It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

This is amazing. Under the terms of the bailout for Cyprus, all account holders with more than 100.000 Euros of savings will immediately forfeit 10% of their money. Wow. I wonder how long it will take before other bailouts across Europe mean that savings accounts will be taxed 10% or more to pay for the mistakes of the governments. And of course Cyprus has a lot of Russian money laundering cash in their banks....

http://www.bbc.co.uk/news/world-europe-21814325

http://www.reuters.com/article/2013/03/16/eurozone-cyprus-anger-idUSL6N0C81DL20130316

http://pawelmorski.wordpress.com/2013/03/16/cyprus-a-brutal-lesson-in-realpolitik-2/

-

And now the EMU goes after Cyprus' gold reserves... could Portugal be next?

-

This is the main issue that actually caused the American revolution against Britain, not taxes as the history books tell us. The colonies controlled their own currencies and the economy of Pennsylvania was especially successful because it developed a currency base on true GDP, not debt. It was so successful Benjamin Franklin went on a speaking tour in Europe extolling its benefits. The Bank of England, which was privately held, realized their demise in such a system and influenced King George to do away with the currencies of the colonies. Such a system might be the only hope for the economies of the world, but I'm afraid the price for bringing it to fruition may be blood in the streets. The idea of private central banks has become so institutionalized that everyone sees it as the norm instead of asking "why the hell is the currency of any country controlled by private interest, especially those who profit from its manipulation?" This site has a public model based upon the Pennsylvania colony that seems feasible if we are ever able to loosen the iron grip around our throats. http://publicbankinginstitute.org

-

"the Euro is shit" the euro is/was NOT shit. The entities that destroyed it in the last few years are! Oh, have you noticed - we are back to the otherwise useless dollar as a global money. So, who is happy now? And it all happened in just a few years. So its more clear who is pulling the strings, now and again.

-

Cyprus banks has been using special software for "mass deletion" to wipe out evidence of Greek bond purchases

Issue is that it was not their idea to purchase this junk.

-

Even more fun today... investigators discovered evidence that one of the Cyprus banks has been using special software for "mass deletion" to wipe out evidence of Greek bond purchases. Starting to stink like criminal conspiracy....

-

We're all to blame. Including the German loans that funded much of the reckless spending over the last decade. We are at the beginning, not the end, the problems are only just beginning to mount up.

-

@jasonp: We will probably never know for sure which individual politician knew what since when, but the relevant fact is that the official numbers given from the Greece gouvernment to the EU were faked beyond recognition. Regardless of who else might have known about this fake, this is reason enough to not blame anyone outside of Greece for the disaster.

And it is no surprise that some professor at Brighton University does not like the Euro... a vast majority of UK citizens do not, so consequentially they retained a currency of their own... and have piled up a huge deficit of their own that is in some aspects more scary than that of most southern European states.

@jrd: I'm fine with letting people who irresponsibly lend money to debitors of questionable reliability cope with their losses when the debitor goes bankrupt. But a) is/was the Cyprus gouvernment trying to avoid exactly that bankruptcy of two local banks, thus linking their own fate with that of those banks, and b) is Germany not a relevant creditor of the Cyprus banks. You probably read that the Bank of Cyprus has significantly more branch offices in Russia than in Cyprus?

The most hilarious news of today: After some foreign politicians have scolded the Cyprus gouvernment for running a "Casino Economy" in the past, the Cyprus gouvernment now officially plans to do just that!

If I was to decide, I would not interfere with the Cyprus politics at all - neither by providing additional credit or aid, nor by demanding any specific political or financial measure. The consequence of that pretty certainly would be an immediate bankruptcy of the two Cyprus banks, then let all who lend them money deal with the consequences. Including the Cyprus gouvernment.

-

The banks are crap(shit) and the Euro is shit - that's the problem - and the dreamer in politics - and the fraudsters in Greece, Cyprus, Italy, Spain, Portugal, etc. - lie in the sun and let the slaves work and earn money

-

Germany played no role at all in the disasterous decisions causing those events.

So the German banks that lent heavily, and irresponsibly, to economies like Spain and Portugal (and Greece? and Ireland?) are to be protected from their own greed and stupidity by demanding that the citizens of those now impoverished countries embrace drastic reductions in their standard of living, in order to pay off odious private debts -- to those same German banks?

If ordinary people are supposed to pay for the sins of their big banks, why shouldn't German consumers shoulder that burden as well?

