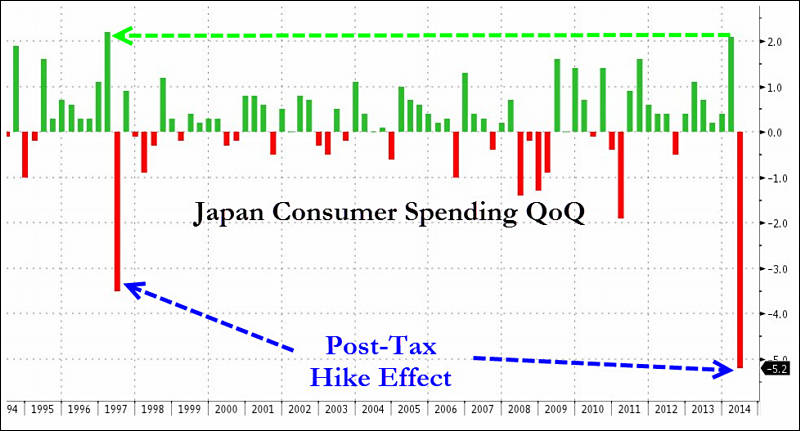

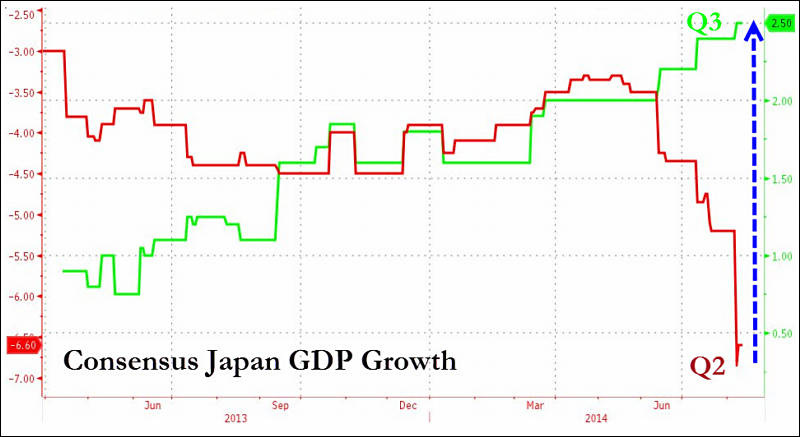

Japanese GDP Plunges 6.8%

fish22.jpg800 x 431 - 60K

fish22.jpg800 x 431 - 60K

fish23.jpg800 x 437 - 48K

fish23.jpg800 x 437 - 48K -

Japan is done - fukushima killed it

-

Japan is done - fukushima killed it

Hard to upset you but Fukushima have nothing to do with it.

-

Abenomics and bad demographics - but I think the bad demographics were driven by adverse incentives resulting from zombie banks, QE and ZIRP. To put it bluntly who would want to bring children into a world of intergenerational mortgages and debt slavery?

-

To put it bluntly who would want to bring children into a world of intergenerational mortgages and debt slavery?

All this also have little to do with situation, this are just consequences.

-

Hard to upset you but Fukushima have nothing to do with it.

actually it does

-

One of Japan's problems lie within the age disparity, and the differences that rise in political ideology between competing generations.

-

I prefer don't eat food from Japan. They are dangerous. After a few years, ills related nuclear will be showed.

-

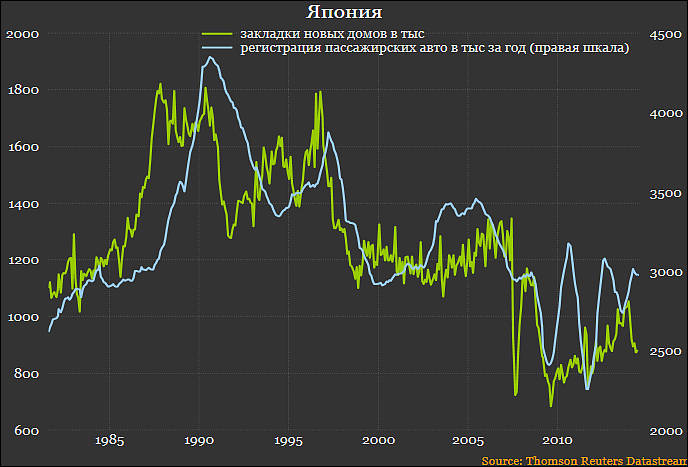

Cars registrations and new homes chart.

