It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

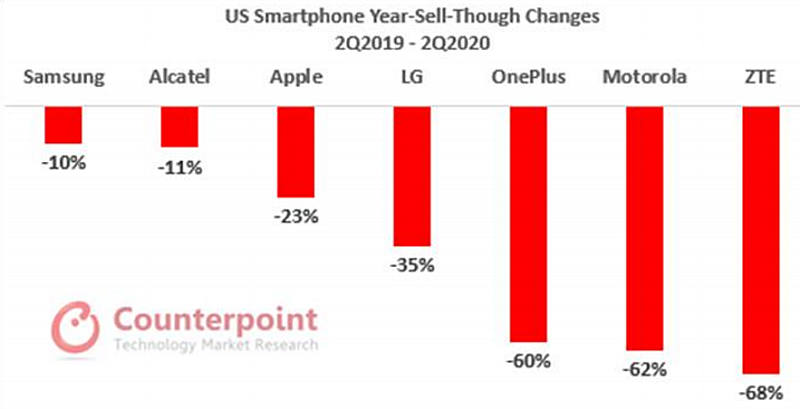

Lot of Apple sales happened in this period thanks to new corporate programs directly financed by goverment (aka free for companies).

sa13822.jpg800 x 409 - 31K

sa13822.jpg800 x 409 - 31K -

In the US, 7 out of every 10 smartphones made in China. COVID-19 likely reason

The United States and China are on less-than-friendly terms at the moment, but you wouldn’t know it by looking at the smartphone market. Canalys estimated that China-made devices represented 70% of smartphones shipped to the US in the second quarter of 2020, a sharp jump from 60% the quarter before.Apple was one of the clear winners, with shipments jumping 10% versus a year earlier. Other brands also fared well, though. Motorola (that is, Lenovo) saw its own shipments climb 8% in the Spring. Additionally, relatively tiny low-cost brands such as Unimax and Wiko also thrived.It won’t shock you to hear that the COVID-19 pandemic likely played a role in the shift. Many consumers needed to be more cost-conscious due to unemployment and personal budget cuts. The $399 iPhone SE was one of Apple’s stronger sellers, for example. As another example, those previously mentioned low-end Android devices sometimes went to people signing up for Lifeline. That’s an assistance program that offers subsidized phone service for low-income families.https://www.androidauthority.com/70-percent-us-smartphones-made-in-china-1146888/

And Chinese connections weren’t a guarantee of success — TCL saw its shipments plunge 43% despite launching phones like the 10 series.The situation could change wildly. Canalys noted that volatile US-China tensions were creating a “perpetual state of uncertainty” for virtually every phone maker beyond Samsung and LG. Even if the pandemic came to an end soon, phone makers might not breathe a sigh of relief until the political climate settles down. -

Worldwide smartphone value is expected to decline 7.9% in 2020 to US$422.4 billion, down from US$458.5 billion in 2019. The downward trend is intensified by consumers turning to devices priced in the low-to-mid range as they prioritize spending on essentials.

Overall, the low-to-mid-end segment (US$100 to less than US$400) dominated global smartphone shipments with 60% market share in the second quarter of 2020 and is expected to grow in the short term to 63% by next year.

The mid-to-high-end segment (US$400 to less than US$600) grew its share of the market by almost 4pp to 11.6% in the second quarter of 2020. Devices from Samsung, Huawei, and other Chinese vendors such as Xiaomi, Oppo, and Vivo are the main vendors driving these segments.

In the US, devices under US$200 increased their share by 10pp on year to capture 27% of the market in the second quarter of 2020. In China, the mid-to-high-end segment (US$400-US$600) grew the most with an 8pp increase in market share to 21% in the second quarter of 2020.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320