-

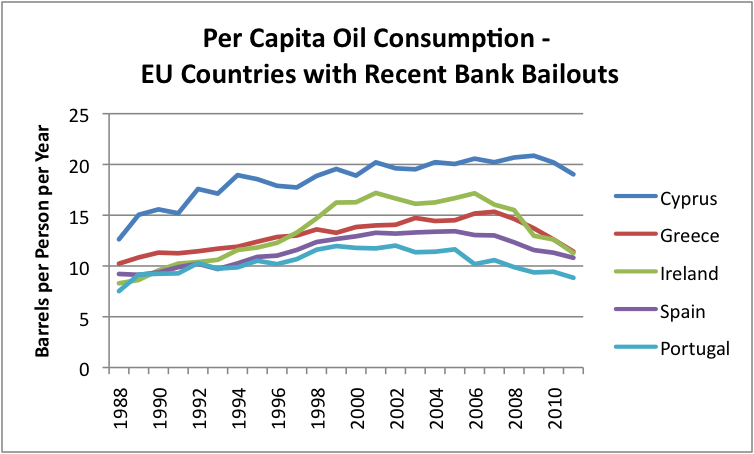

Btw, good charts:

-

My present understanding is that it is not only gradient test (will it do to just rob all their money? ) but also stupid attempt to increase consumption. Force you to get money out of the bank.

-

Goldman Sachs helped Greece cook their books and then made money out of it...

-

I guess the only way for Germany to not be blamed for every financial problem abroad, regardless of its origin, would be to isolate itself like North Korea does.

The Greek gouvernment blatantly lied and falsified official financial statements towards the EU like true criminals, up until the day their catastrophic economic situation, over-spending and huge pile of debt could no longer be hidden.

The Cyprus gouvernment happily allowed the local banks to gamble with (partially less than legally aquired) foreign money like high rollers in a casino, and once a fortune was lost there, the gouvernment bought into the falling banks with money from their tax payers.

Germany played no role at all in the disasterous decisions causing those events. But now that some failed gouvernments approach the EU and IWF like aggressive beggars for billions of Euro, it's so convenient for those gouvernments to blame foreign countries like Germany for all of the consequences.

BTW: Germany is not at all the only country in Europe that practiced at least a little discipline with regards to "not over-spending", countries like Finland or Denmark are just as unwilling as Germany is to let their tax-payers finance the absurdities of some other countries.

-

Reuters also suggests that most of the well-connected Russian millionaires already got their money out of the banks because the branches in London were still open and doing large transfers for an appropriate fee. So things are going to get messy when they realize only the smaller depositors are remaining to take the haircut, and the rest of the money has already gone to Latvia or Iceland or wherever capital flies these days...

-

Under conditions expected to be announced on Saturday, depositors in Bank of Cyprus will get shares in the bank worth 37.5 percent of their deposits over 100,000 euros, the source told Reuters, while the rest of their deposits may never be paid back.

Via:http://www.reuters.com/article/2013/03/30/us-cyprus-parliament-idUSBRE92G03I20130330

In Laiki bank all owners of 100k or more will loose 80% and remaining 20% may be, probably will be paid back after 7 years. But they are not sure.

Good progress. With such speed I expect May announcment that citizens must work as slaves for next 80 years and they must say big thanks that Germany agreed to only 80 years.

-

If you ask me, all mentioned countries are abberation and mistake.

-

Europe with the Mediterranean countries is an aberration and a mistake - one should repent, Germany should withdraw and seek an alliance with the Brics countries: Russia, China, India, Brazil, etc. The euro is bad for the whole of Europe. . . and the greedy banks gamble away the future of the youth in Europe

-

Latest rumor: Cyprus will take 25% from accounts of the wealthy (i.e., Russians with more than 100,000 Euros). I'm sure Putin and his buddies will be so pleased.... :-)

-

@Vitaliy_Kiselev Bitcoin is untraceable, so makes it useful for criminals to use in online transactions. But the same thing applies to cash, except only IRL. In fact, most drug deals are done with cash -- probably less than 0.01% use Bitcoin (e.g. via Silk Road).

-

If you are not permanently banned on google make some research on usage in drug selling, stories of bitcoin exchange sites, malware and botnets selling, etc.

-

I am genuinely interested in specific examples and information.

-

Is this based on particular knowledge about the history of Bitcoin or how it is administered? Or just a suspicion because it is totally cyber-based?

It is based on it's usage and criminal or half criminal trading places :-)

-

@Vitaliy_Kisilev You said "Bitcoin is criminal induced thing. It is not serious thing at all. But sounds modern."

Is this based on particular knowledge about the history of Bitcoin or how it is administered? Or just a suspicion because it is totally cyber-based?

-

Now Bitcoins are making the news in BBC.... some Canadian is offering to sell his house for the equivalent of Bitcoins.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,991

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319