I prefer don't eat food from Japan. They are dangerous. After a few years, ills related nuclear will be showed.

Mass media can do amazing things to minds.

bird3.jpg688 x 467 - 55K

bird3.jpg688 x 467 - 55K -

Japan's massive Government Pension Investment Fund (GPIF) is working on plans to raise the amount of its assets invested in domestic stocks to about 25%, the Nikkei reported Saturday. Current investment guidelines for the GPIF -- said to be the world's largest public pension fund -- call for an allocation of 6%-18% for Japanese stocks, with the weighting at 17% as of the end of June, the report said. "The new standard will likely be about 25%, putting the upper limit at around 30%," while the allocation for government bonds will fall to around 40% from 60% currently.

-

According to Highlights of the Budget for FY2013/2014, the initial 2013 budget was 92 trillion yen, while the actual 2013 spending came in 10 trillion yen higher, at 102 trillion yen.

REVENUES: 92.6 trillion yen

Tax revenues: 43.0 TY

Other revenues: 4.0 TY

Government Bond Issues (borrowing): 42.8 TYEXPENDITURES: 92.6 TY

National Debt Service (interest & bond redemptions): 22.2 TY

Social Security: 29.1 TY

Other: 41.2 TYDebt service and Social Security are 120% of tax revenues. In other words, tax revenues don't even cover debt service and Social Security.

An astonishing 46% of the governments budget is borrowed money. Even with near-zero yields on Japanese government bonds (about 1%), 51% of tax revenues in 2013 were spent on national debt service.

In the decade since 2005, tax revenues actually declined slightly while annual borrowing increased by 8 trillion yen and expenditures rose by 10 TY. Virtually all of this increased spending comes from higher Social Security costs, which rose from 20 TY to 30 TY as the demographics of Japan's aging population inexorably pushes retirement and healthcare costs up.

http://charleshughsmith.blogspot.ru/2014/11/anatomy-of-failing-state-japans.html

-

Others have more moderate opinions on Japan. http://www.nytimes.com/2014/10/31/opinion/paul-krugman-apologizing-to-japan.html?partner=rssnyt&emc=rss&_r=0

EXCERPT: The point, however, is that the West has, in fact, fallen into a slump similar to Japan’s — but worse. And that wasn’t supposed to happen. In the 1990s, we assumed that if the United States or Western Europe found themselves facing anything like Japan’s problems, we would respond much more effectively than the Japanese had. But we didn’t, even though we had Japan’s experience to guide us. On the contrary, Western policies since 2008 have been so inadequate if not actively counterproductive that Japan’s failings seem minor in comparison. And Western workers have experienced a level of suffering that Japan has managed to avoid.

What policy failures am I talking about? Start with government spending. Everyone knows that in the early 1990s Japan tried to boost its economy with a surge in public investment; it’s less well-known that public investment fell rapidly after 1996 even as the government raised taxes, undermining progress toward recovery. This was a big mistake, but it pales by comparison with Europe’s hugely destructive austerity policies, or the collapse in infrastructure spending in the United States after 2010. Japanese fiscal policy didn’t do enough to help growth; Western fiscal policy actively destroyed growth.

Or consider monetary policy. The Bank of Japan, Japan’s equivalent of the Federal Reserve, has received a lot of criticism for reacting too slowly to the slide into deflation, and then for being too eager to raise interest rates at the first hint of recovery. That criticism is fair, but Japan’s central bank never did anything as wrongheaded as the European Central Bank’s decision to raise rates in 2011, helping to send Europe back into recession

-

Well, Krugman lies. In fact idea to spend just more and more and something will change is main guide idea. It is like two drug addicts who opened all water in the house and discuss how it will be better to save it - keep open only half of valves or all of them.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320