It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

The sad truth about the nature of modern cutthroat business is....it's the consumers fault. We want...we want...we want. And that's not even talking about the public's complete abandonment of any political responsibility . The banksters have taken over, and will continue to do so....until the people stop participating. And that's why workers are robots, and will continue to be so...until they're replaced by robots. The whole scenario is apocalyptic .

-

The company reported net revenue of $25.4 billion and net income of $79 million, or $0.17 a share. That means revenue grew 24 percent compared with the same period last year, while income swung positive from a net loss of $437 million, or $0.95 a share, in the year-ago quarter. AWS reported $2.1 billion in revenue and $521 million in profit. That's a 78 percent rise in revenue and 432 percent rise in profit over last year. Overall, AWS now accounts for around 8 percent of Amazon's total revenue, but nearly half of its total profits, which puts it close to matching the performance of its entire North American e-commerce division.

This is why this guys love clouds :-)

-

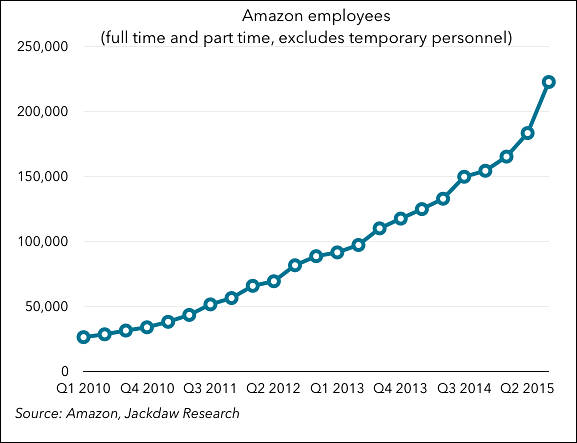

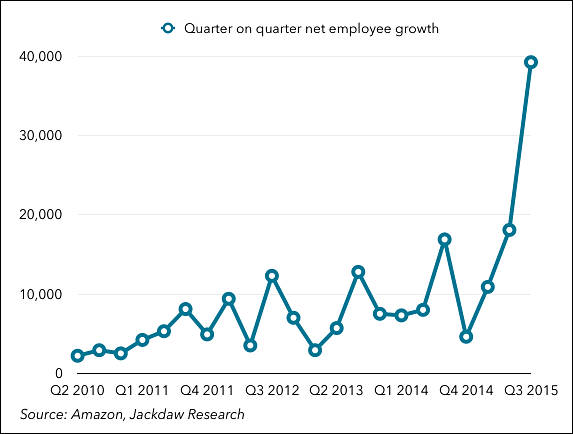

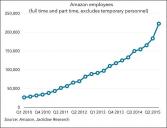

More and more people:

zebra238.jpg577 x 443 - 32K

zebra238.jpg577 x 443 - 32K

zebra239.jpg573 x 434 - 31K

zebra239.jpg573 x 434 - 31K -

German labour union Verdi has announced Amazon Germany's employees will go on strike during the Christmas holiday

-

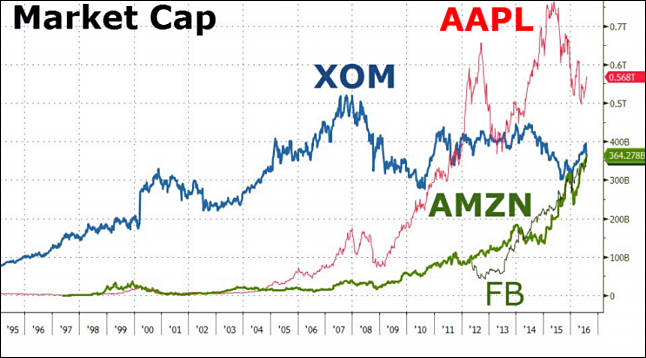

If nothing helps, do that Apple is doing

On February 10, 2016, the Board of Directors authorized the Company to repurchase up to $5 billion of the Company's common stock. The program allows the Company to repurchase its shares opportunistically from time to time when it believes that doing so would enhance long-term shareholder value. The repurchase authorization does not have a fixed expiration. Purchases may be effected through one or more open market transactions, privately negotiated transactions, transactions structured through investment banking institutions, or a combination of the foregoing. This stock repurchase authorization replaces the previous $2 billion stock repurchase authorization, approved by the Board of Directors in 2010.

-

Just for comparison - photos from Gearbest

http://www.mobile-review.com/articles/2016/how-it-works-gearbest-2.shtml

img310.jpg637 x 527 - 82K

img310.jpg637 x 527 - 82K -

Amazon Is Giving Its Workers Treehouses.

No, no, don't get me wrong. Not all workers, only management working in main offices. Others still will be working without breaks in sweatshop warehouses.

img870.jpg800 x 507 - 108K

img870.jpg800 x 507 - 108K -

Amazon discontinued its Unlimited Photos storage plan this week. The service was previously available for $12 a year, and now it is no longer available on Amazon's website. Users who had paid for it have been offered to sign up for Amazon's unlimited storage plan, which costs $60 a year, according to customer emails that the company sent out this week.

