It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

More good news

DRAM contract prices are set to fall nearly 20% sequentially in the first quarter of 2019, according to DRAMeXchange, which estimated previously a smaller 15% price decrease.

-

Major chip suppliers, including Samsung Electronics, Micron Technology, Toshiba and SK Hynix, which had been competing for Apple's orders for DRAM+NAND flash chips used in iPhone XS Max, are now worried about how to keep their memory production capacity occupied.

But they fight hard to not allow price reductions :-) Despite profits are now comparable to selling drugs.

-

Contract prices for PC DRAM memory are expected to decrease by up to 25% sequentially in the first quarter followed by another drop of up to 15% in the second quarter, while prices for server DRAM chips will fall nearly 30% in the first quarter and 15% in the second, DRAMeXchange indicated.

-

Samsung Electronics, SK Hynix and Micron Technology - saw their combined DRAM and flash memory revenues drop 18% sequentially and 26% from a year earlier in the fourth quarter of 2018 due to seasonality and decreasing prices.

Their combined revenues from DRAM slipped 17% sequentially and those from flash memory dropped 20% in the fourth quarter. DRAM accounted for 70% of the top-3 vendors' combined revenues in the fourth quarter, a percentage similar to that of the previous quarter.

-

DRAM contract prices for the first quarter of 2019 are likely to fall nearly 30% sequentially, according to DRAMeXchange, which estimated previously a smaller 25% decrease.

DRAMeXchange in February already warned of a larger-than-expected sequential decline in DRAM contract prices for the current first quarter. The price tracker again revised its price outlook this quarter judging from the prices set for February.

-

DRAM memory contract prices have fallen further in March, and are expected to continue their downward trend through the second quarter indicating PC OEMs and other chip buyers continue to gain bargaining chips when negotiating prices, according to industry sources.

Nevertheless, falls in the contract prices are expected to slow in the second quarter, said the sources. It is likely the prices will return to the levels two years ago, the sources continued.

-

DRAM ASPs are forecast to fall 15-20% sequentially in the second quarter of 2019, and drop another 10% in the third quarter. DRAMeXchange.

-

China at the moment has as many as 30 semiconductor fabs under construction - the most ambitious investment plan the global semiconductor industry has ever seen. China's memory industry was originally meant to be a key growth driver, but it has lost momentum after the US ban on exports to China-based DRAM maker JHICC. On the other hand, China's wafer foundry sector continues seeing expansions with at least 13 local fabs eyeing business opportunities in the sector.

Hence the sudden move by cartel by fast lowering the DRAM prices. And most fun is that Chinese DDR4 modules assembly companies are now using it to wipe out competition at least in Asia.

Not lowering DRAM price was not possible as it could lead to massive tragedy with at least one of cartel members that could go underwater and Samsung also bleeding to death, as now cartel hopes that at least some of planned fabs will be moved to something else and it will save them.

Taiwan-based memory module firms basically intend to shift all their manufacturing lines for products exported to the US from China to Taiwan, while keeping those for products sold locally in China, the sources noted. However, none of the makers is expanding existing factory capacity in Taiwan

It will be also big tragedy for Taiwan memory module sellers, as Chinese companies are closing fast. They are already losing lot of orders in Asia and exUSSR areas due to 15-20% of price advantages as all Chinese memory makers are run on government money and do not need profits.

-

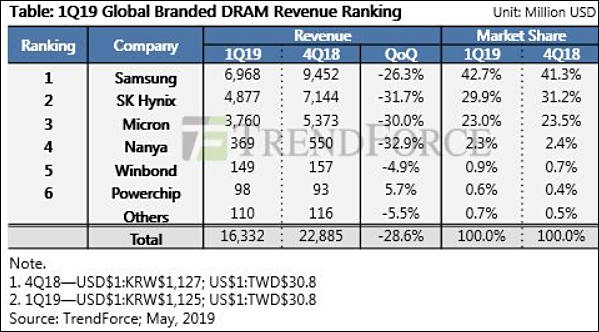

According to the latest investigations by DRAMeXchange , a division of TrendForce , DRAM prices have faced mounting pressure to trend down in 1Q, the traditional offseason. Not only was this due to the production capacities added in 2H18, which found full expression in 1Q, but also a compressed procurement momentum by a demand side busy clearing out their own inventories. This caused a pronounced double-decline effect: Both DRAM prices and volume fell in 1Q, causing overall production revenue to drop by 28.6 % QoQ.

Looking at 2Q19, ASP for 8GB modules have fallen to US$34 in April as seen from the final pricings by Tier-1 PC-OEMs, falling by 20% QoQ. Inventory levels kept rising for DRAM suppliers due to lukewarm trade. TrendForce predicts contract prices will keep plunging under as monthly deals are made in May and June and decline by nearly 25% for the whole 2Q. Server DRAMs, which contribute to over 30% of DRAM shipments, will face an even heavier price pressure.

Revenues show dramatic drops QoQ across the board. Market leader Samsung's reference revenue started low and performed better than expected in 1Q mobile DRAM shipments, bringing 1Q sales bit performance on a par with the previous quarter. Still, revenue was still impacted by declining quotes and dropped by 26.3% QoQ and arrived at US$6.97 billion, with market share recuperating to 42.7%. SK Hynix's sales bit performance slid by 8%, which was slightly better than what it had expected, and arrived at US$4.88 billion in revenue 1Q, a 31.7% decline QoQ, and took home a 29.9% market share.

Micron continued to hold third place and came to US$3.76 billion in revenue, sliding by 30.0% QoQ, while market share remained at about 23%. TrendForce predicts that the top three suppliers will continue utilizing aggressive quoting strategies in the coming months under pressure from mounting inventory levels.

-

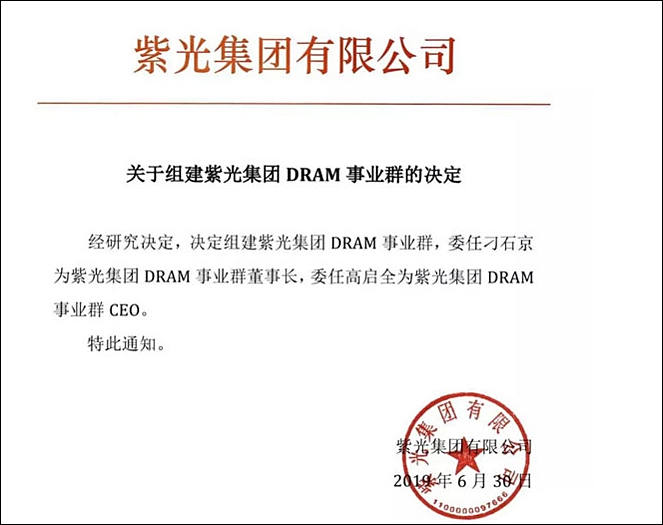

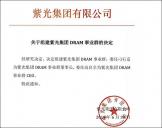

Tsinghua Unigroup announced plans to enter DRAM market

It is same guys who wanted to buy Micron, but US authorities did not allow it.

In 2-3 years time we can have new round of trade wars, now with tariffs and bans on Chinese DRAM and NAND.

sa9014.jpg663 x 525 - 40K

sa9014.jpg663 x 525 - 40K -

DRAM capital spending will fall 28% in 2019, due to economic and trade uncertainties, and softer demand keeping pressure on DRAM ASPs, according IC Insights.

One of the significant questions facing the IC industry in the second half of 2019 is if and when the DRAM market will rebound, IC Insights indicated. Any rebound in the market will be driven in part by available manufacturing capacity. After huge capex outlays for DRAM in 2017 and 2018, the question becomes how much new capacity will come online and how far DRAM prices (price per bit) will fall as a result of this buildup

-

Spot market prices for DRAM memory have started rebounding recently and will continue their growth in the short term, according to DRAMeXchange. But DRAM contract market prices are still under downward pressure.

The DRAM market remains oversupplied with high levels of inventory still held by chipmakers including Samsung Electronics and SK Hynix.

-

The price of key memory chips has risen by more than 20 percent in just two weeks following Japan's restrictions on high-tech material exports to South Korea.

According to industry sources and market researcher DRAMeXchange, the spot price of 8-gigabit DDR4 DRAM, a benchmark price for the category, closed the week recording an average three-dollars-and-74-cents in Friday's trading.

It's up 14-point-six percent from last week's closing price and more than 23 percent higher than that of July fifth, a day after Japan's export curbs took effect.

-

Most probably they will go up until January.

-

Worldwide silicon wafer area shipments for the second quarter of 2019 were down 2.2% from the 3.051 billion square inches shipped in the prior quarter, and 5.6% lower than shipments during the same period in 2018, SEMI indicated.

Look how NAND and DDR cartel dropped production in unison (hence they need less wafers!). And no one going after this criminals.

-

Thanks

-

SK Hynix announced that it would cut DRAM supply in Q4 as it transitions a portion of that production towards CMOS image sensors. As this follows news of potential supply shortages by the Korean firm, it appears that any supply recovery will be used for the production of devices other than DRAM.

-

Contract prices for mobile DRAM memory are set to register another sequential drop of 10-15% in the third quarter of 2019, and will continue trending downward in the fourth quarter, according to DRAMeXchange.

Cartel managed to stop desktop.server memory fall, expect some new fires to make prices back for mobile also.

-

Despite a 38% sales decline expected this year, the DRAM market is forecast to remain the largest of all IC product categories again in 2019 with sales reaching US$62 billion, down from US$99.4 billion in 2018, according to IC Insights.

The DRAM market is expected to account for 17% of total IC sales in 2019, said IC Insights. DRAM sales accounted for 23.6% of the total IC market in 2018.

-

DRAMeXchange said it expects DRAM prices to continue to fall in the third quarter of 2019. Consumer demand isn't expected to rise enough for suppliers to work through existing DRAM inventories, meaning suppliers are likely to see further price drops in the next quarter.

Seems opposite to that you can see on retail market, fall stopped and on many DDR4 sets price started to rise.

-

DRAM contract market prices are likely to stop falling and begin to stabilize in September, according to Simon Chen, chairman for memory module maker Adata Technology.

On retail market they even slowly rebound.

Eight-inch foundry fabs expect their utilization rates to fall on weak demand for automotive and consumer ICs.

Actually, most of real reduction comes from same NAND and DRAM.

-

IC Insights has forecast that capital spending in the DRAM and flash memory segments will drop by 19% and 21%, respectively, in 2019. "The big cutbacks in spending in the DRAM and flash market segments this year are an attempt by the major memory suppliers to prevent further price erosion in the second half of 2019 and into 2020,"

Adata Technology chairman Simon Chen expressed previously optimism about the memory market next year. With 5G, AIoT and automotive electronics applications set to proliferate rapidly worldwide, memory chip demand will be robust in 2021-2022

Do not expect further price drops, as industry reached new cartel agreement.

-

China's DRAM startup ChangXin Memory Technologies (CXMT) will operate as an IDM and start volume production of 8GbDDR4 and LPDDR4 by the end of 2019 as scheduled

DRAM upcoming production is one among big reasons of US new tariffs.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320