Profits optimization :-)

-

The online retail giant said Thursday that opening new warehouses and shipping items with shorter delivery times caused its costs to soar in the third quarter. The company predicts heavy investments will continue through the rest of the year. Amazon opened 23 warehouses world-wide to fill orders since July, after opening just three in the first half of the year.

Well, they post some profit, but just to look good.

-

Another comparison to Amazon... completely automated warehouse . They ship it before you order it!

( English) http://www.cnsuning.com.hk/eng/about-suning.aspx

( Chinese ) http://www.suning.com

-

Typically, Amazon recovers only about 55% of the amount it spends on shipping, a number that has drawn new scrutiny after the company’s third-quarter earnings significantly missed expectations. As it expands its Prime service and other recent offerings, Amazon's net shipping costs—the difference between what it pays for shipping and the amount customers pay in shipping fees and Prime memberships—reached nearly $1.75 billion in the third quarter, its highest quarterly total ever outside of the peak holiday season

That free shipping for customers is an unsustainable trend fueled by giant companies like Amazon that aren’t accountable for profitability to investors in a meaningful way. "Amazon is pulling everyone into the gutter to play that [free shipping] game," Schwartz explained in a telephone conversation. "Amazon to me is the anchor that forces the industry to free shipping because Amazon isn’t held accountable to be profitable. This pulls all the other retailers into the same gutter, yet these other retailers are held accountable to be profitable—even if they’re not held to the same metrics that Amazon is held to.

-

Wow, they subsidize everything! Are they really making enough $$ off of AWS services to cover all these market-share gobbling moves?

If they get hit with an anti-trust suit in the next 2-3 years (Trump seems willing), investors are gonna lose their shirts!

-

Wow, they subsidize everything! Are they really making enough $$ off of AWS services to cover all these market-share gobbling moves?

Theie big investors subsidize everything.

They do it not as present, but because they know capitalism laws.

Amazon is chewing small and medium businesses in US and around by hundreds and thousands. They just are growing up Godzilla, and as it'll grow up enough, price and delivery policies will change overnight.If they get hit with an anti-trust suit in the next 2-3 years (Trump seems willing), investors are gonna lose their shirts!

Yeah, yeah, more probably they will meet aliens who will stop em.

-

Yeah, yeah, more probably they will meet aliens who will stop em.

LOL

-

Amazon has begun shipping products from Chinese merchant partners to its U.S. warehouses via its own ocean freighters.

-

Jeff Bezos is now 3rd richest man, he owns $72,8 billions, 56% more compared to year ago.

At the same year Amazon made real bloodbath for legit small businesses working on platform and resurgence of fake sellers. So much widespread fake sellers makes people afraid to buy anything from 3rd party, hence Amazon wins.

-

Poor small guys

Amazon.com, Inc. (NASDAQ: AMZN) today announced financial results for its first quarter ended March 31, 2017.

Operating cash flow increased 53% to $17.6 billion for the trailing twelve months, compared with $11.6 billion for the trailing twelve months ended March 31, 2016. Free cash flow increased to $10.2 billion for the trailing twelve months, compared with $6.7 billion for the trailing twelve months ended March 31, 2016. Free cash flow less lease principal repayments increased to $6.2 billion for the trailing twelve months, compared with $3.8 billion for the trailing twelve months ended March 31, 2016. Free cash flow less finance lease principal repayments and assets acquired under capital leases increased to $3.3 billion for the trailing twelve months, compared with $1.9 billion for the trailing twelve months ended March 31, 2016.

Net sales increased 23% to $35.7 billion in the first quarter, compared with $29.1 billion in first quarter 2016. Excluding the $492 million unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased 24% compared with first quarter 2016.

-

Make no mistake, while it's true that Amazon is destroying the very foundation of brick-and-mortar retail shopping and shows no signs of stopping anytime soon, their AWS business has taken over the "cloud" storage industry, with little competition left, and provided them a huge amount of cashflow. Haha, I think many of us remember a few years ago when stock analysts were warning people off Amazon because of their investment in AWS.

The point is in numerous industries they are dictating the terms to small AND big business alike. Small business can't fight back, big businesses with their cash tied to retail can't afford to fight back so they decide to make money off the scraps and innovation like touchscreen refrigerators.

-

Amazon will acquire the high-end organic food company Whole Foods Market for approximately $13.7 billion cash.

Larger and larger.

-

According to a 2017 academic study, Vanguard, BlackRock, and State Street are the largest combined shareholder of 40 percent of all publicly listed companies in the US, accounting for a market capitalization of $17 trillion, roughly equal to the total GDP of the United States.

-

I don't even remember the last time I purchased something on Amazon. Not a big user of their services.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,990

- Blog5,725

- General and News1,353

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,366

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320

Tags in Topic

- economics 319